Investors must have 'Reasons' to invest, in particular Jr Exploration where there are 1000s of choices, many who don't know what they are doing, are 'paper' companies and don't do anything, are 'pump & dump' - every few years cycle, lifestyle job for CEO, etc, troubled jurisdiction, to many shares outstanding, unfocused, poor strategy, or inept!

As readers study these facts, are there any comments that resonate with StockHouse readers? Comments welcomed for this un-promoted company that has the: People, Project, Price, and Potential. Top 10 Reasons to have TRO in Portfolio: #6 #6: VERY, VERY, VERY LOW G&A!

Top 10 Reasons to have TRO in Portfolio: #9 #9: Thor project (Blue Bell, True Fissure, St. Elmo, Broadview and Great Northern) saw extensive Underground exploration, but only minimal mining.

OUR EXPLORATION APPROACH AT THOR

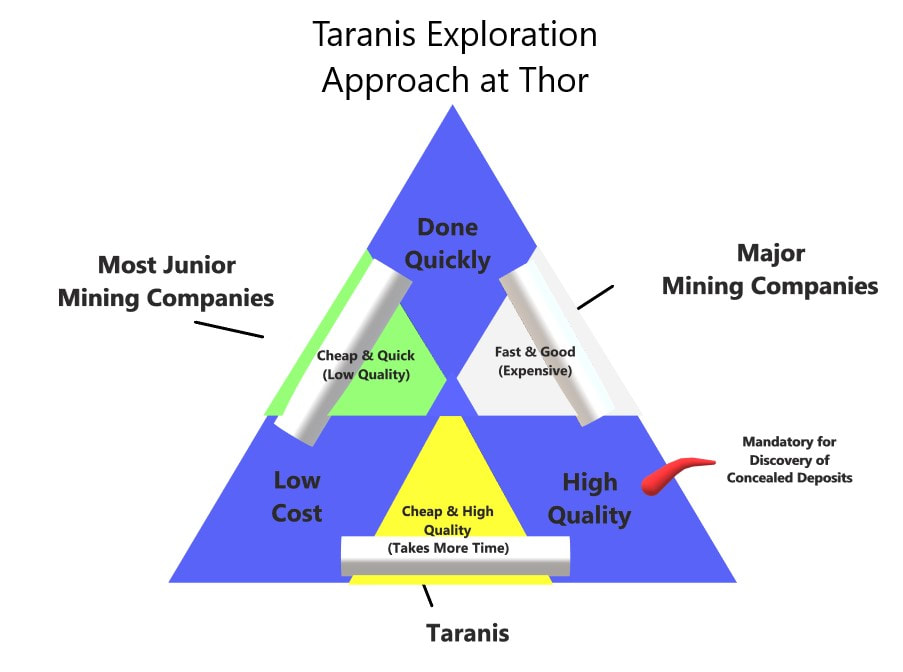

Graphic Description showing Taranis Exploration at Thor | In any exploration program, there are restraints that an exploration company needs to be aware. Serious mineral exploration companies in British Columbia and elsewhere know that certain metallogenic terrains are capable of concealing sizeable, undiscovered mineral deposits. This means that they will often be exploring in old mining districts that provide surface indications that may be connected to larger hidden deposits. With any ‘brownfield’ type exploration, the search for concealed deposits brings with it an exponential increase in the amount of work and capital required to identify these types of targets. The fact is, it costs money, time and sweat equity to find these targets, and most of the entrenched junior mining company approaches do not work. For these reasons, Taranis constructed a different approach to exploration at Thor – one that enabled a small company to explore for large deposits – and do it in the context of maintaining shareholder value. |

Small companies like Taranis do not have the luxury of randomly drilling expensive deep holes to test for the presence of concealed porphyry-type systems, and the targeting needs to be surgical. It is difficult for junior mining companies to undertake such work because the scope and quality of work that is required is typically found only within larger mining companies.

Exploration companies choose from three available approaches: “Done Quickly” “Low-Cost” and “High Quality” – Only two of these approaches can be applied to any exploration project in general, and all mineral exploration fits somewhere into the “triple-constraint triangle”. As a small-cap junior exploration company, Taranis has a “Low-Cost” constraint chosen for us – allowing Taranis to choose between “Done Quickly” or “High Quality” as the remaining approach. The fact is that difficult to find concealed targets will not be found with “Done Quickly” – and the delineation of these types of targets by necessity is “High Quality”.

At Thor, Taranis has spent in excess of $8M defining a portion of an epithermal deposit, but always remained conscious that there is likely something much larger under the near-surface epithermal deposit. Using this “High Quality” approach, Taranis was able to discover the Thunder Zone concealed under a rockslide at the north end of the Thor epithermal deposit, and we believe the next step in this exploration approach is the discovery of an underlying porphyry deposit at Thor.