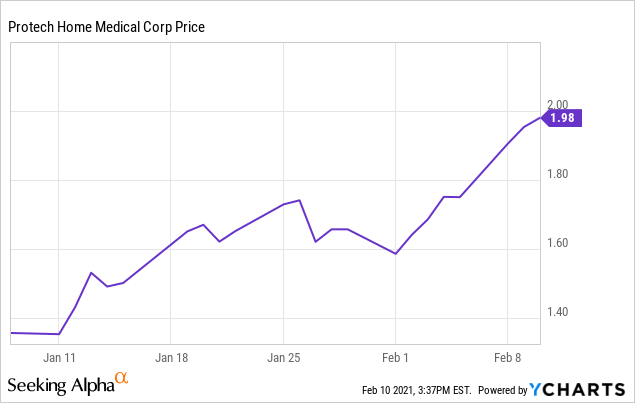

Shares of Protech Home Medical Corp (OTCQX:PTQQF) took a significant hit on Monday, February 1, following the unexpected halting of the stock on Friday, January 29, when the company was supposed to report its 4Q and Full Year Fiscal 2020 earnings results. Speculation over the weekend ran rampant in stock chat rooms, with many investors concerned something must be wrong with the company. After a weekend with no news, PTQQF announced strong results and noted "a delay in receiving the auditor's opinion."

That one line evidently spooked investors, leading to a quick 10% haircut to the share price. However, the shares were quickly resuscitated by eager buyers (including yours truly, and several other investors who have reached out to me via Seeking Alpha to help collaborate on stock research). Having spent hours on due diligence, we knew the idea of any "funny business" going on at PTQQF was unsupported by any data. As other investors came to realize, the audit issue was a complete and innocent anomaly. Shares have since not only recovered from the dip, but have ripped to new all-time highs, up as much as 35%+ since the February 1 intra-day bottom.

Data by YCharts

Data by YCharts

Yet, as I will argue below, PTQQF shares still remain undervalued with multiple catalysts and tailwinds coming in calendar year 2021. Below, I will discuss those various tailwinds and catalysts, as well as provide what I believe is a current fair valuation for PTQQF. In doing so, I will assume readers are familiar with the company from my previous articles. If you are unfamiliar with PTQQF, I recommend you read my previous articles, including my introductory article, as well as a follow-up article here.

Audit Concerns Overblown

Some investors, most especially those not particularly familiar with PTQQF management, sold first and asked questions second, when the company's stock was halted on Friday, January 29 "pending news", and then re-opened for trading the following Monday, February 1. Sellers reacted negatively to "a delayed audit opinion." Investors should know several things about what happened, which ended up being an innocent, though unfortunately-timed, snafu.

(1) On November 30, 2020, PTTQF announced preliminary, unaudited results for its fiscal 4Q 2020, reporting record revenue and EBITDA numbers.

(2) In mid-December, due to an accounting ambiguity and erring on the side of conservatism, the company's auditor requested the company re-classify $1.6M of revenue as "other income." The company complied with the request in mid-December and this re-classification was resolved from that time. In other words, the re-classification of a minor amount of revenue to other income was not the reason for the audit delay.

(3) On January 21, 2021, PTQQF issued a press release announcing the scheduling of their earnings release and conference call. The date of January 29, 2021, was set in order for the company to comply with their reporting requirements under Canadian securities law, since they are primarily listed on the TSX Venture Exchange.

(4) On January 28, 2021, at "the eleventh hour," the company received communication from their auditor that the auditor's report and opinion would not be ready, as previously planned, by January 29. The auditor was simply overwhelmed by its workflow, and missed the deadline, requiring the weekend to wrap up the PTQQF audit.

(5) Over the weekend of January 29 - January 31, the auditor finished the work and issued a clean report for PTQQF. There were no issues with the audit, and all outstanding questions or concerns had been resolved in order for the auditor to issue a clean opinion.

In the end, the audit delay was caused by an issue internal to PTQQF's auditor. There is nothing that should concern investors. The company remains fundamentally strong and financially transparent and compliant. While the delay is obviously regrettable, it is a mere blip on the radar. Investors who understand the trajectory of PTQQF know this provided yet another opportunity to "buy the dip," as I recommended in my December 2020 article linked in the introduction.

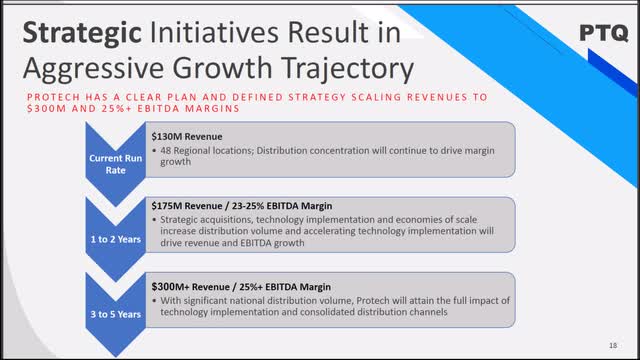

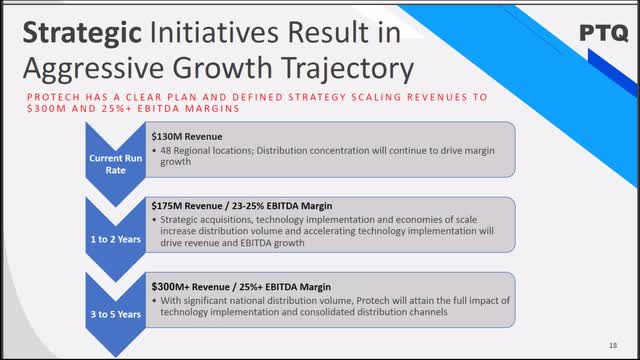

Fourth Quarter Results & 2021 Guidance

As expected, PTQQF ended its fiscal 2020 on a strong note, with record revenue of $25M (plus the $1.6M re-classified as other income). Perhaps most impressively, however, was the EBITDA margin of 23.7%, with adjusted EBITDA coming in at $5.9M. While 4Q tends to be the strongest for PTQQF's margins, the annual EBITDA margin still clocked in above 21%. Moving forward, the company expects annual margins to fall within the 23-25% range in the next 1-2 years.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

Even more exciting than last year's results, is the company's guidance for 2021 and beyond. On the Q4 earnings conference call CEO Greg Crawford noted: "We now estimate within 1 year $175 million in run rate revenue, with adjusted EBITDA margins above 22%. And within 3 to 5 years, over $300 million in revenue with 25% plus adjusted EBITDA margins." In speaking with people familiar with the company's plans, I believe PTQQF management can give such solid one-year guidance based on their current pipeline of acquisition targets. In fact, the day after the conference call, PTQQF announced their entrance into the state of Florida via an accretive acquisition of Mayhugh's Medical Equipment.

According to a representative with another home medical care company with whom I spoke, there are literally hundreds, if not thousands, of relatively small companies like Mayhugh (and previous companies acquired by PTQQF) throughout the United States. These smaller companies today have difficulties competing with the advantages of scale enjoyed by larger companies, such as PTQQF. This representative from another company believes PTQQF could continue successfully acquiring these small companies for decades, although this person believes it is more likely that eventually PTQQF themselves is acquired (for a nice premium, of course) by a larger company. Regardless, either scenario - continuing accretive acquisitions or being acquired - will likely provide PTQQF shareholders with outstanding returns.

Finally, in terms of speaking about the company's expected performance in 2021, I should note that people familiar with the company believe their organic growth will significantly improve once the situation with respect to Covid-19 improves in the United States. Covid protocols make it difficult for salespeople to visit clinics or hospitals to win new business. Once the public health situation normalizes, I would not be surprised to see PTQQF with organic growth reaching 10% or above.

NASDAQ Listing & Possible Russell Inclusion

On January 13, PTQQF applied to list its shares on the NASDAQ Capital Market. Moving to the NASDAQ exchange will provide several benefits to PTQQF shareholders. To begin, the listing on the NASDAQ will broaden the number of investors who can invest in the company. For example, I have spoken with one prominent investor in the small cap space who wanted to invest, but his fund prevents him from investing in companies listed primarily on Canadian exchanges.

Another benefit to being listed on the NASDAQ is the potential PTQQF will execute a 3-for-1 reverse split of their shares to meet the $5 per share listing requirement. Such reverse split would result in a per share price of roughly $6. Many institutions are unable to purchase shares of companies that trade for under $5/share. So again, this move will increase the number of investors who are able to purchase PTQQF shares.

As part of the NASDAQ listing, and a more general move to introduce US investors to the company, PTQQF is attending several "road shows" and investment conferences in the US during the first half of the year, and likely beyond. For example, according to one investment advisor with whom I spoke, PTQQF spent the first week of February visiting with investors courted by Raymond James to hear about the company's plans. And on February 16, PTQQF is scheduled to present at the MicroCap Rodeo Winter Wonderland conference. This increased focus on attracting US investors will only be buoyed by their listing on a major US exchange.

Source: MicroCapRodeo.com

Source: MicroCapRodeo.com

The final thing worth mentioning with respect to a potential NASDAQ listing is its impact on the potential of PTQQF being added to the Russell 2000 Index (IWM). Each year, the IWM re-evaluates its companies and removes those who do not meet its requirements, while adding those that do. One of the main criteria is a company's market cap. With its recent strong move following the 4Q 2020 ER, PTQQF now sits at a market capitalization of ~$220M (in USD), roughly 10% above the expected size needed to be added to IWM in 2021.

Based upon the normal process of 8-12 weeks to be listed on NASDAQ after submitting an application, I estimate that PTQQF will be accepted and begin trading on NASDAQ in April 2021. If this happens, I believe PTQQF would be eligible for the IWM. Furthermore, I believe PTQQF's share price at that point will lead to a market cap in excess of what is needed for IWM inclusion. Many may ask: why is this such a big deal?

My answer is that each year, beginning around this time of the year, or even earlier, astute investors begin assessing companies likely to be added to the IWM in June of that year. As an arbitrage, they purchase shares in companies expected to be added. Such buying "front-runs" the various entities that will be "forced" to buy shares of companies newly added to the IWM. To help make this process more orderly, and not to cause massive, "artificial" demand when the IWM shifts each year, the IWM releases, beginning in May of each year, a couple of lists indicating the companies likely to be included in the IWM. When this happens, institutions tracking the IWM begin buying shares of companies who will be added, in as orderly a way as possible, so as not to spike the share price. In most cases, this process works well.

But in some cases, companies are unexpectedly added, or so thinly traded, that the share price spikes due to the "artificial" demand. In the case of PTQQF, I believe it is possible that many, if not most, IWM arbitrage investors and institutions will miss PTQQF here in January and February since they are currently only traded OTC in the US, and are primarily listed on the TSX Venture Exchange. If that indeed happens and PTQQF is listed on the NASDAQ in early 2Q 2021, then it is possible that PTQQF will surprise most investors and institutions in May 2021, if they are indeed included on the initial IWM list. In such a scenario, we could see some "artificial" demand throughout May 2021 as institutions would be "forced" to buy PTQQF, a fairly thinly traded company in the US, with an average volume per day under 200,000 shares.

While my IWM thesis is interesting, and may result in a sort of "squeeze," readers should note it is "icing on the cake." The more important story is the disconnect between PTQQF's current valuation versus their future potential and relatively low valuation multiple.

Valuation

From my first article on PTQQF, I have noted the reasons why I continue to be bullish on PTQQF's fundamental business. The company continues to grow revenue and expand margins, normally ahead of management's own stated guidance. In addition, I have argued that PTQQF would likely be listed on a major US exchange, and that appears now increasingly likely given their recent application to the NASDAQ.

In addition, however, I have noted that PTQQF's valuation multiple continues to lag industry peers, or even normal valuation multiples for any company growing revenue and margins at PTQQF's rates. While that valuation gap on current trailing EBITDA has somewhat closed since PTQQF has doubled since my first purchases, the stock remains drastically undervalued on a forward EBITDA multiple basis.

The primary metric I have used to value PTQQF compared to industry peers and, as noted, even broader comparisons, is the Enterprise Value (EV) over EBITDA. Since PTQQF currently reports on a Canadian Dollar (CAD) basis, I will be using those CAD numbers in this section. At the time of writing, PTQQF's EV on the TSX Venture Exchange was $272M. Its fiscal year 2020 adjusted EBITDA was $20.8M. That means that at approximately 13x EBITDA, PTQQF trades roughly comparable to industry peers.

However, in valuing companies, we should be paying much closer attention to future expected performance instead of past performance. The past performance, of course, helps to guide expectations. And in this respect, PTQQF gets an A+ for consistently beating management's stated guidance. With that in mind, we should consider that PTQQF, given its stated guidance of $175M run rate by EOY 2021, and expected margins of roughly 23%, would lead to an EBITDA run rate of approximately $40.25M. At that rate - which I believe to be conservative - PTQQF's EV/EBITDA would be about 6.75.

So, when looking at PTQQF's forward, expected EV/EBITDA by EOY 2021, the company could feasibly double between now and then to reach the same 13x EV/EBITDA the market currently uses to value the company. And, of course, that valuation metric only takes into consideration the next year. PTQQF has also guided for $300M in revenue over the next 3-5 years.

Source: PTQQF Investor Presentation

Source: PTQQF Investor Presentation

At $300M revenue and 25%+ margins, EBITDA would be a minimum of $75M. At that rate, the current EV over the guided EBITDA is a mere 3.6. To get to the 13x EV/EBITDA where PTQQF is currently valued, the stock would need to rise 250%--i.e. more than triple from today's share price. Given the 3-5 year timeframe management guided for that $300M, this would imply average annual returns of 50-83%.

As you can see, although PTQQF has been able to close the gap on its trailing EV/EBITDA valuation multiple since my original article, investors should consider the company's future growth and EBITDA prospects, because based on that view, the company can still provide handsome returns to investors.

Risks

Investors should be aware of a few risks related to PTQQF. I believe the two primary risks relate to one key point: the possibility of management making a "transformational" acquisition. On the most recent conference call, as well as at some investor conferences, CEO Greg Crawford has begun to speak about what he calls "transformational-type" acquisitions. When asked about what he means by this on the conference call, the CEO stated: "Yes, so when we're talking transformational, probably talking something above $25 million, probably closer to $50 million plus. There are companies out there like that. A company that's in multiple states, multiple locations."

In the past, management has been acquiring and tucking in complementary businesses in the $5-20M range, and clearly, it has served them well. Personally, I have come to trust PTQQF's management team because of how well they have integrated previous acquisitions, and I believe they exercise discipline and caution before making an acquisition. So I trust that if they find a "transformational" opportunity, it will be one that complements their current business and culture well. However, we should also consider two associated risks.

First, it is often harder for companies of comparable size to merge than it is for a smaller company to be tucked into a much larger company. Although the $50M range is still significantly below PTQQF's size, it could possibly present more of a challenge to bring aboard than a $5-10M company. In addition to that concern, a "transformational" acquisition might require the company to raise additional funds through a capital raise. While people familiar with the company indicate there are currently no plans to do that, I am confident the company would have to consider it if the right opportunity came along. On the one hand, such a move would appear to dilute shareholders; however, if the acquisition is accretive, any selloff following such a move would be yet another buying opportunity.

Conclusion

PTQQF shares have been on a roll since I began covering the company on Seeking Alpha in October 2020, nearly doubling since that first article. Shares were temporarily hit hard by the delayed, but ultimately clean, opinion of the company's auditor. The day after that setback was announced, savvy investors resuscitated shares, bringing them since to all-time highs and a relatively fair valuation when looking at PTQQF's trailing results. However, investors should be looking ahead to the catalysts of strong revenue growth, expanding margins, a NASDAQ listing, and a possible Russell 2000 inclusion. Based on these considerations, shares could still double over the next year from the current ~$2.00/share level, with approximately 250% upside over the next 3-5 years if PTQQF management hits its guidance.