Authored by Matthew Piepenburg via GoldSwitzerland.com,

Critical warning signs from the credit and rates markets are being ignored by tough-talking experts while gold bides its time before it rises in a global financial crisis mathematically too sick to save.

It is fascinating to watch market pundits, policy makers, commercial bankers and other media-supported experts talk tough on the need to fight inflation via rate hikes and central bank balance sheet cuts.

In fact, such chest-puffing would be comical if not otherwise so tragic.

The current war cries to battle persistent rather than transitory inflation (of which we warned a year ago) amount to far too little, far too late.

Like the “science” behind mask or no mask, last year’s omni-changing Fed narrative as to temporary or long-term inflation was a theater of incompetency bordering upon dishonesty, as inflation was as plain to foresee as the rising money supply.

Today, a similar tragi-comedy of open confusion and equally open hypocrisy about tough vs. accommodative (or hawkish vs. dovish) central banking is all the rage.

In our mind, however, all this “taper talk” is little more than public posturing rather effective policy—as it once again ignores math, history and commonsense.

The Gluttons Suddenly Demand a Diet?

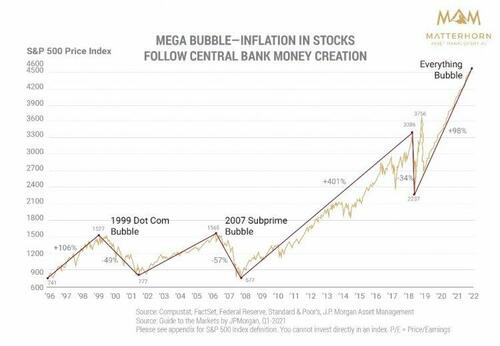

After years and years of dovish Fed support which has led to the most inflated asset bubbles in modern history (as well as the greatest wealth disparity since the French revolution), the very engineers and beneficiaries of this mega bubble are suddenly chiming in with calls for restraint and discipline?

That’s rich…

It seems they can no longer deny the year-over-year 7% inflation data, but what they still seem to be ignoring is the far more un-natural inflation in the S&P…

As I like to say: The Ironies abound.

The very players who gave us the fake liquidity and engineered low rates to create this monster bubble are suddenly screaming for the tapering and rate hikes which will kill it.

As to both the math-ignoring comedy as well as open hypocrisy which underlies such hawkish chest-puffing, I gave two headline examples from Goldman Sachs and Bridgewater in my last report.

Such post-battle courage is nothing new from the experts, and I’ve openly warned elsewhere that there is a genuine danger in trusting the group-think advice of the so-called “experts.”

Of course, the same critiques could be leveled against our own expertise (or bias?) when it comes to gold ownership in the backdrop of an openly distorted and crumbling financial system.

We get this. Fair enough.

But if one simply looks past the immense fog of de-contextualized tweets, incomplete data, endless macro debates and hawkish virtue signaling, the predictable (and dark) future of the global financial system in general, and gold’s bright horizon in particular, is a clear lighthouse rather than a precious metal bias.

The $300T Elephant in the Room

How can we be this certain in a world where nothing is certain?

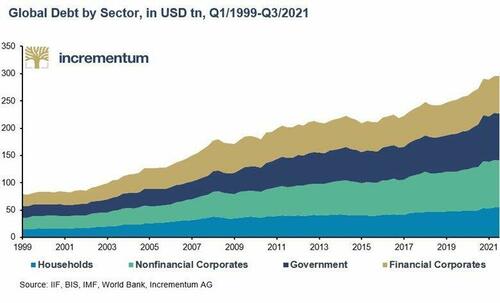

The answer boils down to the honest but hard math of record-breaking debt.

At $300T and counting, total global debt levels have long ago crossed the Rubicon of sustainability, and no amount of “stimulus” or promised GDP growth (currently stagnating at 1/3 global debt levels) will ever prevent the disastrous consequences to come.

As history and math confirm, the toxic relationship between desperate sovereigns and eager bankers promising that a fatal debt sickness can be cured with more debt has never, not ever, been proven true.

Instead, the hard yet blunt reality (as David Hume warned centuries ago) is that too much debt always destroys economies.

The fact, moreover, that today’s global and sovereign debt levels are the highest ever recorded in the history of capital markets is perhaps worth some honest examination, as history’s debt-to-disaster pattern is mathematical rather than political or academic.

This is true not only of places like Yugoslavia, Venezuela, Argentina, Weimar Germany, 18th century Paris or 3rd century Rome, but equally so of the once-powerful US of A and current home to the 21st century’s world reserve currency.

With combined household, corporate and public debt now flirting with the $90T marker and US true interest expenses now greater than 100% of incoming tax receipts, it’s frankly almost impossible to understand why and how this ticking debt timebomb is not otherwise a daily headline?

Looking for Flowers, Ignoring the Manure

Part of the answer lies in the ever-reliable and ever-desperate attempts by bankers, politicos and prompt-readers to see only what they want to see (and you to see).

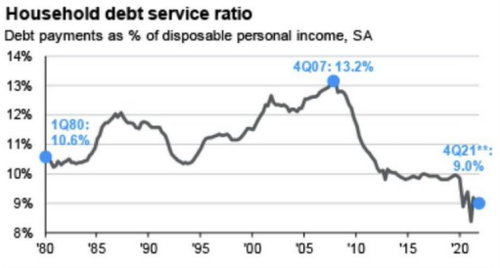

Thanks to massive deficit spending, care packages to Wall Street, handouts to banks and free checks to Main Street in 2020, it is no surprise, for example, that private sector balance sheets aren’t as ugly as pre-2020.

This is something the experts want you to see. Fair enough.

And as for US Households, their debt service ratios have in fact seen a corollary and understandably comforting decline:

But such lauded and frequently acclaimed progresses (or data flowers) in the US debt landscape completely ignores the far more toxic debt levels (i.e., manure piles) at the government level, as Uncle Sam’s $30T bar tab has gone from embarrassingly drunk to just plain difunctionally sick.

The Fog of Distorted Markets

But like the fog of war, the fog of market distortions can often make it hard for sincere investors to see the guiding lights (or golden lighthouse).

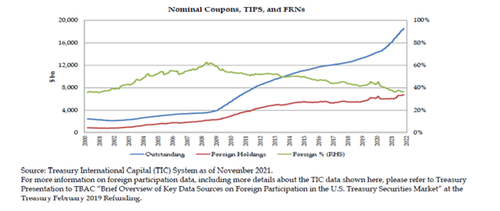

As for the guiding reality of an American policy that produces infinitely more debt-drunk IOU’s (i.e., Treasury bonds) than it does income streams, you may be wondering who is buying those IOU’s?

The graph below makes this unmistakably clear.

As the IOU’s keep coming (rising blue line), the purchasing of those IOUs from foreign parties (lagging red line) has tanked.

What this data confirms is simple: Since the 2008 crisis, the primary buyers of US debt are its central and commercial banks, and all with money created by a mouse-click.

How Markets Tank

Meanwhile, as those some banks and bankers now puff their chests calling for 2-7 rate hikes in 2022 or G4 central-bank balance sheet reductions of at least 2T in the same year, have any of them paused to ask this simple question:

If they taper QE bond support and thus rates and yields subsequently spike (as they do and will), what happens to that once-accommodated bond market and otherwise debt-soaked stock market?

Well, we’ll tell you plainly: They tank.

Shark Fins Emerging from the Bond Market Depths

If this seems theoretical rather than inevitable, just look at what has already been hiding in plain sight, namely tanking global bonds and hence rising global yields.

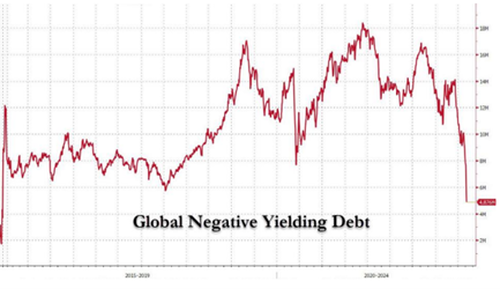

Prior to recent “tough talk” from on high, the global bond market enjoyed so many years of extreme central bank purchasing of otherwise crappy sovereign and corporate bonds that for the first time in history, bond yields (which move inversely to price) were negative (to the whopping tune of $19T) globally.

Yet in just the past few weeks, the mounting tough-talk from on high has so thoroughly frightened this hitherto “accommodated” bond market that bonds have been tanking in price, which means yields have been rising like Lazarus.

As a result, the levels of global negative yielding debt has been cut literally in half in the span of just a single week (!), as the following chart from Bloomberg confirms:

But as anyone who tracks historically-unprecedented levels of debt-soaked and debt-driven risk assets knows, rising bond yields are to debt-driven asset bubbles what approaching shark fins are to surfers: Bad news.

Given that the combined balance sheets of the G4 central banks exceeds $30T, one has to ask how they plan to pay for the rising cost of their own government debt as they get tough and “taper” their QE-hot money printers and send rates (and hence debt costs) higher?

We think those pumping their hawkish chests today will be hiding in a corner tomorrow.

Gold Making Telling Moves

With mounting distortions, ignored warnings and too-little-too-late tough-talk and long-overdue tightening policies comes equally obvious changes.

Traditionally and normally, for example, rising yields and rising interest rates were seen as good for the USD and less good for gold and just about any other asset class.

But what is equally clear after years and years of central bank intervention, accommodation, experimentation and distortion, is that nothing is normal nor traditional anymore.

One of gold’s many attributes is its historical honesty, and as far as we see it, as gold rises, it calls “BS” on the recent tough-talk from on high.

Markets, for example, expected gold to fall hundreds of dollars given the recent and unprecedented yield spikes.

Instead, the gold price rose.

This is because gold knows what Lagarde and Powell are afraid to confess, namely: Systems are falling apart.

Gold knows that tough-talk from on high is ignoring much higher debt levels, the catastrophic implications of which are rising (like bond yields and shark fins) ever more to the surface with each passing day.

Gold also knows that the tapering in vogue today will not last, and that the balance-sheet reductions promised now will be followed by balance sheet expansions (i.e., more money printing) later.

Take the Bank of Japan; they’ve effectively gone full-on QE to keep 10-Year yields down with now unlimited purchases of JGB’s.

Why?

Because they know what the Fed won’t tell you: Broke sovereign can’t afford rising yields.

Gold, in other words, sees the aforementioned disconnect between U.S. bond issuance and bond demand, which means more U.S. “money printing” and more Yield Curve Controls are inevitable, as the cornered Fed literally has no choice but to “turn Japanese.”

While gold rises long-term, in the interim gold can still fall and/or gyrate near-term.

But as currencies and financial systems, from discredited banks to grotesquely at-risk derivatives markets lose credibility in the bond market’s death spiral, gold’s role and value will be measured in grams and ounces not useless dollars and euros.

Much disorder brings extreme price moves. But the informed, patient and prepared buy their insurance before rather than after the fire.

Toward this end, we’ve also noticed some interesting and very big buyers of gold of late, and one wonders who they/it might be and what they/it know is coming?

Hint: We think it’s a sovereign buyer…

As currencies expand, and in turn debase, as bubbles rise, and in turn crash, as pundits squawk and in turn vanish, and as debt rises and in turn destroys, gold is always the patient real asset which, unlike any other, gets the last word over the increasingly discredited words we are hearing from on high today.

For those who know as much about history and math as they do about currencies and debt bubbles, the daily gold price is never a concern, as the long-term play is always clear and always the same: Gold is the ultimate insurance against currencies and systems already burning to the ground.