Vanadium prices do fluctuate. Hopefully they will eventually go up. But when? And how much higher? Right now, with V2O5 prices in the US$7 range it does not look good for Largo due to the fact that management's inability to control costs.

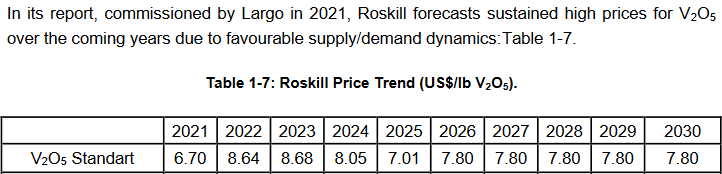

Based on Roskill’s V2O5 price forecasts in a report commissioned by Largo in 2021 (see below) then Largo must reduce its mining operating costs back to below 80% of revenue to be profitable in 2024 even if they can deliver the Ilmenite project as promised at 77,000T/year.

Imho, the following projects / conditions are prerequisite for Largo to embark on the road to recovery in 2024:

1) Successful delivery of the Ilmenite revenue stream (within management control)

2) Successful cost reduction in a meaningful way (within management control)

3) Successful delivery of strategic alternatives for LCE (within management control), and

4) Most important of all: A solid rebound of V prices to US$9.00/lb or higher (outside of management control).

The following table shows the average prices of the benchmark Standard V2O5 as well as Largo’s Sales price per V2O5 equivalent pound (including high purity) for the first 9 months of 2023.

US$

| Period | Avg Standard V2O5 Benchmark Price | Sales price per V2O5 equivalent pound | Sales over Benchmark Prices |

| Q1-23 | $10.39 | $9.14 | ($1.25) |

| Q2-23 | $8.46 | $9.42 | $0.96 |

| Q3-23 | $8.03 | $8.34 | $0.31 |

| 9-month | $8.96 | $8.99 | $0.03 |

| E Q4-23 | Lower than Q3’s | ? | ? |

| FY 2022 | $9.57 | $8.70 | ($0.87) |

From Largo’s NI 43-101 Technical Report issued on Dec 16 2021

DYODD