Because of my own experience with market fluctuation, I recognize the great risks one takes on investments. This converts the Social Security safety net into a risky proposition many cannot afford to take. - Grace Napolitano

The announcement of Tesla's (TSLA) inclusion in SP500 triggered a scorching rally in EV stocks, and GreenPower Motor Company (GP) was one of the beneficiaries. The stock jumped from below $10 levels to $28 within a few weeks in November 2020 but fell to $18 levels after the TSLA news got priced in and because a research firm published an ultra-bearish report on its prospects.

Investors enthusiastic about GP's prospects can consider the following risks that the company faces before making any decision:

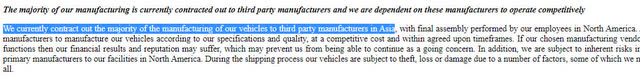

The Chinese Angle

Source: GP's Prospectus

As per the documents filed by GP with the SEC, a majority of the company's manufacturing is outsourced to manufacturers in China, Malaysia, Taiwan, and Hong Kong. The assembly of parts is carried out in its facility in Porterville in California.

The U.S. and China are at loggerheads about technology transfer, trade, and decoupling. If tariffs are hiked or sanctions are imposed by the new U.S. administration, or during the presidential transition process, costs are likely to increase for imports from China.

Though it is more likely that tensions will ease somewhat after the new U.S. administration takes over, the technology transfer issue is contentious and a dangerous wildcard to play against.

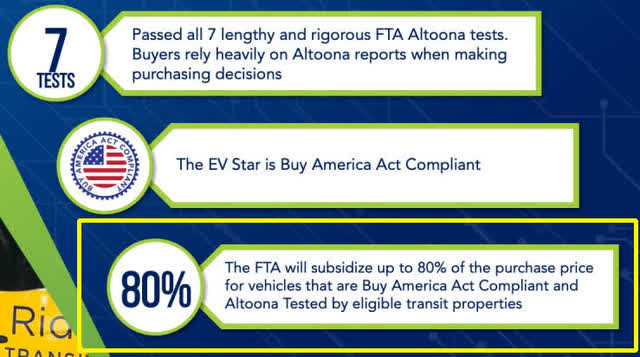

The Subsidy Risk

Up to 80% of the purchase price of vehicles sold by GP is subsidized. One of the key goals of President-elect Joe Biden is to reach 100% EV sales by 2030. The incoming administration has promised new tax incentives and rebates to buy EVs and an expansion of charging stations. Though the new administration will likely encourage EV subsidies, cash-strapped states can enforce a cut.

Image Source: GP's Q2 2021 Presentation

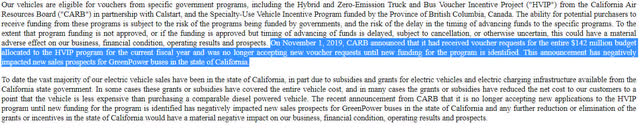

The company sells a majority of its EV buses in California, and it disclosed to the SEC that its vehicle buyers are eligible to receive vouchers of the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) from the California Air Resources Board (CARB). It has also disclosed that the majority of its sales are subsidized by the California state government.

Image Source: GP's SEC Filings

On November 1, 2019, CARB closed its voucher waitlist and announced that no new voucher requests will be accepted until early 2021 (because that is when it anticipates that new funding will be identified). If new funding is not identified or is below what is estimated, GP's sales may be negatively impacted.

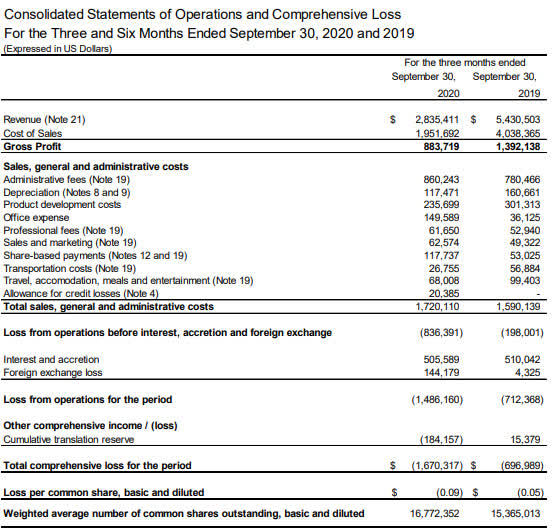

Financials

Image Source: GP's Financials for the Quarter ended September 30, 2020

In the quarter ended September 30, 2020, GP's $884k gross profit (31% of its sales) was destroyed by its administrative expenses ($860k), sales and marketing expenses ($63k), and product development expenses ($236k). The company ended up reporting a net loss of $1.67 million, which was almost double the gross profit it earned during the period.

The company clocked $2.8 million revenues in this quarter and its inventory as of September 2020 was $5.7 million ($1.55 million worth of finished goods + $4.14 million worth of work in progress) (note 6). That implies that the company has sufficient inventory for the next two quarters unless its sales accelerate in the current quarter.

Its quarterly interest expense of $506k million is very high at about 57% of its gross profit. The company has not yet managed to cover its operating costs, which is a big negative because competition in the EV space is heating up.

GP also reported negative operating cash flows of $4.1 million in the same period and had to shore up its cash reserves by issuing stock worth $37 million. After issuing stock, the company had $28 million cash as of September 2020.

Summing Up

COVID-19 has negatively impacted GP's operations in 2020, and I am unsure if it can grow at a fast pace in the coming quarters because COVID-19's economic devastation is likely to take a couple of years to recover.

GP's growth in the post-COVID-19 age also seems like a tough proposition. The research firm Deloitte estimates that the competition is very fierce in the EV space and is about to get worse in the next decade. The firm also opines that supply is significantly higher than demand and the number of potential EV manufacturers appears genuinely unsustainable.

GP's market is mostly restricted to California, and its sales and profitability are dependent on government subsidies. Deloitte opines that the EV market will reach its tipping point in 2022, and by then, the cost of an EV will probably match that of a traditional vehicle. Maybe by that time, the subsidies will be called off, who knows.

I estimate that GP has a small window of opportunity, until 2022, to prove its worth, and consider the company a risky bet because of the reasons discussed above.

*Like this article? Don't forget to click the Follow button above!

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.