Tahoe Resources (TSX, NYSE:THO), which earlier this week announced a deal with Lake Shore Gold(TSX:LSG) that would add two low-cost mines in Northern Ontario to its portfolio, maybe be looking for more assets in the area.

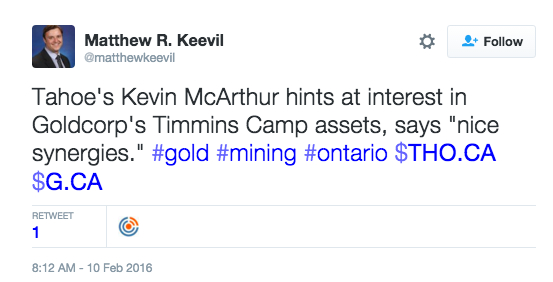

Speaking to The Northern Miner, the company’s founder and executive chair Kevin McArthur hinted there was interest in Goldcorp's (TSE:G, NYSE: GG) Porcupine operation, also located in Timmins, Ontario.

According to McArthur, the asset — which consists of the Hoyle Pond and Dome underground mines, the Hollinger open pit mine, several large tonnage stockpiles, and a central milling facility — would fit into Tahoe’s portfolio as they have "nice synergies."

The Vancouver-based miner, which was spun out of Goldcorp Inc. in 2010, has been one of the most aggressive buyers in the industry. It bought Rio Alto Mining last year to expand into Peru, and the all-stock deal with Lake Shore announced Monday gives Tahoe a suite of mines and projects in Timmins, one of the world's most prolific gold producing camps.

The Vancouver-based miner, which was spun out of Goldcorp Inc. in 2010, has been one of the most aggressive buyers in the industry. It bought Rio Alto Mining last year to expand into Peru, and the all-stock deal with Lake Shore announced Monday gives Tahoe a suite of mines and projects in Timmins, one of the world's most prolific gold producing camps.

Last month, Goldcorp announced it will close its century-old Dome mine in Timmins — one of the oldest operating gold mines in North America and one of the two underground assets that are part of Porcupine — amid a crushing metals downturn that has shaved nearly half the company's share price over the last year.

The century-old mine will shut down this summer, affecting 115 employees and 76 contractors.

In 2015, Porcupine marked its 105th year of continuous mine and mill operations, and has produced more than 67 million ounces of gold since production began. In 2014 gold production totalled 300,000 ounces. According to Goldcorp’s website, production during 2015 is expected to be between 300,000 and 320,000 ounces.