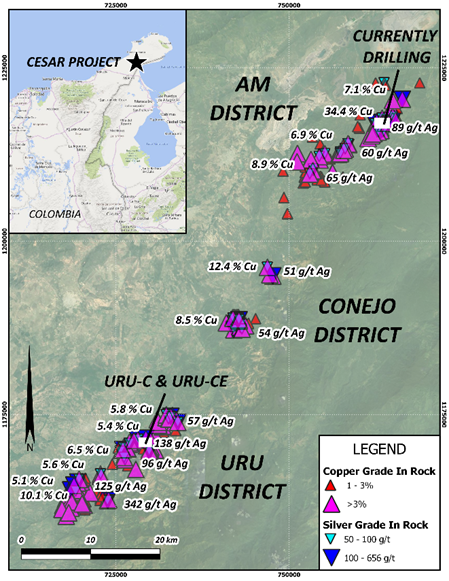

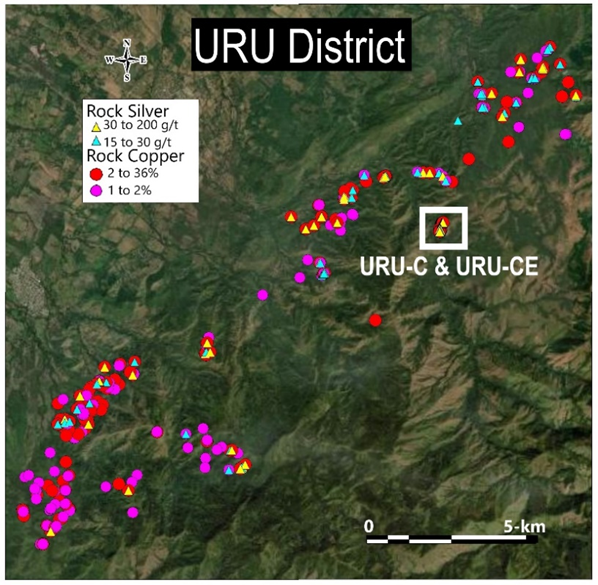

Drill Results of Max Resource Confirm High-Grade Copper Silver at the CESAR Project in NE Colombia. Highlights Include 10.6m at 3.4% Copper and 48 g/t Silver Vancouver B.C., January 24, 2023 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) is pleased to provide assays and analysis for its initial drilling program at the CESAR Project. Within the 20-km-long, 2-km wide copper silver bearing URU District, only two targets (URU-C and URU-CE) were drill tested (refer to Figure 1). KEY POINTS - Drilling the URU-C and URU-CE targets, located 0.75-km apart, confirmed the continuation of copper silver mineralization at depth (refer to Figure 2).

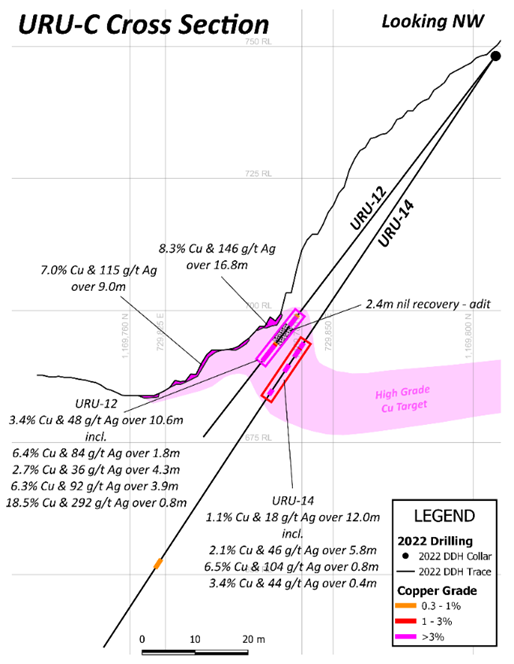

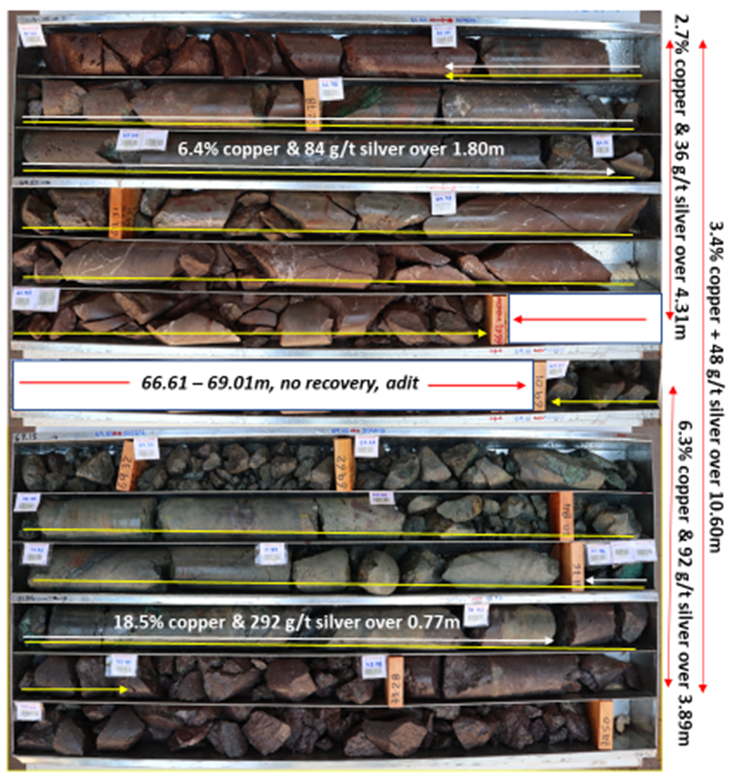

- At URU-C, a 9.0m of 7.0% Cu + 115 g/t Ag discovery was confirmed at depth by hole URU-12, which intersected 10.6m of 3.4% Cu and 48 g/t Ag, including a 2.4m section of no core recovery calculated as nil grade, as the drill pierced a high-grade underground adit. This hole also included 0.8m of 18.5% Cu + 292 g/t Ag. Further drilling is planned to confirm continuation of high-grade mineralization down dip.

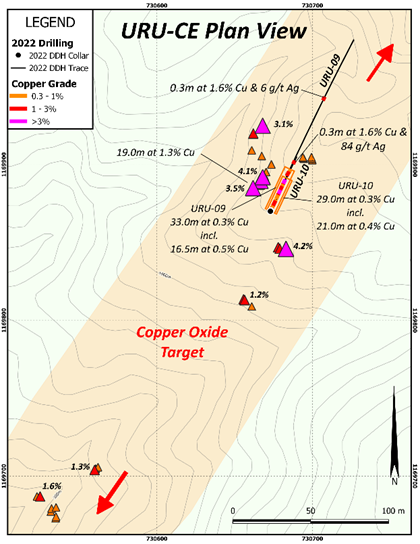

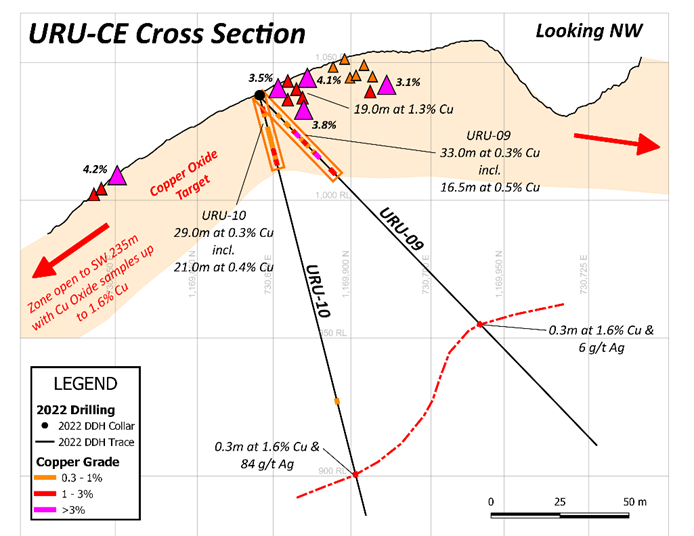

- At URU-CE the 19.0m of 1.3% Cu discovery was confirmed by hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% Cu from 4.0m, including 16.5m of 0.5% Cu. The broad associated alteration zone implies the potential for a bulk tonnage system. Planned drilling will also target surface higher-grade zones, discovered by rock channel sampling along strike 235m to the south.

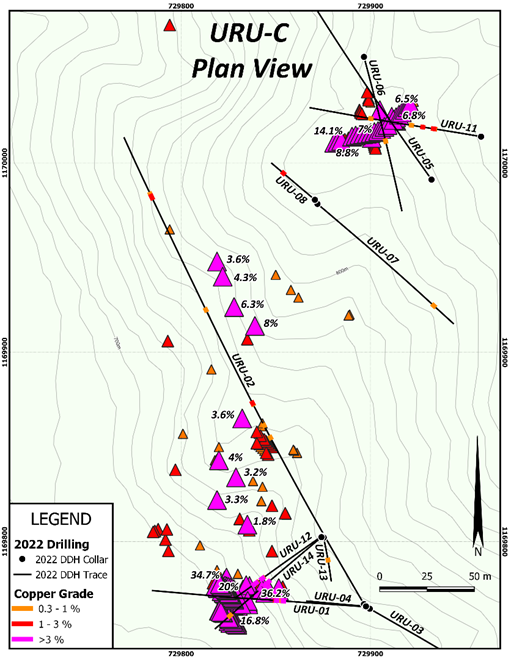

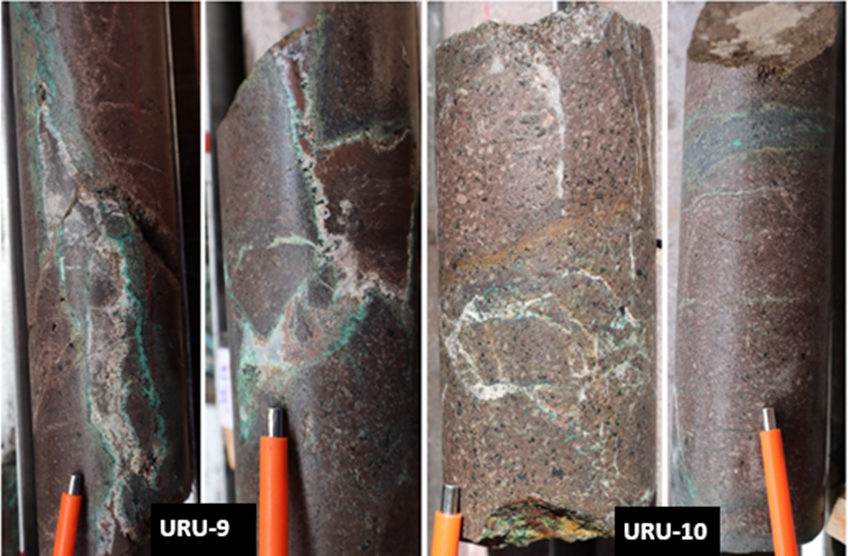

The maiden drill program consisted of 14 holes from 7 drill pads for total of 2,244m. Twelve holes intersected mineralized zones, with six intersecting significant copper silver mineralization. All holes encountered significant alteration associated with a district scale hydrothermal system. All structures identified to date appear to be associated with mineralizing events. Most notable is the presence of widespread copper oxide in the form of malachite and primary chalcocite (refer to Figures 3 to 9). Highlight drill results (core intervals, true widths are unknown at this time) include: | Drill Hole | From (m) | To (m) | Copper (Cu) and Silver (Ag) | | URU-12 | 62.30 | 72.90 | 3.4% copper + 48 g/t silver over 10.60m | | including | 62.30 | 64.10 | 6.4% copper + 84 g/t silver over 1.80m | | including | 62.30 | 66.61 | 2.7% copper + 36 g/t silver over 4.31m | | including | 66.61 | 69.01 | 0% copper + 0 g/t silver over 2.40m (nil core recovery) | | including | 69.01 | 72.90 | 6.3% copper + 92 g/t silver over 3.89m | | including | 71.76 | 72.53 | 18.5% copper + 292 g/t silver over 0.77m | | URU-14 | 64.92 | 77.45 | 1.2% copper + 18 g/t silver over 12.53m | | Including | 65.53 | 71.30 | 2.1% copper + 46 g/t silver over 5.77m | | including | 70.55 | 71.30 | 6.5% copper + 104 g/t silver over 0.75m | | URU-1 | 66.75 | 73.72 | 1.4% copper + 8 g/t silver over 6.97m | | URU-2 | 335.52 | 343.20 | 0.6% copper + 7 g/t silver over 7.68m | | including | 335.52 | 336.90 | 2.1% copper + 30 g/t silver over 1.38m | | URU-9 | 4.87 | 37.84 | 0.3% copper oxide over 32.97m | | including | 13.25 | 29.70 | 0.5% copper oxide over 16.45m | | including | 27.56 | 29.70 | 1.9% copper oxide over 2.14m | | URU-10 | 3.65 | 32.30 | 0.3 % copper oxide over 28.65m | | including | 4.26 | 24.92 | 0.4% copper oxide over 20.66m | “We are pleased that the first drill program has achieved the objective of confirming two discoveries which continue at depth, noting the results are from a 0.75-km partial strike of the 90-km-long copper silver zone. Malachite and chalcocite zones were intersected in 12 of the first 14 holes with significant copper silver mineralization in 6 holes, including bonanza 18.5% copper + 292 g/t silver over 0.8m,” commented Max CEO, Brett Matich. “The Company’s exploration team has now commenced its fully-funded 2023 exploration and drilling program,” he concluded.  Figure 1. CESAR 90-km-belt drill locations  Figure 2. 20-km-long URU District; URU-C and URU-CE location  Figure 3. URU-C Drilling Plan View  Figure 4. URU-C Drilling Cross Section  Figure 5. URU-C, drill hole URU-12 returned ultra high-grades of 18.5% copper + 292 g/t silver over 0.8m  Figure 6. URU-CE Drilling Plan View  Figure 7. URU-CE Drilling Cross Section Both the URU-C and URU-CE mineralization consisted of very favourable primary chalcocite and secondary oxide malachite. The chalcocite forms in significant globular blebs, as disseminations, and also lines the walls of the calcite veining and forms veinlets of massive chalcocite in brecciated areas. Malachite is closely related to the chalcocite in veins and can be seen as replacing chalcocite in some of the disseminations. In addition, Magnetic and Induced Polarization surveys were conducted to test the response of mineralization and determine if blind drill targets could be identified as high probability mineral occurrences (refer to Figures 2 through to 8). The URU-C drill holes, URU-1, 2, 12 and 14 intersected significant grades of copper and silver mineralization. In addition, high-grade mineralization was intersected in holes URU-1, 12, and 14, interpreted as possibly associated with a low angle structure dipping to the southeast. URU-12 was the best intercept of the three and unfortunately pierced an underground adit in the middle of the high-grade, but still reported 10.6m of 3.4% copper + 48 g/t silver, including 0.8m of 18.5% copper + 292 g/t silver and 3.9m of 6.3 % copper + 92 g/t silver. URU-1 and 14 both had significant intercepts with hole URU-1 returning 7.0m of 1.4% copper + 8 g/t silver, while URU-14 intersected 12.5m of 1.2% copper + 18 g/t silver with higher grade of 5.8m of 2.1% copper + 46 g/t silver. At URU-C, hole URU-2 was the deepest hole of the program demonstrating the depth potential drilling large diameter HQ holes to approximately 400m down hole. The target was a deep low order IP chargeability high 150m west of URU-C and coincident magnetic high. An intersection of a 7.7-metre-wide zone of 0.6% copper + 7 g/t silver, including 1.4m of 2.1% copper + 30 g/t silver, demonstrates that IP and coincident magnetics works well at identifying mineralized targets. At URU-CE located 750m east of URU-C, holes URU-9 and URU-10 were drilled from a single pad. From approximately 4.0m surface, both holes encountered wide intervals of lower grade but favourable oxide copper. URU-9 intersected 33.0m of 0.3% copper, including 16.5m of 0.5% copper and URU-10 intercepted 28.7m of 0.3% copper, including 20.7m of 0.4% copper. The broad associated alteration zone implies potential for a bulk tonnage system, drilling will also target higher-grade zones. The copper mineralization at URU-CE is open in all directions. In addition, rock chip sampling returned highlight values of 1.2 to 4.2% copper extending the URU-CE target zone 235m to the south. The target is also on the eastern end of a 1-km long coincidental IP and magnetic anomaly.  Figure 8. URU-CE highlight copper values of 3.7% from hole URU-09 and 3.1% from hole URU-10  Figure 9. Mineralized interval in drill hole URU-2, first identified occurrence of bornite Links to Figures 1 to 9 https://www.maxresource.com/images/gallery/MAX_20230124_Fig1.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig2.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig3.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig4.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig5.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig6.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig7.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig8.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Fig9.jpg | DH No. | E_WGS84z18N | N_WGS84z18N | Elevation (m) | | Azimuth | Dip | Hole Length (m) | Target | | URU-1 | 729,897 | 1,169,766 | 744 | | 275 | -50 | 173.73 | URU-C | | URU-2 | 729,897 | 1,169,767 | 745 | | 330 | -45 | 381.60 | URU-C | | URU-3 | 729,900 | 1,169,765 | 744 | | 120 | -45 | 205.74 | URU-C | | URU-4 | 729,898 | 1,169,766 | 745 | | 275 | -70 | 90.83 | URU-C | | URU-5 | 729,932 | 1,169,991 | 836 | | 325 | -45 | 261.51 | URU-C | | URU-6 | 729,897 | 1,170,056 | 835 | | 165 | -45 | 118.56 | URU-C | | URU-7 | 729,872 | 1,169,978 | 825 | | 130 | -45 | 136.85 | URU-C | | URU-8 | 729,871 | 1,169,981 | 825 | | 310 | -55 | 53.03 | URU-C | | URU-9 | 730,673 | 1,169,871 | 1037 | | 25 | -45 | 174.65 | URU-CE | | URU-10 | 730,673 | 1,169,870 | 1037 | | 25 | -75 | 155.44 | URU-CE | | URU-11 | 729,957 | 1,170,020 | 860 | | 280 | -45 | 131.36 | URU-C | | URU-12 | 729,872 | 1,169,804 | 750 | | 235 | -52 | 90.65 | URU-C | | URU-13 | 729,872 | 1,169,804 | 750 | | 170 | -80 | 136.63 | URU-C | | URU-14 | 729,872 | 1,169,804 | 750 | | 230 | -55 | 133.19 | URU-C | Table 1. Drill hole locations (core intervals, true widths are unknown at this time) Links to Drill Tables https://www.maxresource.com/images/gallery/MAX_20230124_Table1.jpg https://www.maxresource.com/images/gallery/MAX_20230124_Table2.jpg 2023 Exploration Plans Max has now commenced its 2023 exploration and drilling campaign. Additional geophysical techniques including ground Magneto-Telluric (MT) surveys will be deployed to provide a broader basket of tools to explore the AM, Conejo and URU Districts, which collectively cover a 60-km strike length of Copper Silver mineralization. Phase 1 metallurgy will form part of the additional focus, as the unique characteristics of this mineralized district exhibiting strong potential for leachable copper tonnage. Quality Assurance Max adheres to a strict QA/QC program for core handling, sampling, sample transportation and analyses. Drill core samples were securely transported to the Company’s core facility in Valledupar, Colombia. Samples were sawn in half, labelled, placed in sealed, securitized bags and shipped directly to ALS Colombia LTDA in Medellin, with some holes shipped directly to Actlabs Colombia SAS in Medellin. Analysis was completed at ALS Medellin and/or Actlabs Medellin or Actlabs Zacatecas, Mexico. ALS Medellin is an ISO 9001: 2008 certified facility, while Actlabs Medellin and Actlabs Zacatecas are both ISO 9001: 2015 certified facilities. The ALS Medellin analytical technique was ME-ICP 61, a four acid digestion of a 0.25g sample analyzed on an Inductively Coupled Plasma (ICP) with upper limits of 100 ppm for silver and 10,000 ppm for copper. Over limits for copper or silver were analyzed with the OG62 technique, a four acid digestion of a 0.4g sample. The Actlabs Zacacetas analytical technique was IF2, a multielement four acid digestion of a 0.25g sample analyzed on an ICP unit while the Actlabs Medellin analytical technique was TD-AA, a 4 acid digestion of a 0.25g sampled for copper and silver analyzed on an Atomic Absorption (AA) unit, both with upper limits of 100 ppm for silver and 10,000 ppm for copper. Over limits for copper or silver were analyzed with the 8 4 Acid ICP technique, a four acid digestion of a 0.4g sample. QA/QC control procedures include the systematic insertion of duplicate, blank and certified reference materials (CRM), at regular intervals into the sampling stream. A review of the CRM analyses shows repeated under reporting from Actlabs Medellin (below 2 Standard Deviations), while the ALS Medellin CRM analyses reported well within 2 Standard Deviations. A review of duplicates showed no discrepancies. Background Max’s CESAR project lies along the copper silver rich Cesar basin in NE Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejn, the largest coal mine in South America, held by global miner Glencore. Max’s twenty-one mining concessions collectively expanse over 188-km². Max executed a 2-year co-operation agreement with Endeavour Silver Corp. (TSX: EDR, NYSE: EXK), which assists Max to significantly expand its 100% owned landholdings at CESAR, Endeavour will hold underlying 0.5% NSR. Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been rock sampled over many kilometres within the AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in the sedimentary red bed sequences. The Conejo District, midway south, demonstrates mineralization at the contact of intermediate and felsic volcanics which outcrops over 3.7 kilometers. The average of surface samples over a 2.0% cut-off come in at 4.9% copper. To the far south, the 2022 inaugural drilling was initiated at two mineralized surface exposures, each located 0.75-km apart and lie within the URU District’s 20-km long, 2-km wide mineralized target area. The drill program at URU-C and URU-CE was the first opportunity to test continuity of the structurally controlled copper silver mineralization within the volcanic host rocks in the sub-basinal environment of the Cesar sedimentary basin. Corporate Further to the Company’s news release dated September 13, 2022, shareholders confirmed and approved by an ordinary resolution, the Company’s 2022 Omnibus Equity Incentive Compensation Plan (the “Omnibus Plan”) at its October 11, 2022, Annual General and Special Meeting (the “Meeting”) and the TSX Venture Exchange (“TSXV”) has further approved the Omnibus Plan. Under the Omnibus Plan, the Company may grant stock options to the Company’s directors, officers, employees and consultants and performance share units to the Company’s directors and officers. The Omnibus Plan allows option holders to exercise options on a "Cashless Exercise" or "Net Exercise" basis, as now expressly permitted by the TSX Venture Exchange Policy 4.4. Security Based Compensation. A complete copy of the Omnibus Plan is available for viewing under the Company’s SEDAR corporate profile at www.sedar.com Also, at the Meeting and further to its news release dated September 22, 2022, shareholders ratified and approved by an ordinary resolution, the adoption of the Company’s Shareholder Rights Plan entered into with Computershare Trust Company of Canada, as Rights Agent, dated effective September 8, 2022 (the “Rights Plan”) and the TSXV has further approved the Rights Plan. A complete copy of the Rights Plan is available for viewing under the Company’s SEDAR corporate profile at www.sedar.com Qualified Person The Company’s disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P Geo (British Columbia), a member of the Max Resource Advisory Board, who serves as a qualified person under the definition of National Instrument 43:101. About Max Resource Corp. Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered district-scale CESAR copper-silver project. The wholly owned CESAR project sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world class infrastructure and the presence of global majors (Glencore and Chevron). In addition, Max controls the RT Gold project (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone, and 3-km to the NW, a gold bearing massive sulphide zone. Historic drilling in 2001, returned values ranging 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0-metres. Max is proactive, with the corporate goal of transitioning the Cesar basin towards the mining of copper, the key metal for the Colombia’s transition to clean energy. The safety of our people and the communities where we operate is most important. We conduct exploration in a manner which supports protection of ecosystems through responsible environmental stewardship. Source: NI 43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011 For more information visit: https://www.maxresource.com/ For additional information contact: Tim McNulty

E: info@maxresource.com

T: (604) 290-8100 Rahim Lakha

E. rahim@bluesailcapital.com |