Thank you for your kind words. Much appreciated.

I’ve been through the ups and downs of Largo for 16 years since I first bought into the company in 2008. So I can safely say that I’m a “true long”.

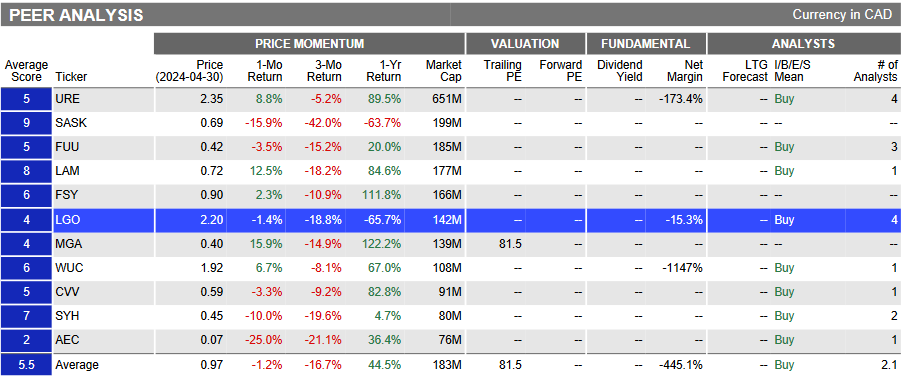

I have to admit that I just can’t wrap my head around the fact that LGO is currently at a historical low, i.e even lower than when Maracas was still in the exploration stage with no revenue stream whatsoever.

1) You hit the nail on the head when you say: “The only question is how quickly this plays out, and for us Largo fans, what condition will Largo be in financially when the story plays out”. This is exactly what’s keeping me awake at night.

Among the reasons for not hitting the sell button, your decision to sell or not to sell a non-stop declining stock like LGO may be based on the fact that you can’t afford to realize your loss. The feeling of “I've lost so much that there's no point in selling now, might as well sit tight and see what happens” is real. However on the other side, your decision to buy or not to buy a stock is mainly based on your risks vs rewards analysis. The chance that you would buy a non-stop declining stock if the risks were not worth the rewards is very slim, especially when you are “smart money” with internal/external analysts at your disposal. LGO is at historical low, how come there is no massive buying from smart money? Why is the smart money just sitting on the sidelines despite the “3 buy” and 1 “hold”rating from analysts covering Largo? The company’s market cap is merely ~US$100M down from ~US$1B at its highest. If the future's so bright, what is the chance for a powerful player to take advantage of the bargain price to buy and take Lago private? This would be a nightmare scenario as the existing shareholders would be left with nothing and the new owner everything.

2) Your remark about the striking similarities between Uranium and Vanadium are also bang on. As you can see the “Peers Analysis” below:

Btw, congratulations for the timing of your entry & exit strategy la “Cooperman”. A truck load of $ he must have made by getting out when he got out.

Please post more often. We need valuable contributions. As Island9999 said recently: “Totally agree,this board has declined over the last few years,as has the company,....”

https://stockhouse.com/companies/bullboard/t.lgo/largo-inc?postid=35987173

Cheers