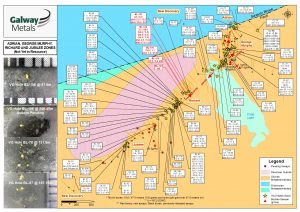

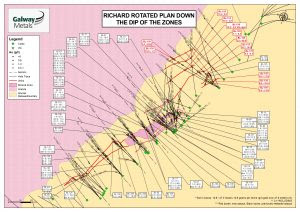

| (Toronto, Ontario, January 25, 2021) - Galway Metals Inc. (TSX-V: GWM) (the "Company" or “Galway”) is pleased to report full and partial assay results from 8 new holes plus results from 2 holes that had some assays pending in the 650 metre gap between the Richard and George Murphy Zones (GMZ) at the Company’s Clarence Stream project in southwest New Brunswick, Canada (Figure 1 and Figure 2). The latest results are highlighted by likely extensions to the east of previously identified veins and new veins to the north, which are denoted as (new 1, 2 or 3): - Hole 128 had pending assays added to the previously-released results with the full intersect now returning 3.5 grams per tonne (g/t) Au over 40.0 metres (m), including the previously-released 5.3 g/t Au over 25.5m, which includes 54.6 g/t Au over 0.5m, 20.9 g/t Au over 2.5m, and 13.7 g/t Au over 2.4m, starting at a vertical depth of 190m below surface. It is 92m below hole 125, but is now interpreted to be a different vein. Hole 125 intersected 17.0 g/t Au over 5.5m, including 163.0 g/t Au over 0.5m with VG. Hole 128 intersected three additional veins: 17.9 g/t Au over 2.0m (new 2), including 33.4 g/t Au over 0.5m, plus 1.1 g/t Au over 8.4m (new 1), plus previously reported 0.5 g/t Au over 13.0m, starting at vertical depths of 375m, 281m and 63m, respectively.

- Hole 133 intersected three veins: 9.5 g/t Au over 6.5m, including 27.2 g/t Au over 1.0m, plus 2.2 g/t Au over 15.5m, including 30.2 g/t Au over 0.7m, plus 10.0 g/t Au over 3.0m (new 2), including 18.7 g/t Au over 1.0m, starting at vertical depths of 148m, 172m, and 319m, respectively. The 3.5 g/t Au over 40.0m from hole 128 is thought to be the same zone as the 9.5 g/t Au over 6.5m, and 2.2 g/t Au over 15.5m, with 72m and 47m between them. Assays are pending for 17.0m of the 18.5m interval between the 9.5 g/t Au over 6.5m and 2.2 g/t Au over 15.5m intersects.

- Hole 130 intersected four veins: 75.9 g/t Au over 1.1m (new 2), plus 1.3 g/t Au over 25.0m (new 3) (included to show the scope of mineralization in this new vein; used the 0.42 lower cut-off for pit-constrained mineralization but the depth likely precludes its inclusion in a pit), including 18.5 g/t Au over 0.65m, plus shallower intersects returning 0.6 g/t Au over 30.0m, including 5.3 g/t Au over 1.0m, plus 0.5 g/t Au over 17.0m, including 1.6 g/t Au over 1.0m, starting at vertical depths of 420m, 472m, 71m, and 137m, respectively. If the intersections are dipping south similar to the Richard vein interpretations, then the 10.0 g/t Au over 3.0m from hole 133 is thought to be a new vein and the same as the 75.9 g/t Au over 1.1m from hole 130, and the 17.9 g/t Au over 2.0m from hole 128. With these intersects, this vein has now been drilled over 174m along strike and remains open, as are all veins discussed herein. These new veins are close to the intrusive that is thought to control mineralization. The intersect hosing 18.5 g/t Au over 0.65m starting at 472m below surface is the deepest in any of the 4 Zones not in resource at Clarence Stream, including the Adrian, GMZ, Richard and Jubilee Zones. The South Zone has been intersected below 500m.

- Hole 136 intersected 19.5 g/t Au over 4.0m (new 1), including 51.6 g/t Au over 1.0m, with the rest of the hole pending, starting at a vertical depth of 273m below surface. This is thought to be another new vein that lines up with the 1.1 g/t Au over 8.4m in hole 128.

Robert Hinchcliffe, President and CEO of Galway Metals, said, “The new veins contain some nice high grades. We’ll expand out from them, and follow-up other high-priority targets to increase the upcoming resource. There are simply so many obvious potential extensions to known and recently discovered veins that the Company has decided to push out the resource update by a few months. To expedite this effort, Galway recently added one drill rig at Clarence Stream to bring the total to 6, and will add a 7th in February as we continue our fully-funded, 100,000m drill program to be completed by year-end. Galway’s aim is to not only expand the existing zones, but to also continue making new discoveries to further demonstrate that Clarence Stream is an important new gold district in North America.” There now appears to be 6 vein zones present in the area of the current drilling, with 3 interpreted to correlate with the previously identified Richard Zone horizons; the other three appear to be new. The 3.5 g/t Au over 40.0m in hole 128 appears to line up best, and is 232m east of the northern-most vein that Galway intersected at the time of the discovery of the Richard Zone, which returned 5.4 g/t Au over 11.0m. The 3.5 g/t Au over 40.0m is also located 262m NE of the previous eastern Richard limit defined by the discovery hole intersection that returned 7.3 g/t Au over 36.7m. Galway is continuing to fill in the 650m gap between the Richard Zone and the GMZ. All veins appear to be sub-parallel to the granite to the north and mimics its dip at ~60-65 degrees. Assays have been returned for 5 additional holes to the east of, plus one drilled south of the highlight holes noted above, with intersections ranging up to 7.5 g/t Au over 1.05m, 0.6 g/t Au over 10.0m, and 0.5 g/t Au over 10.0m. In general, the better results to date are from steeper holes. Table 1. Assay Results | Hole ID | From

(m) | To

(m) | Intercept

(m) | Au

g/t | | GWM-20BL-136 | 61.00 | 291.00 | | pending | | | 291.00 | 295.00 | 4.00 | 19.5 | | including | 294.00 | 295.00 | 1.00 | 51.5 | | | 303.00 | 321.00 | | pending | | | 324.00 | 446.00 | | pending | | GWM-20BL-133 | 56.00 | 136.00 | | pending | | | 137.00 | 138.00 | 1.00 | 1.3 | | | 139.00 | 140.00 | 1.00 | 0.6 | | | 150.50 | 157.00 | 6.50 | 9.5 | | including | 153.00 | 154.00 | 1.00 | 27.2 | | | 157.00 | 174.00 | | pending | | | 175.50 | 191.00 | 15.50 | 2.2 | | including | 175.50 | 176.20 | 0.70 | 30.2 | | | 203.00 | 204.50 | 1.50 | 0.5 | | | 260.00 | 284.00 | | pending | | | 328.00 | 331.00 | 3.00 | 10.0 | | including | 330.00 | 331.00 | 1.00 | 18.7 | | | 337.00 | 353.00 | | pending | | GWM-20BL-130 | 72.00 | 102.00 | 30.00 | 0.6 | | including | 73.00 | 74.00 | 1.00 | 5.3 | | | 95.50 | 97.00 | 1.50 | 1.3 | | | 113.50 | 114.50 | 1.00 | 0.7 | | | 117.00 | 118.00 | 1.00 | 0.4 | | | 132.00 | 149.00 | 17.00 | 0.5 | | including | 132.00 | 133.00 | 1.00 | 1.4 | | including | 141.00 | 142.00 | 1.00 | 1.6 | | | 149.00 | 225.00 | | pending | | | 237.90 | 378.60 | | pending | | | 383.00 | 384.50 | 1.50 | 1.0 * | | | 388.00 | 388.50 | 0.50 | 1.1 * | | | 430.00 | 431.00 | 1.10 | 75.9 | | | 433.00 | 435.00 | 2.00 | 1.7 * | | | 476.00 | 501.00 | 25.00 | 1.3 * | | including | 479.00 | 479.65 | 0.65 | 18.5 | | including | 497.80 | 498.30 | 0.50 | 4.4 | | GWM-20BL-128 | 64.00 | 77.00 | 13.00 | 0.5 ** | | including | 64.00 | 65.00 | 1.00 | 1.9 ** | | | 89.50 | 91.00 | 1.50 | 0.6 | | | 128.00 | 129.00 | 1.00 | 1.6 | | | 193.50 | 233.50 | 40.0 | 3.5 VG | | including | 208.00 | 233.50 | 25.50 | 5.3 VG ** | | including | 214.40 | 214.90 | 0.50 | 54.6 ** | | including | 220.90 | 221.50 | 0.60 | 8.3 | | including | 224.10 | 226.50 | 2.40 | 13.7 | | including | 231.00 | 233.50 | 2.50 | 20.9 ** | | | 288.00 | 296.40 | 8.40 | 1.1 | | including | 295.00 | 296.40 | 1.40 | 2.4 | | | 299.00 | 299.60 | 0.60 | 1.0 | | | 357.00 | 359.00 | 2.00 | 17.9 | | including | 358.00 | 358.50 | 0.50 | 33.4 | | | 494.00 | 494.60 | 0.60 | 0.5 * | | GWM-20BL-126 | 59.00 | 69.00 | 10.00 | 0.6 | | | 133.00 | 134.00 | 1.00 | 1.2 | | | 267.50 | 269.00 | 1.50 | 1.5 | | GWM-20BL-125 | 60.00 | 61.00 | 1.00 | 0.7 ** | | | 64.00 | 67.15 | 3.15 | 0.44 ** | | | 135.00 | 135.50 | 0.50 | 0.6 | | | 137.00 | 141.00 | 4.00 | 0.5 | | | 145.00 | 146.00 | 1.00 | 1.0 | | | 150.00 | 155.50 | 5.50 | 17.0 ** | | including | 154.00 | 154.50 | 0.50 | 10.8 ** | | including | 154.50 | 155.00 | 0.50 | 163.0 VG ** | | | 160.00 | 162.00 | 2.00 | 0.6 | | | 296.00 | 298.00 | 1.50 | 1.8 | | | 340.00 | 350.00 | 10.00 | 0.5 | | GWM-20BL-123 | 233.00 | 238.00 | 5.00 | 0.7 | | | 302.00 | 303.00 | 1.00 | 0.4 | | | 304.00 | 304.50 | 0.50 | 0.7 | | GWM-20BL-121 | 35.00 | 36.60 | 1.60 | 1.3 | | | 65.00 | 67.00 | 2.00 | 0.6 | | | 70.00 | 71.00 | 1.00 | 0.8 | | | 130.50 | 133.50 | 3.00 | 0.7 | | GWM-20BL-119 | 43.00 | 44.00 | 1.00 | 0.4 | | | 46.00 | 47.00 | 1.00 | 0.6 | | | 67.50 | 70.00 | 2.50 | 0.6 | | | 76.00 | 79.00 | 3.00 | 0.8 | | | 82.00 | 83.50 | 1.50 | 0.5 | | | 108.95 | 110.00 | 1.05 | 7.5 | | | 155.00 | 240.00 | | pending | | | 301.00 | 314.00 | | pending | | GWM-20BL-117 | 66.00 | 67.00 | 1.00 | 2.4 | | | 90.90 | 92.00 | 1.10 | 0.5 | | | 121.00 | 124.10 | 3.10 | 1.0 | | including | 122.00 | 122.50 | 0.50 | 2.4 | | | 142.00 | 143.50 | 1.50 | 1.7 | | | 189.00 | 190.00 | 1.00 | 0.8 | ** previously reported; * intersection used 0.42 g/t Au for the bottom cut-off as per pit constrained resources but is at likely too much depth. Shown to indicate scope of mineralization; (TW=True Widths, which are calculated – sectional measuring may give slightly different numbers); True widths are unknown if not noted; VG=Visible Gold; 0.42 g/t Au was used for the bottom cut-off. Table 2: Drill Hole Coordinates | Hole ID | Azimuth | Dip | Easting | Northing | Total Depth (m) | Zone | | GWM20BL-117 | 315 | -45 | 653716 | 5021771 | 303 | Richard-GMZ Trend | | GWM20BL-119 | 315 | -60 | 653716 | 5021771 | 366 | Richard-GMZ Trend | | GWM20BL-121 | 315 | -45 | 653765 | 5021806 | 327 | Richard-GMZ Trend | | GWM20BL-123 | 315 | -45 | 653797 | 5021875 | 324 | Richard-GMZ Trend | | GWM20BL-125 | 140 | -57 | 653619 | 5021817 | 370.5 | Richard-GMZ Trend | | GWM20BL-126 | 348 | -61.5 | 653699 | 5021718 | 402 | Richard-GMZ Trend | | GWM20BL-128 | 286 | -78 | 653699 | 5021718 | 495 | Richard-GMZ Trend | | GWM20BL-130 | 256 | -79 | 653699 | 5021718 | 525 | Richard-GMZ Trend | | GWM20BL-133 | 312 | -76 | 653699 | 5021718 | 399 | Richard-GMZ Trend | | GWM20BL-136 | 263 | -71.5 | 653699 | 5021718 | 453 | Richard-GMZ Trend | New Brunswick Junior Mining Assistance Program Galway would like to acknowledge financial support from the New Brunswick Junior Mining Assistance Program, which partially funded drilling of the GMZ, Jubilee, and Richard Zones. Geology and Mineralization The recent discovery of the Richard Zone in hole 12 contains elevated levels of bismuth, arsenopyrite, and antimony, in multiple quartz veins, with tungsten in the vicinity. This is similar to other Clarence Stream deposits, which can be characterized as intrusion-related quartz-vein hosted gold deposits. Richard Zone contains multiple zones of quartz veining with sulfides and sericite alteration. In general, mineralization at Clarence Stream consists of 10-70% quartz stockworks and veins with 1-5% fine pyrite plus pyrrhotite plus arsenopyrite plus stibnite in sericite altered sediments. The Jubilee mineralization consists of 2%-5% disseminated pyrite, sphalerite, galena, arsenopyrite, chalcopyrite, and pyrrhotite in sediments with white to smoky grey quartz veining. Locally there is up to 10% sphalerite and semi-massive galena veinlets. The 2.5 km trend that hosts the GMZ, Richard and Jubilee Zones contains a mineralized mafic intrusive locally – similar to the South Zone, which currently hosts most of the property’s last reported gold resources (September 2017). A more complete description of Clarence Stream’s geology and mineralization can be found at www.galwaymetalsinc.com. Review by Qualified Person, Quality Control and Reports Michael Sutton, P.Geo., Director and VP of Exploration for Galway Metals, is the Qualified Person who supervised the preparation of the scientific and technical disclosure in this news release on behalf of Galway Metals Inc. All core, chip/boulder samples, and soil samples are assayed by Activation Laboratories, 41 Bittern Street, Ancaster, Ontario, Canada, who have ISO/IEC 17025 accreditation. All core is under watch from the drill site to the core processing facility. All samples are assayed for gold by Fire Assay, with gravimetric finish, and other elements assayed using ICP. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at one per 20 samples. Approximately five percent (5%) of the pulps and rejects are sent for check assaying at a second lab with the results averaged and intersections updated when received. Core recovery in the mineralized zones has averaged 99%. About the Company Galway Metals is well capitalized with two gold projects in Canada, Clarence Stream, an emerging gold district in New Brunswick, and Estrades, the former producing, high-grade VMS mine in Quebec. The Company began trading on January 4, 2013, after the successful spinout to existing shareholders from Galway Resources following the completion of the US$340 million sale of that company. With substantially the same management team and Board of Directors, Galway Metals is keenly intent on creating similar value as it had with Galway Resources. Figure 1: Clarence Stream Plan Map  Figure 2: Plan Map of the Richard Zone  Should you have any questions and for further information, please contact (toll free): Galway Metals Inc. Robert Hinchcliffe President & Chief Executive Officer 1-800-771-0680 www.galwaymetalsinc.com CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements made herein with respect to, among other things, the Company’s objectives, goals or future plans, potential corporate and/or property acquisitions, exploration results, potential mineralization, exploration and mine development plans, timing of the commencement of operations, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, exploration results being less favourable than anticipated, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, risks associated with the defence of legal proceedings and other risks involved in the mineral exploration and development industry, as well as those risks set out in the Company’s public disclosure documents filed on SEDAR. Although the Company believes that management’s assumptions used to develop the forward-looking information in this news release are reasonable, including that, among other things, the Company will be able to identify and execute on opportunities to acquire mineral properties, exploration results will be consistent with management’s expectations, financing will be available to the Company on favourable terms when required, commodity prices and foreign exchange rates will remain relatively stable, and the Company will be successful in the outcome of legal proceedings, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information contained herein, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. |