Contrary to popular perception, stringent regulation may not be the biggest factor behind the delay of mining projects in British Columbia, according to a new study published in the Royal Society of Canada journal FACETS.

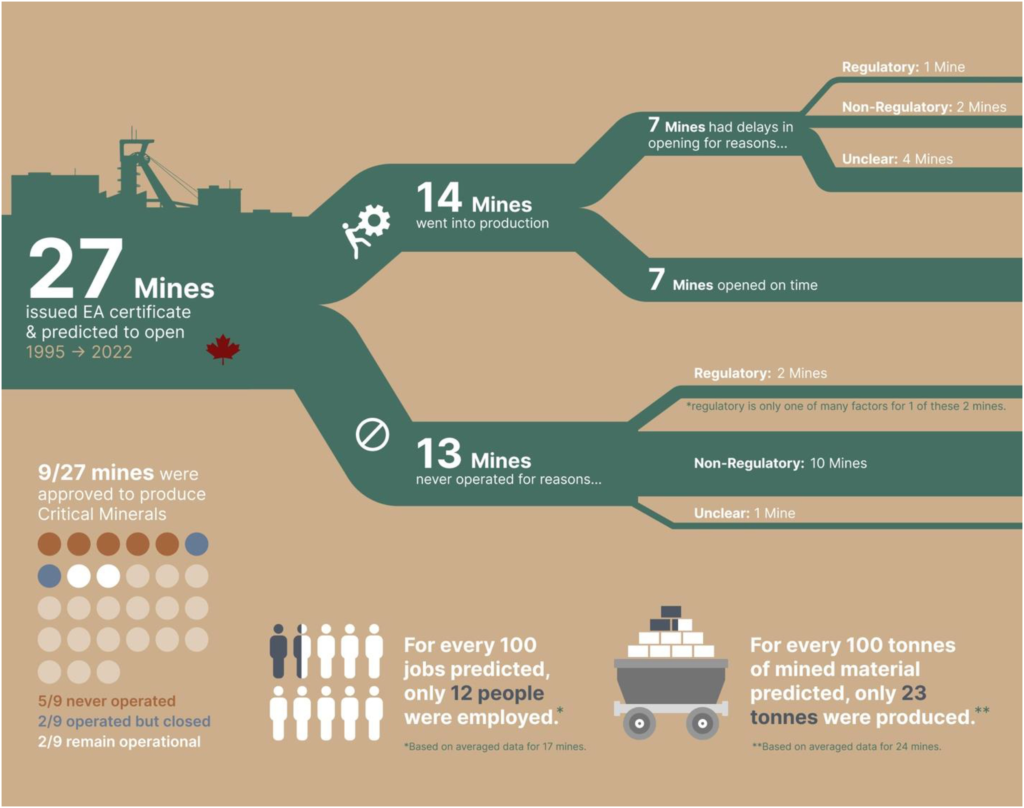

The study, conducted by researchers from Simon Fraser University and the University of British Columbia, conducted an audit of the 27 mines that were granted environmental assessments in the province since 1995 and were projected to open by 2022.

Using public documentation, the authors compared each mine’s forecasted timelines and economic benefits (i.e. production, employment and taxes) against their actual development status, and identified the reasons for discrepancies or delays.

Credit: FACETS

Credit: FACETS

Of the 27 mines, only seven were opened on time. Another seven were delayed but eventually came online. The other 13 remain non-operational to this day. Three of these mines will not operate in the near future as their environmental certificates have expired.

In B.C., a certificate can expire if a mine does not substantially start its operations — a threshold set on a case-by-case basis by the provincial government — by a certain date. It’s typically five years after issuance, or up to 10 years with a one-time, five-year extension.

Regulation was a factor in only three of the 20 delayed projects, according to publicly stated reasons given by mining companies, while economic factors like commodity prices were revealed to be the most common cause of delay.

Among mines that have operated at some point during their lifetime, delays in construction or opening are common, the study also found. Two mines, for example, were hampered by financing or technical issues. Only one mine was delayed by a regulatory factor, the Red Chris project.

Dispelling the narrative

The findings, the authors said, dispel the narrative from the mining sector that regulatory barriers are inhibiting mines’ timely opening and economic performance in B.C.. Rather, it is the unsustainable costs involved in building a mine within the province.

The Mining Association of B.C. previously claimed that “lengthy timelines for mine permitting and authorizations continue to slow project development and are a barrier to investment” and that “permitting and authorization” constitute an obstacle to “unlocking B.C.’s critical minerals opportunity.”

It also goes against the federal government’s position in its Critical Minerals Strategy, which stated that: “Although responsible regulations are vital, complex regulatory and permitting processes can hinder the economic competitiveness of the sector and increase investment risk for proponents.”

The authors said they were also surprised to see almost half the mines approved since 1995 have yet to operate. Although the average total financial cost of an environmental assessment is unknown, the B.C. Environmental Assessment Office charges $250,000 total in fees at three different stages of the EA process, with the largest fee, $150,000, coming at the EA application stage.

Beyond the fees from the EAO, proponents hire consultants to conduct the actual EAs. This adds further costs for mining companies, ranging from thousands to millions of dollars each year,” the authors wrote. Teck Resources, for example, spent $904 million in 2022 on consulting and contractors across its mining operations around the world.

Underperformance of mines

The study also puts government projections of mining’s economic benefits — namely output, GDP, job creation, and tax revenue — into doubt.

MABC, for instance, had projected the aggregated economic impact of 16 potential critical mineral mines (of which two are extensions of already-existing mines and 14 are new) in B.C. to be $24.8 billion in GDP over the next 24 years.

However, an analysis by the authors shows underperformance across all economic indicators — mines are producing only 23% of output and 12% of employment than what was predicted.

The lack of publicly available data on actual mine performance is another significant weakness with the regulatory system, suggesting a lack of transparency about whether benefits materialize and who receives them, the study said.

Current data are skewed towards non-operational mines, for which it is easier to obtain data — when the mine hasn’t opened, the production, employment and taxes are zero, or close to it.

When non-operational mines are excluded from calculations, the picture changes, with mines producing 51% less of output, 53% less employment and 7% of tax revenue.