What do other miner's dish out for Nickel Plants ? Dec 31, 2021 — Changsha-based CNGR plans to produce 30,000 mt of nickel matte per annum, in a $243 million smelting project in Tsingshan's IMIP site. Apr 4, 2023 — A 50Kt Ni/a high-pressure acid leach (HPAL) plant was to be built in Indonesia for US$700M Nickel Creek's ? $ 1.7 billion - $ 2.3 billion for concentrate plant - cheapest end product.

no matte. Which begs the question... Are certain nickel project assessed with matte plant costs but only concentrate

revenues ?

Nickel Creeks IRR = 5.8%

Canada Nickel - 17%

Nickel Creek's ( pre / post ) tax nvp is listed under power ( energy costs ? )

The higher ( pre / post ) = Higher nvp

They configured - lower the energy = higher the saving

Example

$0.09 cents KWh = $ 543 million after tax

https://ceo.ca/@newswire/nickel-creek-platinum-announces-positive-pfs-for-its Just West of Wellgreen is a much larger river How much could a miner save running ( hhydrogen -----> electricity plant ? )

If Wellgreens pre / post nvp base case chosen was,

$0.194 cents This is

running diesel generators to produce electricity. Makes one wonder if diesel for all the trucks were thrown in...lol

So we can't really use the $0.194 cent figure.

We need to compare with

Yukon's Electrical rates

vs hydrogen to elec gen.

2024 KWh rates in Burwash ?

=

$0.1282 cents https://www.atcoelectricyukon.com/en-ca/customer-billing-rates/bill-calculator.html What would 30% savings translate to using ( hydrogen / elec river generator ?

= $0.09 cents What does the PFS say if energy was $0.9 cents KWh ?

NVP =

$ 543 million after tax Interesting.

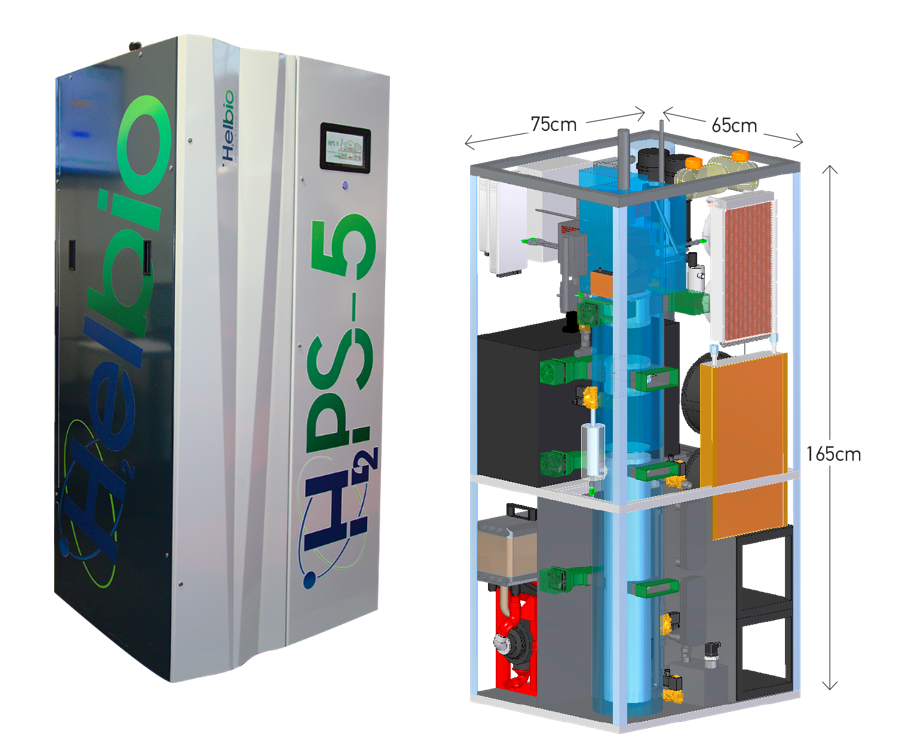

New hydrogen-based electricity generator beats alternatives

(CHP) system cuts the energy bill by

30% Obviously home unit - but you get the idea.

They factor - production of heat + electricity

Ahhh dual energy.

Could traslate to even better energy savings for mine plant.

https://mission-innovation.net/our-work/mission-innovation-breakthroughs/new-hydrogen-based-electricity-generator-beats-alternatives/ Imagine if the engineer thought of this option ?

https://mission-innovation.net/our-work/mission-innovation-breakthroughs/new-hydrogen-based-electricity-generator-beats-alternatives/ Imagine if the engineer thought of this option ? Especially given Wellgreen's location.

Hmmmm

Wellgreen 2012 peridotite nickel assay =

0.40% Sulphides were far higher.

Peridotites were grouped into 3 geo domains as ( all same )

Junior's Mngt/Geo crew took the liberty to pull a figure out of the air and

decided to reduce the grade by 0.10%

0.40 %

- 0.10 % solid solution deduction

= 0.30 %

Wellgreen is graded @ 0.26% Ni

0.04% somewhere in the mix - is also deducted

= 0.26% Ni

Now factor in,

The strignant sulphide extraction that can't quite handle specific ores ( lol )

And the what if... fine grind was employed ?

3 CRITICAL FACTORS = AFFECT NVP - was the cost for plant really for concentrates or.... matte ?

( if matte why not matte end product profits ? )

- energy ( why diesel and not river hydrogen )

- extraction ( need i elaborate ) nitric anyone ?

What about a 4th ? Running Road trains - more tonnage shipped per truck.

What about a 5th, 6th, 7th, 8th, 9th ? Deep intercepts more tonnage - esp UG mine

Exotics

Pull PGM's completely out

Iron credit

Magnesium credit

What would be the NVP then ? Hello.