SL_Photography/iStock Editorial via Getty Images

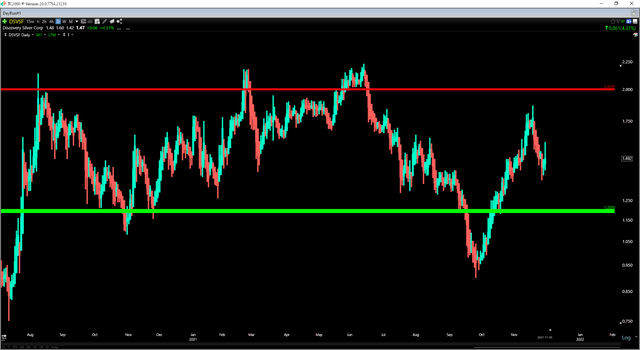

It's been a rough year thus far for the Silver Juniors ETF (SILJ), with the index down 21% year-to-date. However, one name that has continued to perform well on a relative basis is Discovery Silver (OTCQX:DSVSF), which is down just 2% year-to-date. The significant outperformance can be attributed to the fact that the company has been working on a re-vamped Preliminary Economic Assessment [PEA] for its Cordero Project. The results were exceptional relative to the 2018 PEA. Given the significant improvement in the economics, I would view any pullbacks below US$1.25 for Discovery Silver as low-risk buying opportunities.

(Source: Company Presentation)

(Source: Company Presentation)

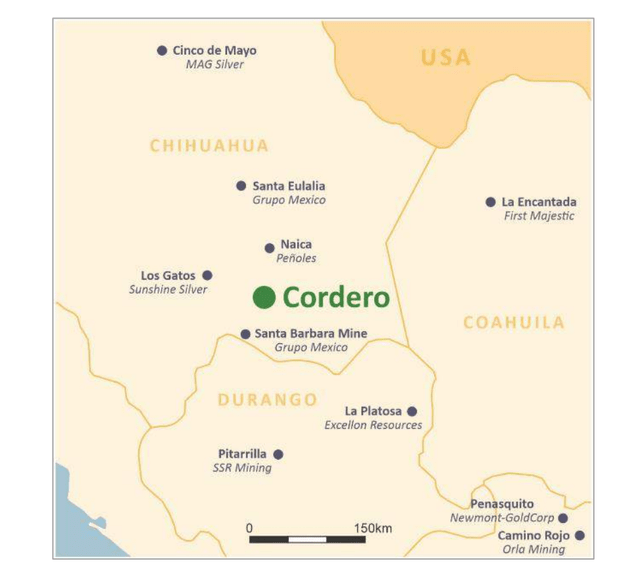

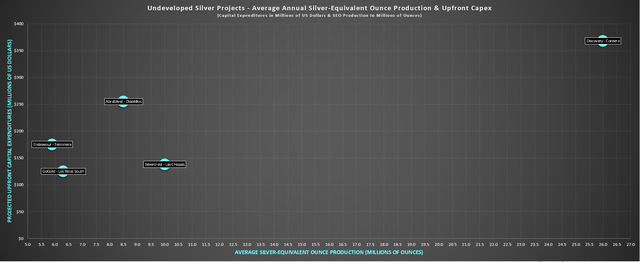

This week, Discovery Silver released an updated PEA at its Cordero Project in Chihuahua, Mexico, with the study showcasing exceptional economics, especially compared to the 2018 PEA completed by Levon Resources. The updated study envisions annual production of ~26 million silver-equivalent ounces [SEOs] over a 16-year mine life, an average production profile of more than 30 million SEOs for the bulk of the mine life (Years 1 through 12). This includes a phased approach to reduce the upfront capex to a more palatable figure. Notably, it's a very simple open-pit project with a favorable strip ratio of 2.2 to 1.0. Let's take a closer look below:

(Source: Company Presentation)

(Source: Company Presentation)

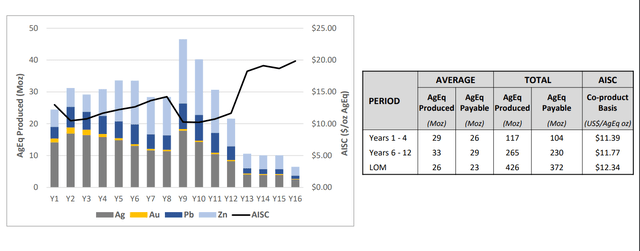

As the chart above shows, Cordero is a primary silver deposit, but also relies on a small amount of gold, lead, and a significant amount of zinc for its production profile. The plan is to mine oxides and sulphides in Phase 1, with annual throughput of 5.0 million tonnes and 5.8 - 10.8 million tonnes, respectively. Following Phase 1, sulphides will make up the bulk of the production profile, with throughput increasing to more than 14 million tonnes per annum. The average head grade for oxides is expected to come in at 42 grams per tonne silver-equivalent, with the average head grade for sulphides coming in at 80 grams per tonne silver-equivalent. Recovery rates for the sulphide material are quite solid, coming in 84% for silver, 86% for lead, and 85% for zinc.

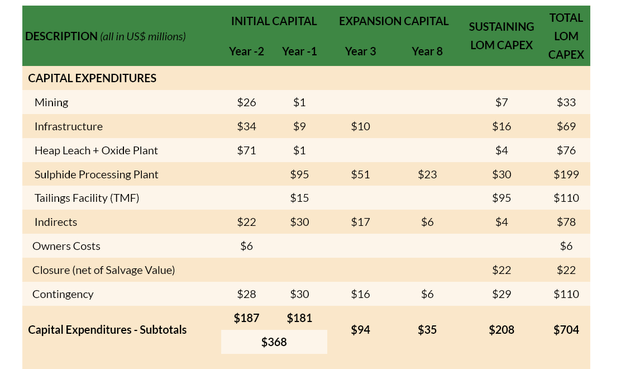

The one issue with the 2018 PEA by Levon Resources was that it was based around a bigger is better approach, contributing to very high upfront capex. This is evidenced by the ~$570 million upfront capex in the 2018 study, which would have stood well north of $625 million if completed today, given the recent inflationary pressures we've seen. However, Discovery's phased approach has led to a dramatic decline in upfront capex, with estimated capital costs now projected to come in at $368 million. This is a ~35% decline from the 2018 PEA, and much more manageable for a company of Discovery's size (~$570 million market cap).

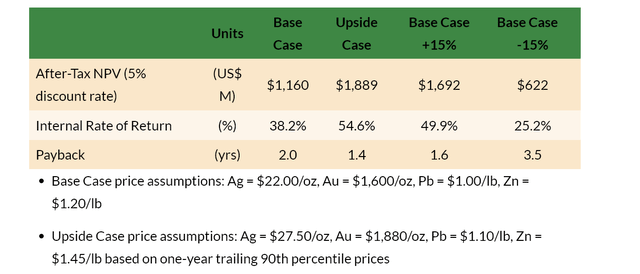

After the first few years of production, the plan is to add a second sulphide circuit to boost the processing rate to 14.4 million tonnes per annum by adding a ball mill and flotation circuit and utilizing the crushing circuit (previously dedicated to oxides) for sulphides after Year 4. The net result of this new plan is a project with an exceptional After-Tax NPV (5%) to Initial Capex ratio of 3.15, based on an After-Tax NPV (5%) of ~$1.16 billion, and upfront capex of $368 million. However, despite this relatively modest upfront capex, Discovery offers unrivaled size among most undeveloped silver projects, which we'll look at below:

(Source: Company News Release)

(Source: Company News Release)

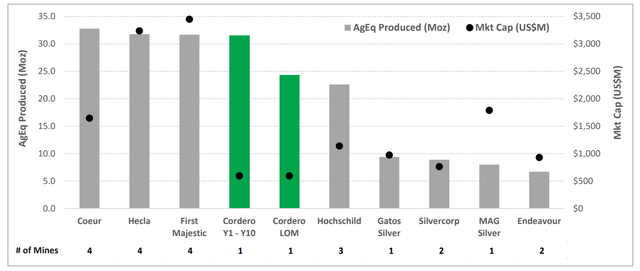

As shown in the chart below, if Discovery Silver were in production today, it would dwarf the production profile of MAG Silver (MAG), Endeavour Silver (EXK), and Silvercorp (SVM). It would also come in well ahead of Hochschild (OTCQX:HCHDF). During the higher production years (1-10), Cordero's production profile would nearly match that of First Majestic (AG) and Hecla (HL), with both companies having four mines to generate a similar production profile. In summary, this is a massive project, and given its relatively low upfront capex, it represents a huge growth opportunity for a producer willing to add a Mexican development operation. It's important to note that Discovery's PEA was based on ~99% measured and indicated resources, so this study is relatively de-risked, unlike some PEAs with a significant portion of inferred material.

(Source: Company Presentation)

(Source: Company Presentation)

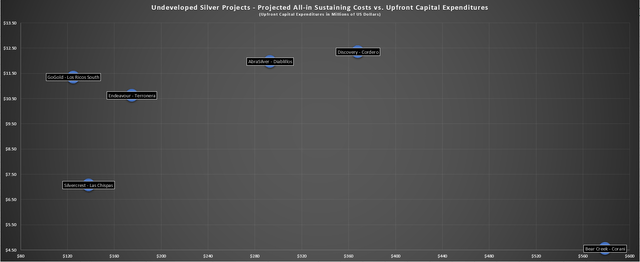

Let's look at how Discovery stacks up against other undeveloped (or in construction) silver projects. We can see that it dwarfs the production profile of its peers, with the only real comparison (not shown) being Bear Creek's Corani Mine. However, Bear Creek's Corani carries a much higher upfront capex bill of ~$600 million, and this is based on a dated study. If we factor in recent sector-wide increases in labor, materials, and fuel costs, it's likely that Corani's upfront capex would come in closer to $700 million today, if not higher. So, while Discovery's upfront capex clearly is much higher than its peers, it easily makes up for this with its size. For example, AbraSilver's (OTCQX:ABBRF) Diablillos requires ~70% of the capex to build vs. Cordero but offers just one-third the production profile (~8.5 million SEOs per annum vs. ~26 million SEOs per annum).

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

Moving over to operating costs, Cordero's massive scale combined with solid metallurgy and a low strip ratio easily offset its much lower head grades. As we can see, Cordero may be the highest-cost undeveloped project, but at $12.35/oz, it stacks up relatively well vs. the peer group of $9.11/oz, and still offers ~48% AISC margins at a $24.00/oz silver price. If we exclude Corani from this figure (~$5.00/oz), which is a massive outlier for undeveloped projects, the peer group comes in at $10.25/oz, showing that Cordero is not a very expensive project at all. Besides, it's important to note that the average operating costs for silver producers currently sits closer to $13.00/oz, which is what really matters. This is because it's these companies (established producers) that might be interested in acquiring Discovery Silver down the road to add Cordero to their portfolio. Let's take a look at the valuation:

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

Based on Discovery's ~378 million fully diluted shares and a share price of US$1.50, Discovery Silver currently trades at a market cap of ~$570 million and has over $40 million in cash to support future work on its project. Meanwhile, using base case metals price assumptions ($22.00/oz silver, $1.20/lb zinc), the After-Tax NPV (5%) comes in at $1.16 billion. This leaves Discovery trading at a very reasonable valuation of ~0.49x NPV (5%) for a company that owns a project with a very respectable ~38% IRR. In a more favorable scenario ($27.50/oz silver, $1.45/lb zinc), the After-Tax NPV (5%) soars to ~$1.89 billion. I would not rely on these prices to be more conservative, but the point is that Discovery is undervalued at base case prices and extremely undervalued in the upside case assumptions.

(Source: Company Website)

(Source: Company Website)

So, is the stock a Buy?

Mexico is not the most favorable jurisdiction by any means. Still, with Discovery Silver trading below 0.50x NPV (5%), I would argue that the risks of operating in the country are mostly priced into the stock. This is especially true given that this PEA does not include ~300 million tonnes of material not included in the study (below optimal cut-off), and it's possible we could see improved economics from a coarser grind size (greater than 200 microns), which will be explored in the 2022 Pre-Feasibility Study. In summary, from a valuation standpoint, Discovery Silver trades at the right price. If not for the market weakness, it's certainly possible that the stock would have had a more favorable reaction to the recent report.

(Source: TC2000.com)

(Source: TC2000.com)

However, if we look at the stock from a technical standpoint, Discovery Silver has come a long way over the past two months, up ~65% from its September lows. This doesn't mean that the stock has to retrace a significant portion of its advance, but I've rarely found that it pays to buy precious metals names that are up more than 50% in less than 50 trading days. Meanwhile, the stock also sits in the middle of a volatile trading range, with support at US$1.20 and resistance at US$2.00. Generally, the best time to buy miners is when they're in the lower portion of their trading range. This is not the case currently, with US$0.30 in downside to support and US$0.50 in upside to resistance.

To secure more of a margin of safety from a technical standpoint, the ideal buy point for Discovery Silver would be below US$1.25, where its reward/risk ratio would improve considerably, sitting next to a major support level over the past 18 months. This doesn't mean that the stock can't go higher, but it's generally much riskier to buy names that are up substantially off their lows, even if they've just reported favorable news. So, while the price is right from a valuation standpoint, I don't see this as a low-risk buy point just yet from a technical standpoint.

(Source: Company Presentation)

(Source: Company Presentation)

Discovery Silver has released an exceptional PEA at Cordero, with very respectable operating costs, a manageable upfront capex bill, yet still boasts a mammoth-sized production profile. With the stock trading at less than 0.50x NPV (5%) at conservative metals price assumptions, the stock remains very reasonably valued here. In fact, it could become a possible takeover target if the stock were to see continued weakness. Given the significant improvement in the economics with meaningful upside outside of the PEA at higher metals prices, I would view any pullbacks below US$1.25 for Discovery Silver as low-risk buying opportunities.