ARCA:UVXY - Post Discussion

Post by

thegreenmile656 on Dec 13, 2022 8:28am

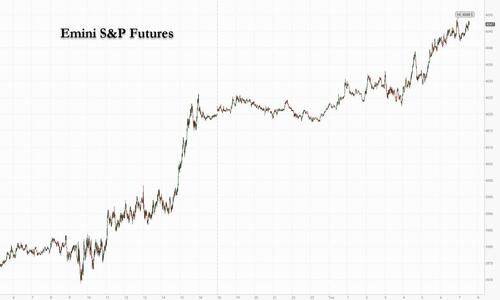

Futures Storm Higher Ahead Of Last Most Important Datapoint

https://www.zerohedge.com/markets/futures-storm-higher-ahead-last-most-important-datapoint-2022

Futures Storm Higher Ahead Of Last Most Important Datapoint Of 2022

by Tyler Durden

Tuesday, Dec 13, 2022 - 08:08 AM

After a dismal start to December, US futures extended their gains to a second day ahead of today's critical economic data: the final consumer prices print due of 2022 which in turn precedes tomorrow's final for 2022 FOMC meeting where Powell is expected to slow the pace of hiking to 50bps. Contracts on the S&P 500 rose 0.6% higher by 7:45 a.m. ET while Nasdaq 100 futures gained 0.7%. The underlying benchmarks advanced on Monday in anticipation Tuesday’s inflation data and Wednesday’s Federal Reserve decision will establish a slower pace of interest-rate increases. The greenback halted a two-day rally, while Treasuries gained. Oil futures extended gains by another 0.5% after almost sliding below $70 on Monday on signs of further easing in China’s Covid rules. Oil traded higher by 0.5% on signs of further easing in China’s Covid rules.

Overnight news centered around further re-opening headlines in Greater China (especially Hong Kong) and a decline in German inflation MoM (although in-line with expectations). On the CPI front, Goldman expects a 0.2% rise MoM (vs cons .3%) as a decline in used cars, hotels and apparel prices should help the headline number (on the flip side expect rebound in airfares and another gain in car insurance). Full preview here. There are no major earnings.

In premarket trading, Oracle shares rose 2.5% after the software company reported second-quarter results that beat expectations. Analysts were positive about the company’s execution and revenue growth in the quarter amid tough macro conditions. Pinterest Inc. also gained, rising 3.75%, after Pinterest (PINS US) shares rise 3.7% after Piper Sandler lifted the social networking site to overweight from neutral, noting multiple tailwinds heading into 2023 that are separate from the health of the ad market.

Be the first to comment on this post