Copper December 5, 2023

The copper market narrative has been one of shrinking supply in the face of surging demand, not only due to electrification and decarbonization — EVs use four times as much copper as regular cars and trucks for example — but all the other applications for copper including in construction, power generation and communications.

In February, CNBC reported that “a copper deficit is set to inundate global markets throughout 2023, fueled by increasingly challenged South American supply streams and higher demand pressures.”

Wood Mackenzie is forecasting major deficits in copper to 2030, attributed largely to unrest in Peru and higher demand for copper in the energy transition industry.

The South American country, which accounts for 10% of world copper supply, has been racked by protests since its former president, Pedro Castillo, was ousted last December.

A strike is currently underway at the Las Bambas mine owned by China’s MMG Ltd.

On Nov. 28 Reuters reported that reduced supply from Panama and Peru, both major copper producers, could flip the copper market from surplus to deficit in 2024, or at least tighten oversupply if disruptions are not resolved soon.

Exposing the copper surplus myth

Last week, Panama’s top court ruled that First Quantum’ contract to operate the Cobre Panama mine is unconstitutional.

Between those two mines the copper industry has lost 570,000 tonnes of production.

In a recent BMO Metals Brief, head of global commodities research Colin Hamilton wrote that copper prices continue to trend higher due to supply issues following the Panamanian government’s announcement that Cobre Panama would be closed.

On Dec. 1, copper advanced to the highest level since August, as bets on a pivot by the Federal Reserve (lower interest rates are bullish for copper and other commodities) and the looming shutdown at Cobre Panama emboldened bulls, Bloomberg said.

It climbed up to 1.2% Friday and increased 4.4% in November, the first monthly increase since July, as a slew of stimulus in China and the potential end of the Fed’s tightening cycle boosted the demand outlook.

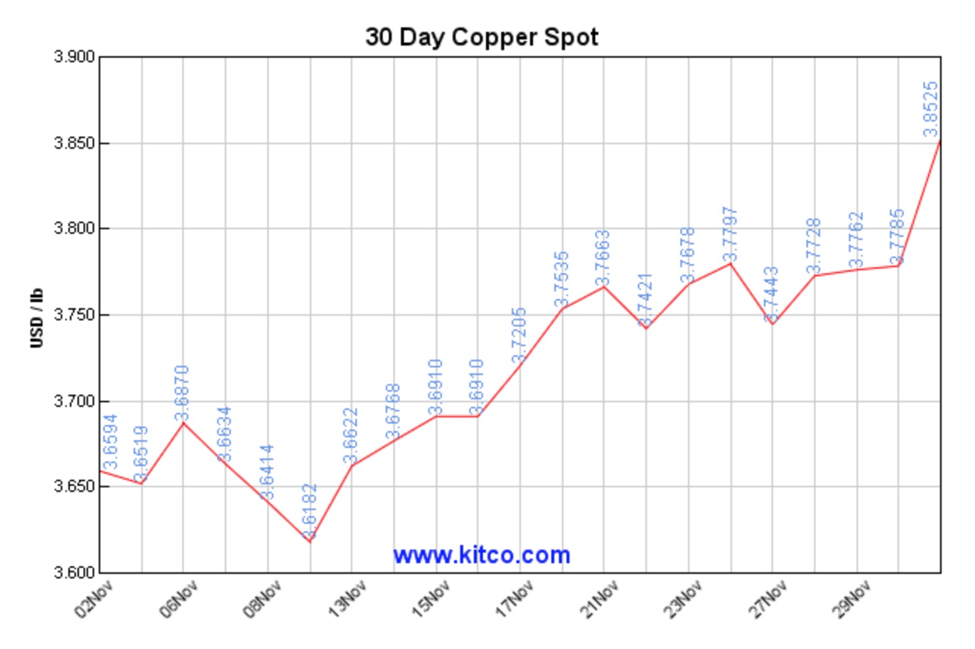

Source: Kitco

Source: Kitco In my view copper will continue to trend higher due to three factors:

- Supply failures at existing copper mines due to resource depletion and lower grades, and mine closures owing mainly to weather and strikes. Remember, 80% of the foreseeable copper supply is coming from just five mines, but four out of five have offtake agreements with non-Western buyers. That supply is locked up.

- The Fed orchestrating a soft landing for the US economy, meaning no recession or an extremely shallow, short-lasting one.

- Demand pressures. Global copper demand remains robust in both OECD and non-OECD countries. For the first four months of 2023, OECD copper demand increased by a robust 3.7%. Despite countless bearish articles in the financial press, Chinese copper demand continues to surge, with refined demand rising by 8% year-on-year.

In fact, we can now add a fourth factor: Chinese copper refining. As we reported earlier, to ensure self-sufficiency, China has expanded its network of copper smelters, meaning it will start to import much more copper ore for processing domestically. According to CRU, the country is expected to account for about 45% of global refined copper output this year.

China’s new copper smelting capacity is expected to turn China into a net copper exporter by 2025 or ‘26. With so many smelters requiring copper concentrate, the market for concentrate is tightening.

Miners pay smelters a fee to process copper concentrate into refined metal, to offset the cost of the ore. TC/RCs fall when tight concentrate supplies squeeze smelters’ profit margins.

On Friday it was reported that global miners reached agreements with Chinese smelters for lower TC/RCs, the first drop in three years. Reuters said the deals reached, including by Antofagasta and Freeport McMoRan, effectively made $80/8 cents the 2024 benchmark.

Conclusion

China’s is going to continue taking a lot of refined copper and wants to switch to importing a lot more unrefined ore. China is building out its network of copper smelters, just like it did for iron ore, cobalt, rare earths, lithium, etc. There is no doubt in my mind that China is aiming to become the swing copper producer, and the world’s largest copper exporter, giving it the strongest influence on the copper market. It would effectively become a price maker, not a price taker.

This is yet another example of the global copper market tightening and supporting higher prices.

https://aheadoftheherd.com/gold-not-yet-copper-will-retest-4-richard-mills/