This year has served to be a pivotal year for the gold industry. To combat the coronavirus's economic effects, governments alongside central banks have had to do some extraordinary things to keep their respective economies afloat during these challenging and still very uncertain times.

With all this uncertainty and economic unrest, this is, the type of environment that gold historically has thrived in. Particularly, with all the new debt issuances alongside the expansion of the money supply, one can only assume economists plan to debase the majority of this debt through inflation in the years to come as global debt has hit all-time highs.

Global debt increased by $15 trillion in the first three quarters of 2020, and it now totals $272 trillion. This is truly an incredible figure and unprecedented. Many reputable firms also note that global debt will surpass $360 trillion by 2030, which is almost an unfathomable number, but it's our reality.

With debt spiraling out of control, investors have typically turned to fiat currency debasement hedges, and gold has historically been one of the most reliable stores of wealth throughout history.

In saying that, back in April, I published a pretty extensive report on one of the most exciting emerging gold camps in Canada called the Fenelon gold camp.

Wallbridge Mining's Fenelon gold property in North-Western Quebec

Wallbridge Mining's Fenelon gold property in North-Western Quebec The camp has generated significant interest from legendary investor Eric Sprott as he is a big shareholder in Wallbridge Mining and Great Thunder Gold. The area continues to develop alongside other companies in the region looking to make a discovery.

I have updated the report to bring you up to speed on the developments and progress made by the companies within the camp since the last article.

The Big Players:

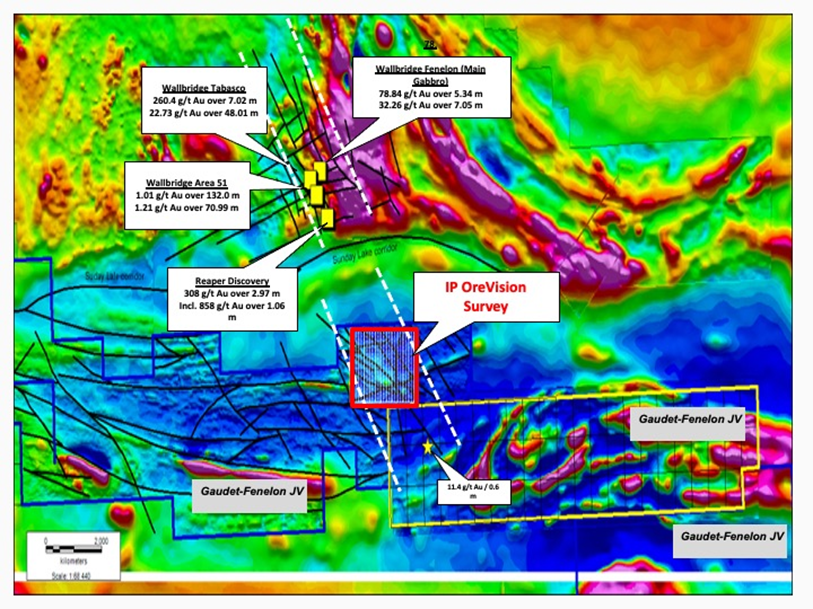

- Wallbridge has continued to show why the Fenelon Project has the potential to be Canada’s next high-grade deposit. Just some of the highlight intercepts since our last update:

- 308 G/T GOLD (8.98 OZ/TON) OVER 2.97 METRES

- 858 G/T (25.03 OZ/TON) GOLD OVER 1.06 METRES

- 70.84 G/T AU OVER 5.35 METRES

- 32.26 G/T AU OVER 7.05 METRES

- 4.06 G/T GOLD OVER 51.70 METRES

- 4.88 G/T GOLD OVER 18.95 METRES

- 24.61 G/T GOLD OVER 15.00 METRES

- 9.06 G/T GOLD OVER 40.05 METRES

- 5.07 G/T AU OVER 100.6 METRES

- These are exceptional results and only the highlights of what could be a multiple page article on all the intercepts that makes this deposit a rare find!

- On October 2nd Wallbridge announced the closing of a $63.8M bought deal financing at a pre-money valuation of over $800 million! Kirkland Lake Gold maintained their 9.9% ownership by contributing $23M to the financing. Kirkland’s continued participation and valuation speak to the Fenelon deposit as a potential world-class deposit, which is comparable to Fosterville.

- Wallbridge is well on their way to completing their 100,000-meter drill program for 2020, and there are significant catalysts in store for 2021 (70M Budget):

- 150,000 meters of drilling

- Maiden resource estimate for Fenelon including the Gabbro, Tabasco, Cayenne, and Area 51 zones during the third quarter

- Commencement of a 10,000 meter, multi-year development program to establish underground drilling platforms in Area 51 and Tabasco.

- On November 23rd, Wallbridge announced a 75% earn-in for $35M in work expenditures on its Detour East Project with Kirkland Lake Gold. Another exciting development and continued collaboration with Kirkland Lake.

- Major investors include Kirkland Lake at 9.9% and Eric Sprott 20.7%. With the Fenlon Project being only 75km east of Kirkland’s Detour Mine, one can quickly see why this is of interest to both investors and a potential takeover target.

2. Probe Metals Inc (PRB.V):

- Since our last update, Probe has been busy expanding their Detour land position to 1,434 claims (777 square kilometers) through a JV with Midland Exploration. They immediately got to work on their district-scale project:

- Regional High Definition Heliborne Magnetics Survey Completed

- Regional Geochemical Surveys to be completed by November (3,650 samples)

- 42.5 kilometers of Induced Polarization (“IP”) survey completed on JV Property

- Drill Program Scheduled for Q1 2021

- On Oct 27th Probe announced several high-priority target areas south of Fenelon-Tabasco; it will be exciting to follow the developments here as they move to drill in Q1 2021:

The Biggest Player:

- With the run in the gold price of almost $400 up to the August high since our last update, it is clear that Kirkland Detour acquisition was the “right acquisition at the right time.”

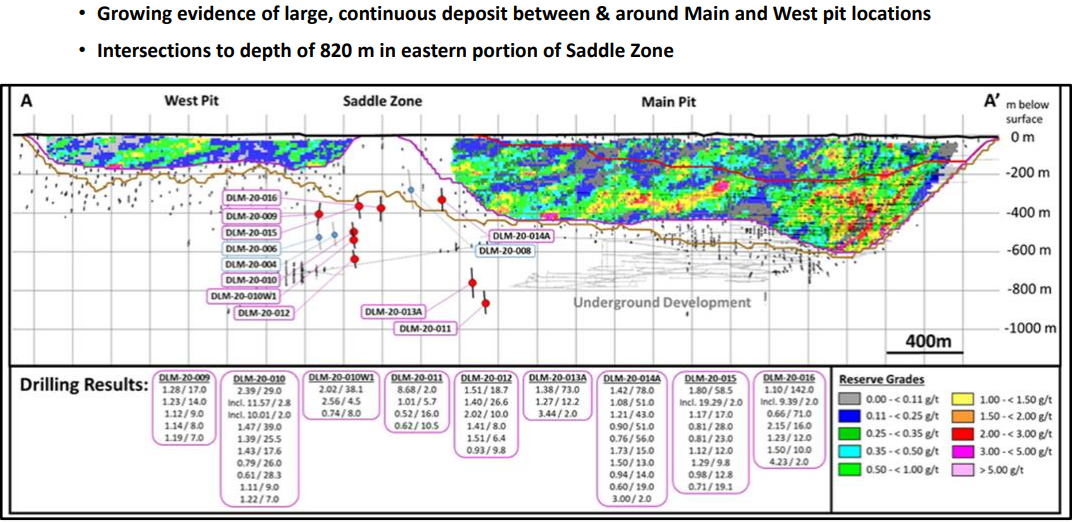

- Kirkland has started on their 250,000-meter drill program at Detour with some exciting results out:

- 1.10 grams per tonne (“gpt”) over 142.0 meters

- 1.80 gpt over 58.5 m

- 1.42 gpt over 78.0 m

- 1.41 gpt over 121 m

- 1.23 gpt over 138.0 m

- 14.6 gpt over 5.0 m

- 11.7 gpt over 13.0 m

- It is clear that although Detour already has 14.8M ozs Au in reserves that there is still a lot of expansion potential. We look forward to their targeted year-end 2021 resource update, which could have significant upside with their large drill program and starting success so far.

- Continuing with our big picture view from our past update, one of the key things here is Kirkland’s 60,000 tons per day mega mill at the Detour Lake Mine with further “business improvement initiatives” planned for 2020. Imagine the margins and volume if one were to blend in some higher-grade ore into this mill, say from the Fenelon project. This theory has continued to gain support through Kirkland’s 23M participation in their recent financing and their increased involvement with Wallbridge through their $35M Option/JV at Detour East.

The New Players:

- Since our last update, Great Thunder has done very well, increasing from a price of 0.40 to a high of 0.96. Investors are clearly looking forward to the Companies maiden drill program at their Southern Arm Project, which should be commencing shortly.

- On October 19th, the Companies Phase 1 drill program was announced, outlining 13 holes targeting a conductive trend in the northern portion of the property, 6.5km south of the Fenelon deposit. Besides the strong targeting outlined in their drill plans and airborne results, this area has been shown as prospective by Probe Metals in the recent updates showing the trend continuing south-east to GTG’s drill targets and north-west to the Northbound Property:

- Eric Sprott is a large backer of Great Thunder, holding 4,735,000 shares (14.2% of shares outstanding) along with the Companies CEO (Blair Naughty) holding 10.4%; it’s great to see him so aligned with shareholders. This is clearly a sign of the potential of Great Thunder’s assets in the Fenelon camp.

- The Company only has 33.2M shares outstanding with little warrant overhang and is fully funded.

- Goldseek announced the identification of three near-drill ready targets along the 7.3 km strike of the Bapst Fault where a VTEM survey identified a conductive trend. In early 2021 the Company will be starting its maiden drill program with 4 diamond drill holes and 51 till samples.

- The Companies top priority is Target 1:

- This target has never been drilled and contains multiple features that indicate gold mineralization potential: A break in a conductive anomaly is located along the Bapst fault 2.4km from Target 1. This indicates a change in the mineralogy of the host rock.

- We look forward to following Goldseek’s maiden drill program! With the large depths of overburden, the use of percussion drilling for till samples is a prudent step to increase the Company’s chances of making a discovery in this high-grade gold camp.

- On Probe’s property located on Goldseek’s south border, there are strong grab samples and drill results as seen below:

- The Company only has 31.9M shares outstanding and is well financed with $2.8M in the treasury.

- Similar to Great Thunder and Goldseek, Xander’s property covers part of the NW-SE trending Bapst Fault. Success by any of these three companies will bring attention to a part of the Fenelon camp that is very under-explored.

- Unique to Xander, the Blue Ribbon Property has historical surface gold showings (8.5 g/t Au over 0.76 meters) in a camp that the majority is underlined by large depths of overburden. The significance of this is the Company can follow up on previous gold showings on surface in a cost-effective manner instead of just relying on geophysics and drilling as a lot of companies have to in the area.

- In November, the Company followed up on the historical gold showing with a trenching program and a MAG Survey. The Company submitted 40 samples from the trenches opened up with results pending. We look forward to the results and following their developments as they progress towards drilling.

- The Company only has 21.6M shares outstanding and has the lowest market cap of the group exploring in the camp at $3.2M.

Conclusion:

- It is clear with the area consolidation and continued success since our last update that the Fenelon Gold Camp is going to be very exciting for the remainder of 2020 and 2021. In a historically underexplored area we expect new discoveries to be made in 2021, which will increase the following on all players in the area.

Click here for full article

Legal Notice / Disclaimer

The Gold Telegraph, goldtelegraph.com, hereafter known as Gold Telegraph.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the Gold Telegraph Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this Gold Telegraph website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any Gold Telegraph document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Gold Telegraph has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Gold Telegraph makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Telegraph/Author only and are subject to change without notice.

The Gold Telegraph/Author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, The Gold Telegraph/Author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this The Gold Telegraph/Author report.

The Gold Telegraph/Author is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading The Gold Telegraph/Author articles, you are acting at your OWN RISK. In no event should The Gold Telegraph/Author be liable for any direct or indirect trading losses caused by any information contained in The Gold Telegraph articles. Information in Gold Telegraph/Author articles is not an offer to sell or a solicitation of an offer to buy any security. The Gold Telegraph/Author is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

The author does own shares of Xander Resources Inc. (XND.V), Goldseek Resources (CSE:GSK) and Great Thunder Gold (TSXV:GTG). GSK is a paid advertiser on the Gold Telegraph.