'Tis a new year and like every other human on the planet I am certainly glad to have turned the page on 2020. The new year always refocuses us and is a great time to look forward to something refreshing.

The cannabis industry has made significant moves in 2020 and mostly it was for the better. That was then, this is now. What can we expect in the next 12 months?

I wanted to share my thoughts on the cannabis industry and where I believe cannabis may end up for the year. I am analytical and very data-driven and from this data, I hope to be able to parse out the potential for the industry for 2021.

When I do my analysis for any particular stock, I first take an organic look at the industry. I do not look at any one company and say that since their products are the best offered or the management is absolutely top tier that they will necessarily perform well. Instead, I start from the industry and frame what is going on in the industry. Then, I figure out how any one particular participant is doing in that arena.

For cannabis, it is an industry that is seeing sales numbers continually climb. It is still a nascent industry and we are a long way away from calling companies "mature". Canada is fully legal, Mexico is on its way, but the United States will likely drag its feet as long as possible. Also, cannabis is an industry that still seems a bit saturated; we are just beginning to see consolidation and this is a trend I expect will continue heavily.

When Canada legalized cannabis, many participants rushed into the industry with high expectations. But, the rollout was slower than originally imagined. And, profits showing up were equally slow. As with any industry, there were a few fringe players that may or may not have done unethical activities. The combination of the headlines and the lack of profits soured investors on the industry. Throughout 2019 and the beginning of 2020, cannabis stocks sold off en masse.

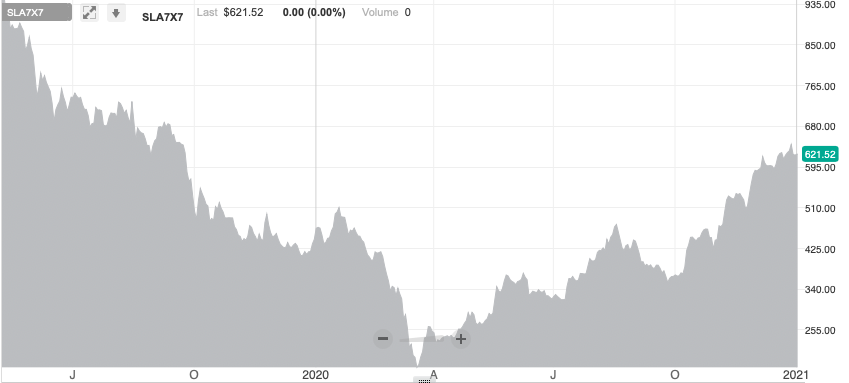

Here is a visual from the OTC MJ index:

(Chart Source: OTC Markets)

As you can see, there was sustained selling in the markets throughout the end of 2019 and into 2020. But, things are changing: companies are printing more and more positive earnings reports. This is driving up stock prices and we see the overall result in this index.

Canada

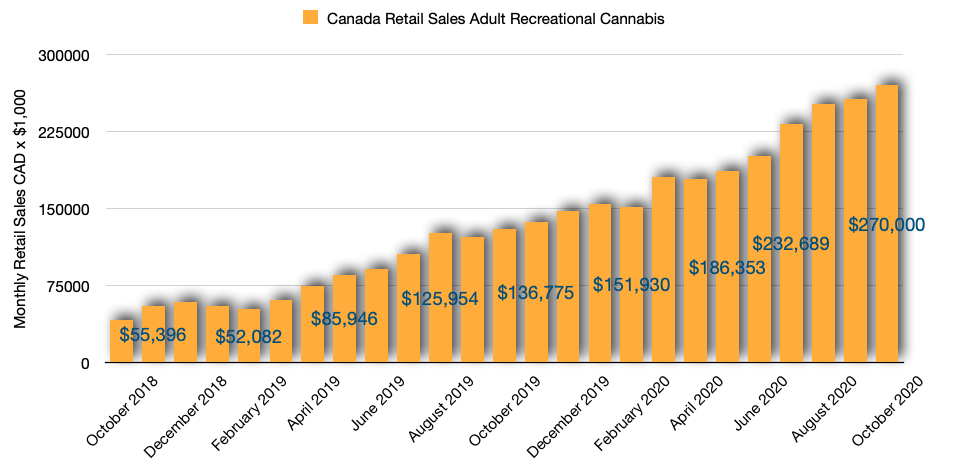

Every month prints new data on Canadian cannabis retail sales and the numbers continue to print higher and higher, as you can see here:

(Data Source: StatCan - Author's Chart)

This is total retail sales of cannabis in Canada; medical and recreational. Nearly every month, the numbers keep pushing higher and higher. The breakdown of the industry is impressive. In January 2020, Canadian retail sales of cannabis were $157M. The last month of the data was at $270M, but that was October's numbers (We are still awaiting November and December). This means that the 10-month rise saw a 75% increase in the total retail sales (The rolling 12-month was 110%).

One of the key factors for the Canadian retail cannabis industry is that more and more dispensaries are opening up. This is increasing access for consumers and the net result of that is an increase in retail sales.

To put that into perspective, there were 452 dispensaries at the end of December 2019. One year later there are more than double that number with over 1,000 dispensaries. There is a waiting list that would double that number once these stores opened up (Ontario alone has a waitlist of 500 dispensaries). Cannabis in Canada is set to continue to grow extensively in the future as more access is established with more retail stores.

Given the data points that we have on Canada and cannabis, if there is a linear relationship between the number of retail stores and total sales, if the waiting list were to be worked through by the provincial governments and these new dispensaries were opened, then it is also reasonable to conclude that the makings of doubling in retail sales for cannabis in the next 12 months is very possible once again.

My expectations for 2021 in Canada: Double. I'm looking for $500M to print in one month at the end of 2021 in Canada.

One important thing to keep in mind is that the above chart above is the combined retail sales of all companies in the cannabis industry.

Since cannabis retail sales are moving higher and higher, if I am looking at a Canadian cannabis company, they had better be participating in the overall upward movement in the cannabis industry. If they are not, that to me is a huge red flag, assuming they are not still in the development stages.

And yet, I do find companies that are not printing upwardly moving revenues. More importantly, I find individuals that defend these companies for whatever reasons after I've flagged them in one of my articles. We don't all see the same reasons to invest in a company and I get that. But, as far as I am concerned if a company is not producing big numbers every quarter, I will pass on this "opportunity".

For me, the industry is expanding rapidly and I want a team that is doing the exact same with equally increasing revenues. Why settle for less? You have to keep saying this over and over again: The chart above is ALL retail sales of cannabis in Canada. If you are looking at a company that is not part of that rapid increase then it must be their competition that is doing it. Which do you choose?

The United States

The story is a bit different in the US, and a bit strange if you think about it. In the United States, cannabis is still illegal on a federal level and this is hampering the industry significantly. And, yet, some states seemed to have openly ignored that illegality aspect.

I see a move by the federal government as being inevitable; it is a matter of when not if. When? That all depends. But, eventually, I believe that the country will be fully legal on a federal level. That will usher in a major shift in the industry. First, banks will be allowed to do business with cannabis companies. But, I do want to point out this does not seem to have hampered the industry too much. Cash still works just fine, it seems. So, I do not see the banks being allowed to get involved in the cannabis industry as a huge positive for the industry.

You can argue all you want that access to capital is king. True. But, where are you right now? I have homes in San Francisco, CA, and Colorado. Cannabis is everywhere in Colorado. And, I mean everywhere. No one can offer me any argument that access to even more capital will mean even more revenue. Just look below at Colorado's retail sales. They are getting the job done just fine.

But, I do see the potential that if the federal government were to legalize cannabis then the United States Postal Service being able to accept deliveries of cannabis as a boon to the industry. You can mail-order cannabis in Canada. And, during the pandemic companies have seen large increases in mail-order deliveries. I would think that being able to have delivery of cannabis products via the mail will be a significant addition to allow for deeper penetration into the market.

But, for now, I wanted to point out a few of the states individually.

California

California was the first state to legalize medical cannabis back in the 90s. The federal government didn't do anything about the fact that it was illegal on the federal level and so the industry began. But, it wasn't until 2018 that the people voted to legalize cannabis on a recreational level. Since then, the charts are all uphill.

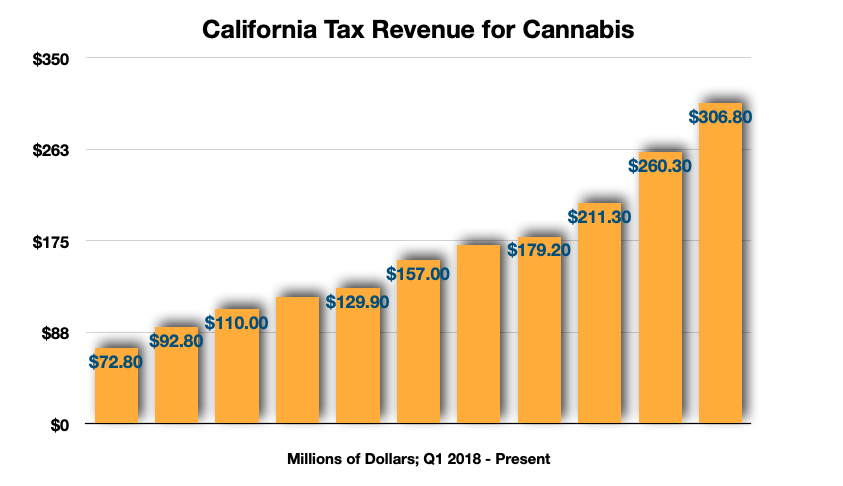

Here is the tax revenue from cannabis sales in California on a quarterly basis:

(Source: State of California Dept. of Revenue - Author's Chart)

I was not able to find continuous data for the State of California for actual retail sales (I just love it when bureaucrats make things absolutely impossible).

Nonetheless, tax revenues on a quarterly basis are a solid gauge of what is coming. The last quarter shown here is Q3 2020 at $306M. The year before it was $170M. That is an 80% YoY increase.

As more and more infrastructure is built, I expect there to be continued increases in cannabis sales, and by extension tax revenues.

I am expecting California to print at least a 50% increase in this chart, probably printing a $500M tax take for one quarter alone. The projections for 2020 I am seeing for California for a year's worth of overall sales is somewhere in the neighborhood of $3B.

Given that, if there is a doubling move higher of revenues to $500M for one quarter alone, that pushes total retail sales to $5B in the Golden State. And, the projections are for $6B in 2021, a 20% increase. But, as I said, I think it will be higher and will likely top $7B for the year in total retail sales next year.

Colorado

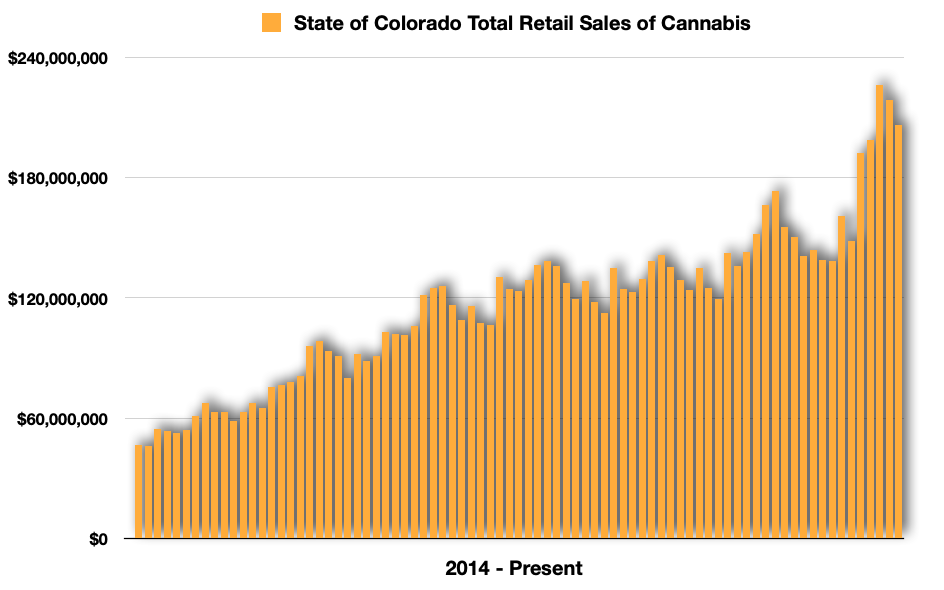

In 2014, the State of Colorado legalized cannabis via a voter initiative. The state had legalized medical cannabis earlier so there was some infrastructure. But, when the state legalized on a recreational level, it was a seismic shift for cannabis; the world will never be the same. Here are total sales for Colorado:

(Data Source: State of Colorado - Author's Chart)

There is actually a troubling move inside this chart. The past five data points are pandemic-induced. We are seeing the same things in Canada's numbers as well. There was a dip in the overall numbers, then a major move upwards as you can see. So, don't just take a quick peek at this chart and assume it is all uphill. In fact, the growth rate prior to the pandemic jump was sort of sluggish if you look at these monthly data points.

I wonder if after the pandemic will the numbers subside?

That, I am not certain about. But, the industry is getting fairly settled into itself. Recreational cannabis began in 2014. This is the 8th year of legalization. Anyone who wanted to try cannabis by now already has. So, how much more growth can we expect out of Colorado?

Right now the state is on track to increase revenues. And, if the legislature has anything to do with the future of cannabis, I can assure you the legislature is pro-cannabis, there will continue to be increased revenues. The legislature regularly passes bills to increase the accessibility of cannabis.

One of the measures is trying to allow cannabis consumption outside of the home, one of the big stipulations in the original legislation passed by the people of Colorado. This will allow for deeper penetration of the market for the product. The only problem with that is that everything is shut down due to the virus, but I expect big changes in that come summertime.

For right now, cannabis in Colorado is set to hit $1.5B for the year. Perhaps we see a modest gain in the state of just 20% for 2021? I think that is in line with some of the data I have been reading and the way the industry has been settling in the state.

Washington

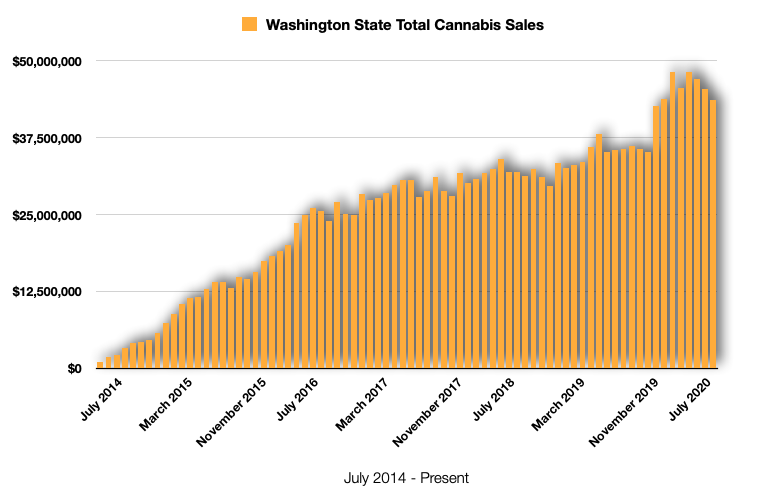

Little do people remember that Washington and Colorado legalized cannabis in their respective states at the same time in 2012 (legal sales for both states for recreational cannabis began in 2014). It's just that Colorado seemed to take the spotlight and ran with things a lot more loudly. Nonetheless, Washington State is another state that is legal for cannabis medically and recreationally, and here is the data since 2014:

(Data Source: State of Washington - Author's Chart)

The initial build-up was swift, just like Colorado. And, just like Colorado, the growth rate tapered off during the past few years only to jump again during the pandemic. The rationale is simple: Bars are closed, what else is there to do?

Given the same projections as Colorado, I am only looking for about a 20% increase YoY in total cannabis sales for the State of Washington. Still, this is respectable.

Right now, I focus entirely on the cannabis sector and am systematically going through a long list of stocks that I have in order to find investment opportunities. Since we are locked down, ultimately I have nothing else to do but do this analysis. I have about 135 stocks I am actively watching (below), another 185 stocks that are cannabis stocks but may not be in a position to make my "List" (further below). Then I still have yet another 225 more stocks (previously 650) that I need to weed through and see which ones are cannabis and if they will make my portfolio list. I hope to finish going through these stocks by the end of January.

Because I am so hyper-focused on the cannabis industry and am writing lots of articles, I am becoming a sort of go-to source for these stocks. I am receiving a lot of comments on my articles here on Seeking Alpha. Based upon the comments I read, it is obvious that some individuals had been burned in their initial investments in cannabis stocks back in 2018. Not everyone shares the sentiment that cannabis stocks are a promising investment right now. I can understand that.

But, I also want to point out that there were many, many times when I used the words "Irrational Exuberance" and cannabis stocks back in 2018. Back then, a lot of investors did not want to hear those words and the comments were interesting then, as well.

I have just highlighted these three states to give a fairly good example of what is happening in the industry. I will do more states as the weeks move forward.

In general, I believe we will see growth across the board in cannabis. But, the more mature states are likely to see lower growth rates and that is a pragmatic assessment. California will have very large sales growth opportunities. But, eventually, the sales growth levels will taper off as the market matures more and more.

Several other states have just recently legalized cannabis and this is going to be a big thing for the industry. The companies I am looking towards are the smallish players that are operating in a few states and are performing well in their respective markets but are now about to expand in the newly cannabis-legalized states. These companies have figured out how to produce and sell cannabis and are going to take these templates and apply them to the newly legalized states. This is where there is going to be growth in the industry.

Then, eventually, if the federal government legalizes cannabis, the remaining states are likely to do the same and this will push growth even further for these companies.

Another key thing to watch out for this year: Many more mergers. There have been a few just recently announced. Expect more. Lots more.