It’s now the Fall Season here in central Japan, which is the best motorcycle touring time of the year. Perfect temperatures in the mid-20 deg C , low humidity, and often sunny (absent the occasional typhoon). One loses track of the time easily when riding about on such days.

https://www.thetravelmagazine.net/wp-content/uploads/Daigo-ji-1200-Adjusted-Sarah-Smith.jpg

Fortunately, I learned to use an old Indian skill when estimating the time of day on such rides. I still use the location of the sun in the sky to estimate approximately how many hours of light are left in the day. I could use my cell phone or my wrist watch, but I prefer to keep my eyes focused on the road ahead and the landscape around me.

It’s a handy skill. Especially in the absence of the internet and other such “modernisms”. One that can be extrapolated onto much larger and more abstract landscapes.

I recently wrote a post called

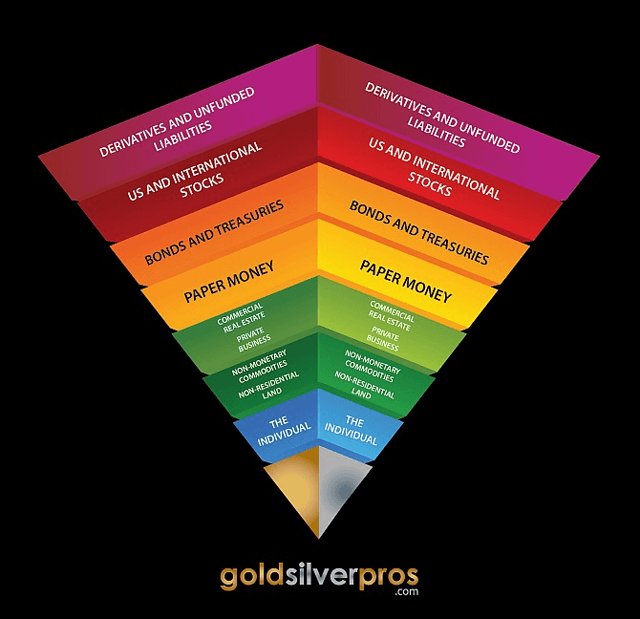

The On and Off Ramps of Exter's Pyramid (link) which is a common theme known to many PM investors. The main point of the post was simply to offer a REVISED interpretation of Exter’s Pyramid so that investors can search in between the extremities of the two goal posts of complex debt instruments and PMs. And that asset classes exist that are layered between Paper Money and PMs that offer unique mixes of utility and value.

https://static.seekingalpha.com/uploads/2020/3/18/410007-15845732610715344.png

But what is not really discussed so much in the above post was timing, which is actually even more important when investing. Where are we in the day? Or where exactly is the Sun in our sky? That is an even more interesting discussion. A discussion that actually requires a basic understanding of the day itself.

Sir John Bagot Glubb (1897-1987), a British general and historian wrote about the collapsed Western Empires of the past. In his book

The Fate of Empires and the Search for Survival, he described a common pattern fitting the history of some fallen empires. They went through a cycle of stages as they started, expanded, matured, declined and collapsed.

The Empire Dates of rise and fall Duration in years Assyria 859-612 B.C. 247

Persia (Cyrus & Descendants) 538-330 B.C. 208

Greece (Alexander & Successors) 331-100 B.C. 231

Roman Republic 260-27 B.C. 233

Roman Empire 27 B.C.- A.D. 180 207

Arab Empire A.D. 634-880 246

Mameluke Empire 1250-1517 267

Ottoman Empire 1320-1570 250

Spain 1500-1750 250

Romanov Russia 1682-1916 234

Britain 1700-1950 250

I suppose historians will argue with Glubb about the duration of the life cycle of each of the Western Empires listed above, as well as certain Eurasian omissions such as the Mongol Empire from approximately from 1206 until 1368. (Note. The Soviet Union which lasted 69 yrs. and did not exist at the time of the author’s life). That’s because Empires do not actually begin or end on a certain date. There is normally a gradual period of expansion and then a period of decline. So, disagreements with the actual duration of these great powers may be valid.

But more to the point, Glubb learned that different empires all had similar cultural changes while experiencing a life cycle in a series of stages that could overlap. He generalized about empires having seven stages of development, identifying these successive ages as follows:

1. The age of outburst (or pioneers).

2. The age of conquests.

3. The age of commerce.

4. The age of affluence.

5. The age of intellect.

6. The age of decadence.

7. The age of decline and collapse.

For a more detailed description of each of these ages, one can simply

read the book. However, for the purposes of this post, we’re only looking for the general time of day from an investment viewpoint (in PMs), and how much sunlight remains until a Golden sunset occurs.

I believe a relevant timeline explanation is offered by

David Murrin. It’s a phase and timeline study that focuses on the financial implications of the Empire Cycle.

Murrin began his unique career in the oil exploration business, and then early in the 1980’s he began a new career with JP Morgan in London. He was later sent to New York on JPM’s highly rated internal MBA equivalent finance program. Then returning to London, he traded FX, Bonds, equities and commodities on JPM’s first European Prop desk. In 1991, he founded and managed JPM’s highly successful European Market Analysis Group, developing new behavioral investment techniques which was utilized to deploy and manage risk at the highest level of the bank.

Murrin summarized the basic stages of Empire into the

Five Phase Life Cycle of Empires -

a model of the growth and decline of civilizations - to provide a way both to understand history’s “big picture” and to accurately assess current and future geopolitical environments. To illustrate the influence and power projection possessed by an empire, Figure 5 uses a graphical representation of the five stages similar to a Gaussian curve - a statistical probability distribution of data around an average. Empires are not all the same, of course, but the majority of them exhibit a similar distribution, peaking at about 60-70 percent along their life cycles. The Five Stages of Empire, then, are as follows:

- Regionalization;

- Ascension to empire;

- Maturity;

- Overextension;

- Decline and Legacy

https://www.davidmurrin.co.uk/sites/default/files/pict_1_0.jpg

These five stages can be compared to the human life cycle, beginning with birth and a period of nurturing, and followed by independence, self-expression and the manifestation of one’s capabilities in the world. A peak is reached after, say, four or five decades; if it could be measured, it would comprise a mixture of wealth, energy, health, contentment, power and creativity. Finally, the decline towards death begins, completing the cycle.

An summary of each of the 5 stages can be read here:

https://www.davidmurrin.co.uk/article/5-phase-life-cycle For us end-of-season riders, the most important reference is not so much to the earlier years. It is to the here and now – in what remains of our lifetimes. The current financial Empire is that of America, which shows a similar debt pattern to that of The British Empire.

“With one important difference, America has no cousin to pass its power baton too that will maintain similar core values. As a consequence, its debt will expand to the point where finally when its hegemonic status is lost it will suffer a debt blow up and crisis.”

Placing investing money at (or near) the top of the Exter Pyramid occurs during the Overextension Stage. In the Overextension Stage, a dominant empire will not reduce social or defense commitments, nor increase taxation. It moves rather into financial deficit, which saps its strength. Financial-market peaks take place PAST the pinnacle of the empire cycle, as the system finds ways to increase spending by raising DEBT.

During these periods, there is always talk of reducing costs, but doing so proves consistently unsuccessful. This marks the maximized level of Exter’s Pyramid, and it is not the place to “stick around” during the impending Decline and Legacy Stages.

Whether one marks the commencement of the Decline and Legacy Stage as 2001 (the NYC Twin Towers event), 2008 (the Great Recession), or 2020 (Covid-19 Crisis) it really is immaterial. The current Empire has appeared to have entered this final stage of decline by every historic and present-day indicator. And once entered, the stage moves rapidly.

“For an empire in the final throes of overextension, the cost of power vastly outweighs its economic benefit. Imperial sustainability becomes increasingly unfeasible, and the system rapidly begins to disintegrate. Although the signs would have been present during the overextension stage, other great powers would, for the most part, not have begun to recognize the waning empire’s vulnerability until the final stage of decline and legacy, when external and internal dynamics deteriorate at an alarming rate. Enemies on the periphery then awaken to the progressive ebbing of vitality, and become emboldened by incremental successes that can soon escalate. The old empire is now prey for other regional powers in the ascendant. The rate of decline surprises the world as a formerly iconic empire collapse.

The stage of decline and legacy can be described as the evolution of multi¬-polarity. The uni-polar world dilutes as the hegemon grows feebler, and challenging nations grow stronger and begin to exert a newfound influence. Characteristic of this stage is the empire’s collective denial that it is declining, expressed by the body politic and by the people themselves, who ask, ‘How can that which we have built up to be so splendid, so powerful, and which appeared so invincible, simply be erased?’

https://www.davidmurrin.co.uk/sites/default/files/inline-images/usmoney.PNG

If you look at the time scale of the US Debt Burden as a Function of its Empire Life Cycle, it does not appear that there are too many years of sunlight left. But that’s how every day ends. And sunsets can be bright and golden. If you bank on it.

It is not to be feared or out-and-out denied. It only needs to be understood and managed. The Brits found out that the Sun does in fact set on the Empire. It was not the end of times at all, just a change in the global financial structure.

And finally: The world in not flat and where the sun sets, it is also rising in another part at the same time. As it always has since the beginning of recorded history.

https://www.davidmurrin.co.uk/sites/default/files/2020-05/fig1.PNG

I reside in both a Setting and Rising Sun. So fortunately, I get to capture both natural events in a brightly colored landscape of the Fall Season..

Tx