Azincourt Energy (AAZ.V) stock saw a daily gain of 9% this week on news of an update on its 2023 Winter exploration program at East Preston. https://equity.guru/2023/03/03/uranium-in-the-winners-circle-after-a-brutal-february-for-commodities/ Investors were keen on commodities continuing to perform well in February 2023 after a strong January 2023. In the first month of the year, we saw commodities rally hard mainly on the ‘China emerging from Covid and returning to normal/strong levels of economic growth’ trade. Some would also say the ‘Fed pivot’ trade had a part to play… and they wouldn’t be wrong given recent price action and the stronger US dollar move in the latter end of February 2023.

Iron ore, coal, lithium, rare earths, gold, silver, nickel, zinc among others fell in February. But prices still remain high from a historical perspective.

Here is some of the data:

Prices correct as of February 28, 2022.

Silver

Price: US$20.53 23/oz

%: -10.73%

Tin

Price: US$24,963/t 29,490/t

%: -15.35%

Zinc

Price: US$3000.50/t 3389/t

%: -11.46%

Cobalt

Price: US$34,180/t

%:-30.24%

Aluminium

Price: US$2373 2532.5/t

%: -6.3%

Lead

Price: US$2104/t 2136.5/t

%: -1.52%

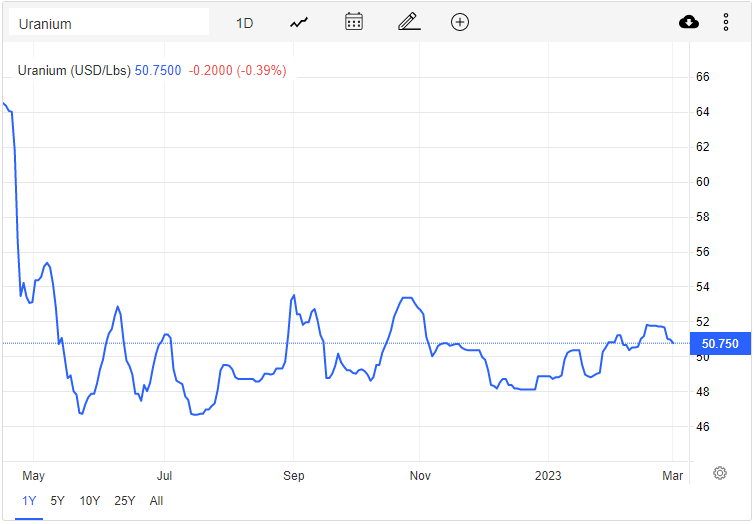

However one commodity irked out a positive gain in February. A gain of 0.5% for the month. Yes you guessed it, it was uranium.

You bulls still know the positive catalysts for uranium going forward. CEO of Australian listed Bannerman Energy (ASX:BMN) Brandon Munro spoke about higher prices:

“The potentiality in 2023 for the uranium market and therefore uranium equities is profound,”

“There are some very high price scenarios that need to be taken seriously.”

Munro says the bear market from 2011 to 2020 could well be matched by a bull market of equal length, given the long contracting cycles seen in the uranium industry.

“The adage in commodities is that ‘the cure for high prices is high prices’, but it takes so long to get uranium mines permitted and up and running, that there isn’t the responsiveness to higher prices that you would expect to see in other commodities,”.

“In uranium there is limited downside risk from current price levels, with a significant probability of upside risk.”

“And there are some extraordinary upside risk scenarios that should be part of any investment decision.”

For bulls, these prices continue to provide us an opportunity to accumulate positions in uranium stocks.

Uranium price is still in an uptrend and $52 provided recent resistance. The $50 zone remains the major psychological support zone.

If we take a look at the URA ETF, then there is a case to be made that another leg lower could be coming for uranium. A major support at the $21.70 zone was broken, and unless price can regain this level, another leg lower is a real possibility. There is a lot of support below coming in at $19 and $20.

Here is what happened with Athabasca Basin based uranium stocks this week:

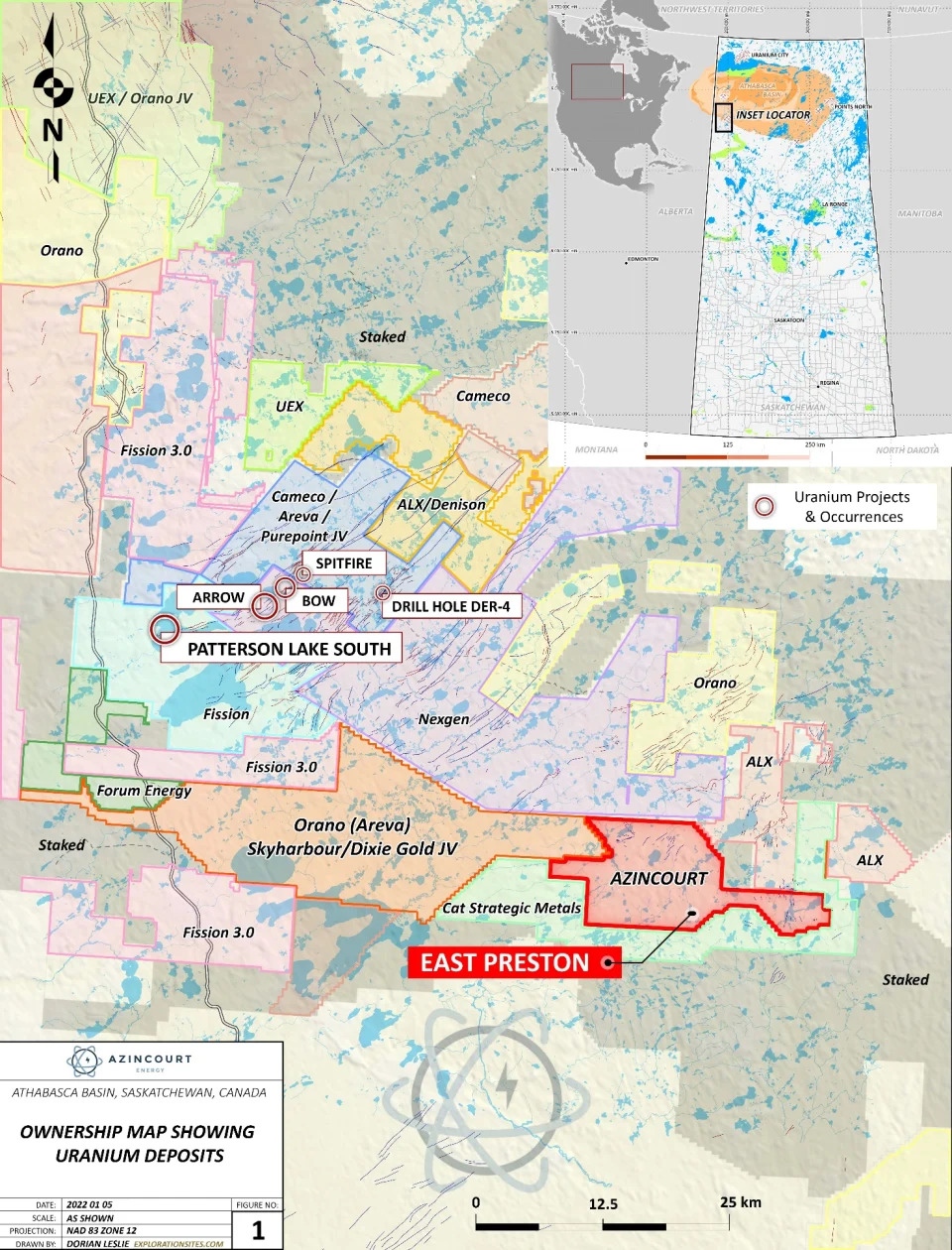

Azincourt Energy (AAZ.V)

Azincourt Energy (AAZ.V) stock saw a daily gain of 9% this week on news of an update on its 2023 Winter exploration program at East Preston.

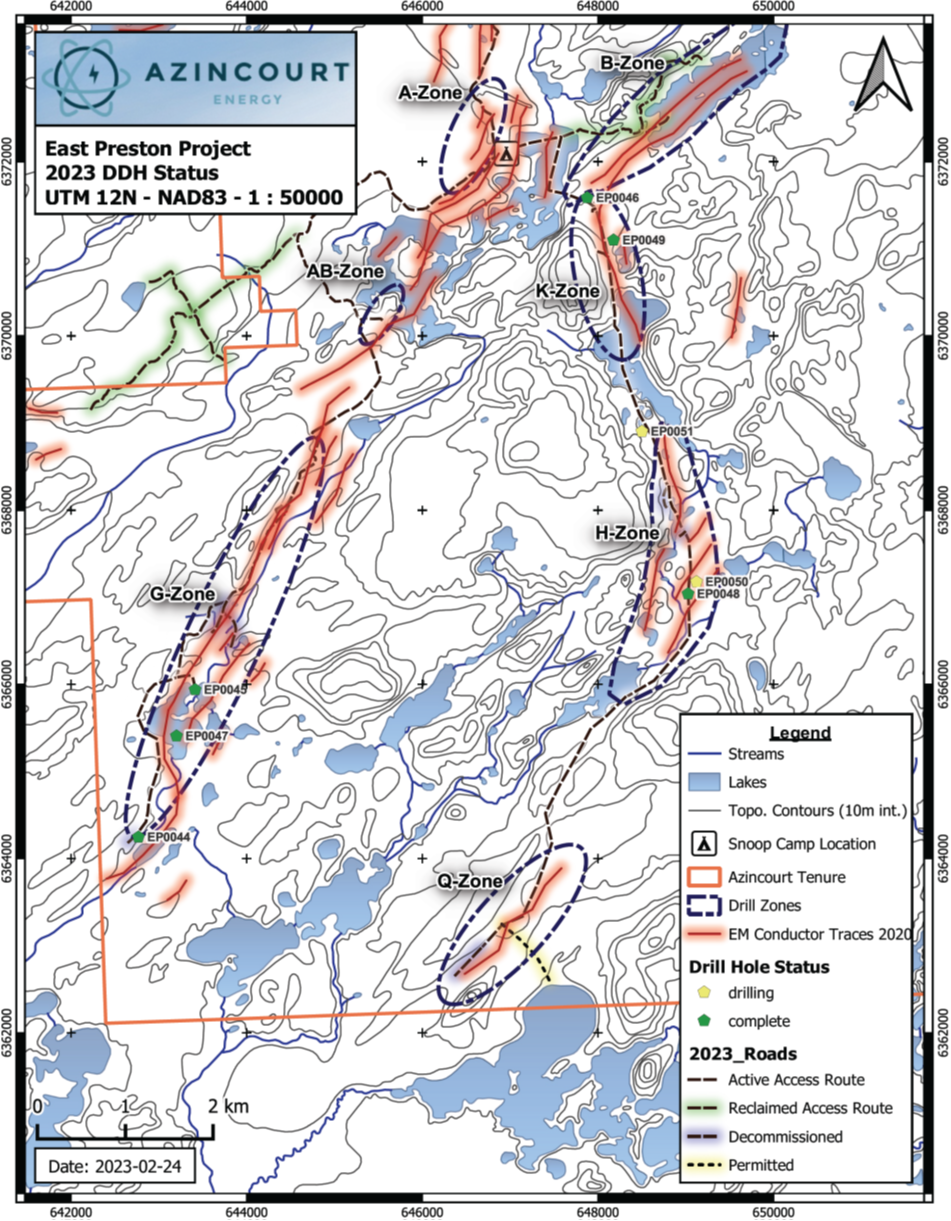

Drilling commenced at the East Preston Project on February 2nd 2023, and so far 1,686 metres has been completed in 8 drill holes. Two rigs are operational on the project after extreme weather delayed the initial startup. Six dill holes are complete and two are in progress. Currently, drills are turning on both the K and H zones (shown below).

The company considers the drilling results to date to be significant, as major uranium discoveries in the Athabasca Basin such as McArthur River, Key Lake, and Millennium were primarily the result of drill testing of strong alteration zones related to conductor features.

“We are excited to be continuing where our 2022 program left off. The previous program has shown that we have a significant alteration system present on the property” said VP, Exploration, Trevor Perkins. “Finding the extents of this system and identifying where within that system the alteration fluids are focusing is very important. We need to focus in on the most responsive areas, and confirm what these anomalous areas have to offer,” continued Mr. Perkins.

Bottom pickers who are bullish on uranium should definitely have this stock on their watchlist. Azincourt Energy is showing promising signs of a bottoming pattern forming. Just looking at the market structure shows that an uptrend could be in the cards. The stock has had a downtrend, and is currently in its range phase. All markets move in three ways: downtrend, range and an uptrend. These just repeat cycle after cycle.

A range tends to show the end of one trend, and a transition to another. In the case of Azincourt Energy, a range has formed after a downtrend, and the breakout of the range would thus trigger a new uptrend. The trigger for a breakout on Azincourt Energy comes with a daily candle close above $0.08.

Baselode Energy (FIND.V)

Baselode Energy (FIND.V) announced the completion of eight drill holes for 1,630 metres on the Company’s first drill program on the Catharsis project. Five of the eight drill holes intersected elevated radioactivity at important lithological contacts.

The first drill program on the Catharsis project has identified:

1) a structurally-controlled quartz-hematite-clay alteration system over 105 m core length in hole CT23-005 that shares numerous similarities with fluid conduits observed near other Athabasca basement-hosted uranium deposits.

2) 17 metres of pervasive and intense clay, chlorite, and desillicification alteration styles.

3) elevated radioactivity* near the lithological contact that separates the metasediments from orthogneiss in five of eight drill holes. Structures and fluids often propagate along this lithological contact in the formation of Athabasca uranium deposits.

“Although no elevated radioactivity was detected within the observed alteration systems, the presence of multiple generations of variable fluid compositions utilizing the same structural corridors is encouraging for continued exploration at this target and within the Catharsis project as a whole. Drill testing this target area has provided us good understanding of the geology and what our geophysical anomalies represent which has helped us identify and prioritize additional high-priority drill targets on the Catharsis project. As we wait for geochemical assay and study results from the Program, we’ll now turn our attention to our other exciting project, ACKIO, which hosts near-surface, high-grade uranium mineralization,” said James Sykes, CEO, President and Director of Baselode.

The stock is approaching a major support zone at $0.375. Buyers should be around that zone but only candle price action will confirm this. I would watch for some sort of range to develop with large wick and green bodied candles providing evidence of buying here. The stock would then need to climb back over the $0.50 major psychological zone for sustained momentum.

CanAlaska (CVV.V)

CanAlaska (CVV.V) this week announced the Company’s newly acquired Enterprise Project totaling 12,060 hectares in the southeastern Athabasca Basin. The Enterprise project is located approximately 20 kilometres south of the Key Lake Mine and Mill complex.

The project has undergone historical exploration programs that have resulted in a series of drill-ready targets. Earlier work on the project consisted of prospecting and geological mapping completed in conjunction with airborne radiometric, electromagnetic, and magnetic surveys in the 1970’s and 1980’s. In the early 2000’s, a helicopter-borne AeroTEM electromagnetic and magnetic survey was completed and followed up by a series of ground-based gravity and Horizontal Loop EM (HLEM) surveys.

The Company believes the Enterprise project is prospective for discovery of basement-hosted uranium targets. The project is well situated with respect to other projects in the Company’s portfolio, including its Voyager and Key Extension projects, and critical infrastructure such as power, road, and the Key Lake mill.

The Company is actively seeking Joint Venture partners to move the project forward.

The stock is battling currently at the major $0.50 psychological support zone. Recent candles have been printing with large wicks indicating that buyers are stepping in around this zone. I would like to see the stock remain above the $0.45 zone for further momentum higher.