American Creek Resources Ltd. [AMK-TSXV] is a Canadian exploration company with a front-row seat in one of the hottest gold exploration projects in northwestern British Columbia’s Golden Triangle area.

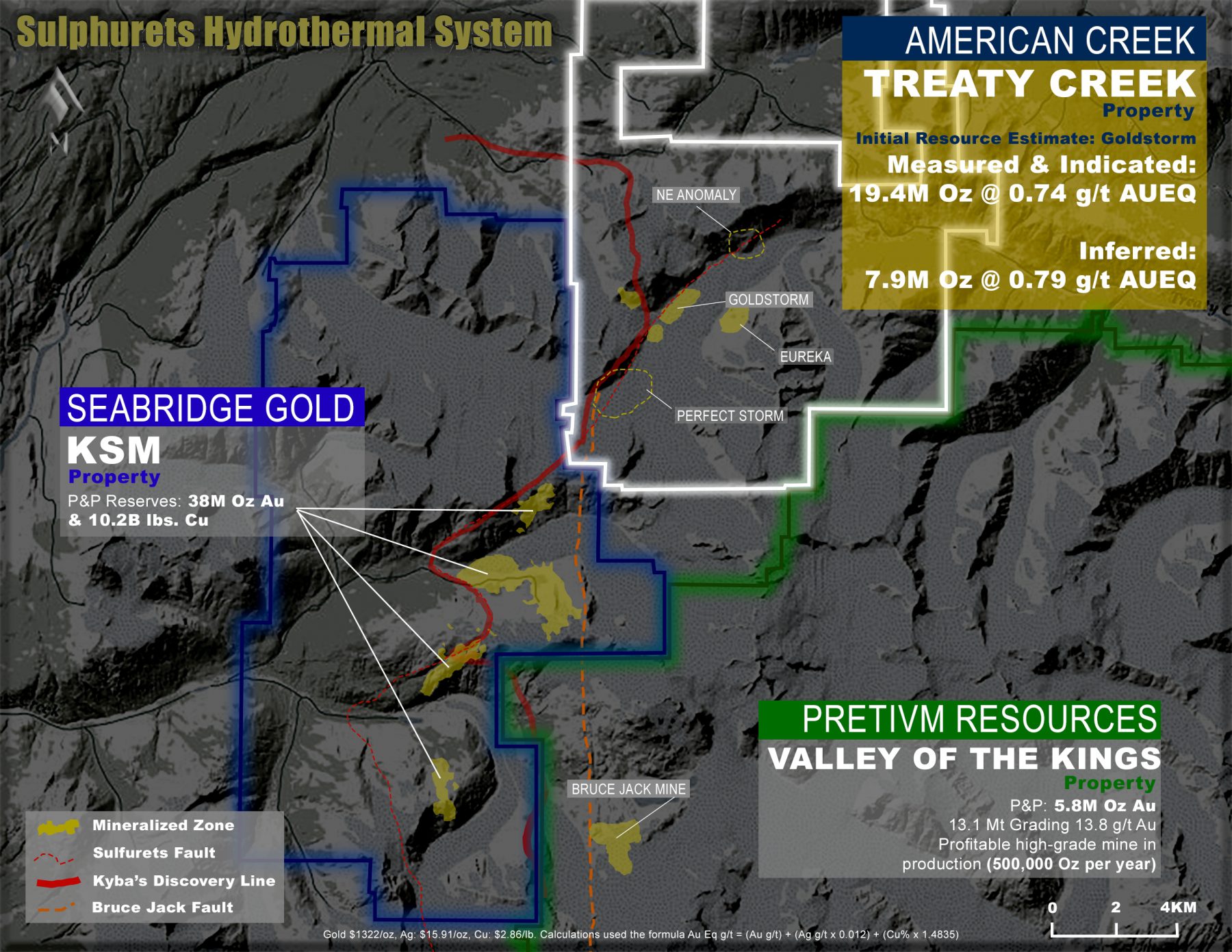

The company’s key asset is a 20% interest in the Treaty Creek joint venture project located in the same hydrothermal system as Seabridge Gold Inc.’s [SEA-TSX, SA-NYSE] KSM property and Pretium Resources Inc.’s [PVG-TSX] Brucejack gold mine.

KSM is one of the world’s largest undeveloped gold projects as measured by reserves, containing 38.8 million ounces of gold and 10.2 billion pounds of copper in proven and probable reserves.

Exploration at Treaty Creek is led by Ken Konkin, Vice-President corporate development and exploration at Tudor Gold Corp. [TUD-TSXV, TUC-Frankfurt], which holds a 60% interest in Treaty Creek and is the project operator. The other 20% is held by Teuton Resources Corp. [TUO-TSXV].

Konkin is best known for his instrumental role in the discovery of Pretium Resources “Valley of Kings” deposit and taking the Brucejack mine into production in 2017. Brucejack is expected to produce between 325,000 and 365,000 ounces of gold this year.

If Konkin can repeat his earlier success in the Golden Triangle, it would put American Creek and its joint venture partners in a very favourable position. American Creeks 20% interest is fully carried until a production notice is given.

This view is obviously shared by key investors, including Bay Street financier Eric Sprott, who continues to fund the drilling effort, including a placement last month and currently holds a significant position in all three companies, including a 17.8% partially diluted stake in American Creek.

American Creek offers investors a low-cost entry to the Treaty Creek story as its share of the M&I resource is currently being valued close to $19/oz gold equivalent. In comparison, the operators’ share is valued close to $32/oz gold equivalent for the same ounces in the ground. As noted above, American Creek will incur no development costs (dilution) for Treaty Creek, and the project may be sold prior to a notice of production is given.

American Creek offers investors a low-cost entry to the Treaty Creek story as its share of the M&I resource is currently being valued close to $19/oz gold equivalent. In comparison, the operators’ share is valued close to $32/oz gold equivalent for the same ounces in the ground. As noted above, American Creek will incur no development costs (dilution) for Treaty Creek, and the project may be sold prior to a notice of production is given.

The largest gold and copper deposits in the Golden Triangle are hosted by the Sulphurets Hydrothermal System and include the KSM and Brucejack deposits, which are located in the southern half of the geological system.

The 17,913- hectare Treaty Creek property covers the northern half of the system, where geology, geophysics, and exploration results show that the known mineralization in the southern half continues north.

That would be in line with the thinking of Konkin, who has referred to deposits in the Sulphurets Hydrothermal System as a “string of pearls….just really big pearls.”

Exploration of the Treaty Creek area over the past 30 years by various junior companies resulted in the discovery of a number of surface mineral showings, some with very high gold and silver values.

However, it is only recently that drilling revealed the potential for a large-scale porphyry-style gold deposit at the Copper Belle and Goldstorm zones, which are located on-trend and just five kilometres northeast of the KSM deposits.

A resource calculation announced in March 2021 for the Goldstorm zone contained *19.4 million ounces of 0.74 g/t gold equivalent (AuEq) in the Measured & Indicated resource category as well as 7.9 million ounces of 0.79 g/t AuEq of inferred resources and open in all directions.

In a September 28, 2021 news release, Tudor Gold said the latest set of results from the 2021 resource expansion and definition drill program indicate that the Goldstorm system is expanding to the northeast.

Optimism is driven by results from four drill holes, including step-out hole GS-21-119, which returned 196.5 metres of 1.76 g/t gold equivalent (AuEq) within a broader zone of 564.0 metres containing 1.09 g/t AuEq, along with previously announced hole GS-21-113 which intersected 927m of 1.265 g/t gold equivalent.

Optimism is driven by results from four drill holes, including step-out hole GS-21-119, which returned 196.5 metres of 1.76 g/t gold equivalent (AuEq) within a broader zone of 564.0 metres containing 1.09 g/t AuEq, along with previously announced hole GS-21-113 which intersected 927m of 1.265 g/t gold equivalent.

However, Goldstorm is only one of several potential deposits on the Treaty Creek project.

In the same press release, the company said near-surface mineralization was encountered at the Eureka Zone, which is located approximately 1,000 metres southeast of the Goldstorm Deposit.

Drilling at Eureka returned 67.5 metres of 1.13 g/t AuEq within 217.5 metres averaging 0.76 g/t AuEq. Like Eureka, Goldstorm remains open in all directions and at depth as drilling continues.

Tudor Gold has postponed drilling on the Perfectstorm zone, located just two kilometres southwest of Goldstorm, enabling them to concentrate their efforts on Goldstorm given the grades are getting richer to the north. It appears that 2021 drilling will expand the resource extensively.

The hope is that the higher-grade material in the first 300-400 metres from surface in the 300 horizon could help to improve the economics of Goldstorm by reducing the Cap-X payback period of an open pit operation.

American Creek’s other key asset is the Austruck-Bonanza in central British Columbia. The property is contiguous to WestKam Gold Corp.’s [WKG-TSXV] Bonapart gold property, where two open pits yielded a 3,700-tonne bulk sample grading 26.5 g/t gold.

* Metal prices used were US$1,625/oz Au, US$19/oz Ag, US$2.80/lb Cu with process recoveries of 88% Au, 30% Ag and 80% Cu. A C$16.50/tonne process and C$2 G&A cost were used. Approximately 90% of the AuEq is gold.