Just caught this piece in SeekingAlpha, it's a very comprehensive review of SLL, thought I would share it.

I'm long on SLL!

Summary

- Industry investments in lithium (paired with government incentives via rebates) may result in excessive demand for lithium-fueled automobiles.

- Standard Lithium is in joint venture talks with Lanxess (market cap $6 billion) to form a direct extraction lithium mine in Arkansas.

- This is potentially the most boring lithium play on the stock market and aligns with what Peter Lynch preached, to paraphrase: "Boring is good".

The Lithium Sizzle (or Lack thereof)

I'll tell you what's hot in lithium mining: Big, beautiful, sprawling lithium properties; Large brine ponds that stretch forever; Clay assets near the surface and lithium laced rocks. These are the things that investors can look at and say "This makes sense" and the prices rise due to excitement sizzle. What investors are not looking at is Standard Lithium (OTCQX:STLHF) with its direct extraction technology in Arkansas. Frankly, it is a boring play that is difficult for the masses to fully understand since the company is a technology play. Thus, Standard Lithium is unloved by the masses and the current price offers a discounted way to enter lithium. With the prospect of the company making hundreds of millions over time, I can yawn all the way to the bank. This is why I have them as part of my "Fearsome Lithium Five".

Boring is Unnoticed. Boring is Undervalued. Boring is Good.

To this day, I still tell people getting into investing to pick up copies of Peter Lynch's "One Up On Wall Street" and "Beating The Street". They are both excellent primers and cover principles that Mr. Lynch expounds on which make a lot of sense and have worked for me: 1. Invest in what you know. 2. Boring is good because boring stocks can be undervalued due to lack of sizzle. I think Gordon Gekko would agree and that brings us to the point of this article, the most boring lithium stock on the entire stock market. A real gem that is going to make us a lot of money and that is Standard Lithium.

Lithium Demand is Coming

I've written about lithium demand in detail and the industry is investing hundreds of billions in lithium. Consumer demand is growing and government incentives are just icing on the demand cake.

Industrial Investments in lithium

Updates since my last published article

Government investments in lithium

The current administration has pledged $174 billion for lithium investments via proposal. I recently covered this in my Lithium Americas (LAC) article, but new details have been released which are interesting. Per Reuters:

The Biden administration's $174 billion proposal to boost electric vehicles calls for $100 billion in new consumer rebates and $15 billion to build 500,000 new electric vehicle charging stations, according to a Transportation Department email sent to congressional staff and seen by Reuters.

The new EV rebates, part of a $2.3 trillion infrastructure and jobs proposal, would be a potential big boost to U.S. automakers, especially General Motors and Tesla Inc., which no longer qualify for $7,500 rebates after they sold more than 200,000 zero-emission models.

The plan also calls for $20 billion for electric school buses, $25 billion for zero emission transit vehicles and $14 billion in other tax incentives.

$100 million in consumer rebates for electric cars and $15 billion to build a charging infrastructure may result in additional investments by the automotive industry in lithium. Expect to see additional off take agreements (On par with Tesla signing Piedmont Lithium, joint ventures, and equity investment to secure supply. Cream of the crop projects will sign deals first with smart money. Dumb money that drags its feet will be forced to sign less favorable deals with marginal lithium producers or projects that offer inferior returns or higher risk.

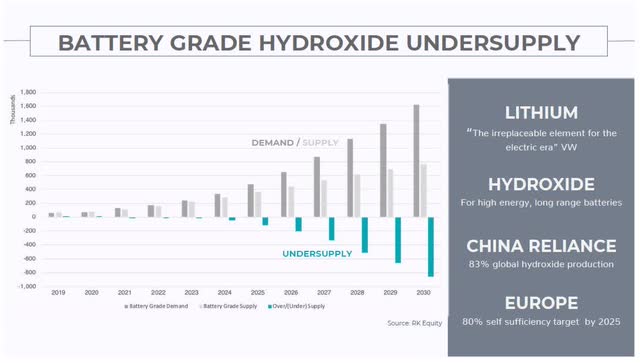

(Source: European Metals Holdings Limited via RK Equity)

(Source: European Metals Holdings Limited via RK Equity)

The Most Boring Lithium Play On The Stock Market

Standard Lithium without a doubt is the most boring lithium play you can find. Try to find a more boring lithium play. Let's compare:

Lithium Americas has two mines they are working on. China owns 51% of the South American play and the Nevada mine is in the approval stage.

Neo Lithium (OTCQX:NTTHF) has a mine with low impurity and monster battery producer CATL owns 8%.

Nano One (OTCPK:NNOMF) has two automotive deals. One with is Volkswagen and the other a mystery automotive company. Those are exciting wildcards for sure.

Cypress Development (OTCQB:CYDVF) is rumored to be in bed with Albemarle (ALB) and has a simply mind boggling lithium play deposit.

European Metals Holdings Limited (OTCPK:EMHLF) is located close to Tesla's (TSLA) soon to be completed battery plant in Germany. Low distance to deliver product is an obvious advantage. Clearly exciting. Yet, Standard Lithium can be summed up as "Put filter on pre-existing pipe, profit". That is it. Nothing exciting and it's perfect.

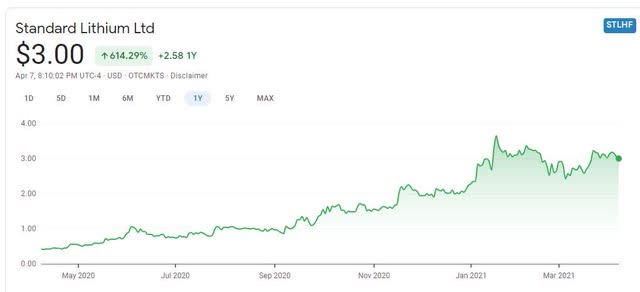

(Source: Google Finance)

(Source: Google Finance)

A Not So Standard Story

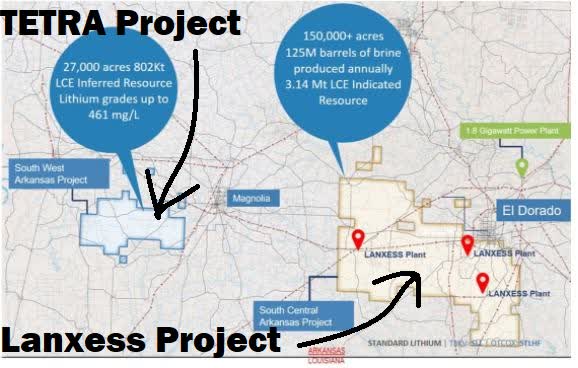

Standard Lithium has 3 lithium projects in the works. The most attention appears to be for the project where they have paired up with Lanxess (LXS.DE), an established company with a market cap of 5.57 billion. The plan is to tap into the massive brine operation that Lanxess runs in Arkansas. Per Standard Lithium:

"Lanxess operations in south Arkansas cover 150,000 acres that include 10,000 brine leases. Lanxess extracts brine from their wells located throughout the area, and the brine is transported through a network of 250 miles of pipelines to three plants where the brine is processed for bromine recovery with the tail brine then re-injected into the aquifer. The three bromine extraction plants currently employ approximately 500 people, have been in production for nearly five decades, and produce roughly 5.3 billion gallons of brine annually.

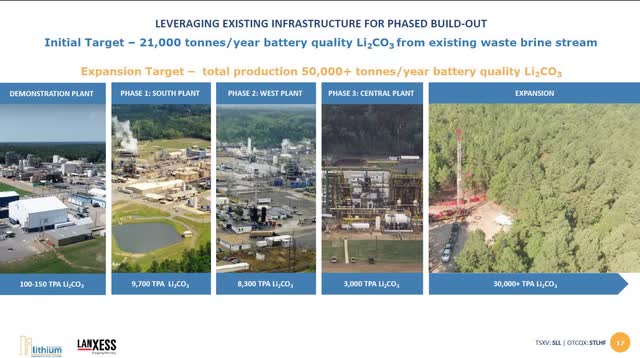

A Preliminary Economic Assessment prepared by Advisian (a consulting arm of Worley Parsons), released June 18, 2019, considers the production of battery-quality lithium carbonate through a phased build-out to a total 20,900 tons per annum (tpa) from the contemplated joint venture with Lanxess AG at their three operating bromine-processing plants."

Given that Standard Lithium does not have to drill wells and they will have a 30% share of the proposed joint venture (expandable to 40% if they hit certain milestones) this looks to be favorable. The nice part here is given the weather of Arkansas they will not suffer from water issues like lithium properties in the west or in South America. Also, working with an existing mining powerhouse means they do not have to jump through nearly all the permitting issues since they will be operating on pre-existing permitted land. Details on the Lanxess project are:

Annual production: 20,900 tons lithium carbonate (1)

- Plant operation: 25 years (2)

- Total capital expenditures estimate of US$437 Million (3)

- Non-optimized reagent cost per ton lithium carbonate of US$3,107

- All-in operating costs, including all direct and indirect costs, reagent, sustaining capital, insurance and mine-closure costs of US$4,319 per ton of lithium carbonate (4)

- Average selling price $13,550 USD per ton battery quality lithium carbonate (5)

- Pre-tax US$1.3 Billion NPV at 8% discount rate and IRR of 42%

- Post-tax US$ 989 Million NPV an 8% discount rate and IRR of 36%

- Resource upgraded to 3,140,000 tons Lithium Carbonate Equivalent (LCE) at the Indicated Category.

The 2nd lithium project is for a property very close to the proposed joint venture to the east called the TETRA project at 802,000 ton LCE Inferred resource and a future expansion target of 15k ton/year of LCE initially. Key word is "initially".

(Source: Standard Lithium)

(Source: Standard Lithium)

Looking at page 17 of the Standard Lithium investor presentation, we see the following expansion intent to 50,000+ tons. (Source: Standard Lithium Investor Presentation)

(Source: Standard Lithium Investor Presentation)

The 3rd lithium project is located at Bristol Lake in California. While 2017 and 2018 had press releases concerning the 3rd property, it appears to be put on the back burner for now.

Funding Standard, Political Support, & Insiders Buying

Any project will need funding, and political support is very helpful as it can remove red tape. Looking at the Standard Lithium, we see they are building up a small war chest and bringing on political advisors.

Standard has been busy raising capital in the last few years via:

1. Oct 2019 $5 million Canadian via a convertible loan and guarantee agreement with Lanxess.

2. December 2020 $34.5 million Canadian. A total of 15,697,500 common shares of the Company were sold.

3. Feb 2020 $12.1 million Canadian via "the Company has issued 16,140,220 Special Warrants at a price of $0.75 per Special Warrant."

4. Per the previous link the CEO and various power players of the company bought $800,000 of warrants. That is quite a statement of confidence.

Turning to political support, in the below video link, the governor of Arkansas supports Standard at the 35:00 min mark. Standard has also brought on an advisor that should open some political doors for them via LinkedIn and Standard.

Risk for Standard Lithium

Any investment contains risk. The risk with Standard is what happens if the potential partner in Arkansas backs out of the project? However, given the groundwork laid down by the Trump administration concerning lithium(and continued by the Biden administration), I see Standard lithium being at the forefront of Chinese lithium and additionally rare earth element independence.

Given the above industrial investments flowing into lithium (combined with government incentives), I view the risk for Standard as low compared to other junior miners. Frankly, it's one of the safest of the junior plays. Yet, unexpected things do happen in the markets. Hope for the best; do homework; trust but verify; keep your positions reasonable. Do not bet the farm on one investment.

Investor Takeaway

Standard is a very boring technology company that is going to make a lot of money given time. The market cap is at $383 million USD (as of 4/11/21 at $2.97 a share) and while this might sound high, I think they are a steal deal.

Once the projects in Arkansas are up and running, I see little to hinder Standard from expanding the California operation and going after other pre-existing projects that might benefit from their direct extraction technology. This will unlock value and I'll go out on a limb and say the share price should be $6 - 9 dollars (market cap $800 million to 1.2 billion) but this will take time measured in years to fully pan out.

We currently own shares in Standard and are expanding our position.