gchapel

Just over two months ago, I wrote on i-80 Gold (NYSE:IAUX), noting that it was a top-5 exploration story sector-wide, and the sector-wide weakness was providing a gift, given that it could easily be trading above US$3.00 with its exploration success to date. Since then, the stock has been the top performer in the sector by a wide margin, up ~60% since October vs. a ~30% rally in the Gold Miners Index (GDX). However, the second batch of drill results from the Hilltop Zone far exceeded my already semi-lofty expectations (given how the first batch of holes looked), with a highlight hole of ~800 gram-meters, or 10.0 meters of roughly ~80 grams per ton gold-equivalent, with 60.0 grams per tonne gold alone in addition to lead/zinc and silver credits.

i-80 Gold - Seeking Alpha Article - October 7th (Seeking Alpha Pro)

Most gold juniors would give an arm for a hole like this, but this was not the only hole released by i-80 Gold. In fact, it followed up on 28.3 meters of 25.0+ grams per ton gold equivalent (Hilltop Upper Zone), and IRH22-53 also intersected 18.3 meters of 25.0+ grams per ton gold equivalent. These incredible intercepts have elevated i-80 Gold from a top-5 exploration story to easily a top-3 exploration story. The big question now is what might lie beneath the Archimedes Pit that might be contributing to this rich mineralization that i-80 Gold is hitting closer to the surface. Given this further upgrade to the investment thesis, I see i-80 Gold as a top-3 producer in the sector with a rare mix of growth and value.

Recent Exploration Success

It's no secret that i-80 Gold has enjoyed considerable exploration success across its properties over the past 18 months, and the impressive intercepts out of the Hilltop Zone have certainly elevated that success to a new level. However, with hundreds of gold juniors in the sector all releasing drill results each week, it's worth highlighting just how impressive these intercepts have been at Granite Creek, Ruby Deeps, and the Hilltop Zone.

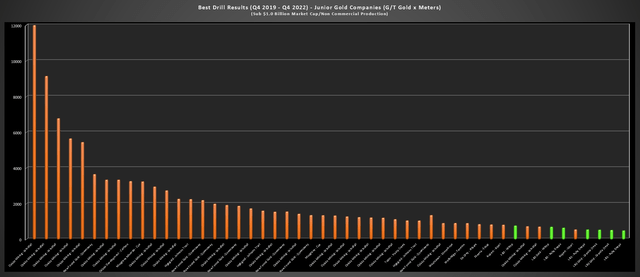

The chart below shows the majority of the best intercepts I have tracked on a gram-meter basis for sub $1.0 billion market cap gold juniors over the past three years. As we can see, i-80 Gold (green shaded bars) now has seven top-100 intercepts drilled over the past three years, with hits ranging from 500 to 790 gram-meters, with multiple 250+ gram-meter intercepts as strong runner-ups.

The best drill holes sector-wide over the past three years are shown below on a grams per tonne gold by meters basis, with i-80 Gold's intercepts released across its projects shown below in green.

Best Drill Results - Q4 2019-Q4 2022 (Junior Gold Companies - Sub $1.0 Billion Market Caps/Non-Commercial Production) (Company Filings, Author's Chart)

This number of holes (7 of the top 100) places i-80 Gold in third place behind just Osisko Mining's (OTCPK:OBNNF) Windfall deposit and New Found Gold's (NFGC) Queensway Project, and if we exclude Osisko's Windfall, which is a freak of nature with a highlight hole of 2.0 meters at 13,634 grams per tonne of gold, i-80 Gold now has over 40 of the top 100 intercepts, i-80 Gold would be #2 among gold juniors, with seven of the top ~60 intercepts drilled since Q4 2019.

This is truly incredible when we consider that Osisko Mining has drilled ~1.7 million meters over five years to amass these blockbuster intercepts, and i-80 Gold has logged seven world-class intercepts by drilling a modest ~100,000 meters by comparison. Some examples of highlight gold hits (separate from Hilltop polymetallic intercepts discussed above) are as follows:

- 23.2 meters at 9.7 grams per tonne of gold

- 18.3 meters at 9.0 grams per tonne of gold

- 78.6 meters at 7.1 grams per tonne of gold

- 71.6 meters at 7.0 grams per tonne of gold

- 22.4 meters at 8.2 grams per tonne of gold

- 13.4 meters at 13.9 grams per tonne of gold

- 33.2 meters at 19.8 grams per tonne of gold

- 22.4 meters at 19.8 grams per tonne of gold

- 51.2 meters at 9.0 grams per tonne of gold

Some investors might argue that i-80's Gold highest-grade intercepts are concentrated among the back of the pack from a gram-meter standpoint. However, it's worth noting that its hit rate (percentage of holes hitting economic mineralization) is among the best in the sector; its intercepts are all over very mineable widths, suggesting less dilution than some very narrow intercepts that make up some of the top-25 (2.0 meters or less), and its intercepts are all over what's estimated to be at least 70% true width in most cases, while true widths are not provided for some peer holes. However, the biggest differentiator is that these intercepts are significantly more valuable, even if they're lower grade in some cases, given that they're on permitted properties with existing infrastructure.

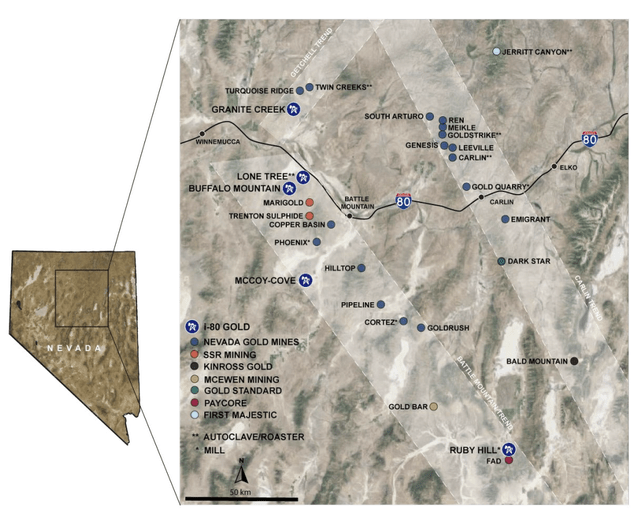

Nevada Map & I-80 Gold Projects/Processing Facility (Company Presentation)

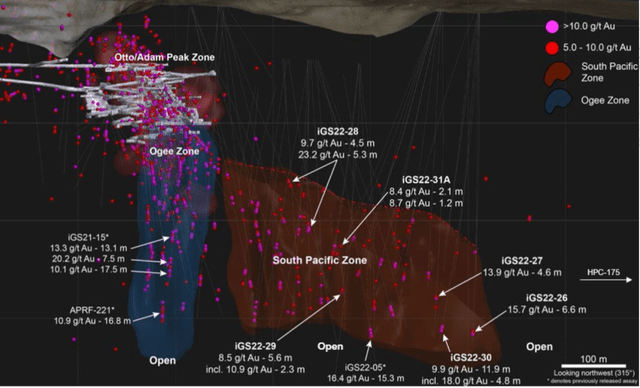

In the case of its Granite Creek Project, which could ultimately host a separate 2.0+ million-ounce deposit with the newly identified South Pacific Zone, this newly discovered zone could boast grades north of 10.0 grams per tonne of gold and is expected to be accessible by 2023, made possible due to its close proximity to underground workings. Mining is already ongoing at the Ogee Zone, with a toll-processing agreement in place with Nevada Gold Mines to process material mined here (until its newly acquired Lone Tree Facility is refurbished).

As for oxide material which is proving more prevalent than expected at the Ogee Zone (Granite Creek), it has leach pads a short drive to the south (Lone Tree) and a CIL Plant that requires modest capex to restart at its Ruby Hill Project to process the higher-grade oxide mineralization.

Granite Creek Infrastructure & South Pacific Zone (Company Presentation)

As for the Ruby Hill Project, i-80 Gold has existing heap leach pads to treat lower-grade oxide material, and it has a CIL Plant with barely $10 million in restart costs (as noted above) to process higher-grade oxide material on site. In terms of high-grade refractory mineralization at Ruby Deeps, the company has Lone Tree, which it's planning to refurbish where it can truck this material, translating to the production of ~70,000 ounces per annum even at just a ~1,000 ton per day rate.

Finally, its CIL Plant could be converted to a floatation plant long-term to process base metals and take advantage of the polymetallic opportunity. In summary, the company has nearly all of its bases covered, and the grades it's hitting today and this year translates to areas it could fast-track to mine within the next year in some cases.

Ruby Hill Infrastructure (Company Presentation)

For those unfamiliar with the story, I recommend reading this primer for the i-80 Gold story, which goes into considerable detail. However, in short, the company's medium-term plan is to produce 250,000+ ounces of gold per annum in FY2025 by trucking material from its three high-grade mines (McCoy Cove, Granite Creek, Ruby Deeps) to its central Lone Tree Facility, with further utilization of a toll-milling agreement to process double-refractory ore from McCoy Cove. This is expected to be supplemented by oxide production that can be placed on its leach pads or processed at its CIL Plant, with the possibility to produce ~275,000 ounces in FY2026, depending on grades.

Hub & Spoke Model - 250,000 Ounces In 2025 (Company Presentation)

This production profile in Nevada could easily justify a $1.80+ billion market cap, given that Nevada is a top mining jurisdiction, and i-80 Gold will be one of the highest-grade miners globally when all three mines are in production (Granite Creek is already operating, advanced work underway on other two projects), with an average feed grade north of 8.0 grams per tonne gold. Based on a conservative fully-diluted share count of ~310 million shares, this already points to a fair value of US$5.80 for its 2-year target price - representing a 115% upside from current levels. However, this production profile ignores the growing upside opportunity that cannot be overstated.

The Upside Opportunity #1

Before moving over to Ruby Hill, which is quickly becoming the company's flagship property, it's worth noting that Granite Creek is not just home to the underground that Ogee, Adam/Peak, and future South Pacific mining areas; it's also home to a very high-grade open-pit project. This potential future mine (CIL/heap leach) has phenomenal economics, is a past producer, and could produce over 195,000 ounces per annum at sub $1,000/oz all-in-sustaining costs [AISC]. Even adjusting for inflation, upfront capex could come in at less than $170 million, making this a project that i-80 Gold could easily finance with cash flow once the Hub & Spoke Model is up and running in late 2025 with three mines feeding Lone Tree.

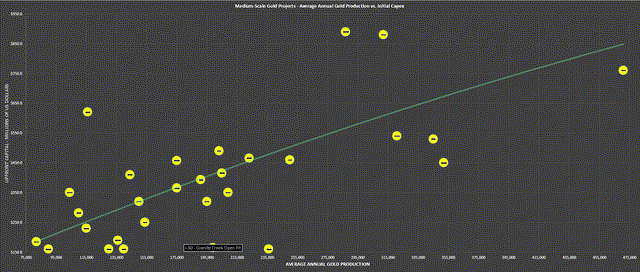

Medium-Scale Gold Projects - Average Production vs. Initial Capex (Company Filings, Author's Chart)

To put this project's economics in perspective, we can look at the above chart. In this chart, those projects furthest to the right and closest to the bottom of the chart are the most attractive given that the most significant future production profile combined with the lowest capital intensity. As we can see, Granite Creek Open Pit is truly exceptional from this standpoint, with an average production profile that dwarfs that of Valentine, Magino, Railroad South, Marban, and others, but at a fraction of the cost, especially in the case of Valentine and Magino with 100% to 200% higher capex.

Granite Creek Mine (Company Presentation)

It says a lot for a company when its #4 project, which in this case is Granite Creek Open Pit (behind Granite Creek Underground, Ruby Deeps/426, McCoy Cove), would be a company maker for the average gold junior. Assuming i-80 Gold brings this project into production by 2027, its production profile would increase to ~450,000 ounces at industry-leading margins. In fact, Granite Creek's costs are expected to be more than 25% below the estimated FY2025 industry average AISC of ~$1,330/oz, translating to ~$800/oz AISC margins or ~44% at a conservative $1,800/oz gold price.

The Upside Opportunity #2

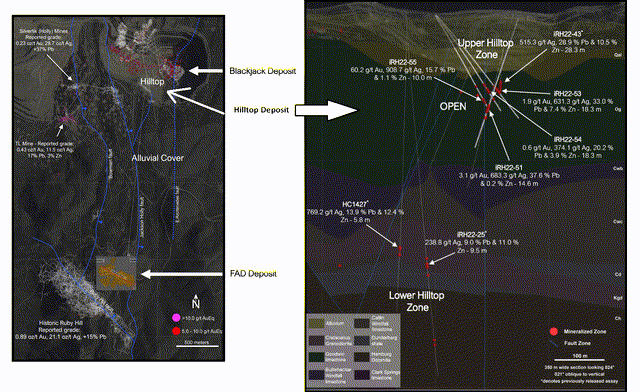

Moving over to Ruby Hill, the upside opportunity is truly astounding, and it's hard to put numbers on the potential here, given that the company is still at the top of the 1st inning in terms of defining the size of this opportunity. The first major opportunity is the polymetallic opportunity with Hilltop and Blackjack, which could combine to feed a floatation plant later this decade, producing two concentrates (lead/silver and zinc).

Assuming the company can outline a resource of 10.0+ million tons of material, and assuming a 2,000 ton per day processing rate with an average rock value of ~$650/ton (~12.7 grams per tonne gold-equivalent) and an ~80% recovery rate, we could see annual production of 210,000+ gold-equivalent ounces per annum. This would be a game-changer, nearly doubling production from its three future gold mines combined.

However, while a polymetallic mine of this size would nearly double production relative to the current Hub & Spoke model, it would dwarf anything i-80 has in its portfolio from a grade and margin standpoint. This is because margins could come above 60% on ~$650/ton rock value material at an ~80% recovery rate compared to conservative estimated mining/processing costs of ~$200/ton. However, I believe a blended rock value of ~$650/ton for Blackjack and Hilltop might be conservative if we keep seeing grades coming in north of $1,000/ton as we have from Hilltop to date (with some intercepts above $3,500/ton). Using a ~$750/ton rock value and the same recovery, production would jump to ~250,000 GEos at well over 60% margins.

i-80 Gold - Ruby Hill Project (Company Presentation)

To put this in perspective, this could end up being the equivalent of Rupert's (OTCQX:RUPRF) Ikkari Project in Finland, where a recent study estimated that it could produce an average of ~200,000 ounces per annum at 60% plus margins in its recent Preliminary Economic Assessment. To put this in perspective, Rupert will need to spend a minimum of $400 million to get Ikkari/Pahtavaara into production. Rupert is sitting at a market cap of $750 million fully-diluted based on this opportunity alone. So, suppose a project of this quality in its early stages in a Tier-1 jurisdiction can command this type of valuation. In that case, this gives an idea of what kind of valuation the polymetallic opportunity at Ruby Hill could command if it continues to grow.

To prove my point about how valuable carbonate replacement deposits [CRD] like Hilltop are, Arizona Mining was acquired by South32 (OTCPK:SOUHY) for well over $1.0 billion as a development stage company in 2020.

However, Hilltop is just one discovery in a ~600-meter-wide corridor, and there exists the potential to find other high-grade gold and CRD deposits within the untested structure due to it being under alluvial cover. There's also the ability to expand the resource at Blackjack, and the bonus to this opportunity is that Hilltop and Blackjack are sitting beneath and just south of an already mined open pit. This means easy access and much lower capex, making this a project that i-80 Gold could finance independently once it morphs into a cash flow machine when its three high-grade mines are in production.

Given that high-grade gold-rich CRD mineralization is being intersected to the south of this corridor at FAD, and ultra high-grade CRD mineralization with a gold kicker is being intersected on the north end of this corridor just south of the Archimedes Pit at Hilltop, I would be shocked if the untested area between these two deposits was barren. Hence, I am cautiously optimistic that there might be another Ruby Deeps or another Hilltop, which would further grow the already abundant resource at i-80's Ruby Hill Project.

The New Upside Potential Upside Opportunity - What Lies Beneath

The polymetallic potential at Ruby Hill is a game-changer, and it would likely be accretive from a margin standpoint if it were brought into production. However, the exciting part about this CRD potential is that it has i-80 Gold's CEO Ewan Downie and his team thinking big picture and questioning where the elusive potential heat source (porphyry) might be. As stated by i-80 Gold's CEO in a recent interview:

"We think that the Ruby Hill Property has the textbook geological system for finding a major porphyry deposit. Ruby Hill has all the ingredients. We have the disseminated gold mineralization as you see at Mineral Point, the distal carbonate replacement deposit [CRD] mineralization like we're seeing at Hilltop and FAD, and the distal zinc-lead rich skarns that we have at Blackjack. So the big question is that we have all the ingredients for one of these massive systems; where is the porphyry?"

- i-80 Gold CEO, Ewan Downie

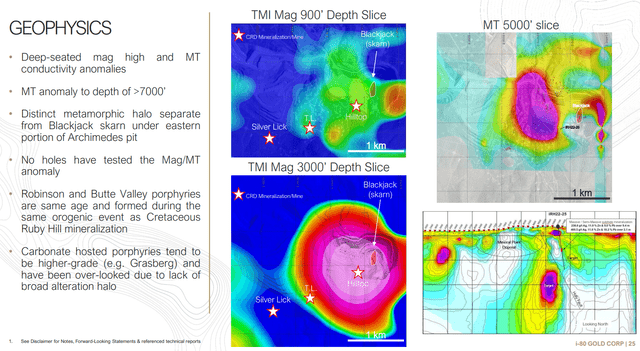

Geophysical work has identified a major anomaly of the Archimedes Pit at depth, evidenced by magic highs, with the possibility that this could be the porphyry source (yielding copper, gold, and molybdenum). There's already evidence of copper at the project, with copper values in Homestake's historical hole (HPC1427: 5.8 meters at ~769 grams per tonne of silver, ~13.9% lead, ~12.4% zinc, and 1.0% copper) and in holes drilled into the Blackjack deposit, such as HRC603 (~21.6 meters at ~57 grams per tonne of silver, 0.2% lead, ~21.9% zinc, and 0.2% copper, and 1.8 grams per tonne of gold). Finally, the company has also seen evidence of molybdenum over narrower intercepts.

Geophysics - Ruby Hill Project (Company Presentation)

As shown above, the 900-foot depth slice of the magnetics shows a magnetic anomaly in the Ruby Hill Pit, highlighted by the warmer colors that indicate a higher magnetic signature. Meanwhile, in the 3,000-foot depth slice image below, there appears to be a very high conductor distinct from the Blackjack skarn, which is much smaller and also shows up in the images. The company noted in its recent Conference Call that it is doing additional Induced Polarization work and hopes to have these results before year-end.

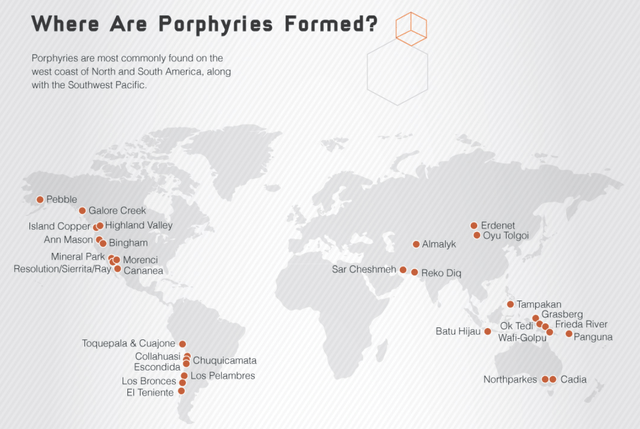

While there are no guarantees, and this is a longer-term exploration target, this is a big deal, and the discovery of a porphyry may not be just an average lower-grade porphyry. This is because just as the Carlin overprint at Ruby Hill has resulted in elevated gold values at CRD targets (Hilltop) and historical mines in the area (Holly, TL, and Ruby Hill), carbonate-hosted porphyries tend to host higher grades. For those unfamiliar, the Indonesian Mine owned by Freeport (FCX) is a company maker, with production expected to be ~1.6 billion pounds of copper and ~1.6 million ounces of gold for the next five years, which is incredible for an asset that's already been in production for well over 30 years.

Porphyry Deposits Globally (Visual Capitalist)

Regarding major porphyries in the United States, Bingham Canyon in Utah is a monster that has been in production for over a century. In fact, the value of the resources extracted from the mine exceeds that of the Comstock Lode, Klondike, and California Gold Rush mining regions combined. Meanwhile, i-80 Gold noted that the Robinson and Butte Valley porphyries are the same age and were formed during the same orogenic event as Cetraceous Ruby Hill mineralization. The Robinson Mine started as a gold/silver mine and is also a monster (shown below) located in White Pine County, Nevada.

Robinson Mine (KHGM)

For those unfamiliar, mining at Robinson (Ely Mining District) in eastern Nevada dates back to the 1860s (similar to CRD mining in the Eureka District where Ruby Hill lies). It began when Thomas Robinson discovered silver, gold, and widespread low-grade copper. Several gold mines were opened from 1892 to 1907, but none were successful. Fortunately, Robinson's future was much more profitable, with supergene mineralization (2-4% copper) discovered on the Ruth claims. Large-scale copper mining has been ongoing for over a century with two brief hiatuses (1978-1985, 1999-2004). In the 1908-1978 period alone, Robinson produced ~4.0 billion pounds of copper and ~2.7 million ounces of gold, making it a very productive mine, to say the least.

It might seem like a stretch to assume that i-80 Gold might have a monster porphyry on its hands as well at what looks to be ultimately a multi-million-ounce 8.00+ gram per tonne gold mine in Ruby Deeps. However, it's important to note that there's been little effort to chase down anything but oxide gold at the deposit in the past. Of course, the focus was on CRD mineralization, but hunting down potential deposits under 60 to 120 meters of overburden wasn't possible for the old timers in the Eureka District, with these fault structures under alluvial cover with no outcroppings. However, from what the old timers did find, the mines worked were among some of the highest-grade CRD discoveries globally.

The respective grades mined at these deposits were as follows:

- Silverlick (Holly): 0.23 ounces per ton of gold, 28.7 ounces per ton of silver, and additional lead grades

- TL Mine: 0.43 ounces per ton of gold, 11.5 ounces per ton of silver, 17% lead, and 3% zinc

- Ruby Hill: 0.89 ounces per ton of gold, 21.1 ounces per ton of silver, and 15% lead.

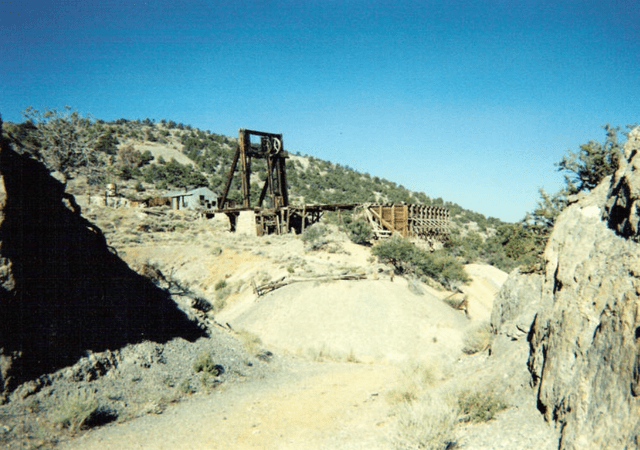

Local Headframe & bins at Past-Producing Ruby Hill Mine (RainesMarket.Com, Lee Raine, Connie Hicks Photo)

This limited attention on other opportunities has worked to i-80's favor, already yielding what could be a high-grade future CRD mine in Hilltop, what already looks to be a sizeable polymetallic deposit in Blackjack and a much larger and higher-grade resource in Ruby Deeps. So, while I'm not assigning any value to a major porphyry, I certainly wouldn't rule another significant discovery out, and it could be yet another game-changer. As I pointed out in my initial article on i-80 Gold (IAUX), I was not placing any value on the polymetallic potential at Ruby Hill, but that further exploration success from a CRD standpoint would be a game-changer for the company. This is exactly what's transpired, and the discovery of a porphyry would further augment arguably a top-3 exploration story sector-wide.

As it stands, i-80 Gold increased its Ruby Hill drill program to continue testing the CRD potential, and it could release a resource estimate on Blackjack in 2023.

Summary

Obviously, it's early to suggest that i-80 Gold might have a major porphyry discovery on its hands in addition to a future polymetallic mine. Still, the good news is that the current market cap of ~$625 million (~240 million shares at US$2.60) is supported by the gold Hub & Spoke model alone.

This means that the polymetallic and potential porphyry opportunity is an upside to the current investment thesis, meaning they could push the stock to a market cap north of $2.8+ billion long-term (~$9.00 per share fully diluted) if they pan out in a best-case scenario, but they don't need to pan out since the stock is already undervalued on its gold business, but is wildly undervalued if it can grow into a ~600,000-ounce producer, which looks to be upside case (Polymetallic, Granite Creek Open Pit + Gold Hub & Spoke Model).

Given this significant bonus kicker to what's already a strong investment thesis, I continue to see i-80 Gold as a top-3 producer sector-wide and a rare mix of growth and value. This is because companies with similar exploration success without infrastructure have been acquired twice i-80 Gold's market cap on average (Ventana, Arizona Mining, Fronteer, Great Bear, etc.), and i-80 Gold already has more resources than these companies at the time of their acquisition by a wide margin, but in a similar or more attractive jurisdiction (Colombia, Arizona, Nevada, Red Lake), and considerable sunk costs in place that would require $1.0 billion in construction costs and considerable time/permits to replace (autoclave, leach pads, CIL plant, rail siding, assay labs).

While it has outperformed its peers, I see i-80 Gold as sitting in the bottom of the second inning in terms of the overall thesis, and I expect much higher prices ahead over the next two years. Longer-term, i-80 Gold is unique in that it benefits from a growing NPV (5%) due to recent discoveries/resource growth, expansion in its multiple as it grows in scale, and limited share dilution. The result is a company with rapidly growing reserves, net asset value, and production per share, exactly the model that led to 1000%+ returns in American Barrick (1980s) and Kirkland Lake (2017-2021). To summarize, I continue to see i-80 Gold as the best opportunity in the sector since Kirkland Lake Gold in 2017, and I would view weakness in the stock as a buying opportunity.