Shortly after my introductory article on Protech Home Medical Corp. (OTCQX:PTQQF), the stock ripped upward, rising as high as $1.36, a nice 30% gain in less than two months. However, since reaching that 52-week top, PTQQF has pulled back to the $1.15 range, giving investors an opportunity to enter at a very attractive price. Incredibly, since reaching the 52-week high, the company has announced extremely positive news and continues to show progress towards reaching its goals, even moving up its timeline for doubling its annual revenue run-rate. Furthermore, the company recently announced the appointment of a new independent director, a major step toward them being listed on the NYSE/Nasdaq. In short, my original thesis in that introductory article - that PTQQF could conceivably triple within the next few years - remains intact, and I believe investors are wise to “buy the dip” in PTQQF.

For more detailed background information on the company, please see my original article linked in the first sentence above. The information below is provided to update that article.

Revenue and EBITDA Margin Growth and Expansion Accelerates

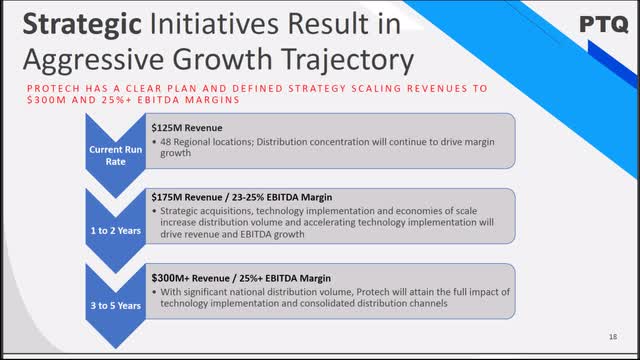

When I was first introduced to PTQQF in September 2020, the company’s investor presentation disclosed that management believed they would double their annual revenue run rate to $200M within 3-5 years. In only the last few months, the company has made acquisitions with the effect that the most recent investor presentation now indicates the company will reach a $175M revenue run rate “within 1-2 years” And a $300M+ run rate “within 3-5 years.”

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

While this growth rate is impressive enough as stated, my own research leads me to believe that PTQQF is likely to reach the $175M annual revenue run rate by EOY 2021, i.e. within one year.

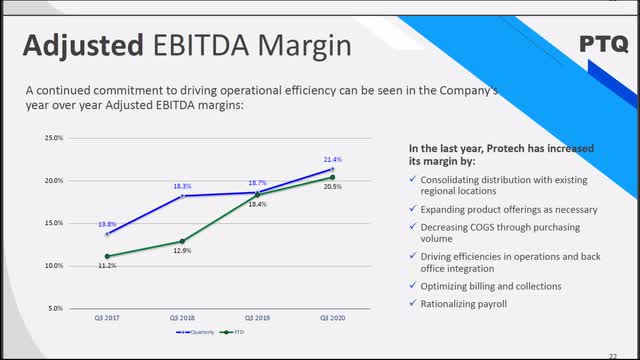

In addition to this explosive revenue growth, PTQQF continues to project incremental EBITDA margin expansion. In its most recent update on preliminary Q4 2020 results, PTQQF (implicitly) noted their quarterly EBITDA margin to be between 21-23%. As you can see from the slide above, those margins should progressively expand, reaching the 25%+ range within 3-5 years. As with the revenue growth, these projected margins are already expanding beyond what PTQQF projected only three months ago. I will discuss below some of the reasons for this acceleration and expansion of revenue and margins.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

In any case, management’s track record indicates they are generally able to exceed their stated guidance, so I would not be surprised to see PTQQF reach their goal to triple revenue and reach 25%+ margins by EOY 2023.

Tele-Health Platform and Covid Tailwinds

While Covid-19 has clearly weighed heavily on societies across the globe, it has benefitted many technology companies, or those who take advantage of technological innovation, like PTQQF. A major aspect of PTQQF’s business, and one that helps it grow recurring revenue and expand margins, is its tele-health platform. According to the most recent investor update, PTQQF has seen “a surge” in the usage of their tele-health platform. The platform offers both remote and in-person options to patients to educate them on the utilization of PTQQF’s equipment. In other words, the tele-health platform helps to ensure that patients are aware of the benefits of using their products, and makes it much more likely that once PTQQF wins a customer, the customer stays with them and continues ordering the high-margin disposables PTQQF sells.

Also in that investor update, PTQQF management indicated they “believe the need for in-home healthcare will only continue to accelerate across the country, and hospitals will continue to provide Protech with continued opportunity,” on which they are “ready to capitalize.” Clearly, home health care has been on the rise in the US and other developed countries for some time. But the Covid-19 pandemic significantly compressed the natural progression towards tele-health, with many hospitals cancelling elective procedures and doctor’s offices across the globe limiting patient-physician contact in an effort to suppress the spread of the virus.

In speaking with people familiar with both the tele-health industry and PTQQF, I learned that Covid-19 provided the company with a significant tailwind related to its tele-health platform. Specifically, PTQQF saw many physicians move towards online platforms for the reasons I mentioned above. While these physicians had been hesitant to do so before, fearing both lower patient compliance and a potential loss of revenue themselves, the pandemic essentially forced their hand. However, in a win-win scenario, patients, doctors, and PTQQF have all benefitted from this transition towards tele-health.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

When using the tele-health platform, with a few clicks of the mouse, patients can order supplies from PTQQF, who can immediately drop-ship to the patient directly. In the past, patients would have to leave their home, go to the doctor’s office, and then perhaps return to the doctor to pick up the supplies and learn how to properly use PTQQF’s product. With the ease of tele-health, more patients are immediately adopting PTQQF’s solutions. Furthermore, the company is seeing less attrition, again because patients require fewer visits to the doctor’s office.

In fact, patients can easily use PTQQF’s tele-health platform to subscribe to PTQQF’s disposable program. These disposables are necessary for the patient to continue to see positive results, but are also highly beneficial to PTQQF with high margins. As for the physicians, they seem to be extremely pleased with patient compliance, and the lack of attrition seems to offset any potential revenue loss from patients visiting them less frequently.

While the Covid-19 pandemic will inevitably end - hopefully sooner than later - it is highly unlikely this transition to tele-health will slow down or regress. In addition to patients preferring this alternative and physicians seeing better compliance, the use of tele-health also frees up the physicians to deal with more urgent patient problems, and to spend more time with those patients in more severe need. Consequently, it seems that Covid simply sped up the natural transition to tele-health, and once the pandemic subsides, PTQQF should see no downside.

Uplisting To A Major US Exchange

Currently, PTQQF trades on the OTC market in the US, as well as on the Toronto exchange. The complex history as to why this is the case - even though all of PTQQF’s business is in the US - was explained in my introductory article. As I stated in that article, PTQQF is now laser-focused on introducing itself to US investors and obtaining a listing on a major US exchange, either the NYSE or Nasdaq.

An uplisting to either of these exchanges has many advantages. Primarily, the stock will be more liquid, and certain institutions who cannot trade OTC stocks would be able to take a position in the company once they are listed in the US. In fact, I recently spoke with an investor who wanted to initiate a position in PTQQF, but could not because they are not traded on a major US exchange. This person is extremely disappointed and would have invested a relatively significant sum of money in PTQQF if they had met the requirement of the person’s fund.

Another benefit to PTQQF being uplisted to the Nasdaq or NYSE would be the potential for the company being added to major US indices, such as the Russell 2000. As I noted in my last article, there is still an outside chance the company could be listed on a US exchange very early in 2021, and then be added to the Russell 2000 later in the year, off the radar of most arbitrage investors who screen for potential additions around this time of year. It remains much more likely, however, that PTQQF will be added to the Russell 2000 in 2022 instead of 2021.

But there are several other benefits to the company being added to a major US exchange. Most specifically, to meet listing requirements, the company needs to make several structural and fundamental improvements in order to be listed on one of those exchanges. For example, the company needed to add at least one more independent director, a move they made on December 9, with the announcement of the appointment of Dr. Kevin A. Carter to their Board of Directors as an Independent Director. As you can read in the press release, Dr. Carter brings a wealth and breadth of knowledge and experience to PTQQF’s Board, which not only allows them to meet regulatory requirements to be uplisted, but also helps to fundamentally strengthen the company.

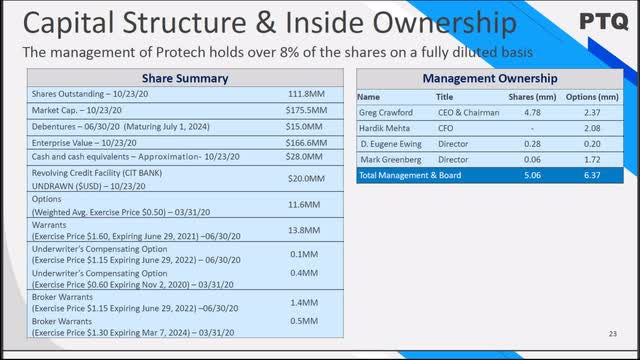

In addition, people familiar with PTQQF’s strategy indicate that the company, in conjunction with its uplisting, intends to “clean up” its capital structure.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

As the company has been reaching out to US investors, they have increasingly heard that their structure, which includes all sorts of debentures, warrants, capital leases, etc., has confused or perplexed many investors. In fact, many people with whom I have spoken believe this capital structure is the primary reason for the company’s EBITDA valuation multiple being so depressed compared to industry peers. Although all of those people ultimately found no issues or warning flags after diving deeper into PTQQF’s structure, they noted that most investors will simply walk away from these types of situations, lacking in-depth knowledge or understanding of these various instruments. As I will discuss below in the “Valuation” section, PTQQF shares could easily increase by 50% or more simply by closing this valuation multiple gap. I am encouraged that the company apparently recognizes this concern and fully intends to remedy the situation.

Ultimately, I believe the company will surprise investors by being listed on a major US exchange sooner than later. In fact, I would not be shocked to find PTQQF trading on the Nasdaq or NYSE by the end of March 2021. While this timeline may be aggressive, I am told that PTQQF will almost certainly be uplisted by mid-2021. I believe this move, together with the necessary steps to qualify for such listing, will result in the company achieving a much higher EBITDA multiple valuation, one much closer to industry peers.

Valuation

In my introductory article, I stated four reasons I believe the company is a strong buy and undervalued. I already spoke in this article about three of those reasons: (1) robust guidance for revenue growth and (2) margin expansion (with a history of management hitting stated targets), and (3) an uplisting to a major US exchange. Consequently, in this section I will now focus on only the fourth aspect I referenced in that first article: PTQQF’s low relative EBITDA margin valuation.

Currently, PTQQF’s Enterprise Value (EV) is approximately $148M (in Canadian dollars). The low end of their EBITDA expectation from the last quarter, recently announced in their preliminary results, is $5.6M, or $22.4M annualized (there are no quarterly anomalies to account for with PTQQF, so annualizing their past quarter is a good estimate of their current annual run rate). Therefore, PTQQF is currently trading at a trailing EV/EBITDA multiple of roughly 6.6.

Now, as we know, a stock should truly be valued based on its future potential, not on its past performance. As I mentioned already, it is likely by this time next year, PTQQF will be on an annual revenue run rate of $175M. At the low end of their EBITDA expectations, that would mean they should see their EBITDA run rate at a minimum of $40.25M. Based on that, their forward EV/EBITDA multiple is at a measly 3.7!

For a company growing revenue and EBITDA as robustly as PTQQF, one would normally expect at least an 8x EV/EBITDA multiple, with 12x not being out of question. As stated above, I believe PTQQF’s complex capital structure is part of the reason for this relatively low valuation, and I believe that situation will be largely resolved/clarified by EOY 2021, if not sooner. If that happens and/or the market gives more respect to PTQQF’s solid underlying business, then the company could nearly quadruple simply by closing the EV/EBITDA valuation multiple gap. In other words, this dip from $1.36 at PTQQF’s 52-week high offers an attractive entry point for new investors, or an opportunity for current shareholders to buy more on the dip.

Looking ahead even further, 3-5 years, if PTQQF can do $300M in revenue, their annual EBITDA should be at least $75M. At that rate, and assuming they are able to attain a 10x EV/EBITDA valuation multiple (actually about the average in their industry right now), they could be a five to six-bagger from current levels.

Risks

In speaking with seasoned investors, one concern often expressed is that PTQQF will make another equity offering to raise money for acquisitions. While this is, of course, possible, I believe it to be unlikely for a number of reasons. First, the company currently has just under $30M of cash on hand. In addition to that, they have a credit line of $20M with some favorable terms. And on top of those two components, from the last equity raise, PTQQF has warrants that were issued “out of the money.” These warrants were issued to give PTQQF the opportunity to receive more cash later for their acquisitions, totaling around another possible $20M. Putting all these together, and based on the fact that PTQQF is cash flow positive, with $19.7M in cash flow from operations in the first three quarters of 2020, it seems the only reason PTQQF would raise funds would be for a large, accretive acquisition.

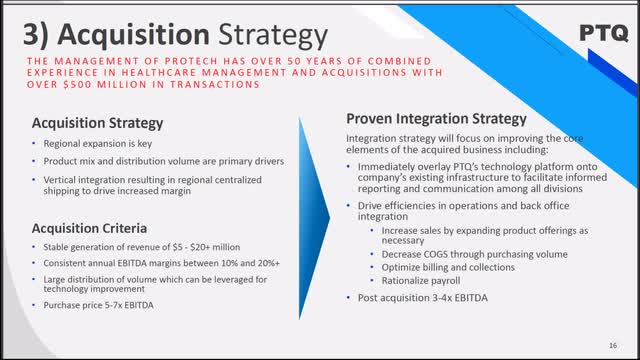

Speaking of acquisitions, this area of focus presents another risk to PTQQF’s business. While they have a successful track record of integrating acquired companies, the possibility always remains that one bad acquisition could cause some stumbling blocks to PTQQF’s progress. As with the equity offering risk, I believe this risk is also minimal. Again, PTQQF has a track record of success with acquisitions, and one that generally includes keeping the key employees and executives of acquired companies. Moreover, many of these companies serve relatively local markets, and continue to do so after being acquired, so from a practical standpoint they do not need to make many changes once acquired.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

The final risk I will mention is that perhaps the company will fail to be listed on a major US exchange. If that happens, the stock will remain less liquid and it may be harder for them to close the valuation multiple gap previously discussed. Even in this scenario, however, note that PTQQF is still likely to increase their revenue and EBITDA by about 75% within the next year or so, and just from that, holding the valuation multiple constant, the stock should respond by a comparable amount of 75%.

Conclusion

In short, I believe PTQQF presents investors with a risk vs. reward scenario highly skewed to favor the reward. PTQQF has many ways to win, but much fewer to lose. They have robust revenue growth and EBITDA margin expansion. Within six months, they have a high probability of being traded on a major US exchange. Their available cash, cash flow from operations, warrants, and line of credit for possible acquisitions makes it unlikely they will see a need to dilute their current shareholders. Finally, their relatively low valuation multiple compared to industry peers alone provides the possibility for significant upside. Taken together, I am using any dip in PTQQF’s share price to add to my current long position.