IvelinRadkov

Investment summary

As investors reposition to capture the market's latest relief rally, obtaining exposure to justified quality is an essential to reduce portfolio variance. Defensive names with low historical volatility, robust earnings quality and high cash conversion have caught a bid in H2 FY22 in just about all sectors. Within healthcare, the market has bifurcated those weaker names from the long-term cash compounders.

In that vein, we had been hoping for more substance from Viemed Healthcare, Inc. (NASDAQ:VMD) in its Q2 FY22 earnings report. By that, we mean a turnaround in the longer-term operating and profitability trends. However, this wasn't to be, and we remain trigger shy on the name. With these points in mind, we rate VMD a hold, price target range $6.12–$8.46 per share.

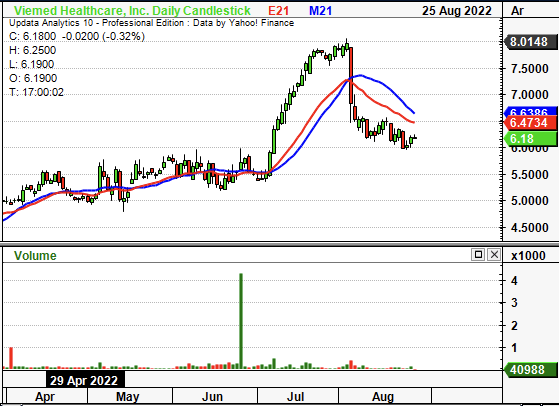

Exhibit 1. VMD 6-month price action

Technical studies indicate price action to have weakened since the roll into August – For instance, shares now trade below key moving averages, as seen below.

Data: Updata

Q2 earnings don't exhibit turnaround

We were left a little unsatisfied with VMD's Q2 FY22 earnings. By estimate, it was difficult to observe exactly where the company's strategy as a specialised respiratory healthcare services company was on full display. The company is a play on chronic obstructive pulmonary disease ("COPD") and the ageing population. It aims to capture the expanding US expenditure on COPD and the shifting age demographics that mean more COPD cases each year.

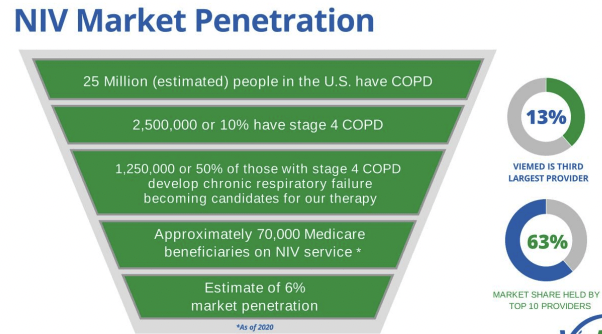

Noteworthy is the COPD treatment market is projected to grow at CAGR 4.4% per year from 2022–2031. Presuming this to be accurate, then VMD secured an above-market growth last quarter. Revenue growth was 26% for the quarter to $33 million, ~6% annualized. This suggests the company obtained additional market share, basing the COPD treatment market growth on an annualized 4.4% growth. VMD's position in the non-invasive ventilator ("NIV") segment of the market positions it in a niche position to capture market share, as NIV therapy doesn't require ongoing consultation. As seen below, VMD is the third largest provider in this segment, holding 13% market share.

Exhibit 2. VMD's NIV market penetration

Data: VMD Investor Presentation

The bolus of upside was underscored by growth across all product segments, including, vents, positive airway pressure's ("PAP's") and oxygen supplies. Vents in particular contributed 69% to the top, down 10 percentage points from Q2 FY21. Management attributes this more to diversification of the product mix, whereby revenue is more evenly distributed amongst offerings. To illustrate, vent active patient growth still came in with the highest quarterly growth in three years.

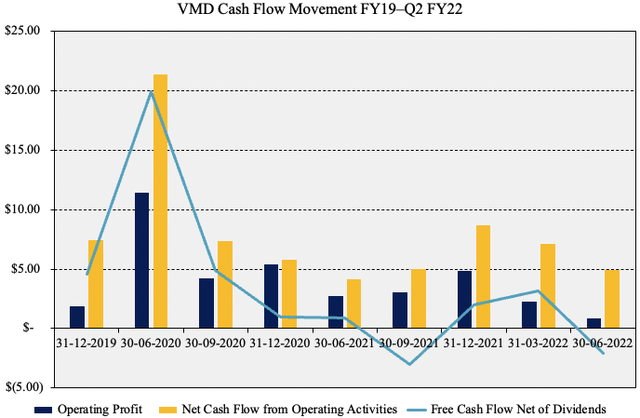

Gross profit margin came in at 60.5%, down 300bps YoY as cost of revenues increased over the 12 months. The company saw a large ~35% of headwind at the SG&A line totalling $17.5 million or ~53% of turnover. Management attributed the uptick in expenditure to a growth in hiring and other organic expansion plans, all to serve a higher patient count. Moving to the balance sheet, CAPEX came in at $7 million for the quarter. Meanwhile, cash conversion continues to remain relatively light for the company. For instance CFFO narrowed sequentially from $7.15 million in Q1 FY22 to $4.95 million in Q2. The cash conversion ratio from net income is 5.1 turns, and each of operating income, CFFO and FCF have narrowed on a sequential basis since FY19.

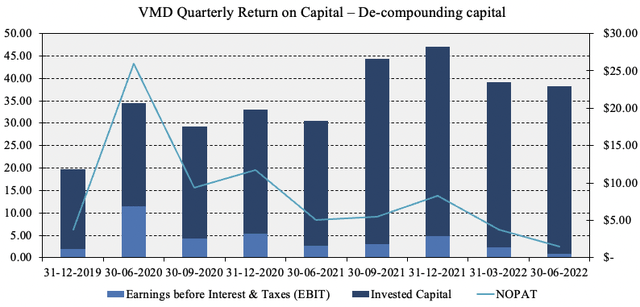

Exhibit 3.

Data: HB Insights, VMD SEC Filings

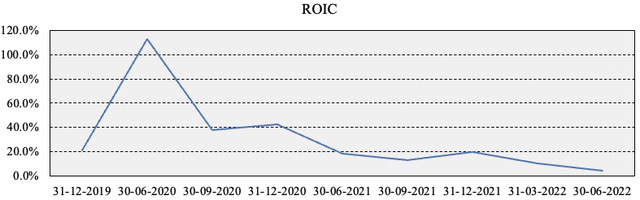

Our findings demonstrate a key issue in the company's profitability. Here we examined how much NOPAT VMD generated from the previous period's invested capital, and found results to be less than impressive. As seen in Exhibit 4, return on the company's invested capital has narrowed substantially to 4.1%, well below the company's WACC of 11.3%. Trends in ROIC have also been moving down for several periods on a sequential basis. Heading into a potentially weaker economic climate, these are undesirable holding characteristics in our estimation.

Exhibit 4. Return on investment has narrowed substantially for the company, whilst the level of invested capital remains buoyant

In effect, the company is de-compounding capital at this rate, particularly with a high WACC of 11.33%. As such ROIC fails to meet the hurdle.

Data: HB Insights, VMD SEC Filings

Data: HB Insights, VMD SEC Filings

The company also repurchased more than 960,600 shares last quarter for a consideration of $5.1 billion, or 15.4% of total revenue. To date 1.35 of the two million authorized shares to be bought back have been completed.

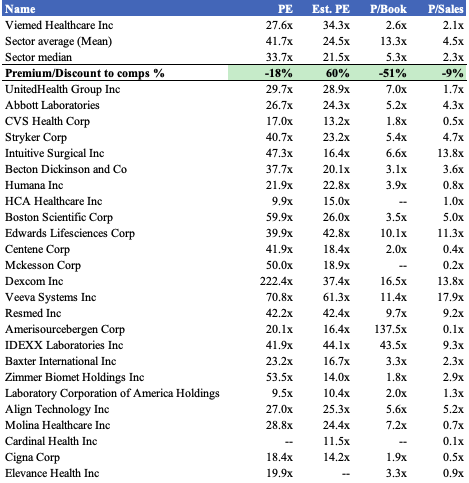

Valuation

Shares are trading at lofty multiples but still come in at a discount to peers within the GICS industry median. We are paying 27x trailing earnings as ROIC and NOPAT continue to decline, in addition to a declining cash-conversion schedule. Still, the stock is priced at a 60% premium to peers at 34x forward P/E, suggesting the market is expecting an above-sector result from VMD next year.

Exhibit 5. Multiples and comps

Data: HB Insights

We've forecasted $0.18 in EPS for FY22 and $0.28 per share in earnings for FY23. Prescribing the 34x forward P/E to these estimates sets a price target of $6.12 in FY22, and, $8.46 when discounting back from FY23 at a rate of 12.5%. Blending the two results on an equal-weight basis sets a price target of $7.29 per share, leaving us trigger shy on the name from a valuation standpoint.

In short

We were hoping for a more robust earnings result from VMD in Q2 FY22, particularly with respect to bottom-line fundamentals. However, longer-term trends prevailed, and now we are asked to pay 27x trailing earnings (34x forward earnings) for a declining picture of profitability. Moreover, forward looking valuations are unsupportive.

Tilting the investment debate to neutral is VMD's positioning within the COPD treatment market and the company's unique product offering which differentiates it from peers. Without the remaining substance to build out the investment debate, we rate VMD a hold.