China is in talks with Russia to buy its cheap oil to replenish strategic reserves, in the latest indicator of deepened energy ties between the two large powers and rivals to the United States. It's also the latest sign that a mulled EU Russian oil embargo may in the end be blunted before it ever gets off the ground, amid continuing inter-EU resistance led by Hungary.

Bloomberg reports Thursday that "The crude would be used to fill China’s strategic petroleum reserves, and talks are being conducted at a government level with little direct involvement from oil companies, said a person with knowledge of the plan."

Novokuibyshevsk oil refinery plant in Russia, via Chron.com

Novokuibyshevsk oil refinery plant in Russia, via Chron.com Currently the EU is negotiating toward a phased embargo, seeking to find compromise with those central and eastern European members which are heavily dependent on Russian energy.

The prior US ban on imports of Russian oil, which came early in the invasion of Ukraine, has already served to push more Russian oil tankers east towards Asia, diverting from Western markets. India too has reportedly been taking advantage of the comparatively cheaper prices.

A source privy to the talks said they aren't close enough that a deal is guaranteed to be signed, nor is an estimated volume of crude Beijing is reportedly seeking known at this point.

"There is still room to replenish stocks and it would be a good opportunity for them to do so, if they can be sourced on commercially attractive terms," a senior oil analyst at industry firm Kpler, Jane Xie, told Bloomberg.

The report cites the data analytics firm to estimate that China's "overall stockpiles are at 926.1 million barrels, up from 869 million barrels in mid-March -- but still 6% lower than a record in September 2020." And by way of comparison, "the US Strategic Petroleum Reserve has a capacity of 714 million barrels. It currently holds about 538 million barrels."

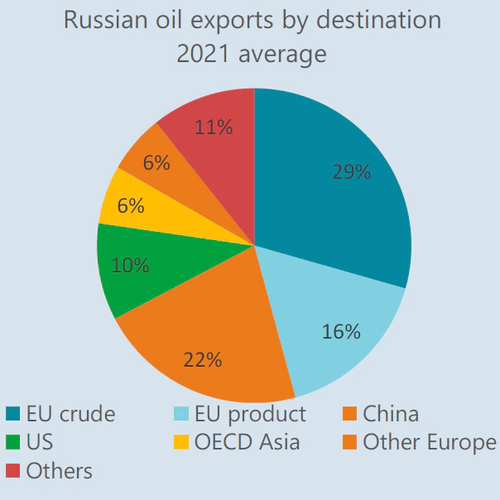

Chart via Reuters

China remains the world's single biggest buyer of Russian oil, with official Chinese government figures for 2021 showing it imported almost 1.6 million barrels per day of Russian crude that year.

But the immediate impact of Western punitive action targeting Moscow has seen more shipments sent to Asia. "China is now clearly buying more Ural cargoes. Ural exports to China have more than tripled. This is despite a weakening of Chinese imports," said Homayoun Falakshahi, senior analyst at Kpler, as

cited in Reuters