The FDA Breakthrough Therapy Designation (BTD) was an offshoot of the Food and Drug Administration Safety and Innovation Act (FDASIA) that was signed on July 9, 2012, that called for a new designation to be created. Since 2012, only 147 drugs have been approved having this designation, which averages out to 21 approvals a year over the past 7 years. BTD is an elite level of review and the biggest beneficiaries have been big pharma, highlighted in the charts below. The real issue for investors is figuring out the impact in terms of value, which this designation can bring to a development-stage biotech. The key metrics to follow are patient population of the indication, the potential revenue streams, time to approval, possible future indications, and if there is more than one BTD.

Defining Breakthrough Therapy Designation and Prevalence

Breakthrough Therapy is given to a drug with the following characteristics:

- Intended alone or in combination with one or more other drugs, to treat a serious or life-threatening disease or condition

- Preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints.

If a drug is granted BTD by the FDA, the agency will expedite the development and review of the drug. All requests for BTD will be reviewed within 60 days of receipt, and FDA will either grant or deny the request.

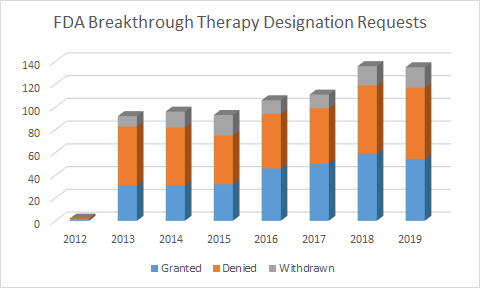

FDA Breakthrough Therapy Requests

This chart shows that historically only about 39% of applicants are granted BTD designation. Of that 39% that get the coveted designation, only 147 drugs to date have been granted under the program, out of 771 total applicants.

Approximately 1 in 5 applications for BTD will actually get BTD, and then get approved under it. What is paradoxical about this number is that these drugs have to be at least through a phase 2 trial that demonstrated efficacy. According to BioMed Tracker, the likelihood of approval (LOA) is 30.7% for all drugs going from a phase 2 to phase 3 program. Therefore, BTD does not increase the likelihood of approval. So, why go through the trouble?

Average Approval Times

A study was done in 2015 by PhamaExec, which compared the average development time for all drugs, compared to BTD drugs. The article sought to figure out if a BTD was worth it. The charts show that there was a clear benefit for BTD over standard status or other special programs like accelerated or orphan designations. The benefit averaged 2.5 years earlier approval for a New Molecular Entity (NME), and 3.5 years earlier approval for a drug under an orphan drug or accelerated product approval designations.

PharmaExec

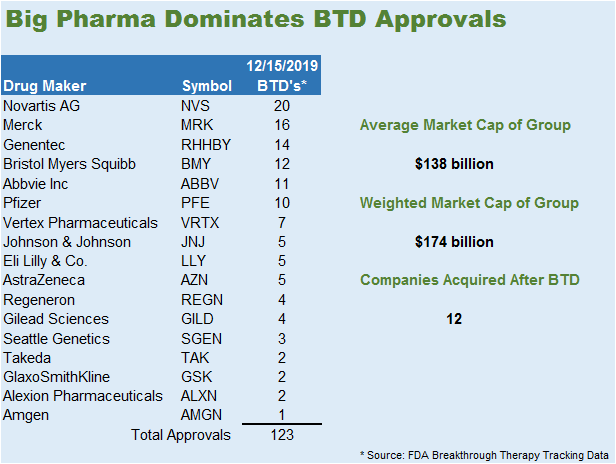

Big Pharma Dominating BTD Approvals

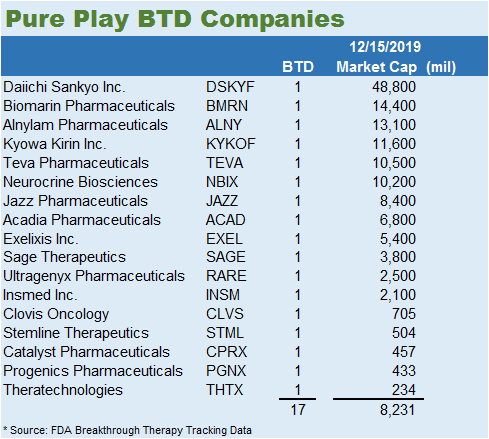

BTD seems to have an unintended consequence of assisting big pharma (see below). Since the program began in 2012, a total of 130 FDA approvals are split between 19 public companies and 5 private companies. The average market capitalization of these players is $138.2 billion, but the weighted average of $174.1 billion suggests that the larger players have a greater number of BTD approvals. The smaller subset of companies that only has one BTD approval totals 17. These companies represent a more pure play on BTD. The average valuation of these companies is $8.23 billion. Within this subset, the data is skewed by 4 players that got BTD on very obscure indications. This means that an $8.0 billion valuation for a BTD could be reasonable.

BTD Pure Plays

The reason the list of pure plays is so small is that a little less than half got swallowed up by big pharma, 12/29. All the companies with 2 or more BTDs were gobbled up by big pharma. This list essentially represents low hanging fruit for a Big Pharma acquisition. Any company with 2 or more BTDs would be in the hot zone for acquisition. Dissecting this list, the companies with the lowest market capitalization were targeting disease indications that represent small patient populations.

Market Size is Determinant in BTD Valuation

The worst performing company to ever receive a BTD is Theratechnologies (THTX). Trogarzo received FDA approval on March 6, 2018, to treat multi-drug resistant HIV patients. It is an antiretroviral intravenous drug that is taken every 14 days. Most of the participants in the study failed 10 or more antiretroviral drugs, which means this drug was developed for a very small niche of HIV patients. There are still severe side effects with the drug, like rash and immune reconstitution syndrome. Combined quarterly revenue for the company almost 2 years after launch is running close to $16 million per quarter. Their target patient population is approximately 10-12K patients annually which require new treatment. Progenics (PGNX) has a very weak pipeline. Their lead candidate is Azedra, which is a radiotherapeutic for unresectable locally advanced or metastatic pheochromocytoma and paraganglioma. This is a very rare disease that affects approximately 93 people per every 400 million population. The company is earning about $5.6 million per quarter based on the last quarterly report. Catalyst Pharmaceuticals (CPRX) is also in a similar situation with their lead drug candidate Firdapse. They received regulatory approval on November 29, 2018, for the treatment of Lambert-Eaton Myasthenic Syndrome (LEMS). This drug is targeting a patient population of 7,000-8,800 patients in the United States. Rounding out the bottom 4 is Stemline Therapeutics (STML) with their treatment of blastic plasmacytoid dendritic cell neoplasm (BPDCN). The company has quarterly revenue of $13 million and has a strong balance sheet with close to $200 million in assets. There are only 1000-1400 casesannually in the United States and Europe.

Acadia Pharmaceuticals (ACAD) is more representative of the mean. In many Parkinson's patients, the drug regimens they take eventually cause hallucinations called Parkinson's Disease Psychosis. Their lead drug candidate Nuplazid has the potential to be a blockbuster with 50% year over year results and year-end guidance close to $330 million. The potential patient population with Dementia-Related Psychosis (DRP) is 2.4 million and only half are being treated. ACAD got a BTD for Parkinson's Disease but also got a BTD just recently for DRP which could make them a ripe target for big pharma. In September 2019, they halted their trial for strong efficacy which is a positive indicator that they are likely to get that coveted second BTD approval.

Blockbuster Threshold

The key to understanding the effect that a BTD will have on a stock is related to its potential patient population. Valuation is very much tied to the patient population along with the expected revenues. Blockbuster status is defined as drugs that generate over $1.0 billion in annual sales. In general, this threshold, according to the analysis, seems to lead to a value for BTD drugs of $10.0 billion, like Neurocrine Biosciences Inc. (NBIX). In 2018, they had revenues of $451 million. Credit Suisse is projecting $786 million in 2019 and $1.18 billion in 2020. There are exceptions to this rule because Alnylam Pharmaceuticals (ALNY) has a much richer valuation than its revenue supports, but it has a deep pipeline and has been awarded 3 BTDs.