-

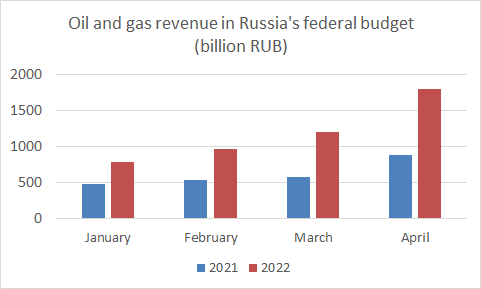

Russia’s oil and gas revenues hit another record high despite sanctions designed to hurt the Russian economy.

-

The removal of some Russian oil from markets only served to send oil prices higher, boosting revenues from the oil that it is able to sell.

-

There is no way to remove Russian oil from the market entirely without sending oil prices much higher, possibly above $200.

We now have data in hand to confirm that the subsequent sanctions on Russia’s oil are in fact boosting Russia’s oil revenues:

Although the U.S. has stopped buying Russian oil, the challenge remains that Russia is one of the largest global producers and exporters of oil. There is no way to completely remove Russian oil from the market without sending oil prices much higher — perhaps to $200 a barrel.

Further, as oil prices go higher it increases the appeal of Russia’s oil. Right now, China and India, for example, have tremendous incentive to buy discounted Russian oil.

In other words, it is a classic catch-22. In attempting to punish Russia by keeping its oil off the market, Russia is enjoying a net benefit of higher oil revenues.

By Robert Rapier of OilPrice.com