Supreme Pharmaceuticals (

CSE:C.SL,

Stock Forum) got it right. At the risk of looking like they were running from paperwork, and complete in the knowledge that a CSE listing may limit investor exposure,

Supreme tossed away its Venture Exchange listing last week and embraced what is quickly becoming known colloquially as the Cannabis Stock Exchange.

Papuan Precious Metals (

TSX:V.PAU,

Stock Forum) was trade halted Monday after a 60+% price spike, following a pretty innocent looking press release that pointed to a letter of intent signing regarding the purchase of a Colorado dispensary. The market dug the news. The exchange, however (or rather, IRROC), did not.

Because V.PAU is supposed to be a mining company.

I pontificated in my Monday update that I didn’t think such a rise was coming from one dispensary purchase, and that I was hearing word that bigger things were to come. So I reasoned the trade-halt was

likely an innocent and soon-to-be overturned situation to stop the stock taking off on leaked news.

Boy howdy,

was I wrong.

“Further to the TSX Venture Exchange bulletin dated April 28, 2014, effective at 11:31 a.m., April 28, 2014, trading in the shares of the company will remain halted pending receipt and review of acceptable documentation regarding the change of business, pursuant to TSX-V listings Policy 5.2. This regulatory halt is imposed by Investment Industry Regulatory Organization of Canada, the market regulator of the exchange, pursuant to the provisions of Section 10.9(1) of the universal market integrity rules.”

Papuan Precious Metals is in Chlormet Technology (

TSX:V.CMT,

Stock Forum) country now, which means no trading until a change of business process has been entered into. That means lots of paperwork, stock holder approvals, and exchange investigations. It is not a short process.

So if your money is in V.PAU today, it’s going to be out of your hands for some time. It’s also not going up – or down – for the foreseeable, a situation that will irk those feeling like the company was starting a long term upward move.

Chlormet found itself in similar circumstances a few weeks back, riding a nice stock rise, getting everything happening, when all of a sudden the exchange jumped in and picked them out of a gang of forty for special attention.

Now it’s frozen in time, like Donald Sterling’s social skills. Or Paula Deen’s recipes. Or Jay Leno.

The fact that both Chlormet and Papuan were being open and clear with investors, where so many others are keeping schtum, is something that IIROC sees as a bad thing.

Others are playing cards so close to their chest, you wonder if there are actually cards to be played at all.

Terra Firma Resources (

TSX:V.TFR,

Stock Forum) announced it might go into weed, then it appointed a consultant, and then nothing since. The stock is trading at $0.015, and has asks and bids so huge that should you be unfortunate enough to own some, you can’t lose your holding without taking a 33% loss. But that’s okay by the Venture because they haven’t signed an LOI and can still pretend they’re a risk of drilling a hole in the ground.

Satori Resources (

TSX:V.BUD,

Stock Forum), which I’ve oft-mocked as an empty shell, barely had enough directors to keep trading a month back, and hasn’t revealed any info about what they’re planning beyond ‘hey, they used to grow it in mines in Flin Flon a while back, you know’ talk. They changed their name and symbol to a weed focus many months before they even sent out a ‘we’re looking into weed’ press release, but IIROC is okay with them, because they’re a ‘mining company’.. with a weed name and a weed symbol.

Why is IIROC letting that slide? Because Satori is not telling you anything about their upcoming deals.

Consultants are okay, because IIROC sees them as a tool to be used in the exploration of new business. Options to buy based on due diligence and shareholder approval, or letters of intent to maybe buy if the company decides to go in a certain direction, are not.

Venture companies could negotiate themselves into six changes of business, as long as they don’t put out a press release with real information about it. Because the moment they do that, even if, like Papuan Precious Metals, they acknowledge in the release that they still have mining interests and are still actively promoting them, the lawyers at IIROC consider a line has been crossed and will shut them down for the foreseeable.

Of course, you may ask, shouldn’t IIROC WANT companies to tell shareholders what they’re doing? Shouldn’t they be actively promoting a system in which a full and frank accounting of plans is put forward so investors can make strong financial decisions? Shouldn’t they be encouraging companies to be ‘best of breed’ in the marijuana sector, rather than driving them into the arms of the CSE, where listings can be found in the bottom of a cereal box?

Greenbank Capital, on the CSE, has changed what it does so many times, management tattoos their most recent plans on their chests so when they wake up in the morning, they know what they need to be doing that day.

Today I believe the tattoos read “build a bad website.”

Check.

It’s clear in looking at Chlormet and Papuan, if you’re a mining company on the TSX Venture that is looking to return shareholder value by hitting the medical marijuana market, you might want to get the heck off the Venture now, while the going’s good.

And if you’re investing your money, looking for good volatile stocks that have a little risk tied to a little reward, and don’t want your cash to get needlessly tied up for a month because you invested in a company that’s actually making moves, you might want to consider applying a value discount to anything with a V in front of the ticker.

THE UPPERS:

Greenbank Capital (

CSE:C.GBC,

Stock Forum) led the field today, climbing 36.3%... On a $1200 trade.

Windfire Capital (

TSX:V.WIF,

Stock Forum), which the TSX lists as “an exploration stage company” that “acquires, explores and develops mineral deposits in North America”, rose 33.3% on its ongoing shift to medical marijuana. Careful Windfire, make sure you don’t announce too many plans…

Jourdan Resources (

TSX:V.JOR,

Stock Forum), which the TSX thinks is about the “acquisition, exploration and development of mining properties in phosphate and lithium, primarily in Canada”, rose 16.6% today, and that rise sure as hell wasn’t on the back of lithium, though Jourdan has more mining going on than most hybrids in the space.

Jourdan is hopeful it will find iron, titanium, copper, nickel and cobalt in the ground at its new Picnic Phosphate project, while it’s pulling up phosphate to use as a weed fertilizer option.

In volume terms, today’s winner was Affinor Resources (

CSE:C.AFI,

Stock Forum) which I keep hoping will dip so I can jump in, but isn’t playing ball. Up 11.4% today on 1.8 million voume. Lot of people liking this play.

THE DOWNERS:

Just about everyone else.

Premier Brands (

OBB:BRND,

Stock Forum) is down 40$ on 50m volume and no news, presumably as the market works out that ‘we’re going to sell a few weed products, sometime’ and a $293,000 market cap isn’t a good start on building an empire.

Growlife (

OTT:PHOT,

Stock Forum) plunged 31.5% on 49.2m volume as the dead cat bounce brigade began to realise the cat was still falling.

Thelon Capital (

TSX:V.THC,

Stock Forum) dropped 6.2% after it bought space in the Globe and Mail for a

fluffertorial.

Enertopia (

CSE:C.TOP,

Stock Forum) shed another 11.8%, continuing its fall from grace. A brave man might buy into that drop-off. I am not that brave a man. Enertopia has a large and growing perception problem that it needs to fix, and the sea of down days over the last month is only fueling the fire.

Creative Edge Nutrition (

OTO:FITX,

Stock Forum) dropped 6.3% after

HotStocked.com’s Dragni Dragnev posted a story that focused hard on the following quarterly info from December:

- Cash - $19 thousand

- Total Current Assets - $0.8 million

- Total Current Liabilities - $4.6 million

- Revenues - $303 thousand

- Net loss - $1.4 million

- Market cap: $298 million

FITX has brought in $20m of investment since those numbers came out, which still doesn’t make sense of that high a market cap. I like FITX and think it’s doing the right things, but it’s definitely overbought.

IN BRIEF:

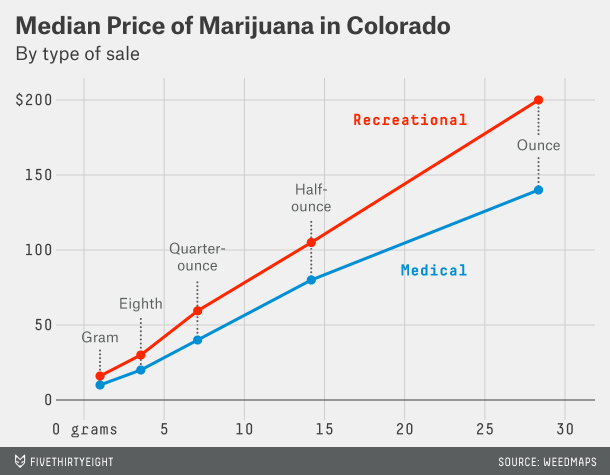

Data out of Colorado is showing that, far from driving pot prices down, the shift to allowing medical marijuana and recreational marijuana has actually seen prices rise, with

medical marijuana prices offering a far better deal than the party stuff.

This may have something to do with the fact that the industry there has been very slow to hit full steam, with municipalities not overly embracing a speedy approval of local outlets.

THE MOVERS:

THE MOVERS:

Updated at close:

Check back daily for the latest news in this sector.

For more stories on this sector, see our

Medical Marijuana section.

Follow me on Twitter at @ChrisParry

Send tips, news, suggestions to chris(dot)parry(at)stockhouse(dot)com