An exciting and new commodity cycle and lengthy bull market for commodity stocks is about to start. While our company is focused on the energy sector, we believe base and precious metals will also be very rewarding.

By the end of June, I see the Dow Jones Industrials Index breaking below the 26,000 level. We should then see a turbulent market during May to July, providing another low risk buying window.

Investors should become as informed as possible prior to this coming opportunity and be ready to purchase securities in these areas when they become bargains. Once or twice a year they go on sale so get your buy lists ready so you can pounce when stocks are being sold off irrationally.

The reason for a new commodity cycle is basically the lack of capital investment to replace declines. In energy it is a shrinking Reserve Life Index and a new entrant’s increasing demand that makes for a powerful cycle. In Chart #1 one can see that Japan affected the 1970’s cycle, China the 1999-2008 cycle and it is India impacting the 2016-2024+ cycle.

image: https://mikesmoneytalks.ca/wp-content/uploads/2019/05/JS-1-300x151.png

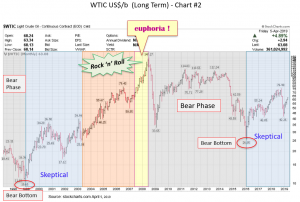

There have been only two major energy cycles in my 40+ year career so far, and the third one started in February 2016 when crude bottomed at US$26/b (Chart #2).

image: https://mikesmoneytalks.ca/wp-content/uploads/2019/05/JS-2-300x202.png

In the last cycle we saw WTI crude oil lift from US$10.65/b in late 1998 to US$147.27/b in mid-2008. In this cycle we see WTI moving from the low in early 2016 of US$26.05/b to a new all time high above US$150/b during the Euphoria Phase. Strong demand, low inventories and supply problems usually occur at the commodity cycle peak.