Eoneren

Investment Summary

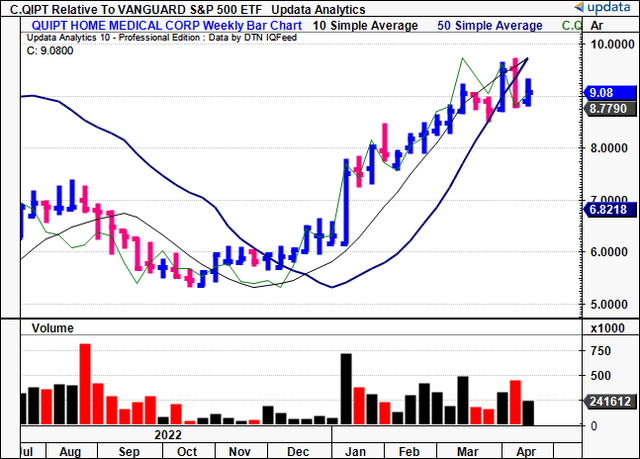

When covering Quipt Home Medical Corp. (NASDAQ:QIPT) in June last year I had targeted a 40% return objective "as a long-only play with a tight risk budget". This followed with another buy rating in November when shares were compressed, and where I revised the price target to $9.50–$11. Turning to the present day, the stock is up 50% from the June publication, meeting the original $6.20 price target with ease. Further, it has rallied 50% from the November publication off the previous lows. After extensively reviewing the firm's latest numbers I've come to a similar conclusion and given Wall Street has priced it at just 5.6x forward EBITDA there looks to be attractive value at the current market cap of $246mm.

Fig. 1

Data: Author's previous QIPT publication

In the analysis presented here I'm going to run through the key facts underpinning my buy thesis. Intelligent investors might find benefit in the data presented here that's not found publicly. In that vein, it's important to value the firm as a function of two categories:

- The contribution from current operations

- Contribution from growth initiatives.

With the QIPT share price continuing on trend into the second quarter of 2023, I believe there is scope for it to rate higher to $11–$12 or 10x forward EBITDA estimates, in-line with its historical averages. Rate buy.

Fig. 1 (a)

Data: Updata.

Key risks to the investment thesis:

- Macroeconomic headwinds driven by rates and potentially sluggish economic growth.

- The company fails to meet my growth estimates on sales, capital expenditures ("CapEx") and working capital requirements.

- Regulatory headwinds that remove key tailwinds in the company's growth route.

- Reduced capital from hospitals and medical/healthcare service providers.

Investors should understand these risks in full, as they potentially nullify the investment thesis and could result in loss of capital.

Catalysts from current operations

As to where QIPT stands today, there's numerous bullish factors that investors should consider here. Its existing operations reveal the following insights:

One, the firm is at a $220mm run rate at the top-line for FY'23, and is on track for $49mm in adjusted EBITDA. It now boasts >1,000 employees and printed ~$41mm in top-line revenues for its Q1 FY'23 [corresponding to Q4 2022, but I'll talk in terms of Q1 for simplicity]. The 38% YoY growth in turnover is welcomed and management are confident QIPT can reach historical 8–10% sequential growth rates as we roll through the remainder of 2023. Two main benefits of the accelerated run rate:

- The higher rates of income increase QIPT's purchasing power, enabling it to purchase inputs with greater economies of scale. Inventories have increased 71% YoY to $17mm but is still only 48% of current operating assets (less cash). Moving forward, the rate of inventory change is likely to benefit from economies of scale, as mentioned.

- Recurring revenues are at 77% of turnover ($31.4mm in Q1), and with a $220mm print at the top-line this would total $169mm in recurring revenues going forward. At Q1 adj. EBITDA margin of 22%, this would mean $37mm of pre-tax income would be recurring as well.

- Further, with the acquisition of Great Elm now complete, management forecast 82% of revenues to be recurring in nature (pro forma basis). The maths is even more appealing with this point in mind.

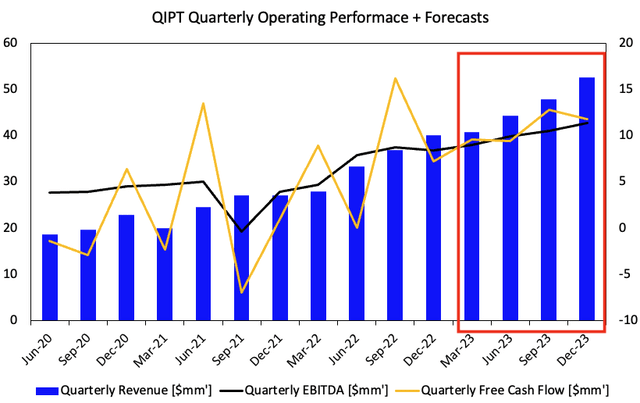

Looking ahead, my numbers have baked in 8.5–10% sequential growth into QIPT's Q2 FY'24 [Q4 2023], with the firm hitting $60mm in quarterly turnover by the end of this year [Figure 2]. On this, I am calling for the firm to be generating $11–$13mm in quarterly core EBITDA over the coming 3-4 quarters, in-line with management's projections for a $49mm EBITDA run rate.

Fig. 2

Data: Author, QIPT 6-Ks

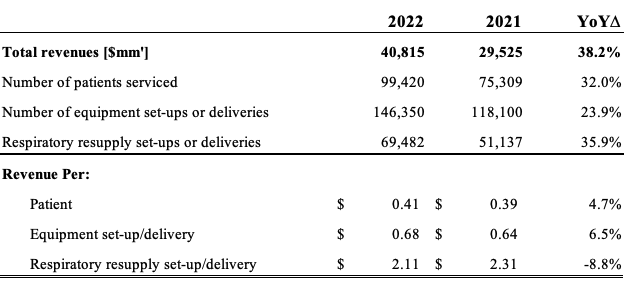

Two, metrics used to analyse QIPT's business economics are showing constructive signs as well. Consider that:

- The firm started 2023 with 270,000 patient lives – 70,000 more than my November publication.

- In FY'22, it recorded a 32% increase in number of patients served, along with another 24% and 36% in equipment and respiratory set-ups/deliveries, respectively [Figure 3].

- Therefore, revenue per patient served lifted 470bps to $0.41mm, with a similar gain in revenue per equipment set-up/delivery to $0.68mm.

- Turnover per resupply lifted from $0.57mm to $0.7mm.

Subsequently, the unit economics for QIPT's business model are showing tremendous leverage as further upsides in turnover are likely to lead profit higher for each patient serviced and set-up/delivery made. This is the kind of business model I am attracted too. I want to see a firm that has ability to become more profitable as it grows, exactly how QIPT is doing here.

Fig. 3

Note: All figures are quoted in quarterly. (Data: Author, QIPT 6-Ks)

Three, there are regulatory tailwinds beneficial to QIPT's business economics as well. Chief among these, the Medicare fee CPI increase for durable medical equipment ("DME") suppliers, raising reimbursement between 6.4%–9.1%. This was effective from January 1 this year. QIPT says it can capture an increase of ~8% given the structure of its portfolio, and to recognize this from its Q2 FY'23.

In addition, CMS also made the decision to cancel 2021 competitive bidding across 13 product categories. This means a more benign bidding environment and is a positive demand-pull for purveyors such as QIPT to remain competitive in the marketplace. I believe these two factors are likely to serve as meaningful tailwinds for the firm over the next few periods.

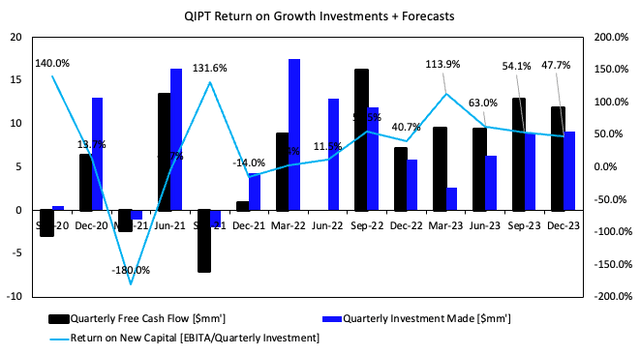

Growth contribution to sustain the rally

Meanwhile, the contribution from its growth strategy is equally as appealing in my estimation. A few points to note here. Firstly, the company's CapEx as a function of revenues declined last quarter, "a trend that the company will like to maintain" per language on the Q1 call. Quarterly CapEx pulled to 3.1% of turnover, 6.7% on a TTM basis, down from 8.4% and 6.8% respectively.

The reduction in capital expenditures relative to the projected revenue growth is a tremendous value creator in my estimation. My numbers show that, on a recurring basis, the firm has routinely generated substantial returns on investments into new capital, on a quarterly basis. I measure this by observing quarterly EBITA to the new capital investments made each quarter. Looking ahead, QIPT could generate 47%–114% return on new capital over the coming 4 quarters [Figure 4]. This, as net working capital requirements are projected to $22mm over the same time.

Fig. 4

Data: Author, QIPT 6-Ks

My reasons underpinning QIPT's growth drivers and ability to create value for shareholders in 2023 and 2024 are follows:

- The firm is committed to growing its sales team, which will reduce the area/size of each sales rep and potentially lower the amount of revenue per rep required to hit sales targets.

- This wouldn't be meaningful without increasing the company's payer base. Thankfully, management are onto this, and this will flow on well with an increased headcount in sales reps by feeding into more territories and distributing the top-line across a broader array of regions.

- Added to that, management continue integrating the use of technology.

- The company also intends to uplist on the Toronto Stock exchange, and this will create greater liquidity and potentially see its share price catch a bid if the offering is oversubscribed and valued above the current market price.

- Further, whilst there may or may not be a more appropriate use of capital, the firm is well committed to putting the balance sheet to use, chasing strategic bolt-on acquisitions to build out operations.

- To this point, as mentioned earlier, the firm expects 82% of revenue to be recurring on a pro forma basis by the end of this year.

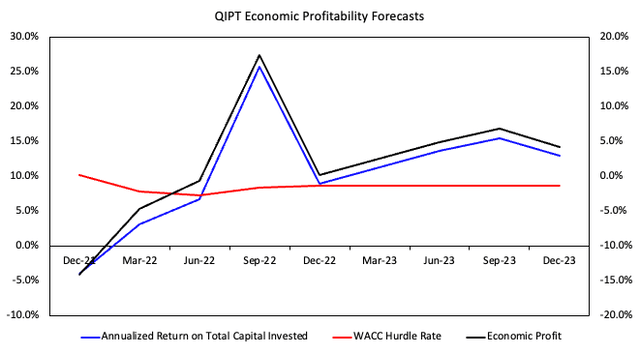

Subsequently, my quarterly numbers have forecast the company to generate sound economic profitability looking ahead. This is defined as the annualized return on invested capital ("ROIC") spread above(below) the company's cost of capital. You'll see in Figure 5 the economic profit of 8–11% per quarter with these inputs, meaning my projected revenue and EBITDA growth numbers are likely to generate substantial value for shareholders.

In that vein, capital intensity looks to be decreasing. Specifically, CapEx tightening as a function of revenue, on extra NWC requirements of ~$1mm per quarter for 2023 in my modelling. The lighter capital charge is coupled with projected upticks in revenue and profitability, meaning the prospect for QIPT to throw off attractive rates of cash to shareholders is quite high. This is measured by the economic profit forecasts discussed. But how does this quantify?

To answer that, consider the following:

- Over the 4 quarters from QIPT's Q1 FY'22 to its Q1 FY'23, it made an additional $48.3mm towards investments for growth.

- It generated a cumulative $11mm in pre-tax income, growing its quarterly EBITA by $3mm.

- Therefore, it 'required' an additional $48mm investment to hit these growth numbers.

- As such, it reinvested ~123% of its pre-tax income to generate 6.2% incremental ROIC.

Contrast this to the forward estimates I've baked into my growth assumptions over the coming 4 quarters:

- It is assumed QIPT will require an additional $9mm investment in growth capital required to generate $18mm in pre-tax income.

- The projection is to grow EBITA by just $2mm.

- However, given (a) the lower capital intensity, and (b) growth in income, I project that QIPT will only reinvest 51.6% of its pre-tax income to generate an incremental ROIC of 21%.

- This means the capital is more profitable, less intensive, and most importantly – a much higher degree of free cash flow can be thrown off to shareholders.

- Precisely, my assumptions call for $48mm in additional FCF over the next 4 quarters [$1.33/share], of $12mm per quarter on average [$0.33/share].

Fig. 5

Data: Author, QIPT 6-Ks

Valuation and conclusion

I'd note that QIPT is priced at 5.6x forward EBITDA but my conclusions lead me to believe it should trade more towards its historical averages of 10.4x given the firm is set to move back to growing at a historical rate. At this multiple, the firm looks fairly valued at ~$12 on my EBITDA assumptions for the coming 4 quarters. We'd be paying 5.6x and getting 10x worth of value and this is a very attractive prospect of re-rating should the assumptions turn out to be correct. As such, I am reiterating my upside targets of $11 and adding a second price objective to $12.

Net-net, there's multiple tailwinds that have yet to be priced into the QIPT share price in my estimation. These range from the company's growth targets, regulatory tailwinds, in addition to the economics of its business in generating additional profits from its growth capital. In particular, the most appealing point for mine is that capital intensity looks to be decreasing, such that a lower unit of capital is required to generate unit growth in profits. This is very attractive in my eyes, especially if the trend were to continue, as QIPT could throw off tremendous amounts of free cash to shareholders, driving its valuation to the upside. Rate buy, price target $11–$12.