dalomo84/iStock via Getty Images

Gran Colombia Gold (OTCQX:TPRFF) released the Q3 2021 financial results. The quarter was weaker than the previous one, as the gold production declined, the AISC increased, and revenues and net income moved in the negative direction too. On the other hand, the operating cash flow increased, and the company released great exploration results from Segovia, as well as Toroparu. Moreover, following the $300 million debt financing, the Toroparu mine construction is fully funded now. And Aris (OTCQX:ALLXF) Gold experienced major progress at the Marmato mine.

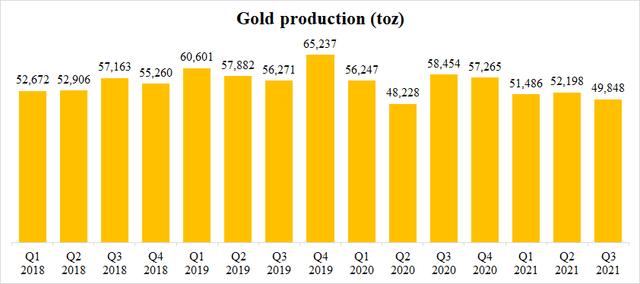

In Q3, Gran Colombia Gold produced 49,848 toz gold. It is 4.5% less compared to Q2. The decline seems to be even more dramatic in comparison to Q3 2020, but it is important to note that the 2020 numbers include also the production of the Marmato mine. Segovia alone produced 51,555 toz gold in Q3 2020, which is only 3.4% more than in Q3 2021. The Q3 2021 production was negatively affected by a scheduled maintenance shutdown of the plant in July. As a result, the volume of milled ore declined from 143,909 tonnes in Q2 to 136,796 tonnes in Q3. The head grade increased from 12.55 to 12.61 g/t gold, but it was not enough to fully compensate for the decline in throughput rates. However, the management believes that the 2021 production guidance will be met and Segovia will produce 203,000-207,000 toz gold. It means that 51,896-55,896 toz gold should be produced in Q4. In other words, the management believes that Q4 will be the best quarter of 2021.

Source: Own processing, using data of Gran Colombia Gold

Source: Own processing, using data of Gran Colombia Gold

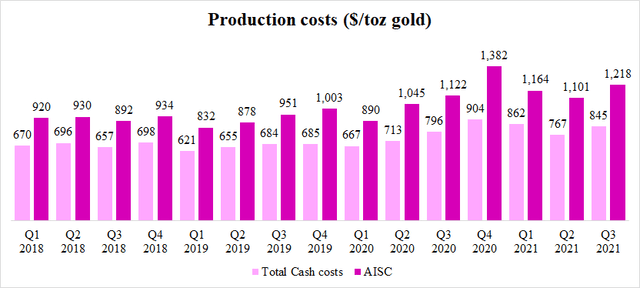

As the production volume declined, the volume of sold gold declined too, from 52,838 toz in Q2 to 50,171 toz in Q3. This, along with an increased proportion of material obtained from contract miner and small-scale miners at the Segovia title, pushed the unit production costs higher. The total cash cost increased by 10.1% to $845/toz, and the AISC increased by 10.6%, to $1,218/toz.

Source: Own processing, using data of Gran Colombia Gold

Source: Own processing, using data of Gran Colombia Gold

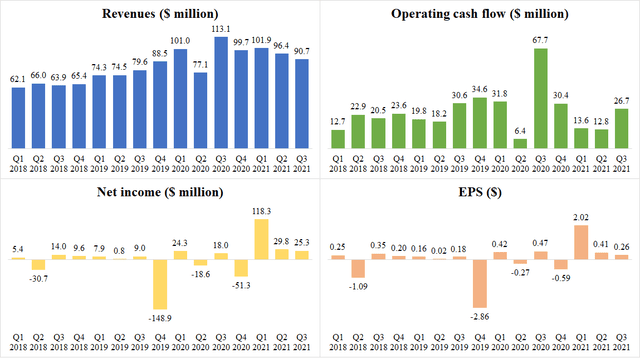

As mentioned above, the gold sales equaled 50,171 toz in Q3, which is 5% less than in Q2. The average realized gold price declined from $1,797/toz to $1,784/toz, or by 0.7%. As a result, Gran Colombia's revenues declined by 5.9%, to $90.7 million. The operating cash flow increased to $26.7 million, well above the Q2 levels. However, when compared to Q3 2020, it declined significantly. Not only due to the divestment of the Marmato mine, but mainly due to the lower gold prices, higher income taxes, and a change in the timing of VAT refund claims remittance that was shifted to H1 2022. The net income declined from $29.8 million in Q2 to $25.3 million in Q3. The EPS declined even more, from $0.41 to $0.26. The reason is simple, the EPS is calculated using the average number of issued and outstanding shares during the quarter, and in late Q2, Gran Colombia completed the acquisition of Gold X Resources. The increased volume of issued and outstanding shares impacted the Q2 average share count only partially, but it fully impacted the average share count in Q3. As a result, the net income decreased only by 15%, while the EPS decreased by 37%.

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

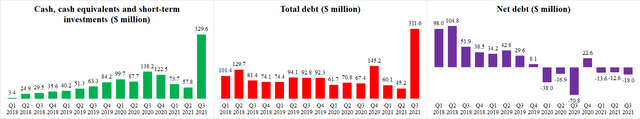

In Q3, Gran Colombia's cash position improved significantly. While the company ended Q2 with cash on hand of $57.8 million, it ended Q3 with $329.6 million. The reason is the $300 million debt financing that took place in August. The money should be used for the Toroparu mine development. The total debt increased to $311.6 million, however, the cash on hand grew more than debt, therefore, the net debt declined to -$18 million.

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

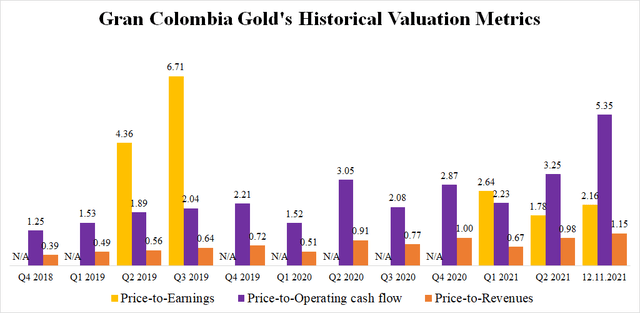

As the Q3 revenues and operating cash flow were lower in Q3 2021 than in Q3 2020, their TTM values declined. Moreover, Gran Colombia's share price increased by 10.5% compared to the end of Q2. As a result, the valuation metrics increased. Right now, the price-to-operating cash flow ratio stands at 5.35, the price-to-earnings ratio stands at 2.16, and the price-to-revenues ratio stands at 1.15. Despite this growth, Gran Colombia remains very cheap. Especially if one realizes that Toroparu is fully funded and permitted and that Gran Colombia owns 44.3% of Aris Gold that announced that the Marmato Lower Mine development will begin in December, with an average annual production of 165,000 toz gold expected to start in 2024. Source: Own processing

Source: Own processing

The Q3 was pretty eventful for Gran Colombia Gold. As mentioned above, in August, Gran Colombia completed a $300 million senior unsecured notes offering. The notes will mature in 2021 and they bear an interest of 6.875%. The proceeds will be used for the Toroparu project development that should cost $378 million (however, Gran Colombia needs to fund only $272 million, as there is the streaming agreement with Wheaton Precious Metals (NYSE:WPM)). Following the closing of the debt financing, Gran Colombia made an early redemption of the remaining gold-linked notes worth $18 million.

Gran Colombia also announced that in Q3, the polymetallic recovery plant construction was completed and the commissioning is underway. The plant will be recovering zinc, lead, gold, and silver from the tailings at the Segovia mine. First concentrate production is expected by the end of this year.

The drill results released on July 6 have confirmed a 4 km strike length of high-grade structurally controlled gold mineralization at Toroparu. Gran Colombia believes that a high-grade resource amenable to underground mining methods lies at the core of Toroparu. This should help to boost the economics of the project further. An updated Toroparu PEA was originally expected in September, but now it seems that it will be released in December.

On July 12, Gran Colombia announced the discovery of two new high-grade gold veins at Segovia. The discovery holes intersected 137.44 g/t gold and 10.1 g/t silver over 0.56 meters, and 93.19 g/t gold over 0.54 meters. The new veins are close to the mine workings of the El Silencio mine (part of the Segovia mining complex).

Gran Colombia also renewed its normal course issuer bid. It is valid until October 19, 2022, and enables Gran Colombia to repurchase and cancel up to 9,570,540 shares (10% of Gran Colombia's issued and outstanding shares).

Aris Gold (44.3%-owned by Gran Colombia Gold) announced that the Marmato Lower Mine development will commence in December. Moreover, according to the new resource estimate, the Marmato measured and indicated resources increased by 42% to 5.8 million toz gold, and inferred resources increased by 18% to 2.6 million toz gold.

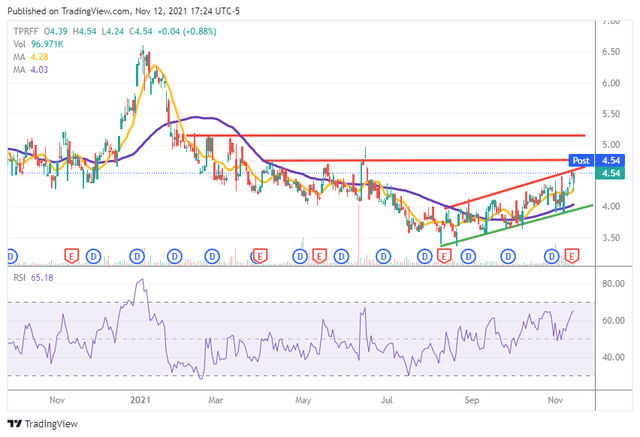

Source: Trading View

In August, Gran Colombia found a bottom in the $3.5 area and a bullish trend has started. Right now, the share price stands at $4.54 which is above the 10-day as well as the 50-day moving average, close to the upper boundary of the upwards channel and the resistance in the $4.75 area. The gold price back above $1,850/toz provides nice support, and if a positive updated PEA for Toroparu is released in December, it is possible to expect the share price to break not only the $4.75 resistance but also the next one located in the $5.1 area.

What I like about Gran Colombia Gold's Q3:

- The Toroparu mine is fully financed now.

- The exploration results from Toroparu and Segovia are very good.

- The polymetallic recovery plant at Segovia was completed and is being commissioned.

- Aris Gold announced surprisingly robust growth in the Marmato mine resources.

What I don't like about Gran Colombia Gold's Q3:

- The gold production decreased.

- The production costs increased.

- The revenues and net income decreased.

My new marketplace service "Royalty & Streaming Corner" will be primarily focused on precious and industrial metals royalty and streaming companies, however, it will include also investment ideas like Gran Colombia Gold. We are starting on December 14! The first 10 annual subscribers will receive a 25% legacy discount!