Look what Galen also said recently....

Up to the Deadline, NRG is free to negotiate and/or accept competing offers, and upon such acceptance, notify Alberdi it has five business days to meet or beat the competing offer. That's right....competing offers. Now if you think that's good...let's backtrack to the infamous article interview where Dave admits

Portofino has been in discussions with

multiple interests...

Yes...Portofino admits to having discussions with multiple interests... Now

compare what NRG can command ....

THEN compare what Portofino wants to do with the 2 locations on, Hombre....

Literally give them away...with 900+/ppm just drilled + proved by, Galen.

CAPTIONS FROM PORTOFINO INTERVIEW - ARTICLE Depending upon geophysical results, we will likely drill to an initial depth of 150m Are you in discussions with any potential strategic partners? Yes, we are having preliminary discussions, off and on, with multiple interested parties. We would like to bring in a partner on one or more of our projects. However, there is no certainty that any agreements will be reached. WHERE'S OUR INFAMOUS PROJECT 2 - TAFFEL...? Please tell us more about your second project, named Project II. Portofino can acquire 85% of Project II, which is 3,950 hectares in size, located approximately 10 km from the Chile border, and 65 km northeast of Neo Lithium Corp’s well known 3Q project. Historical exploration work included near-surface auger brine samples that averaged 274 mg/L lithium, with several in excess of 300 mg/L lithium. YIP....

PROJECT 2 HAS VANISHED....JUST LIKE RIO GRANDE. NO PRESS RELEASE EXLAINING PROJECT 2..

NO LONGER SEEN ON PORTOFINOS WEBSITE.

DAVE...YOU GOTTA GO...BUT BEFORE YOU DO....

WAVE THE WAND AND MAKE.....

PROJECT 2 REAPPEAR. Portofino speaks of drilling...all all thier excitement for each of thier projects...

Yet...why is Portofino slipping SALARS out the back door, or...in Hombre's situation,

Giving it away when...Galen recently proved west Hombre has big lithium ppm...900+/ppm.

FULL ARTICLE INTERVIEW - GOOD REFRESHER -

3 Shots at Lithium Glory

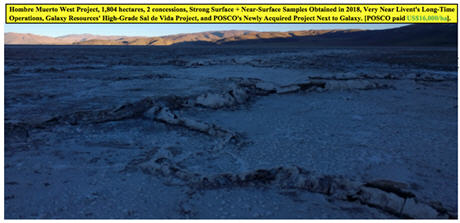

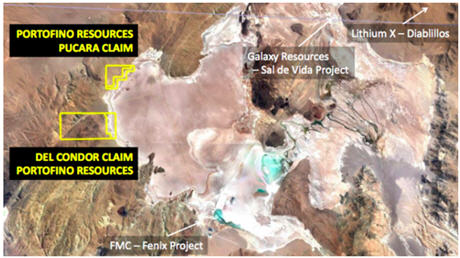

Green shoots? Anyone seeing the green shoots of a Springtime recovery in lithium stocks? No, me neither…. However, I do note one positive development, Lithium Americas is receiving US$160M for 12.5% of its JV brine project in Argentina. That implies a C$1.7 billion valuation for the entire project, of which Lithium Americas will own half. This is the best news since POSCO paid US$280M to Galaxy Resources for 17,500 hectares in Catamarca province, Argentina. They paid US$16,000/ha for a reported 2.54 million tonnes of high-grade resources. Speaking of Catamarca, that’s where CEO David Tafel’s company Portofino Resources (TSX-V: POR) controls 3 projects totaling > 8,600 hectares. One of the Projects is very near the projects of POSCO & Galaxy. Another is near Neo Lithium’s very high-grade 3Q project. I recognize I’m name dropping and playing the close-ology game, but Portofino has 3 shots at glory. Three legitimate chances of finding good, or even high-grade lithium deposits. Yet its market cap is just C$2M. This seems like attractive risk/reward to me. Please give readers the latest snapshot of Portofino Resources. Sure. Portofino Resources holds an interest in 3 lithium property groups in Argentina representing over 8,600 hectares. Our projects are located within the world-renowned “Lithium Triangle”, specifically focused in Catamarca Province, which was ranked by the Fraser Institute Annual Survey of Mining Companies, 2018, as the best mining province in Argentina. The Hombre Muerto West project is our most advanced and is within Argentina’s most prolific producing lithium brine Salar.  Portofino’s close neighbors in the Hombre del Muerto Salar include Majors– Livent Corp. (formerly FMC Lithium) and POSCO, and Australian-listed Galaxy Resources. All of our projects have been negotiated on the basis of 4-yr earn-in agreements with very low upfront costs. Between now and the end of next year, our total cash outlay is ~US$50K, for all 3 projects, and that’s not until 2020. I should add, we have no work commitments or royalties on any of our projects. Very few lithium stocks are doing well lately, or over the past year for that matter. What’s your view of the sector? Yes, it has been a very tough year for lithium stocks and lithium company shareholders, as the excitement for lithium projects has retreated and share trading has dried up. The market is no longer interested in companies with vast hectarage. It’s more about advancing projects with good addresses and good grades. Investors have become much more selective. However, a few companies with promising projects have begun to move up off their lows, and I believe this will continue. NOTE: {Bacanora Lithium, Lithium Americas & Neo Lithium are up an average of ~75% from their 52-week lows} Tell us more about the Hombre Muerto West project, how many drill holes are planned?

Portofino’s close neighbors in the Hombre del Muerto Salar include Majors– Livent Corp. (formerly FMC Lithium) and POSCO, and Australian-listed Galaxy Resources. All of our projects have been negotiated on the basis of 4-yr earn-in agreements with very low upfront costs. Between now and the end of next year, our total cash outlay is ~US$50K, for all 3 projects, and that’s not until 2020. I should add, we have no work commitments or royalties on any of our projects. Very few lithium stocks are doing well lately, or over the past year for that matter. What’s your view of the sector? Yes, it has been a very tough year for lithium stocks and lithium company shareholders, as the excitement for lithium projects has retreated and share trading has dried up. The market is no longer interested in companies with vast hectarage. It’s more about advancing projects with good addresses and good grades. Investors have become much more selective. However, a few companies with promising projects have begun to move up off their lows, and I believe this will continue. NOTE: {Bacanora Lithium, Lithium Americas & Neo Lithium are up an average of ~75% from their 52-week lows} Tell us more about the Hombre Muerto West project, how many drill holes are planned?  We have a team on site that should complete a geophysical survey by the end of April. This is a follow up on encouraging lithium results achieved during last year’s surface sampling. The present program will help define the extent of brine in the sub-surface, which will be used to define targets for initial drilling. We expect to generate at least 2 or 3 drill targets from the geophysics. Drilling should commence following interpretation of the survey results. What grades & intercept widths would your team consider to be a success? Depending upon geophysical results, we will likely drill to an initial depth of 150m and hope for grades exceeding 400-500 ml/L lithium over 75-100m. What excites you most about Hombre Muerto West? Our Hombre Muerto West project is located within the best known and top producing lithium brine Salar in Argentina. Galaxy Resources recently sold a portion of their holdings in the Salar to POSCO for US$280 million (US$16,000 per hectare!). In 2018, our geological team sampled 18 sites in a near-surface auger program. Six samples were over 700 mg/L lithium and the highest sample returned 1,031 mg/L lithium plus 9,511 mg/L potassium. The samples also contained low impurity levels, including low magnesium.

We have a team on site that should complete a geophysical survey by the end of April. This is a follow up on encouraging lithium results achieved during last year’s surface sampling. The present program will help define the extent of brine in the sub-surface, which will be used to define targets for initial drilling. We expect to generate at least 2 or 3 drill targets from the geophysics. Drilling should commence following interpretation of the survey results. What grades & intercept widths would your team consider to be a success? Depending upon geophysical results, we will likely drill to an initial depth of 150m and hope for grades exceeding 400-500 ml/L lithium over 75-100m. What excites you most about Hombre Muerto West? Our Hombre Muerto West project is located within the best known and top producing lithium brine Salar in Argentina. Galaxy Resources recently sold a portion of their holdings in the Salar to POSCO for US$280 million (US$16,000 per hectare!). In 2018, our geological team sampled 18 sites in a near-surface auger program. Six samples were over 700 mg/L lithium and the highest sample returned 1,031 mg/L lithium plus 9,511 mg/L potassium. The samples also contained low impurity levels, including low magnesium.  Please tell us more about your second project, named Project II. Portofino can acquire 85% of Project II, which is 3,950 hectares in size, located approximately 10 km from the Chile border, and 65 km northeast of Neo Lithium Corp’s well known 3Q project. Historical exploration work included near-surface auger brine samples that averaged 274 mg/L lithium, with several in excess of 300 mg/L lithium. What excites you most about Project II? Project II captures the whole salar, has relatively easy access, and has returned consistent surface / near-surface sampling results over a wide area. In addition, the Maricunga (BFS completed) lithium project is located just across the Chile border. Maricunga is billed as the highest grade, undeveloped lithium salar project in the Americas.

Please tell us more about your second project, named Project II. Portofino can acquire 85% of Project II, which is 3,950 hectares in size, located approximately 10 km from the Chile border, and 65 km northeast of Neo Lithium Corp’s well known 3Q project. Historical exploration work included near-surface auger brine samples that averaged 274 mg/L lithium, with several in excess of 300 mg/L lithium. What excites you most about Project II? Project II captures the whole salar, has relatively easy access, and has returned consistent surface / near-surface sampling results over a wide area. In addition, the Maricunga (BFS completed) lithium project is located just across the Chile border. Maricunga is billed as the highest grade, undeveloped lithium salar project in the Americas.  Are you in discussions with any potential strategic partners? Yes, we are having preliminary discussions, off and on, with multiple interested parties. We would like to bring in a partner on one or more of our projects. However, there is no certainty that any agreements will be reached. Please tell us more about your third project, Yergo. Portofino has the right to acquire a 100% Interest in the 2,932 hectare Yergo lithium brine project. The property covers the entire Aparejos salar. Yergo is located approximately 15 km southeast of Neo Lithium Corp’s 3Q project. We completed an initial field exploration & sampling program consisting of surface & near-surface brine sampling & geological mapping. A total of 25 locations across the property were sampled. Samples have been shipped to a certified lab in Argentina. Results will be announced as soon as received. You said that Yergo is ~15 km from Neo Lithium’s project. Neo just released a very favorable PFS. Does Yergo have anything in common with the 3Q? Neo Lithium’s deposit is very high-grade with very low impurities. Our geological team just completed an initial sampling & mapping exploration program. We believe there are common characteristics. Once we have had a chance to review the results, we will be in a better position to comment further on commonalities.

Are you in discussions with any potential strategic partners? Yes, we are having preliminary discussions, off and on, with multiple interested parties. We would like to bring in a partner on one or more of our projects. However, there is no certainty that any agreements will be reached. Please tell us more about your third project, Yergo. Portofino has the right to acquire a 100% Interest in the 2,932 hectare Yergo lithium brine project. The property covers the entire Aparejos salar. Yergo is located approximately 15 km southeast of Neo Lithium Corp’s 3Q project. We completed an initial field exploration & sampling program consisting of surface & near-surface brine sampling & geological mapping. A total of 25 locations across the property were sampled. Samples have been shipped to a certified lab in Argentina. Results will be announced as soon as received. You said that Yergo is ~15 km from Neo Lithium’s project. Neo just released a very favorable PFS. Does Yergo have anything in common with the 3Q? Neo Lithium’s deposit is very high-grade with very low impurities. Our geological team just completed an initial sampling & mapping exploration program. We believe there are common characteristics. Once we have had a chance to review the results, we will be in a better position to comment further on commonalities.  What excites you most about the Yergo project? As mentioned, Yergo is close to Neo Lithium’s PFS-stage 3Q project, yet as far as we are aware, it had remained completely unexplored. Our geologists were quite upbeat after their visit and we are anxious to see the lab results of our initial sampling program. Your 3 projects might be promising, but at 1,804 ha, 3,950 ha & 2,932 ha, are they large enough to host sizable resources? Our Hombre Muerto West property is relatively small, about 1,800 hectares, but could still host a sizable resource subject to ultimate grade/basin determination. However, it would make sense to consolidate our project with another in the same salar. Our other 2 projects are big enough, and in each case we control the entire salar. The advanced-stage, well regarded Maricunga project in Chile is approx. 4,000 hectares– so comparable from that perspective to both Yergo and Project II. Why should readers consider buying shares of Portofino Resources? Lithium stocks are out of favor, but select stocks have moved off their lows. We have just 24 M shares outstanding and a modest market value of ~C$2M. Our 3 projects are located in close proximity to advanced-stage & producing lithium companies. Near-surface sampling at Hombre Muerto West returned some very positive results. Depending on the weather, we hope to start drilling in coming months. We have 2 exploration programs underway, the other being Yergo, so readers can expect news on both projects. We believe there’s significant upside potential in the share price.

What excites you most about the Yergo project? As mentioned, Yergo is close to Neo Lithium’s PFS-stage 3Q project, yet as far as we are aware, it had remained completely unexplored. Our geologists were quite upbeat after their visit and we are anxious to see the lab results of our initial sampling program. Your 3 projects might be promising, but at 1,804 ha, 3,950 ha & 2,932 ha, are they large enough to host sizable resources? Our Hombre Muerto West property is relatively small, about 1,800 hectares, but could still host a sizable resource subject to ultimate grade/basin determination. However, it would make sense to consolidate our project with another in the same salar. Our other 2 projects are big enough, and in each case we control the entire salar. The advanced-stage, well regarded Maricunga project in Chile is approx. 4,000 hectares– so comparable from that perspective to both Yergo and Project II. Why should readers consider buying shares of Portofino Resources? Lithium stocks are out of favor, but select stocks have moved off their lows. We have just 24 M shares outstanding and a modest market value of ~C$2M. Our 3 projects are located in close proximity to advanced-stage & producing lithium companies. Near-surface sampling at Hombre Muerto West returned some very positive results. Depending on the weather, we hope to start drilling in coming months. We have 2 exploration programs underway, the other being Yergo, so readers can expect news on both projects. We believe there’s significant upside potential in the share price.