Has this been posted before?

Hot Sector News

This month we’re putting the spotlight back on Burnaby, British Columbia-based Nano One Materials Corp. (Nano One), which is listed on the TSX as NANO. We initially covered this company in June 2023.

The clean technology company was founded in 2011, featuring a patented, scalable, low carbon intensity industrial process for the low-cost production of high-performance lithium-ion battery cathode materials. The technology can be applied to electric vehicles, energy storage, consumer electronics and next-generation batteries — essentials for a zero-emissions future.

Nano One’s “One-Pot process” produces coated nanocrystal battery materials, and its metal-to-cathode active material technologies address fundamental performance requirements and supply chain constraints while reducing cost, complexity, and environmental footprint.

The company has received the green light and funding from various government programs over the years, including the Canadian Industrial Research Assistance Program, the National Research Council of the Innovative Clean Energy Fund of the Province of British Columbia, and Sustainable Development Technology Canada (SDTC).

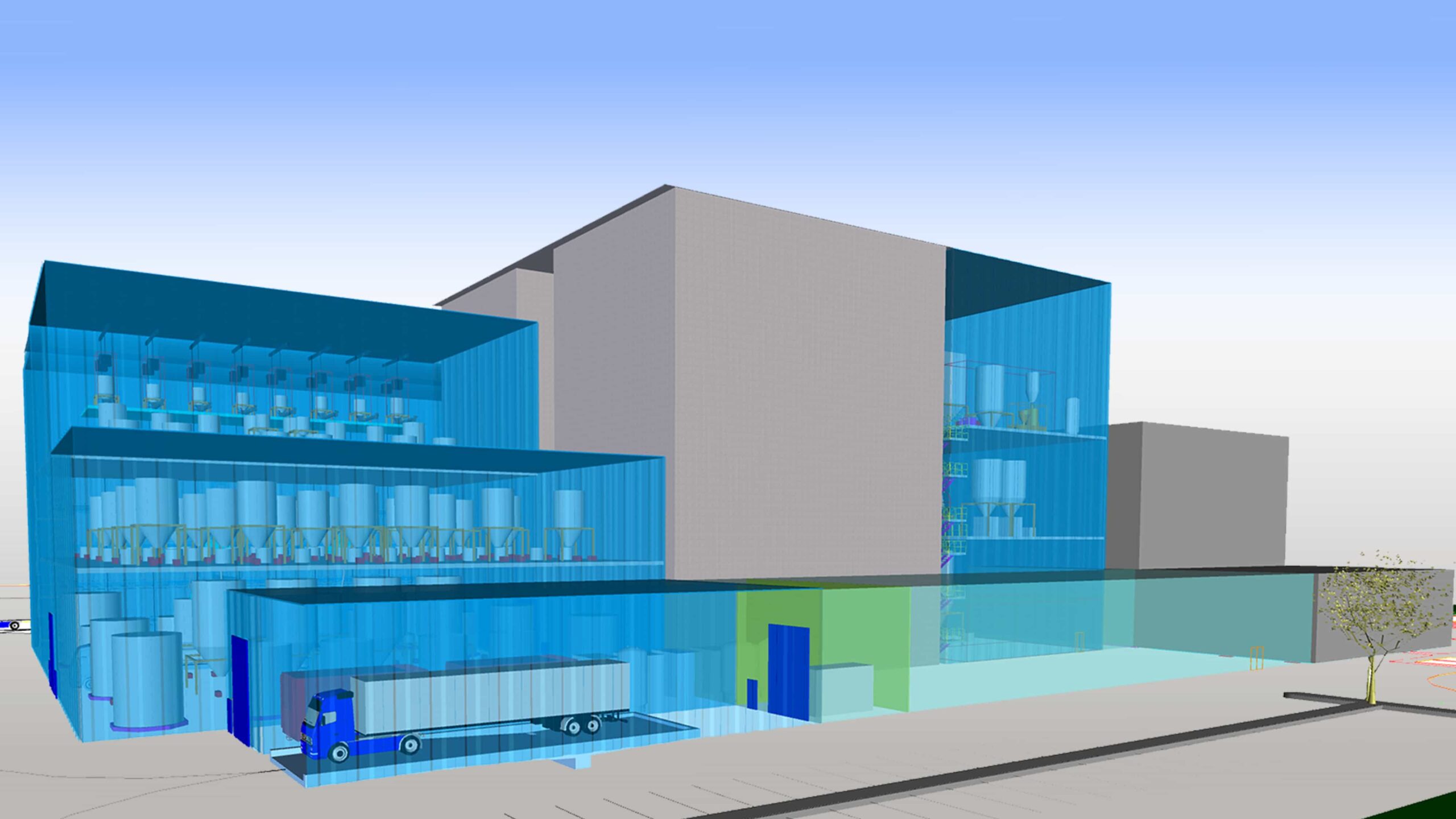

A rendering of Nano One’s proposed first commercial Lithium Iron Phosphate (LFP) facility. Credit: Nano One.

Nano One recently entered into a strategic agreement with Worley Chemetics, a wholly owned subsidiary of Worley Limited, for the purpose of jointly developing, marketing and licensing a process engineering design package for the deployment of cathode active material (CAM) production facilities for the lithium-ion battery materials sector. Worley Chemetics offers technology and solutions for sulphuric acid and other specialty chemicals facilities.

“This licensing agreement and global strategic alliance with Worley is another major milestone,” said Nano One CEO Dan Blondal. “It adds to the growing confidence of our shareholders, partners, and government stakeholders. It amplifies the value of our One-Pot process and addresses a growing need for a new generation of scalable battery cathode material production technology and clean, diversified supply chains.”

Blondal points to Worley’s global network of clients, deep engineering knowledge and a track record of designing and building process facilities “that can accelerate our design-once-build-many growth strategy. We have found in Worley a collaborative, insightful and visionary team that is just as passionate about changing how the world makes battery materials as we are.”

According to the company’s most recent financial disclosure, Nano One’s 2024 Q1 highlights are as follows:

- Quarter over quarter reduction in cash used in operating activities.

- Cash and cash equivalents of $23.1 million.

- Working capital of $21.2 million.

- Total assets of $41.1 million.

- Total liabilities of $5.3 million with no long-term debt.

We asked Paul Guedes, director of Capital Markets at Nano One, to provide some context to these numbers and to share his perspectives on market trends.

What would you say is the current value proposition for investors and prospective investors of Nano One?

Nano One is nearing commercialization of a technology that solves enormous issues with present manufacturing processes for battery materials that are not sustainable at the larger volumes we will need to produce for the energy transition. Solving the sulphate waste stream is critical and ensuring costs remain low and performance high.

With the shifting dynamics in the lithium iron phosphate (LFP) battery market, how is the company navigating supply chain challenges and other obstacles?

Nano One is working with global players like Rio Tinto to secure a resilient, low carbon supply chain that will be locally supplied to meet IRA compatibility, thus decoupling from the Chinese supply chain which dominates 99% of LFP supply today.

What are you hoping to achieve in your strategic partnership with Worley?

Worley is a transformative partnership for Nano One as they bring the experience of a US $9B company with 48,000 employees. Together they will develop cathode active material packages that will be inclusive of engineering drawings, flow sheets, equipment specs and licenses to produce materials using the One-Pot process. The key is to design once and build many as the One-Pot process will enable modular lines to be designed and built bringing costs down and easier permitting.

What are your next steps for growing the business and setting yourself apart from the competition?

Nano One has engaged with multiple companies evaluating its materials for the purposes of entering offtakes which moves Nano One to commercialization and revenue. Working with Worley, we will co-market the CAM packages which will allow a modular design to be deployed globally. The key is the design once build many will allow rapid deployment of the technology which will enable the energy transition to grow sustainably with no waste streams and grow fast to meet demands.

How are market projections for the growth of the EV market aligning with your growth plans?

EV growth has slowed but continues to be growing year on year even though the media has reported a different narrative. Nano One has engagements with multiple OEMs and working with them as they navigate which strategy they will undertake. In the meantime, stationary storage is a strong and growing market we are focusing on for near term adoption of our technology as LFP is a ideal chemistry for storage applications and they have shorter evaluation periods which means go to market faster.

Any other comments or news to share with readers working in the environment sector?

The energy transition will be one of the biggest opportunities and costly endeavours as we move away from fossil fuels. It is critical to ensure we adopt sustainable manufacturing processes that have limited if no environmental waste streams and low carbon footprints. The only way to do this is via innovation and technology.

The next shareholders’ meeting is scheduled for August 1, 2024.

Today, the trading price of Nano One is $1.24.

Stocks to Watch

Here is a list of Canadian cleantech stocks that we are monitoring for this column. This list of public companies is by no means complete, and we are open to suggestions from our advisors and readers.

| Name | Symbol | Price in $CDN

(June 15/24) | Price in $CDN

(July 15/24) | % Change |

| Algonquin Power & Utilities Corp. | AQN | $7.84 | $8.41 | +7.27% |

| Anaergia Inc. | ANRG | $0.14 | $0.34 | +142.86% |

| Ballard Power Systems Inc. | BLDP | $3.48 | $3.46 | -0.57% |

| *BIOREM Inc. | BRM | $2.08 | $2.02 | -2.88% |

| Boralex Inc. | BLX | $33.59 | $34.48 | +2.65% |

| *CHAR Technologies Limited | YES | $0.33 | $0.31 | -6.06% |

| Electrovaya Inc. | ELVA | $3.92 | $3.42 | -12.76% |

| Engine No 1 (Transform ETF) | NETZ | $93.79 | $95.66 | +1.99% |

| EverGen Infrastructure Corp. | EVGN | $1.91 | $2.15 | +12.57% |

| Greenlane Renewables Inc. | GRN | $0.08 | $0.09 | +12.50% |

| Li-Cycle Holdings Corp | LICY | $6.28 | $5.28 | -15.92% |

| Loop Energy | LPEN | $0.04 | $0.035 | -12.50% |

| Northland Power Inc. | NPI | $23.29 | $24.50 | +5.20% |

| *Thermal Energy International Inc. | TMG | $0.24 | $0.26 | +8.33% |

| TransAlta Renewables Inc. | RNW | $12.48 | $9.84 | -21.15% |

| UGE International Ltd. | UGE | $1.87 | $1.94 | +3.74% |

| Westport Fuel Systems Inc. | WPRT | $8.20 | $8.57 | +4.51% |

| Zinc8 Energy Solutions Inc. (Abound Energy) | ZAIR | $0.08 | $0.13 | +62.50% |