March 29, 2019

Aimia Inc. 525 Viger Avenue West, Suite 1000

Montreal, QC H2Z 0B2

Attention: Board of Directors

Dear Members of the Board:

As you know, Laughing Water Capital, LP ("LWC" or "we") is a significant and growing shareholder of Aimia Inc. ("Aimia" or the "company")(GAPFF). Further to our March 27, 2019, letter to the board of directors ("the board") regarding those directors whose tenure began prior to the 2018 term, we would like to share additional thoughts in light of the company's press releases and conference call from the morning of March 28, which in our mind covered three important topics:

1) A thank you to Messrs. Brown and Doroniuk for their past service to the company, and their decision to remove themselves from the board. We would like to congratulate them on their sense of self awareness, and sense of duty to Aimia shareholders to ensure that our company is stewarded by a board that has the skills needed to manage "new Aimia."

2) Thank you to the board for your decision to begin returning capital to shareholders. In our view, repurchasing shares at today's prices will be materially accretive.

3) We would like to share our thoughts on our company's "new strategy." In our view, the board is guilty of exhibiting "man with a hammer" syndrome. If you are not familiar with this term, it has been made famous in the investment community by Charlie Munger, Warren Buffett's partner, who has commented, "to a man with only a hammer, every problem looks like a nail." We believe this aphorism fits the current situation perfectly; the incumbent board was elected to lead a loyalty company, so despite the fact that the company has been completely remade through the sale of our core loyalty assets, the incumbent board determines that pursuing additional acquisitions in the loyalty space is the best use of shareholder capital!

In our view, this is no surprise because logically, if the incumbent board reached any other conclusion, the appropriate course of action would be to step down. To be fair, perhaps this conclusion is coincidence, but in our opinion, even a casual observer aware that the incumbents own a negligible amount of stock, and are thus seemingly only incentivized to entrench themselves, would be suspicious.

We believe this suspicion would be well placed, as it is rooted in mathematical elegance. Simply stated, options have value. That is an indisputable mathematical fact. In keeping with the tradition of value destruction at Aimia, the board has elected to pursue a strategy that limits our options to one sector. Even before considering that our company does not have a track record of success in this sector, limiting our options destroys value.

On the 3/28/2019 conference call following the announcement of our company's new strategy ("the conference call"), CEO Jeremy Rabe commented, "open-ended investment vehicles with unrelated assets in disparate industries are rarely given full value." This statement is also a fact. However, we believe it entirely misses the point. It is true that on any given day if one were to compare market cap to NAV, holding companies often trade at a discount.

But has the incumbent board considered the view if you zoom out and examine performance over longer periods of time? The long-term chart of these holding companies almost always goes up and to the right if the decision makers are properly incentivized professional capital allocators. In many cases, this strong performance over time is paradoxically tied to the fact that "open-ended investment vehicles with unrelated assets in disparate industries are rarely given full value."

This is because for expert capital allocators, an undervalued stock is an asset, not a liability. The entire point of a holding company structure is to purchase cash generative assets, and then to redeploy that cash into attractive opportunities. If the most attractive opportunity happens to be the company's own stock, then so be it. It is a far better use of cash to buy more of what you know at low prices than it is to use cash to buy things that you don't know as well at higher prices.

In fairness, the company's buyback announcement suggests that there may be some awareness of this concept at the board. Additionally, although we have our doubts, we would like to acknowledge that it is certainly possible that buying more loyalty assets is the best use of our cash going forward. You will note that we have not suggested that Jeremy resign from the board because he appears qualified to manage our loyalty assets going forward. That being said, we consider it laughable to bathe today's announcement in plaudits of "transformation," while declaring a "clear plan for profitability," when no substantive details were provided, profitability is defined as adjusted EBITDA, and the strategy seems to hinge on not only identifying attractive assets, but also paying attractive prices for them, and then relying on "synergies" when there is overwhelming evidence to suggest that making acquisitions based on synergies is a losing strategy. All this when the board has predeterminedthat spending money in the loyalty space is the best option is not in our view a recipe for success.

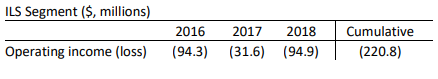

On the conference call, Jeremy further commented, "we'll not be making risky investments in unproven ideas in areas outside of our core expertise." If we are not mistaken, the center piece of our new strategy is the existing Insights & Loyalty Solutions segment ("ILS"), which has generated more than $220 million in operating losses over the last 3 years.

We believe this 3-year period is important to reference because it has been nearly 2 years since Air Canada announced their intention to withdraw from Aeroplan sending our company into a tailspin, and it seems likely the board would have been aware of this possibility well in advance. It thus appears to us that despite having more than 2 years to prepare for life without our company's cash cow, the board has been unable to implement a plan to make our company pro forma profitable. Further, during this period, the board approved the sale of the Air Miles Trademarks, Nectar, and Aeroplan at what we believe were fire sale prices, resulting in the destruction of more than an estimated one billion dollars of shareholder value.

Yet, we are to believe that as of the conference call, our hammer holding board members have rabbits in their hats?

If ILS is not an investment in a risky and unproven idea, then what exactly qualifies as such? And if ILS is not an investment in a risky and unproven idea, then how can shareholders take any comfort that avoiding additional risky and unproven ideas will generate acceptable returns on our capital? Based on ILS, it appears to us that by the board's definition, investing in money losing, unproven strategies with no clear path to success is not risky.

We define risk differently.

Regardless of these doubts, to reiterate, it is a mathematical fact that options have value, and assembling a board with the skill set necessary to review opportunities across multiple verticals seems the best way to lever this fact to the benefit of new Aimia's shareholders. If a qualified board of experienced capital allocators determines that investing in loyalty is the best use of cash, then so be it: Jeremy appears to be well suited to execute the task.

But in our view, for a group of hammer wielding loyalty folks to determine that buying more loyalty assets is the best use of cash without considering every other alternative defies logic. It is akin to a contestant on Jeopardy! pressing their buzzer before they have even seen the clue. How can you know the answer before you have been given the prompt? In our view it is mathematically impossible, intellectually infeasible, and downright dishonest to conclude that investing in loyalty will always be the best use of our capital. Perhaps Alex Trebek should be nominated to join our board?

In closing, we assume you have noticed that Aimia shares just barely moved higher in their first day of trading following the announcement of the new strategy and buy back. We believe the fact that Aimia stock barely reacted - on high volume and with a positive index - following an announcement that the company will repurchase more than 25% of its market cap at current prices is illustrative of the risk the market attaches to the idea of the incumbent board pursuing a loyalty only strategy.

We encourage you to take a minute to digest this information.

To recap it for you, in our opinion, the board has created a near risk-free scenario for Aimia equity investors over the next month by telling the market that in only a few weeks the company will repurchase approximately 25% of all shares, which is approximately 33% of the float assuming Mittleman Brothers does not participate. The laws of supply and demand suggest that a repurchase of this size can only happen at a substantial premium. This sort of near risk-free return is exceedingly rare in the investment world, and typically vanishes in milliseconds as buyers almost instantly appropriately price the anticipated return of capital. Yet, more than twice the average volume of Aimia stock traded on the day of the buyback announcement, and the stock barely inched higher. We believe the only reason anyone would sell an opportunity for short-duration near risk-free return is because the market has zero faith in the incumbent board’s ability to generate acceptable returns by focusing purely on loyalty.

As such, we would like to renew our suggestion that the incumbent board members gracefully step down in advance of the annual general meeting so that Aimia shareholders can have the benefit of a board that does not appear to be tainted by the presence of a loyalty hammer in their hand. Alternatively, please comply with best practices as suggested by Canada's leading authority on corporate governance, the Canadian Coalition for Good Governance, and open voting at the annual general meeting to all shareholders, so that all shareholders are assured of a board that has a proper mandate to oversee Aimia as it exists today, not as it existed when the incumbent board assumed their positions.

Matthew Sweeney, CFA

Managing Partner

Laughing Water Capital

About Laughing Water Capital