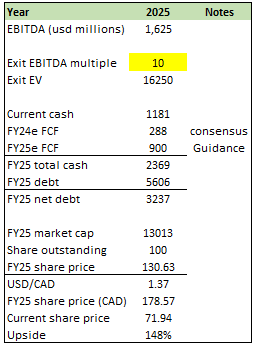

Valuation

Author's work

I believe the upside for BBD.B:CA remains attractive. I am still confident that BBD.B:CA is on track to meet its FY25 targets, although the market seems to think otherwise (based on consensus estimates). Achieving a FY25 EBITDA target of at least $1.625 billion would mean that consensus needs to upgrade their estimates for the following years (FY26 and beyond), which I expect to prompt an upgrade in valuation. From a historical perspective, achieving the FY25 EBTIDA target also meant that BBD.B:CA is a much higher margin business than in the past ($1.625 billion will mark the highest EBITDA that BBD.B:CA has generated since FY11 and at a much lower revenue base), which further supports my view that the stock should trade at a higher multiple than today. Using the historical 10-year average multiple of 10x forward EBITDA, I believe the stock is worth CAD178 (which is also where BBD.B:CA traded back in FY11 when it generated a similar level of EBITDA: $1.567 billion, slightly below the FY25 EBITDA guide).