ARCA:UVXY - Post Discussion

Post by

thegreenmile656 on Dec 15, 2022 1:50pm

MS Slams The Fed's "Inconsistent", Contradictory Message

https://www.zerohedge.com/markets/morgan-stanley-slams-feds-inconsistent-contradictory-message

Morgan Stanley Slams The Fed's "Inconsistent", Contradictory Message

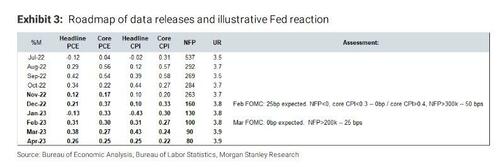

The next exhibit provides a roadmap of Morgan Stanley's data release forecasts through April 2023, alongside the bank's subjective view on the Fed’s data-dependent action. The table shows potential thresholds around the incoming data that could move the extent and pace of the Fed's tightening path. Between now and the February meeting, there will be one more inflation print, which should be roughly in line with the November print. As such, the strength of the labor market will be key – expect a step down in the December payroll print (released January 6), to below 200k. But if payrolls continue to run at their September pace (300k+), combined with stronger inflation, managing the step down will be difficult for the Committee and another 50bp rate hike in February could become more likely. The state of the labor market also holds the key for the March meeting. So while a slowdown in job gains in line with Zentner's forecasts should see the Fed not raise rates further beyond February, persistent payroll prints above 200k could see the tightening cycle extend with additional 25bp steps.

This also begs the question if the BLS is intentionally rigging the jobs data, and mucking up US monetary policy just to make Biden's policies look better than they are in reality (the gaping chasm between the Household and Establishment survey answers a resounding yes), but we will leave this debate for another time.

Finally, Powell noted during the press conference that "over the course of the year, financial conditions have tightened significantly in response to our policy actions" which is paradoxical because as we showed yesterday, financial conditions are now back to June levels when rates were below 2%.

Be the first to comment on this post