Post by

martindale on Jan 31, 2021 2:18am

Jus getting started people..!

First Majestic Short Squeeze Just Beginning

Summary

First Majestic Silver shares are the most heavily shorted among the mining sector.

The stock is undergoing a short squeeze as we speak, due to higher silver prices and the Reddit crowd targeting the stock, forcing shorts to cover.

First Majestic shares were up 30%-40% pre-market Friday but could be heading much higher if shorts cover positions.

First Majestic Silver Short-Squeeze

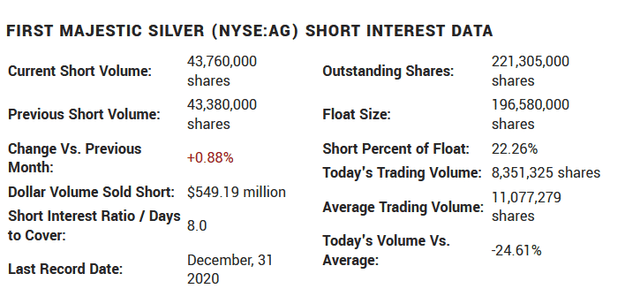

First Majestic Silver (AG) is the most heavily shorted stock in the precious metals sector, with short interest 22.26% of the float, and $549.19 million of total dollar volume is sold short, according to Marketbeat.

First Majestic Silver (AG) is the most heavily shorted stock in the precious metals sector, with short interest 22.26% of the float, and $549.19 million of total dollar volume is sold short, according to Marketbeat.

The stock was up 20%+ on Friday due a combination of factors: higher silver prices (SLV) which rose 5.5%, positive news on its Mexican tax situation, and presumably, new buying from the Reddit crowd, and short covering..

Shorts are only just beginning to cover AG positions, and the stock could be on the verge of a massive run - maybe as not as spectacular as what we've seen with GameStop (GME) since that stock was shorted more than 100% of its float, but remarkable in its own right. A stock price of $50 or higher cannot be ruled out, especially if silver makes a run past $30/oz.

Be the first to comment on this post