Bitcoin: The Moment Of Truth

Bitcoin has corrected by nearly 50% since its most recent high in late June.

However, 40-50% "corrections" are not an uncommon phenomenon in Bitcoin's upward waves, that continue to bring the digital asset's price higher and higher very time.

Libra is on "hold", the Fed is "seriously" contemplating "digital dollars"; looks like the current predatory financial system sees Bitcoin as a threat, and is showing signs of weakness.

Wait, how much fiat money is out there, and how much of the market do Bitcoin and other digital assets currently control?

Here's why Bitcoin could be trading between $140K - $280K within the next 5 years.

This idea was discussed in more depth with members of my private investing community, Albright Investment Group . Get started today »

Source: CoinDesk.com

Source: CoinDesk.com

Bitcoin: The Moment Of Truth

It's been about 10 months since I wrote "The Bottom Is In" article concerning Bitcoin (BTC-USD). Since then, Bitcoin skyrocketed by over 330%, before finally topping out close to $14,000. However, since the Libra induced top was reached in late June, Bitcoin has been brutalized by a vicious correction which has cut its price nearly in half.

Incidentally, I put out a "Time to Take Profits" article on June 26th, mentioning a possible reentry point between the $9K - $10K level. Soon thereafter I moved my reentry price target down to the $7.5K - $8.5K level.

Well, here we are, Bitcoin's correction has lasted roughly 4 months, has cut its price down by nearly 50%, and the digital asset is trading right around the bottom range of my buy in price target. I believe the time has come to begin rotating capital back into Bitcoin and into other select systemically important cryptocurrencies.

There are several fundamental, technical, and psychological reasons why the time to get long Bitcoin and certain other digital coins has arrived once again. Please read on to find out why.

Technical Image

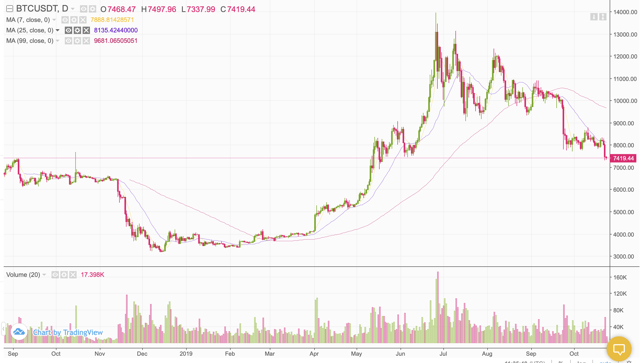

Let's begin with the technical image

Source: Binance.com

Bitcoin has been trading in a very tight trading range for a month now (roughly $7,500 - $8,500). This appears to be a consolidation phase before Bitcoin's next move higher. Nevertheless, I want to stress that Bitcoin is still in a somewhat unpredictable stage of its development cycle and the correction could potentially bring BTC down to as low as $6,500 in my view.

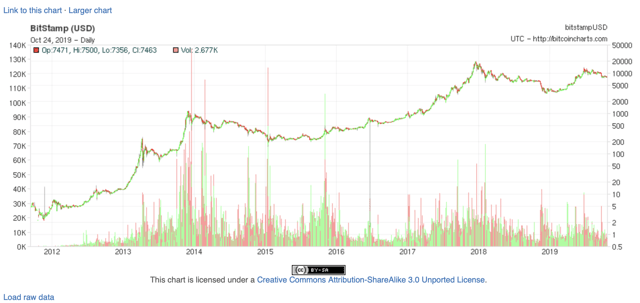

Source: Bitcoincharts.com

However, if we look at BTC's long-term chart, we see that Bitcoin clearly moves in waves, and each wave's top is substantially higher than the previous ones. Furthermore, Bitcoin is no stranger to "corrections" of 40-50%, while the overall wave's trend remains upward.

But It's Not Just Bitcoin

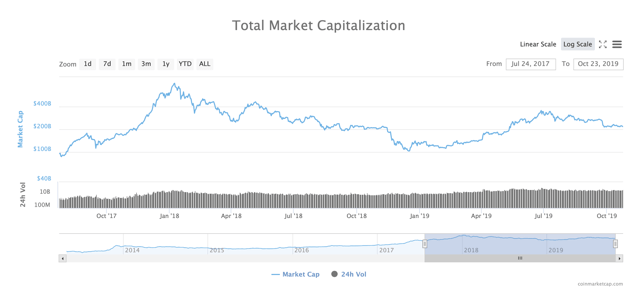

Bitcoin is not the only digital asset to take a substantial beating since its recent top. If you think 48% is bad, look at Litecoin (LTC-USD), which is down by 65% from its top in June, or Zcash (ZEC-USD), which is down by over 70% from its recent high, Dash (DASH-USD) is down by 65%, etc. In fact, the entire cryptocurrency complex is still down by roughly 75% from its top of over $800 billion in early 2018. Source: Coinmarketcap.com

Source: Coinmarketcap.com

So, Why the Carnage?

Well, for one, the Libra has been "put on hold" by regulators. The introduction of a Libra type stable coin by a large company like Facebook (FB) would be a very positive development for Bitcoin and other important alt-coins as it would likely help propel Bitcoin into the main stream, and further legitimize cryptocurrencies in general.

Source: CNN.com

Source: CNN.com

Another reason is that the Fed officially said it is actively debating the creation of a digital dollar.

Source: Bloomberg.com

Source: Bloomberg.com

So, why would the Fed be interested in introducing a "digital dollar"?

In my view, the reason is simple. The Fed feels threatened about losing control over the world's monetary system and is afraid of the dollar being replaced as the world's reserve currency. Furthermore, the dollar, digital or not, is still just a dollar that can be manipulated, inflated, and devalued by the Federal Reserve System, as it has been for over 100 years now.

Image Source

Image Source

The same cannot be said for true mineable digital currencies like Bitcoin and other analogous coins as they are immune to inflation due to a set amount that can ever exist in circulation. Therefore, despite the noise, and the temporary setback in price, Bitcoin and other systemically important coins are very likely headed much higher long term.

So, How Many Bitcoins are There?

For instance, nearly 18,000,000 Bitcoins have been mined, the total number that can ever exist is 21,000,000 and an estimated 4,000,000 Bitcoins have been lost forever. This implies that likely fewer than 14 million Bitcoins are in circulation right now, and an estimated 17 million will ever exist in the world's global financial system.

Source: Fortune.com

Source: Fortune.com

On the other hand, the dollar, digital or not, is still just a dollar and can be manipulated, inflated, and devalued at the Fed's will. Even if the Fed tries to introduce a similar (separate from its current fiat dollar) mineable digital dollar, it is not likely to be a great success for several reasons.

One of the main reasons is that it is against the Fed's interest to have a currency (blockchain based, mineable dollar), because the Fed (in theory) wouldn't be able to inflate, manipulate, and devalue it. If it is not mineable, then it is essentially no different from the current digital fiat dollars circulating the globe, because the Fed can create an unlimited amount of its "new digital dollars".

If the Fed goes through with its plan and does create a digital dollar that operates on a blockchain network, it would probably be positive for Bitcoin and other crucial coins anyways. Such a move by the Fed would likely provide a gateway for Bitcoin and other true digital coins to go mainstream sooner than anticipated. Moreover, it seems almost inevitable that in time the two systems (Fed's digital dollar and true digital coins) will become intertwined and compatible with one another.

Therefore, any negative noise regarding this subject is just that, noise, and will likely reflect positively on Bitcoin and other digital assets in the future. Moreover, the Fed is showing signs of weakness, as it is implying that it sees Bitcoin and the cryptocurrency complex as a real threat and competition to its current predatory and parasitic financial world order.

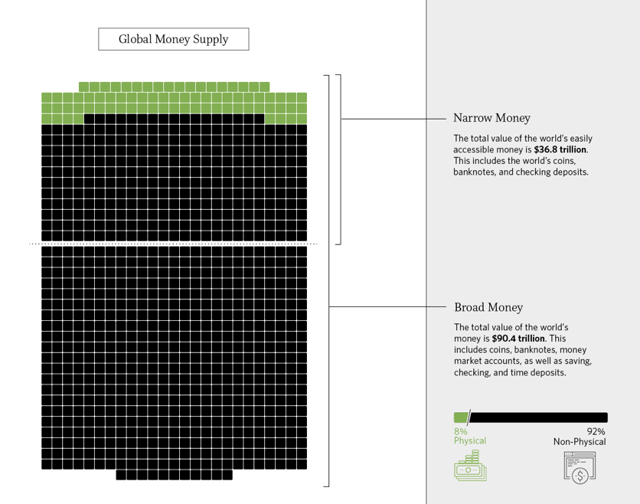

Wait, How Much Money is Out There?

At the same time, the M3 money supply plus the world's investible gold market value is likely roughly $100 trillion by now. At the same time, Bitcoin's market cap is merely $135 billion today. The entire cryptocurrency complex is valued at just around $200 billion now. Thus, Bitcoin only has about a 0.135% of the world's M3 fiat plus investible gold market, and the entire cryptocurrency complex has a share of just 0.2% of the same immense market.

Source: MarketWatch (2017)

And the Fed is worried about this? Why?

This tells me one very important factor, and that is that Bitcoin and digital assets in general are likely to go much higher. Let's presume that the Fed and other major central banks continue to expand the world's monetary base. This seems likely as many government bond/treasury rates are close to, at, or below zero. Moreover, The Fed is already starting to engage in programs it is not calling QE, but they closely resemble QE.

In any case, I am convinced that the "real QE" is coming shortly, once the U.S. goes into a recession and the "real QE" will likely continue as the U.S. attempts to climb out of the upcoming recession. Thus, the monetary base will very likely increase substantially over the next 3-5 years (my estimate is that it could possibly double from its $4 trillion high in 2015 to about $8 trillion within the next 5 years).

This should lead to higher inflation, higher prices on consumer goods, and many more dollars in the world's fiat financial system. Ultimately, many consumers may begin to lose faith in the current fiat monetary order, and could turn to inflation proof, decentralized digital currencies such as Bitcoin, LiteCoin, Dash, Zcash, etc.

If we presume that the world's M3 monetary base + investible gold is still worth around $100 trillion a few years from now (number could be a lot higher due to more fiat money creation), and the cryptocurrency complex captures 5-10% of the world's medium of exchange and global store of value markets, we're looking at a market cap of roughly $5 - $10 trillion for the entire cryptocurrency complex.

Right now, it is only worth about $200 billion, thus we could see an increase of roughly 2,400% - 4,900% from current levels. Furthermore, Bitcoin currently represents about 66.5% of the entire cryptocurrency complex's market cap. Even if Bitcoin's dominance declined to 50%, we may be looking at a market cap of around $2.5 - $5 trillion for Bitcoin under such a scenario.

This would put Bitcoin's price at roughly $140K - $280K per coin within the next 5 years or so. Does this price target seem plausible and realistic? Well, considering the enormous fiat money creation around the world, the decentralized nature of Bitcoin, the possibility of an upcoming fiat currency crisis, and other factors, I believe yes. Bitcoin could be trading between 140K and $280K within the next 5 years.

Also, let us not forget about the roughly $545 trillion in fiat derivatives floating around the globe that are essentially tied to the dollar and other fiat denominated derivatives, and core assets. Once these begin to lose value (possibly like many derivatives imploded in 2008), more money will need to be "created" to fill the empty gaps in the collapsing financial system and to keep the current financial status quo from crumbling.

This scenario works out very well for Bitcoin and other major coins as they are largely insulated from the current finical fiat order, and are not under threat of government/central bank backed inflation, manipulation, devaluation, etc. Yes, Bitcoin could be regulated properly, but I believe it is too late to consider any talks about outlawing, or banning it, considering that its blockchain is quite transparent, every transaction is stored permanently, and can be traced back to the user/users.

For more detailed information regarding Bitcoin, altcoins, and how to integrate them into a modern portfolio, please visit here.

Potential Risks to Consider

Possibly the No. 1 long-term threat bitcoin faces is detrimental government regulation or an all-out bitcoin ban. If major bitcoin-friendly governments like the U.S., E.U., Japan, South Korea, and others follow the footsteps of China and essentially make bitcoin use and trading illegal, it could have catastrophic consequences for bitcoin's price.

Continued Functionality Issues

Another risk factor is the concern that bitcoin may never become a widely-used transactional currency due to its issues with speed, cost, and scale. Yes, the Lightning Network promises to solve many of the issues associated with speed, cost, and scale, but there's no guarantee that the LN will become widely adopted, even over time.

Therefore, there's the risk that newer and more efficient digital currencies like Litecoin, Bitcoin Cash, and others may make bitcoin somewhat obsolete as an actual medium of exchange for the masses.

Continued Security Breaches and Fraudulent Activity

Continued security breaches in the bitcoin world concerning exchanges and individual wallets are a constant concern. If significant breaches continue, investors and users may start to lose confidence in the system and demand could decrease as well.

Likewise, there are fraud cases. In an industry that's still loosely regulated, substantial fraudulent activity is a persistent risk factor. Just like with security breaches when people get ripped off, it reflects poorly on the entire industry and demand along with prices can suffer.

Bitcoin is Not for Everyone

The bottom line is that bitcoin is not for everyone. I view it as an investment for people with a moderate to relatively high-risk tolerance, and a portfolio allocation of 5-20% seems appropriate for investors looking to gain exposure in this space.

Want to know more? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

- Receive access to our top-performing portfolio that returned 38.5% in H1 2019.

- Take advantage of this limited time 2-week free trial offer now and receive 10% off your introductory subscription pricing.

- Don’t hesitate, click here to find out more, and become a member of our investment community for fewer than just $20 per month!

Disclosure: I am/we are long BTC-USD, BCH-USD, LTC-USD, DASH-USD, ZEC-USD, XMR-USD, BTG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.