https://www.fdiintelligence.com/content/data-trends/chinas-steel-overcapacity-foments-dumping-concerns-83748

China’s steel overcapacity foments dumping concerns

Rising Chinese steel exports have triggered new trade measures in US, India and elsewhere

Excerpt

“China’s overcapacity and non-market investments in the steel and aluminium industries mean high-quality US products have to compete with artificially low-priced alternatives produced with higher carbon emissions,” read a White House statement on April 17. Data supports this narrative.

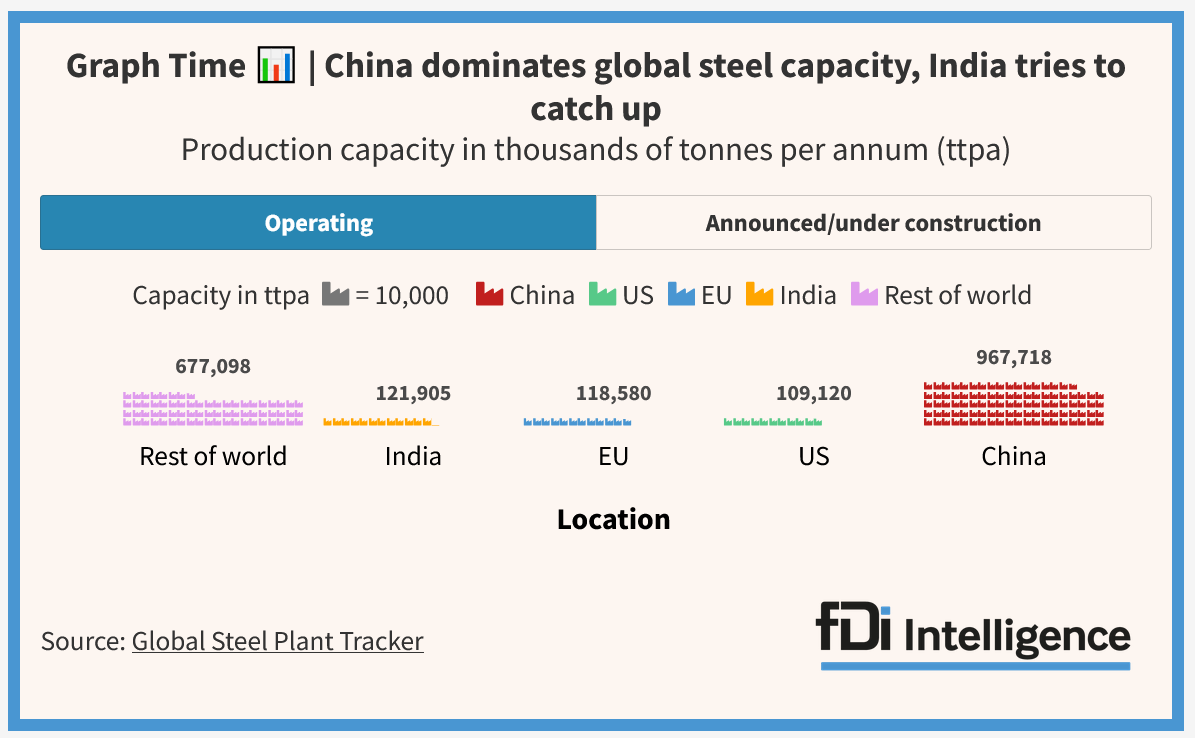

Chinese steelmaking capacity and output has grown massively since 2000 to meet soaring demand during a two-decade period of rapid economic growth. Today, China has operating plants able to produce over 967,000 tonnes of steel per year, according to Global Energy Monitor – over double the operating steel capacity found in the US, EU and India combined.

A sharp contraction in Chinese domestic demand and prices for steel, mainly due to a slowing property sector, has now led Chinese steelmakers to sell excess steel cheaply into overseas markets. Steel exports from China rose year-on-year by 36.2% to 90.3 million tonnes in 2023, while average export prices fell by 32.7% to $936.80 per tonne, according to official statistics.

China, which produces more than half of the world’s steel, is accused of helping to fuel a global steel excess capacity crisis. In January, the OECD warned that global excess capacity widened to 610 million metric tonnes last year and is expected to “become even more acute” in the future.

“China disrupts world markets both by subsidising the production of steel and other products and by dumping those products in the US and other markets,” says Kevin Dempsey, CEO of the American Iron and Steel Institute (AISI).