https://www.zerohedge.com/markets/esg-funds-post-largest-monthly-outflow-record-greenwashing-racket-starts-unravel

After years of being critical of "ESG" investing and how appending the label to literally any company immediately caused a misallocation of capital in its direction, it looks like the buzzword investing scam is starting to unravel in real time.

First, the Securities and Exchange Commission said this month that it was planning on cracking down on misleading ESG claims. New rules "would specify disclosures to be made by investment funds when they mention terms like 'ESG', 'low-carbon', or 'sustainable' in their names," Bloomberg reported last week.

Regulators are also looking at "ESG funds marketing and how environmental, social and governance is incorporated into investing along with these funds voting at companies’ annual meetings," the report says.

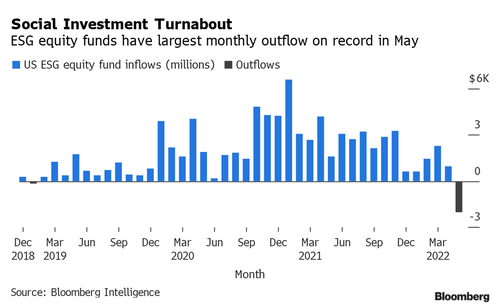

It was then reported on Wednesday that ESG equity funds had their worst month of outflows on record.

Recall, we first noted back in September 2021 that the SEC was on the case looking at companies that claimed to be ESG.

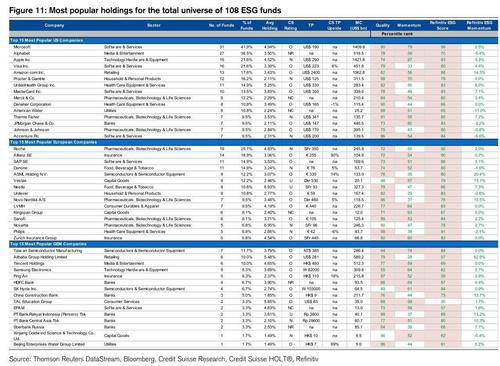

As the pace of growth in terms of assets dedicated to "ESG" funds started to accelerate, we also started to notice that the assets being stuffed into these ESG funds didn't really look all that different from a typical equity fund. Just take a look at a list of the most popular holdings from 2020:

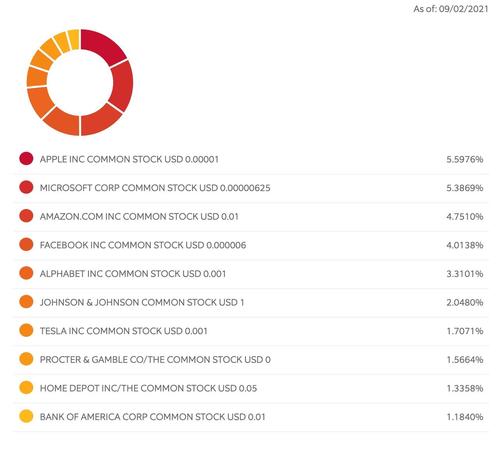

Now, take a look at the top holdings for ESGG, one of the top ESG-focused ETFs.

Stocked with blue-chips, these funds don't exactly scream environmentally friendly and socially responsible. One industry insider confirmed as much when he shared a new term: "green washing".

Since then, we have run at least a half dozen reports about abuses in the ESG space: