Nano One (OTCPK:NNOMF) has been partnered for cathode material process development with Volkswagen (OTCPK:VWAGY) since 2019. Volkswagen's "Power Day" presentation strongly suggests that Nano One cathode process technology will play a major role in Volkswagen's BEV manufacturing.

Nano One's cathode process produces inherently more precise crystal structures within cathode material. For LNMO cathode material (aka HV Spinel) the precision of the Nano One process effectively eliminates voltage fade and delivers good cycle life for this low cost, cobalt free, high performance cathode material. Protective (titanium) coatings on individual single crystal LNMO particles - also possible with the Nano One process - has recently allowed practical use of LNMO with liquid electrolytes.

Most recently Nano One announced its M2CAM cathode process (for which patents are pending). Nano One's M2CAM process greatly simplifies and shrinks the environmental footprint of cathode material manufacturing and is applicable to most all cathode materials used or planned for use in electric vehicles.

Volkswagen in their Power Day presentation called cathode material the

CONTROL LEVER FOR SUSTAINABLE SUPPLY CHAIN, COST, AND RANGE.

Volkswagen's prominent focus on supply chain sustainability aligns perfectly with Nano One's latest M2CAM development.

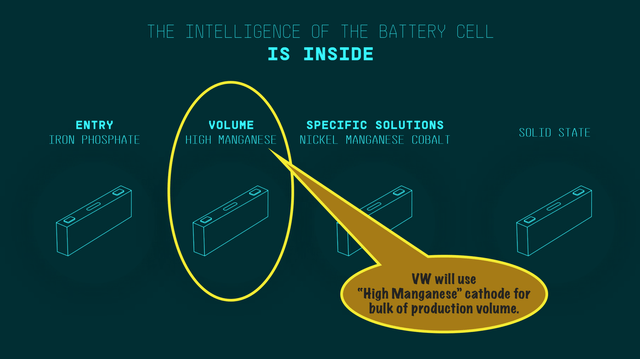

Volkswagen went on to describe how three different cathode materials will be utilized for different segments of their electric vehicle business. Volkswagen will use a high manganese cathode material for most of their planned electric vehicle volume. This is similar to the approach Tesla (TSLA) showed at Battery Day...

Source: Volkswagen Power Day 2021

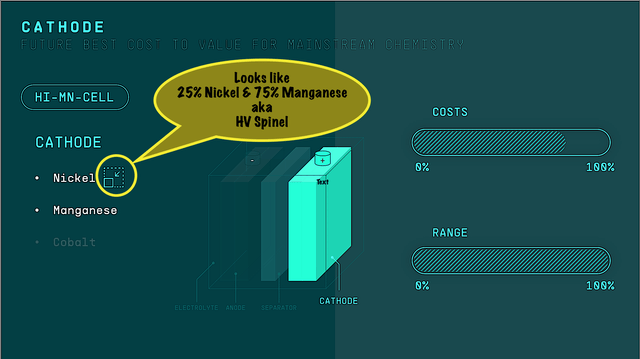

There is an important clue in another Volkswagen slide about the type of high manganese cathode they have in mind. Whereas Tesla described their high manganese cathode as being just a third manganese, this Power Day slide suggests Volkswagen is looking to roughly three quarters manganese content - exactly the ratio of manganese to nickel in Nano One processed LNMO HV Spinel.

Source: Volkswagen Power Day 2021

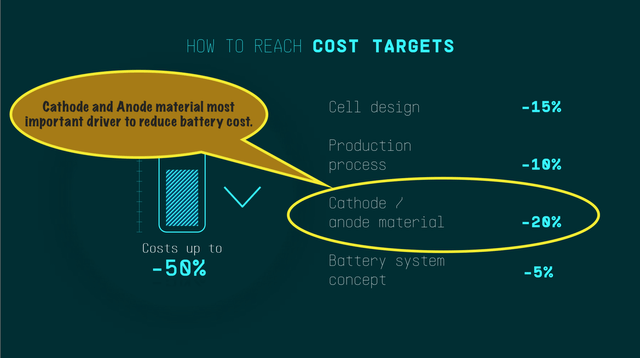

The Power Day presentation goes on to describe how Volkswagen intends to cut battery costs by half - which is strikingly similar to Tesla's plans... According to Volkswagen, material related costs are the largest driver in their battery cost reduction plan.

Source: Volkswagen Power Day 2021

Since Volkswagen plans to introduce batteries built to their Power Day roadmap by 2023, but not have solid state versions in the marketplace until 2025. Nano One could well end up playing an earlier, and perhaps more significant, role in Volkswagens battery plans than Volkswagen's solid state battery technology partner QuantumScape (QS).

Conclusions for Investors

Before describing potential investor opportunities here I need to offer the following:

Disclaimer: Nano One is a small (roughly $430 million market cap) pre-revenue company. Investors should seek professional advice, perform thoughtful due diligence, and limit any investment in this company to funds they are prepared to put fully at risk. I am long NNOMF. That alone does not mean you should be too.

Over the three and a half years since September 2017 I have written several articles that have chronicled Nano One's steady advancement of the cathode materials manufacturing art. Nano One is the only company I know of that is at once a pure technology play in the lithium battery supply chain, publicly traded and not a one-trick pony.

QuantumScape, Volkswagen's solid state battery partner that has nearly fifty times Nano One's market cap (14 March 2021) is a one-trick pony. Solid state batteries are not the only path to high performance metal anode cells. General Motors (GM) is pursuing a metal anode Ultium battery that uses liquid electrolyte. If Nano One enjoyed the same market cap as QuantumScape, Nano One shares would be at $235, not $4.74. Investors might want to think about that.

Nano One, in contrast to QuantumScape, has technology that every lithium battery needs - a better way to make cathode material. Not just one special kind of cathode material but most any cathode material you might need. Nano One has multiple industry partners - carmakers, battery companies and cathode material manufacturers. And, Volkswagen's Power Day presentation suggests Nano One has taken another big step.

There are several carmakers including GM, Tesla and Volkswagen that are racing to conquer or at least be major players in the emerging electric vehicle market. These companies all have plans to make better, cheaper batteries and at least some of these companies are working with Nano One. In coming weeks and months investors should expect to hear more news concerning Nano One and their cathode materials manufacturing technology being on roadmaps to better, cheaper, more plentiful, and more sustainable electric vehicle batteries.