At its monthly meeting yesterday, OPEC+ accelerated its monthly quota increases by 50% in the summer months, a gesture of reconciliation to the US while keeping Russia at the heart of the cartel.

The White House quickly welcomed the deal, which came after months of diplomatic pressure on Saudi Arabia to mitigate the surge in energy prices. The US hailed OPEC+ for accelerating oil production increases and singled out Saudi Arabia, as President Joe Biden’s administration seeks to cool surging fuel prices. Washington “welcomes the important decision from OPEC+ today,” said White House Press Secretary Karine Jean-Pierre. “We recognize the role of Saudi Arabia as the chair of OPEC+ and its largest producer in achieving this consensus amongst the group members.”

Ultimately, Biden was hoping that this move would send oil prices sharply lower. It did not.

What happened? As Bank of America's Christopher Kuplent writes this morning (in a note available to professional subs), contrary to earlier press reports, OPEC's "increase" does not mean an overall increase of OPEC+ output targets previously designed to reach pre-covid levels by the end of September 2022. Instead, the decision merely brings forward September’s planned increase of 432kb/d – to be spread across both July and August (thus growing by 648kb/d each).

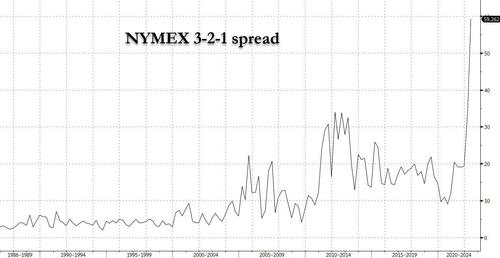

And while this acceleration by OPEC+ may be designed to alleviate inflation into this summer’s driving season, or at least make Biden happy, BofA sees limited upside in refining utilization - implying oil product supply constraints persist.

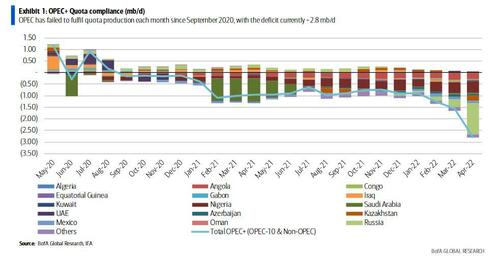

As BofA elaborates, OPEC+ compliance against production quota was already running a record net deficit of 2.78mb/d (“over-compliance”) in April: OPEC crude supply increased marginally 50kb/d to 28.67mb/d as increased production from Saudi Arabia and Iraq offset a 200kb/d decline from Libya. Meanwhile, non-OPEC production stood at 14.45mb/d – a m/m decrease of 1.08mb/d mainly driven by Russian losses.

As a result, Kuplent sees around 2mb/d of spare capacity remaining (mainly in Gulf states and excluding Iran), with more supply disruptions in Nigeria (TTE most exposed), Kazakhstan (ENI most exposed) and Libya (OMV most exposed) afoot – as BofA believes that a growing number of OPEC+ members face acute social and political headwinds to boosting output.

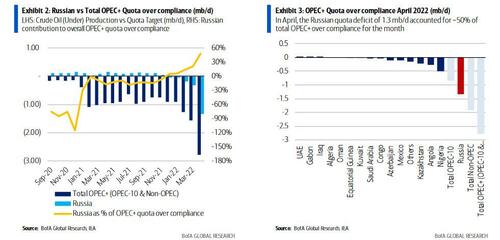

Meanwhile, Russian production outlook remains uncertain: after falling only 50kb/d in March during the first month after Russia’s invasion of Ukraine, Russian oil production fell by 900kb/d in April to 9.1mb/d to now 1.3mb/d below the country’s OPEC+ quota. The IEA expects a further loss of 600kb/d in May as sanctions tighten and a lack of storage forces producers to shut in still more wells –

taking Russia’s overall production decline since February to ~1.6mb/d (here, JPM disagrees and sees Russian output spiking on the back of Chinese and Indian orders).

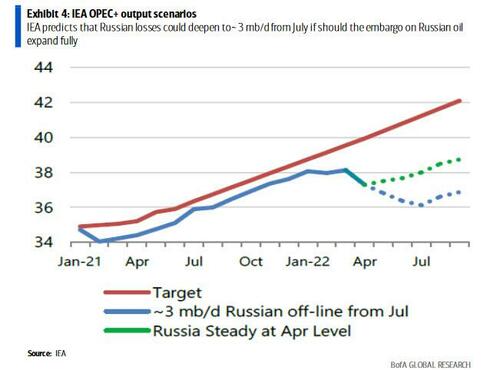

Worse, the IEA predicted that Russian losses could stretch to more than 2mb/d in June and deepen to close to 3mb/d from July onwards if "existing sanctions deter further buying or should the embargo on Russian oil expand" As the chart below shows, Russia now accounts for ~50% of OPEC+ over compliance.

After consistently producing above quota limits until December 2021, Russian contributions towards overall OPEC+ quota compliance have rapidly deteriorated: In April, Russia accounted for ~50% of total OPEC+ over-compliance. Exhibit 3 illustrates that, the Russian quota deficit was 500 kb/d greater than the entire OPEC-10 figure and 800 kb/d above Nigeria, the second-largest contributor to group over compliance, and a country which has struggled with record theft, sabotage and downtime.

Looking ahead, the IEA expects a further loss of 600 kb/d in May as sanctions tighten and a lack of storage forces producers to shut in still more wells – taking Russia’s overall production decline since February to ~1.6 mb/d. However, Russia’s energy and Prime Minister Novak recently commented “In April, we cut production by some 1 million barrels a day, and in May we have increased it by 200,000 to 300,000 barrels,” he said. “We expect a further recovery in June.”

EU Sanctions package to cut off 90% of Russian imports by YE22: On Monday this week, the EU agreed to sanction all seaborne Russian oil imports (>65% of all Russian oil imports). Imports by pipeline benefit from a temporary exemption. However, the bulk of the current pipeline deliveries are to Germany and Poland, which have signalled they will wean themselves off Russian oil imports regardless of any EU action, which would cut 90% of Russian crude oil sales to the EU by year-end. Pipeline oil supplied to landlocked Hungary, Slovakia and the Czech Republic via Druzhzba is set to be sanctioned at an unspecified later point, however will require unanimous agreement – something Estonian Prime Minister Kaja Kallas said may be found at the EU's next summit on June 23-24

As for the IEA, the energy agency sees up to 3mb/d losses from July, supporting oil prices In their May Oil Market Report, the IEA predicted that Russian losses could stretch to more than 2mb/d in June and deepen to close to 3mb/d from July onwards if ‘existing sanctions deter further buying or should the embargo on Russian oil expand’.

JPM agrees with BofA, writing that the oil cartel’s recent decision to increase production quotas in July and August won’t be sufficient to make a difference in global oil balances. The banks wrote that increased output "won’t offset heightened demand at seasonal peaks alongside China’s reopening" and warned that "risks to bank’s supply estimates are skewed to the downside."

Putting it all together, Bloomberg's Sungwoo Park writes that the price action following the latest OPEC+ meeting reinforces the argument that oil’s rally has room to run: "Brent crude is showing its resilience by rebounding quickly from losses after the alliance’s decision to boost the size of its monthly output hike by 50% for July and August. This may be counterintuitive, but it’s a testament to strong market fundamentals, which means the hike is simply not enough."

As Park adds, "doubts grow that actual output may fall short of the headline number as some members struggle to meet targets. Add to that Europe’s partial ban on Russian supply and the demand picture improving with China easing Covid curbs and the US driving season underway."

All that also explains why oil futures curves remain in backwardation -- a bullish market structure, and why the 3-2-1 NYMEX spread just hit a record high $62, as the bottleneck is no longer how much oil is producer but how much refining capacity there is...

... or rather isn't.