RobertKacpura

MODERN PROBLEMS REQUIRE MODERN SOLUTIONS

BASF, the $48 billion powerhouse has a big problem. How big? Big enough to shut down a rather large battery materials project. Nano One (OTCPK:NNOMF) has a modern solution to this problem.

Guess who has a Joint Development Agreement? Yup, Nano One and BASF are sporting a JDA. Intriguing isn't it? Let's explore BASF's problem and the solution Nano One has developed. Then we can look at the JDA for further connect-the-dots.

BASF Battery Material Project Is Delayed Due to Sulfates; A Benefit to Nano One

Why am I bringing up sulfates? On Feb 29th, 2024 BASF announced they have a problem that is delaying a battery materials plant: The problem is excess sulfates and what to do with them.

Sulfates are not something you hear about much in investing circles but they are very important as they can impact project costs and be difficult to dispose of but what are sulfates?

Sodium Sulfates (Aqua Metals)

What Are Sulfates?

For this article I wanted to reach out to the industry for a quote of just what are sulfates? Trent Mell, the CEO of Electra Battery Materials (ELBM) was gracious enough to provide an answer.

Sulfate is basically salt that originates in nature or in industrial processes that use sulfuric acid. Sodium sulfate is a by-product of the EV battery supply chain, notably refining and cathode precursor manufacturing. Historically, many jurisdictions allowed sodium sulfate to remain in plant process water that was returned to the environment. In small quantities, trace amount of sodium sulfate in large bodies of water could be assimilated with no adverse environmental impacts.

However, as the transition to BEVs picks up steam, industry insiders equate a larger battery supply chain with a looming problem - what to do with large quantities of sodium sulfate?" - Trent Mell, CEO of Electra Battery Materials

This paragraph from C&en provides a bit of additional color concerning sulfates:

"A caustic, like sodium hydroxide, is generally used to remove the sulfur component, a process that yields metal hydroxides and sodium sulfate waste." - Robert Baylis of battery consultant Carding Mill

BASF Has A Sulfate Problem But So Does The Industry

This brings us back to the problem that BASF encountered --- a local environmental group delayed the opening of a battery materials plant due to the proposed discharge of sulfates into waterways.

"A Finnish court has ordered BASF to delay the opening of a battery materials plant in Harjavalta, Finland, after environmental groups argued that the company's plan for dealing with sulfate waste isn't sufficient."

These delays in Finland can cause delays in Germany.

"BASF's Finnish plant is a key piece of a battery supply chain the company is trying to establish in Europe. It will be able to produce 30,000 metric tons (T) per year of precursors for battery cathodes. BASF will convert the precursors into cathode powders at a facility it commissioned last year in Schwarzheide, Germany" - Source: C&en

Now BASF can most likely come up with a compromise or solution but the premise is if they are encountering this issue then it is likely this issue will grow as the environmental awareness of sulfates grow and as the EV industry grows, lithium demand will grow.

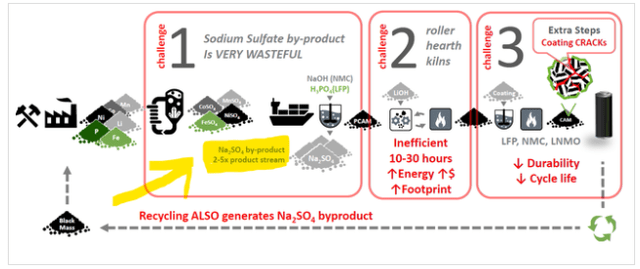

We can see in the below graphic that the traditional process to create lithium battery material can result in Sulfates. This is a lot of waste product for a company to dispose of and a potential issue that could delay a project.

Sodium Sulfate By-Product (Nano One)

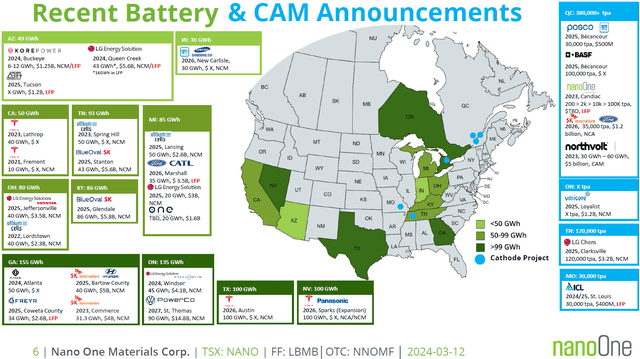

Demand for Lithium Will Increase Sulfate Production

Look at the below graphic which shows a small view of demand for lithium (and other metals) that is expected. Directly or indirectly these projects could produce or contribute to sulfate production. This is a rather large problem. (click to expand the picture)

Sulfates Are Going To Be A Problem (Nano One)

Nano One Sulfate Disposal

Sulfates are not bad per se, but you do have to do something with them. Simply producing them as a by-product and selling them into the market might not be efficient. Current worldwide demand is $0.7 billion USD in 2022. Worldwide growth estimates vary widely from a market size of $1.1 billion to $2.6 billion USD by 2032 with estimated growth at about 4% annually. Can all the sulfates from lithium and metal demand that will be created at 2x to 5x per input be sold off? Doubtful. One solution might be to convert the sulfates into sulfuric acid (which might benefit projects like Lithium Americas (LAC) Thacker Pass which will need large amounts of H2SO4). Let's see what Trent Mell of Electra said on the topic of converting sodium sulfates to sulfuric acid:

"One of the most attractive options is salt splitting, whereby electrolysis is used to split sodium sulfate (NaSO4) into sulfuric acid (H2SO4) and sodium hydroxide (NaOH), each of which are reagents require in the midstream of the battery supply chain. Thus, it has the potential to lower operating costs BUT the capex associated with salt splitting is not insignificant and the process is energy-intensive, which favors cheap power jurisdictions." - Trent Mell of Electra

Another disposal method was in the past, unmarketable sulfates were simply discharged into rivers or the ocean. This resulted in algae blooms that killed off marine life. Clearly this is unacceptable, thus, enter the Nano One solution which eliminates sulfates entirely from the equation, rather than reducing them. This brings us back to BASF.

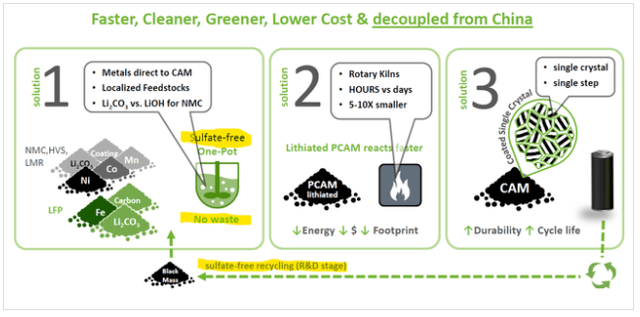

THE NANO ONE "ONE POT" PROCESS -

REWRITING THE RULES OF LITHIUM BATTERIES

While I often try to avoid long block quotes from companies in this case the most informative method is to just post what the company says about the "One Pot" process and what it brings to the table concerning sulfates. While it is a lot to read I think it is worth your time to read and digest what Nano One is claiming.

Nano One's patented One-Pot process is engineered to make cathode materials directly from non-sulfate forms of battery metals. This eliminates the need for intermediate metal sulphates, all sodium sulphate by-product, and all wastewater, which avoids permitting obstacles in jurisdictions with strict environmental regulations such as Canada, USA, and Europe. The waste streams avoided can amount to three times the product stream, and the One-Pot process simplifications also reduces operating costs, capital equipment costs and GHG emissions. Furthermore, the process uses lithium feedstock in the form of carbonate rather than hydroxide, which is costly, corrosive and harder-to-handle.

Nano One's patented One-Pot process forms durable single crystal cathode powders and protective coatings simultaneously and the process has been adapted for M2CAM, enabling these materials to be made directly from nickel, manganese, and cobalt metal powder feedstocks rather than metal sulfates or other salt powders. Metal powders are one-fifth of the weight of metal sulfates, avoiding the added costs, energy, and environmental impact of converting to sulfate and shipping and handling of waste." - Source: Form 61 from the March 27th, 2024 SEDAR filing - Page 2/3.

Pepperidge Farms Remembers the BASF Deal

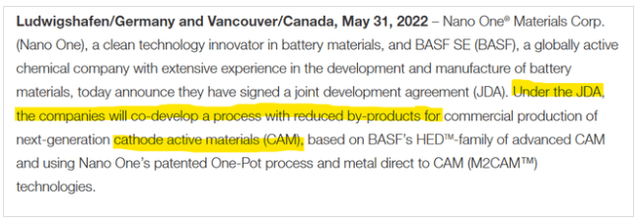

Back in 2022 BASF and Nano One entered into a Joint Development Agreement that specified a reduction in sulfates:

BASF JDA (BASF)

The key words are "reduced by-products for cathode active materials". Now what could that be? I think one answer might be the Nano One process does not reduce sulfates but rather they are never produced. Thus, we might say the Nano One process eliminates the sulphate issue since they are never created in the first place.

Nano One - Sulfate-free (Nano One)

Nano One CEO Dan Blondal on Sulfates

In a recent interview, Nano One CEO Dan Blondal was asked for 3 points of why Nano One is superior. His response is interesting. First he talks about having the only LFP cathode facility in North America:

"We have the only production facility, uh LFP production facility outside of Asia so we are very well positioned to address a market that has reached 60 to 70% market share in China and is virtually nil in North America and Europe. "For his 2nd point he moves on to sulfates: "We completely eliminate all of the water waste and all of the sulfate waste that the rest of the industry is saddled with and by eliminating sulfate and using nickel metal or iron metal as our input materials we're able to decouple from the strangle hold that China has on nickel sulfate and iron sulfate for instance."

Concerning Nano One's expansion strategy, per Mr. Blondal:

"We are looking to use the pilot plant we have in Quebec to define the turn key plant that will become the source of our expansion. With the intellectual property, the patents, the knowhow, the engineering plans, the flowsheets and then on top of that, key pieces of equipment. That then becomes something that we can modularize around the world, not only here in Canada, central Canada, Quebec but also in the U.S., in the Indo-pacific region, in Europe. That's really how we expand this technology and get it into many many different hands."

Nano One Financials

That all sounds great, but what do the financials look like? Nano One has $31.9 million in cash and cash equivalents as of Dec 31st, 2023 (per the March 28, 2024 PR). Liabilities stand at $5.5 million with no long-term debt at the year end. Nano One also has $6,715,493 remaining in Canadian government grants available per:

Government Grants (Nano One March 2024 Annual Financial Statements)

It is interesting to note the program is for a Cathode Piloting Hub. It aligns with Nano Ones long term goal of having multiple cathode lines producing produce for the auto industry (and the cell phone industry too) but for today we will just focus on sulfates.

Nano One Risk

What are the most important elements of a company? Management and cash on hand. If you have smart, motivated people at the helm you can overcome many obstacles and many setbacks. However, you need fuel to accomplish this and cash is that fuel. So good management, a healthy amount of cash and hopefully low debt, along with some good ideas paired with luck and you might fair well. Then again, Nano One is a penny stock. With penny stock comes extraordinary amounts of risk and uncertainty. It is not for everyone. Know your risk tolerances; know what you can afford to lose. Have a plan of what you will do if a penny stock declines 10%, 50%, or 75% and the same can be said for having a positive exit plan as well, even if it is simply to reevaluate the company if the stock appreciates in price.

CONCLUSION

When I ponder Nano One long term, I see a company that is working on expanding its cathode facility. Samples are being sent out to various battery companies and we might guess automotive companies.

The Nano One "One Pot" offers longer battery life and eliminates sulfates. These sulfates might prove costly to dispose of, or in the case of BASF, result in a project halt (for the time being). Looking forward a year I think we will start to see revenue producing deals, partnerships, and funding. Looking 5 years out and assuming the demand for lithium is growing I view Nano One as a good bet to play the shift from ICE engines to EV.

Additional Reading - A Nano One Sulfate Patent

Nano One had a patent approved on 3/21/2024 involving sodium sulfates. It can be viewed here.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.