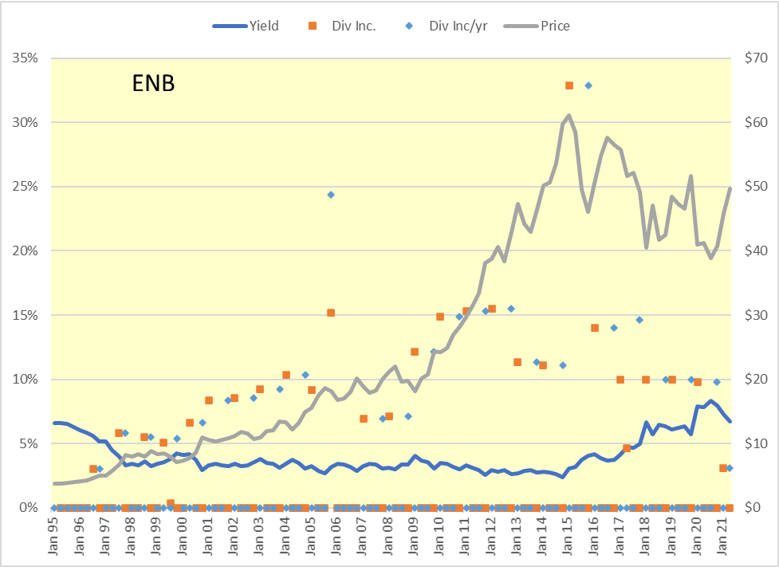

This is the second year in a roll that dividend increment is about 3%. For the last few decades, there was only a few times that were less than 5%. Most of the time, it was close to 10% or higher.

The management mentioned during the Investor Day was that the yield was about 7% but ignoring the share’s price performance is not doing well since 2015.

Let's see what are the different payout ratio scenarios. To simplify the calculation, the outstanding shares is 2B.

| | Low | High |

| Future DCF | $5.25 | $5.50 |

| Payout Ratio | 60% | 70% |

| Possible Div. | $3.15 | $3.85 |

| Average | $3.50 | 4.79% |

| Current | $3.34 | |

| Now | $3.44 | 2.99% |

The $3.15 is lower than current dividend, so it is out of the question. The higher end of $3.85 is within the management’s parameter but it will be more than 10%.

The following table shows what will be the fund needed for different dividend increase. Remember that this will be needed for future years to come.

| Div inc % | Div./Year | Added Cost |

| 3% | $3.44 | $200M |

| 4% | $3.47 | $267M |

| 5% | $3.51 | $334M |

| 6% | $3.54 | $401M |

| 7% | $3.57 | $468M |

| 8% | $3.61 | $534M |

| 9% | $3.64 | $601M |

| 10% | $3.67 | $668M |

The management states that the DCF growth will be 5-7%. So I would expect the dividend increment to be within 5-7% or $300-$500M additional fund which is not a big amount. For comparison, the stock buyback is $1.5B.

Why does the management keep the dividend increase low? Does it mean future profit will be lower so they have to lower the dividend increment? Lower dividend and few outstand share will cost ENB less. I will leave it up to your imagination to decide the reason.