RE:ZNX - Ahead of the HerdAHEAD OF THE HERD

2021.02.05

As the global economic recovery progresses over the next few years, demand for base metals is expected to rise thanks to the relentless spending on construction and infrastructure in emerging economies led by China.

Zinc, which is primarily used as a coating on iron and steel to protect against corrosion in buildings, bridges, railways and automobiles, will be among the raw materials facing an imminent shortage of supply. While it is the third most used non-ferrous metal in the world after aluminum and copper, zinc’s value goes beyond our traditional urbanization process.

The metal is also a crucial component in batteries; in fact, the world’s first-ever battery (made in 1799 by Alessandro Volta) used zinc as an anode. Nowadays, zinc-powered batteries enable everything from hearing aids to military applications.

Future of Energy Storage

In the future, zinc is also expected to play a crucial role in the energy storage market for electrical grids, which is increasingly seen as key to unleashing solar and wind power upon the world.

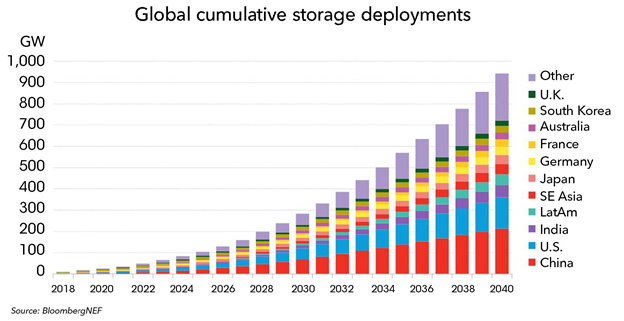

According to Bloomberg, the tumbling cost of batteries is set to drive a boom in the installation of energy storage systems for power grids over the next two decades. By 2040, the global energy storage market is forecast to grow to a cumulative 942GW/2,857GWh, attracting more than $600 billion in investment along the way.

Global cumulative energy storage deployment from 2018 to 2040

Global cumulative energy storage deployment from 2018 to 2040 Despite this rapid growth, stationary storage will make up only 7% of the total installed power capacity globally in 2040. As a result, energy storage for utilities represents an untapped market for battery makers.

While this will undoubtedly impact the supply-demand balance of battery metals such as lithium, zinc is also set to gain from the growing need for big battery systems.

Recent research shows that battery systems built around zinc don’t catch fire like the lithium-ion systems commonly used in electronics and electric vehicles. Not only are they safer, zinc batteries are also much cheaper to build and can last longer.

Many places have already started looking beyond lithium-ion batteries. Last year, California officials invested as much as US$16.8 billion into new energy storage technologies, most of which employ zinc.

In a webinar hosted by the Clean Energy States Alliance in September 2020, Mike Gravely, research program manager at the California Energy Commission, stated:

“If you look past lithium-ion, probably zinc is the next metal that’s the most popular for energy storage, and it does appear to be able to provide performance equal to or better than lithium if given a chance.”

Supply Deficit

While zinc has a big part to play in the energy storage technologies of tomorrow, the metal is set to experience a chronic shortage of supply.

For the first ten months of 2020, the global refined zinc market registered a supply deficit of 480,000 tonnes, according to the International Lead and Zinc Study Group (ILZSG).

This is due to a combination of rising demand and the coincidental closure of major zinc mines over the past few years, which is expected to remove 15% of the current global zinc concentrate supply.

Zinc fundamentals remain supportive, with global exchange stocks at near decade lows and the forward price curve now in backwardation through mid-2019, suggesting that the market expects supply to remain tight.

Analysts at Haywood Securities recently raised its price forecast for zinc from US$1.10/lb to US$1.25/lb this year, citing optimism over economic recovery and positive sentiment about base metals.

Thus, the need for additional zinc metal under a robust price environment creates the perfect scenario for those developing the world’s next zinc mines.

ZincX Resources

One company that has set its sights on the undersupplied global zinc market is Vancouver’s ZincX Resources Corp. (TSXV: ZNX, US: ZNCXF), which has secured a dominant land position in the prolific Kechika Trough district of northeastern British Columbia, an area known to host several Zn-Pb-Ag deposits.

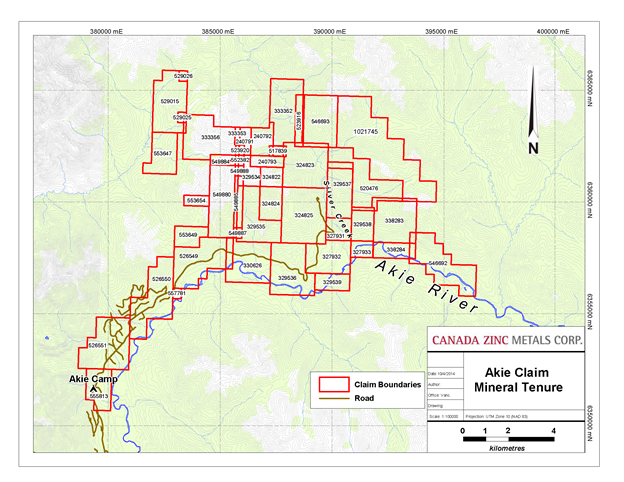

ZincX’s current focus is on the advanced stage Akie project, consisting of 46 mineral claims covering a total area of approximately 116 km2 within the Kechika Trough. The property is named after the Akie River which runs along the southeastern boundary (see map below).

Akie property overview map

Akie property overview map The property is underlain by the prospective black siliceous shales of the Gunsteel Formation and is host to the Cardiac Creek deposit, a large sediment-hosted stratabound SEDEX type Zn-Pb-Ag deposit.

The deposit was first discovered in 1994 by Inmet Mining Corp. Initial drilling programs outlined a historical mineral resource of 12Mt grading 8.6% Zn, 1.5% Pb and 17.1g/t Ag. Infrastructure in the region has improved substantially since then, expediting further surface work and potentially underground work.

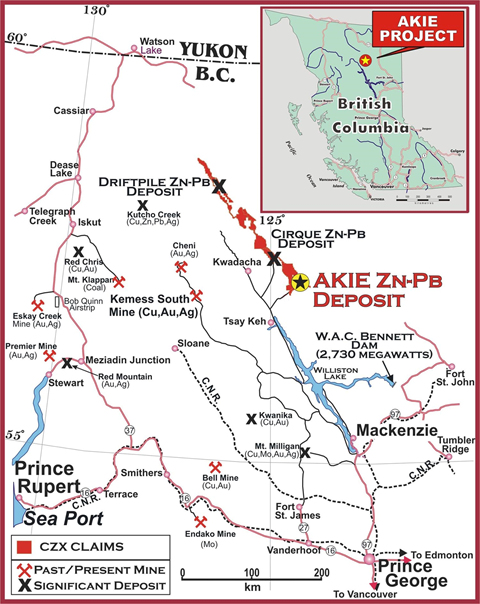

Akie project regional map

Akie project regional map Recognizing that this could be one of Canada’s largest untapped Zn-Pb-Ag deposits, ZincX (then known as Canada Zinc Metals Corp.) entered an option on the Akie property in late 2005, subsequently leading to its takeover of the project owner Ecstall Mining Corp. in 2007.

Subsequent drilling by the company to this day has resulted in tremendous growth for Cardiac Creek, which now contains an estimated 22.7Mt of indicated resources averaging 8.32% zinc (4.16 billion lb), 1.61% lead (804 million lb) and 14.1 g/t silver (10.3 million oz), as well as 7.5Mt of inferred resource averaging 7.04% zinc (1.17 billion lb), 1.24% lead (205 million lb) and 12 g/t silver (2.9 million oz).

A preliminary economic assessment (2018) for Cardiac Creek envisions a 4,000-tonne underground mine providing ore for a 3,000-tonne-per-day mill that is expected to produce 3.27 billion lb of zinc and 362 million lb of lead over an initial 18-year mine life.

Exploration Program

Earlier this week, ZincX announced that planning is now underway to launch a summer drill program on the Akie property, consisting of three holes totalling approximately 2,000 metres of drilling.

The primary objective of the drill program is to acquire mineralized drill core sample material for advanced metallurgical testing. The holes will target specific areas of Cardiac Creek to provide material representative of the deposit across its strike and width.

Using the new drill core sample, ZincX will then investigate the metallurgical response of the mineralization, with a focus on enhancing the recoveries and boosting concentrate grades for both zinc and lead. This will be done through the state-of-the-art metallurgical testing facility owned by China’s Tongling Non-Ferrous Metals, a Chinese state-owned enterprise and the company’s largest shareholder.

The drill program, as currently planned, is expected to have a 4 to 6 week timeframe from start to finish, with a scheduled start somewhere between late May and mid-June. Drilling was originally set to begin last year as part of the company’s 2020 exploration program, but it was later postponed due to the risk of Covid-19.

Tongling will conduct the metallurgical test program at the conclusion of the 2021 exploration season. This test is intended to enhance metallurgical work conducted and reported in the 2018 PEA.

Tongling Investment

As ZincX’s largest shareholder, Tongling had previously agreed to fully fund the drilling and subsequent metallurgical test program.

Funds have already been advanced to the company, in exchange for shares at what would be a 400% premium to ZincX’s stock price when negotiations between the parties first began. This would see Tongling increase its investment in the company by nearly $1.4 million.

One of China’s largest smelting companies, Tongling’s metal products are currently exported to over 10 countries including Japan, Germany, United States, and Singapore. The corporation also invests in resource exploration and development both domestically and abroad. Its most notable mining operation outside of China is the Mirador copper project in Ecuador, where a Tonglingled Chinese consortium put the $1.4 billion mine into production in 2019.

Tongling, which in the past took over TSX listed Corriente Resources for about $680 million, is hopeful that ZincX’s Akie project will now become the next “big name” in its portfolio. When announcing the Tongling designed drill program last year, ZincX Resources CEO Peeyush Varshney stated:

“Tongling is thoroughly familiar with the progress to date on the Akie property, including the 2017 metallurgical test program and the robust and positive results from the 2018 PEA. Tongling last toured the Akie property in 2018, and to this day recognizes the inherent value of the company’s significant prospective land package and the potential long-term district development opportunity.”

It is expected that Tongling will send a technical delegation to visit the project site and provide expertise and guidance with respect to the upcoming program.

Kechika Regional Project

In addition to the Akie property, ZincX is looking to make more discoveries throughout the Kechika Trough region, having assembled as many as 11 other property blocks comprising 184 mineral claims covering an approximate area of 682 km2 (together known as the “Kechika Regional project”).

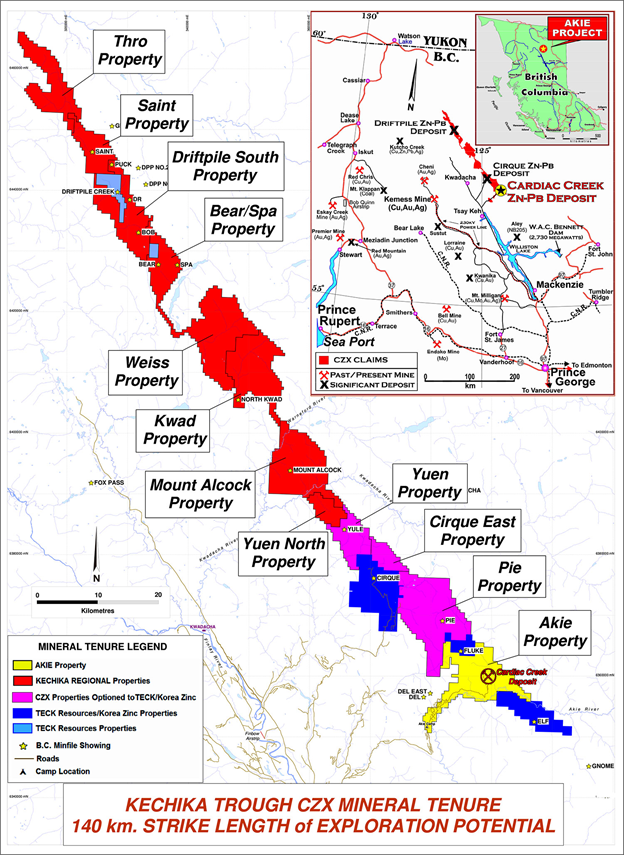

Tenure map of the Kechika Trough

Tenure map of the Kechika Trough The property blocks (from south to north on the tenure map above), include: Pie, Cirque East, Yuen, Yuen North, Mt. Alcock, Kwad, Weiss, Bear/Spa, Driftpile South, Saint, and Thro. The company owns 100% of eight of the property blocks and maintains a significant interest in the Pie, Cirque East and Yuen properties with partners Teck Resources Ltd. and Korea Zinc Co. Ltd., both of which are prominent figures in the zinc industry.

Exploration of the various property blocks has been intermittent. The discovery of the Driftpile deposit in 1972 prompted a flurry of exploration activity within the project area, with the majority of work occurring in the late 1970s and early 1980s focusing primarily on the northern properties as well as the Pie property in the south. Subsequent work up to the mid 1990s by Triumph Resources Ltd. and Ecstall Mining Corp. mainly focused on the southern properties such as Pie and Mt. Alcock.

Historical drilling on the Kechika Regional project so far has defined two major occurrences of Zn-Pb-Ag mineralization at the Bear/Spa (Pb grades up to 5.73%, Zn grades up to 10.7%) and Mt. Alcock (9.30% Zn+Pb over 8.8 m) properties.

ZincX believes both prospects represent an “exciting opportunity to make a significant and new discovery” within the Kechika Trough.

Conclusion

Given our current rate of consumption, it is projected that global zinc reserves — estimated at 250 million tonnes (as of February 2020) — would only last for another 17 years. This is not counting all the existing zinc operations that have closed down since then.

The global zinc market has reached a critical stage where more mines are simply needed. But even if all the development projects come on-line at full capacity, industry experts think that wouldn’t be enough to outpace demand.

As such, miners like ZincX are facing a tremendous growth opportunity. Its Akie project is one of the premier global zinc projects in a top-tier jurisdiction (Canada was at one point the world’s largest zinc producer). Through the Cardiac Creek discovery, the company has demonstrated a high-grade, large-tonnage, minable-scale deposit that has expansion potential and enormous district exploration prospectivity.

ZincX, at least to us at AOTH, seems to be trading at a deep discount to most its peers. ZNX’s Akie Project is a high-quality project with the size, grade, jurisdiction and further exploration upside that I look for. And it’s one deposit not several smaller deposits.

As ZincX mentioned in its media release, an increased level of participation in the Akie project by one of the world’s premier base metals companies, under the current global market conditions, also serves as a great advantage for the company.

ZincX Resources Corp.

TSX.V:ZNC US:ZNCXF

Cdn$0.17, 20.2001.04

Shares Outstanding 107.3m

Market cap Cdn$29.8m

ZNX website

Richard (Rick) Mills

aheadoftheherd.com