TORONTO, April 23, 2020 (GLOBE NEWSWIRE) -- Kerr Mines Inc. (TSX: KER, OTC: KERMF), (“Kerr” or the “Company”) is pleased to announce its plans for the first phase of its 2020 resource and reserve expansion program which will consist of an initial 5,000 meters and up to 44 holes of both core and reverse circulation drilling at the Copperstone Mine located in Arizona, USA. Based on a very successful 2019 drilling program, this success driven drilling program is comprised of two phases, the first of which totaling 5,000 meters is nearing completion of planning and is targeted to commence in Q2-2020. The total the 2020 resource and reserve expansion drilling program will consist of up to 10,000 meters.

The 2020 drilling program, a continuation of the Company’s 2019 resource expansion program, will remain focussed on expansion, by way of adding new Inferred gold resources and upgrading resources into higher categories, of the Copperstone and Footwall Zones using underground core drilling and surface reverse circulation drilling. The ultimate goal would be the addition of resources along all sections encompassing the entire current resource strike length of over 1,500 meters.

Copperstone Zone

Underground core drilling up to 3,200 meters will utilize 4,300 meters of existing underground development and workings to focus on stepping out along strike and dip targeting the D and C zones of the Copperstone Zone. These high priority targets extend beyond the previously defined mineralized domains many of which are reflecting further continuity with higher grades.

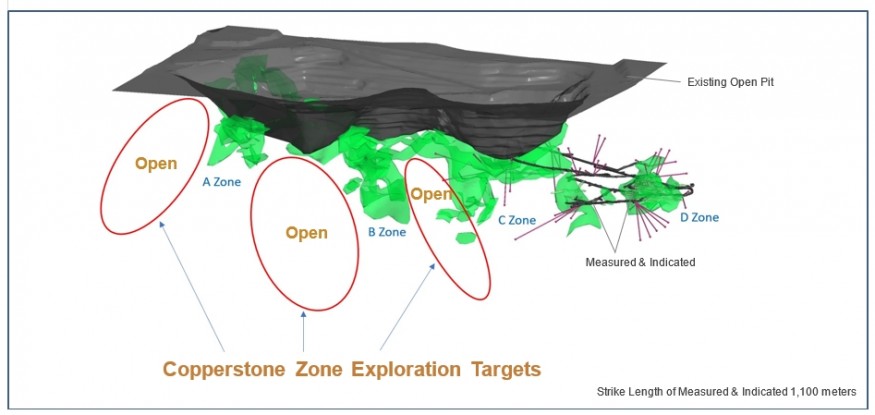

Surface reverse circulation drilling up to 1,500 meters will utilize the extensive access provided by the historic Cyprus open pit to target areas of the Copperstone Zone which are not currently accessible from the underground workings. The focus will target areas of the C, B & A zones which have never been drilled but are proximal to historically successful locations of Measured and Indicated Resources (See Figure 1).

Footwall Zone

Underground core drilling up to 1,000 meters will focus on extending the newly defined Footwall Zone both down dip and along strike. The advantage of drilling the potential down dip extension of the Footwall zone from underground is the very close proximity to the potential extension of the zone resulting in an average hole depth of 200 meters.

Surface reverse circulation drilling up to 2,800 meters is a continuation of the Phase I drilling program which, in 2018, announced the newly defined Footwall Zone as having extents of 375 meters of strike and 350 meters of dip. The goal of the 2020 program is to extend this zone along strike and down dip. Given that the source of the gold mineralizing fluids is below the current extent of drilling, the down-dip potential of these zones is visually intuitive (See Figure 2).

Highlights from previously reported drill results from 2017 to 2019 are included below for reference. These results are forming the basis of defining the high priority targets which will be based on a success-driven drilling program in 2020. Reported intervals indicate length of drill sample only. True width not indicated.

- Intervals announced in 2019 and drilled from underground through the Copperstone Zone include:

- 16.8 meters @ 8.25 g/t Au (18-08A-03)

- 7.6 meters @ 7.71 g/t Au (18-05A-06)

- 4.6 meters @ 9.48 g/t Au (18-05E-07)

- 6.1 meters @ 15.91 g/t Au (18-04-01)

- 10.7 meters @ 17.49 g/t Au (18-21-04)

- 6.1 meters @ 15.02 g/t Au (18-21A-05)

- 16.8 meters @ 40.00 g/t Au (18-21-06)

- Intervals announced in 2018 and drilled from the surface through the Footwall Zone include:

- 3.4 meters @ 7.9 g/t Au (KER-17S-10)

- 4.6 meters @ 13.2 g/t Au (KER-17S-13)

- 4.3 meters @ 6.8 g/t Au (KER-17S-17)

- 36.6 meters @ 7.5 g/t Au (KER-17S-21)

- Intervals announced in 2017 and drilled from underground through the Copperstone Zone include:

- 9.8 meters @ 16.2 g/t Au (KER-17U-12)

- 6.1 meters @ 8.6 g/t Au (KER-17U-06)

- 4.6 meters @ 5.1 g/t Au (KER-17U-04)

- 3.0 meters @ 7.9 g/t Au (KER-17U-05)

- 8.7 meters @ 39.1 g/t Au (KER-17U-12)

- 3.2 meters @ 8.8 g/t Au (KER-17U-13)

- 8.8 meters @ 38.6 g/t Au (KER-17U-14)

- 4.4 meters @10.9 g/t Au (KER-17U-16)

South West Zone

Surface reverse circulation drilling up to 1,500 meters. The Copperstone and Footwall Zones are mineralized and parallel listric faults which are important conduits of mineralizing fluids originating from the main detachment fault located below the known extents of the gold mineralization. As per the well-known characteristics of detachment fault systems, numerous parallel listric faults are common (see Figure 3). Other potential parallel listric faults have been identified and drill tested on the Copperstone Mine property with very positive results. One such area which has shown very positive drilling results is the South West Zone. This area located 900 meters to the south west of the open pit was historically identified as a target for exploration as a result of geophysical surveys. A small area within the target was subsequently drilled in the late 2000’s to find similar gold grade, minerology, alteration, width and inferences of a similar strike direction as the Copperstone and Footwall Zones.

- Intervals historically announced and drilled from the surface through the South West Zone include:

- 5.2 meters @ 18.3 g/t Au (07CS-30)

- 5.8 meters @ 10.3 g/t Au (07CS-31)

- 6.1 meters @ 8.0 g/t Au (06CS-22)

- 3.1 meters @ 10.5 g/t Au (08CS-45)

Giulio T. Bonifacio, Chief Executive Officer stated: “The Copperstone Zone is limited only by the lack of drilling which is why we are targeting multiple areas from both underground and the surface in our 2020 drilling program as evidenced in Figure 1 which clearly reflects the open extent nature of these high priority targets. The Footwall Zone is in its infancy as it was recently classified as a new discovery zone through the results of the Company’s 2018 drill program. Together, both zones have a total strike length of 1,500 meters and, based on our extensive data review and planning, we believe the Footwall Zone has the potential to match the endowment of the Copperstone Zone because of the similarity in minerology, alteration, grade and thickness to the Copperstone Zone. Additionally, the proximity of the Footwall Zone to the Copperstone Zone of approximately 150 meters, could allow for the doubling of the ounces per vertical meter at the Copperstone Mine.”

Mr. Bonifacio further commented: "COVID-19 represents a significant and unprecedented challenge for many businesses. We will continue with our planned exploration activities and take steps to minimize risks to the health and safety of our employees and contractors. Energy and focus is being put into maintaining government regulations, including our own mandates for a safe and healthy workplace, while maintaining as strong an employment framework for our people as possible. We are not sure how the issue will impact our site activities or timeline in the second quarter, but we are prepared to be quick to adapt to any changes necessary. The company will monitor and assess developments, including recommendations from governmental authorities, and adjust its activities accordingly."

The Copperstone zone is the underground extension of the same orebody that was historically mined as an open pit. The pit mined nearly 150 vertical meters of the Copperstone zone and produced in excess of 500,000 gold ounces historically. The Copperstone orebody currently has a horizontal strike length of over 1,500 meters and extends 110 meters beneath the historical open pit. Within this area and the Footwall Zone, there are Measured and Indicated resources of 276,100 gold ounces and Inferred resources of 145,700 gold ounces.

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Michael R. Smith, SME Registered Member (Geology), who is a “Qualified Person” as defined by NI 43-101 for this project.

Continuous Disclosure Obligations

The Company also announces that it will be relying on the blanket relief granted by Ontario Instrument 51-502 - Temporary Exemption from Certain Corporate Finance Requirements and comparable relief granted by other Canadian Securities Administrators in respect of its obligation under National Instrument 51-102 – Continuous Disclosure Obligations to file its interim financial statements and its interim management's discussion and analysis for the nine-month period ended March 31, 2020 on or before May 15, 2020. Management of the Company expects that the interim financial reports will be filed on or before June 30, 2020.

The Company confirms that its management and other insiders are subject to an insider trading black-out policy that reflects the principles in section 9 of National Policy 11-207 – Failure-to-File Cease Trade Orders and Revocations in Multiple Jurisdictions.

The only material developments of the Company that have occurred since December 31, 2019, being the date of the last interim financial reports filed by the Company, have been the following:

- On January 22, 2020 U.S. Bureau of Land Management issued a Decision of Record based on a Finding of No Significant Impact formally approving Kerr Mines Inc.'s mining plan of operation;

- On February 28, 2020 closing of oversubscribed Private Placement totaling Cdn.$3.2 Million; and

- On March 23, 2020 closing of US$500,000 senior secured convertible note with Sprott Private Resource Lending.

About Kerr Mines Inc.

Kerr Mines is an Emerging American Gold Producer currently advancing the 100% owned, fully permitted past-producing Copperstone Mine project to production. Copperstone is a high-grade gold project located along a detachment fault mineral belt in mining-friendly Arizona. This gold project in Arizona demonstrates tremendous exploration potential targeting multi-million-ounce prospects within a 50 Square kilometers (12,259 acre) land package.

Quality Assurance and Quality Control Statement

Procedures have been implemented to assure Quality Assurance Quality Control (QAQC) of drill hole assaying being done at an ISO Accredited assay laboratory. All intervals of drill holes are being assayed and samples are securely stored for shipment, with chain of custody documentation through delivery. Mineralized commercial reference standards and coarse blank standards are inserted every 30th sample in sequence and results are graphed to assure acceptable results, resulting in high confidence of the drill hole assay results. When laboratory assays are received, the QAQC results are immediately evaluated and graphed to analyze dependability of the drill hole assays. As the Copperstone Project advances, additional QAQC measures will be implemented including selected duplicate check assaying on pulps and coarse rejects at a second accredited assay laboratory. All results will be analyzed for consistency.

For further information contact:

Giulio Bonifacio

Chief Executive Officer

gtbonifacio@kerrmines.com

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements, including current expectations on the timing of the commencement of production and the rate of production, if commenced. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to, the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with underground operations. Risks and uncertainties about Kerr Mines’ business are more fully discussed in the Company's disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Kerr Mines assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law. Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release and no stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein ..."