Have recently come across an interesting fact regarding companies that have reported their moly deposit in MoS2 (molybdenite) as opposed to molybdenum (Mo).

Stuhini has reported their molybdenum resource in molybdenum ( Mo )

Belwo are a couple of examples of companies reporting in molybdenite (MoS2)

In Greenland Resources March 2022 Feasibility Study has reported their Malmbjerge moly deposit in MoS2.

https://greenlandresources.ca/data/pdfs/Malmbjerg-FS-Report-1.pdf See Table 1.3 Sensitivity of the MRE to Cut-off Grade (Base Case Highlighted) on Page 1-9

The same reporting method of using molybdenite occurs in the CuMo Project’s May 2020 Preliminary Economic Analysis which is owned by American CuMo Mining.

https://cumoco.com/wp-content/uploads/2020/06/CuMo_PEA_NI43-101_June-2-2020.pdf There is a conversion factor in the American CuMo PEA that is referred to for obtaining the equivalent value of molybdenum (Mo) instead of molybdenite (MoS2)

See 10.6 Metal Equivalent Calculations on Page 62, and also refer to the notes under the tables on Page 61.

“ ….Note: The convention for the CuMo project has been to measure percent elemental molybdenum (%Mo) in assays and to calculate %MoS2 by multiplying %Mo by 1.6681 …. “

“….Note: that since the convention on the CuMo project has been to work with %MoS2 for resource estimation, in the foregoing equivalency formulae, %MoS2 is converted back to %Mo by dividing by 1.6681. %Mo is then converted to %MoO3 by multiplying by 1.5. Also, the %MoS2 Equiv values would be 1.6681 times greater than %Mo Equiv…..” So, seeing that Greenland Resources share price has also been rising significantly over the past few months, let’s use the Greenland Resources mineral resource estimate for their Malmbjerge Project for comparison to Ruby Creek applying the conversion factor:

Greenland Resources trading at $1.18 currently sports a market cap of C$122 million, Stuhini's market cap at $0.48 share price is about $18.5 million.

Greenland Resources uses a 0.08 MoS2 cut off grade which is equivalent to (0.08 / 1.6681 = 0.048% Mo)

Greenland Reasources average grade of 0.18% MoS2 / 1.6681 = 0.11% Mo average grade

Conversely:

Stuhini’s Ruby Creek cut off grade of 0.02% X 1.6681 is equivalent to 0.0333% MoS2 cut off

Stuhini’s Ruby Creek 0.053% average grade is equivalent to 0.053 X 1.6681 = 0.0884% MoS2

So a more apples to apples comparison after the conversion fatcor sees Malmbjerg with a 0.11% average Mo grade with a 0.048% Mo cut off grade, compared to Ruby Creeks reported 0.053% average Mo grade with a 0.02% cut off.

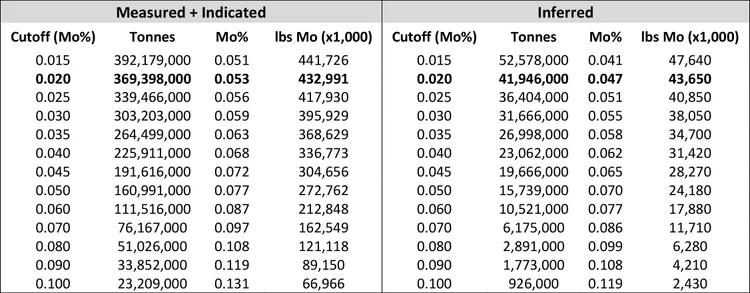

If we refer to Stuhini’s Mineral Resource Estimate chart and look at the cut off grades of 0.045% and 0.050%, the average Mo grade would be 0.072 to 0.077 and there would be somewhere on the upper side between 272,762 lbs to 304,656 lbs of moly in comparison to Greenland’s reported 661 million lbs using a 0.08 % MoS2 cut off grade.

Malmbjerg, after the conversion factor, is a little more than twice the size in resource than Ruby Creek, with roughly 55% more tonneage at this level compared to Ruby Creek.

Recall that some of the best drill results by the previous operator at Ruby Creek, Adanac Moly, reported some very high grade results from their final drilling that remain outside the pit constrained resource reported by Stuhini in the 2022 updated Mineral Resource Estimate . For example, Hole AD-417 reported 0.23% moly over the final 45 meters.

Chart of Ruby Creek Mineral Resource Estimate.

However, due to Malmbjerge's remoteness, I would suspect that the road accessible Ruby Creek moly deposit will be less expensive from both CAPEX and operations in comparison. Greenland Resource (MOLY) issued a Feasibility Study on their Malmbjerge pure moly deposit in Greenland back in early 2022. That study provided a US$820 million price tag for a processing plant and tailings infrastructure with an additional US$218 million sustaining capex cost for a total of US$1.038 Billion. In their Feasibility Study there are a few infrastructure expenses that shouldn't be required for any mill development at Stuhini's Ruby Creek project.

However, due to Malmbjerge's remoteness, I would suspect that the road accessible Ruby Creek moly deposit will be less expensive from both CAPEX and operations in comparison. Greenland Resource (MOLY) issued a Feasibility Study on their Malmbjerge pure moly deposit in Greenland back in early 2022. That study provided a US$820 million price tag for a processing plant and tailings infrastructure with an additional US$218 million sustaining capex cost for a total of US$1.038 Billion. In their Feasibility Study there are a few infrastructure expenses that shouldn't be required for any mill development at Stuhini's Ruby Creek project. No airport strip to construct for a mine support at Ruby Creek, ....there is already an airfield in Atlin B.C .... whereas Malmbjerge is 33 km from the nearest airstip and 185 km from the nearest town.

"The nearest sources of logistical support are in Iceland, and currently supplies must either be shipped or flown to Mestersvig and then airlifted by helicopter to the site." (Page 1-4) Malmbjerge will require a 26 km RopeCon Conveyor system to trransport ore from the mine site to the mill. Malmbjerge will also require a port site facillity to be constructed for transportation of supplies, container storage, etc.

The Ruby Creek moly desposit has easy road access from the town of Atlin 14 km away and Atlin is about 90 km south of the TransAlaskan Hiway which runs through southern Yukon. The hiway south to Atlin is paved. Whiethorse, Yukon is about a 1 hour 45 minute drive from Atlin B.C . The Ruby Creek deposit is also 275 km by road from the sea port of Skgaway, Alaska.

Based on the above data, Stuhini's market cap should be at least 1/2 of Greenland Resources currently at $122 million...... roughly $61 million ..... equating to a share price of $1.58 for Stuhini .

Just a little more informations ....

Another somewhat apples to apples comparison of a molybdenum resource is the Kitsault deposit also in northwestern B.C held by New Moly Corp, who will most likely be listing some time in 2023. The overall grade is measured in Mo but it also has a silver component. Kitsault is already reported in molybdenum grades, as opposed to molybdenite

https://www.paidpromotionalmessages.ca/companies/news/75444/avanti-minings-final-feasibility-study-for-kitsault-molybdenum-project-sees-46-npv-boost-10982.html “….. The report assumed an average annual production of 23.4 million pounds of molybdenum for a 16 year mine life at an operating cost of $4.76/lb, with the first five years averaging 29.6 million pounds per year.

The feasibility study also indicated a boost to the project's mineral resources, now estimated to contain Measured and Indicated resources totaling 298.8 million tonnes grading 0.072% molybdenum and 4.20 g/t Ag containing 472.5 million pounds of Mo and 40.3 million ounces of Ag, at a cut-off of 0.021%.

This represents a 9.7% increase of contained molybdenum and an 18% increase of contained silver over the company's prior estimate for measured plus indicated mineral resources, Avanti said.

In addition, the Inferred category now totals 157.1 million tonnes grading 0.050% Mo and 3.65 g/t Ag containing 172.2 million pounds of molybdenum and 18.4 million ounces of silver, an increase of 330% of contained molybdenum and 360% of contained silver from the pre-feasibility study results.

The Kitsault property, which is located about 140 km north of Prince Rupert, includes three known molybdenum deposits: Kitsault, Bell Moly, and Roundy Creek….. “ GLTA !