Newsy day on the medical marijuana front as several companies are moving to the next stage of the sector’s life cycle, looking to acquire, merge, sign options and generally bulk up.

Thelon Capital (

TSX:V.THC,

Stock Forum) President Scott Walters announced today that company has

signed an MOU to purchase a 30% interest in The Cannabinoid Medical Clinic, thereby securing a foothold in the patient acquisition space (and also closer to the dreaded TSX Change Of Business process).

Thelon’s stock price has leveled off of late, like many, and the announcement today didn’t do much for that price, sending it down 13% on the day.

PMX Communities (

OTCQB:PMXO,

Stock Forum) announced

they’re making a push with their LXIV BUD BOX medical marijuana terminals (read: vending machines) into the California market, fresh off the news their machines would

need to be manned and not include any actual marijuana in Colorado… no news on whether California would feature the same restrictions.

Previously they’ve sold gold bullion vending machines. Presumably to survivalists and Ron Paul voters.

Anexco Resources (

CSE:C.AXO,

Stock Forum) signed an LOI to

acquire 100% of a BC interior grow facility capable of being scaled to 60,000 sq. ft (it’s much smaller currently), and presently capable of producing 2500 kilos of weed annually. The facility has not yet applied for an MMPR, but did grow under the old system. Anexco was up 16% on the deal.

I’m not so into Anexco following conversations at the GreenRush conference. Their plan is to brand BC Chronic as a world recognizable brand is a good one, but they want to keep it to only their products which is the kind of all or nothing play that increases investor risk for negligible return.

But hey, they’re in the race to a deeper extent than many companies – godspeed.

Supreme Pharmaceuticals (

CSE:C.SL,

Stock Forum) did a big promotional push today on the news

they’ve got a second acquisition target and it puts a large piece of the Supreme puzzle in place.

The company has zeroed in on a southern Ontario greenhouse facility that has a pre-build approval from Health Canada to put together a 342,000 sq. ft. grow operation that will produce up to 24,000 kilos of pot annually.

The facility already exists. It was built by Agriculture Canada but needs to be upgraded to cater to weed and not tomatoes, and it needs to be inspected by Health Canada to get its full license once that happens.

But it’s a real thing. You can touch it. The city it’s located in is okay with it. The company expects to be Health Canada-ready in 90 days, initial production is expected by Q4 and over two years it will cost $5.5 million to complete the deal.

This is what I’d call a GOOD DEAL, and the market agreed, cranking the share price up 40% on the news. Congrats to the Supreme faithful for your glorious return.

Compare and contrast time: Hunter S. Thompson once told me, in between shots of Chivas and some Turkish bubble hash that had me analysing the hairs on my elbow for four hours, that if you’re not getting hate mail, you’re not a journalist.

So thank you, Creative Edge (

OTO:FITX,

Stock Forum) cultists, for confirming that I am indeed a journalist.

Yesterday’s medical marijuana update was the opposite of what we see with Supreme Pharmaceuticals today: It was all about how Creative Edge’s CEO has a habit of making bold statements that he can’t (yet) back up, and how anyone who had invested in the company’s claim that it will build ‘the world’s largest marijuana production facility’ was buying a promise the company had yet to figure out how to deliver on.

To recap: The Mayor of Lakeshore, where Creative Edge has purchased its facilities,

hasn’t received any application for the largest marijuana production facility in Ontario, let alone the world. And the city isn’t sure it can get water to a facility much bigger than what’s permitted (60,000 sq. ft. – the size little Anexco’s planned facility maxes out at), and the company only has permits for five employees, and they don’t yet have an MMPR, and the city has given permits for a warehouse and a fence, not a gigantor so much weed that you can smell it in Guelph grow op, and when they actually do get an application for what they’ve planned, it might take six months to do proper investigation to see if it’s even possible.

Of course, for many, that information is helpful. After all, a failure to do paperwork in a sector that will be hamstrung by bureaucracy for the foreseeable future is a big deal. And a major selling point for the company that may not be actually possible is something the company should answer to.

Especially when there were

allegations from earlier in the year that CEO Bill Chabaan was telling people Health Canada were pushing him to get his application done so they could approve it, something Health Canada denied and FITX management blew off as unimportant when it was exposed.

That little PR issue was eventually almost forgotten with time, but this new issue points to a pattern of behaviour that should give investors pause.

It won’t – at least, it won’t give

every investor pause - if the torrent of baseless idiocy that I’ve had thrown at me in the last 24 hours from certain sectors of the FITX shareholder base is any guide.

People who follow

FITX on InvestorsHub, or on the

company facebook page, blow off the issue as, in no particular order, me shorting the stock, me being paid by other companies to kill the stock, me being a slimy douchebag, me being paid per click, me not trusting management who are totes smarter than me, me misquoting the Mayor, me being unprofessional because I used the word ‘bullshit’… basically a tsunami of “SHHH, Shut up bro! I’ve got my 401K all up in this mofo an ur ruinin’ my crap! LOLZ”

Here’s the deal: Creative Edge’s marketing push is to keep saying “largest marijuana production facility in the world’ over and over. If pressed, the CEO will say “well, in five years maybe,” but only if pressed. Otherwise, it’s everywhere.

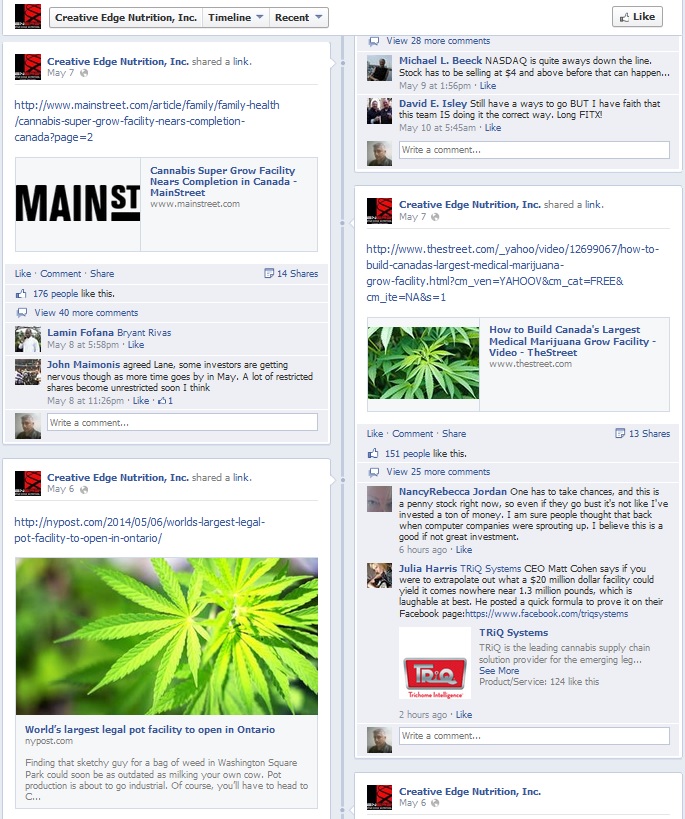

Look at their

Facebook page and see what the company is pushing:

That’s one screenshot showing three stories all on the same story arc:

How to Build Canada's Largest Medical Marijuana Grow Facility - Video - TheStreet

World’s largest legal pot facility to open in Ontario

Cannabis Super Grow Facility Nears Completion in Canada - MainStreet

There’s even a video embed of a Seth Myers monologue from The Late Show that mentions the largest ‘and most efficient’ marijuana factory in the world, pointing out ‘most efficient marijuana factory in the world’ is a pretty low bar to aim for.

There’s nothing there saying, “Actually guys, we won’t be achieving this for the next five years”, or, “Well, we’d have to get a lot of regulatory stuff done first,” or “We don’t really have the money for that but we hope to soon,” it’s just straight up repetition of the same (I’ll say it again) bullshit line, that assumes Creative Edge has the money, demand, permits and pieces in place to put together ‘the largest medical marijuana facility in the world’.

They have none of the above. No money to build more than they’ve built, no actual distribution or customer base, no permits beyond a warehouse and fence, and no infrastructure to run the largest of anything.

But clearly, ‘largest ever’ is the story that Creative Edge Nutrition wants to push. They do not want to push “We’re building a medical marijuana facility with five employees about the same size as Anexco” as a selling point. They don’t want to push “We hope we get an MMPR approval” as a selling point. Because you guys won’t buy that stock. Because it’s no more interesting than any five other companies I could mention. Because it doesn't back a $200m+ market cap.

There are other questions to ask of FITX, like are they concerned that they’ve distributed almost their limit of possible shares? Is that why they had to go to private financing when the Growlife deal fell through? How are they going to finance expansion when there’s no room for a private placement? Why don’t they have a website? And why, if they’re doing so much business in Canada, do they only list on the OTC?

Let’s be clear: I don’t care if the stock goes up or down. That’s not my job, I don't own it, nor work for anyone shorting it. My job is to ask questions any good company can answer in its sleep, and reveal when a company doesn’t fit the definition of ‘good’. What the people on iHub do with their pension money is not my concern. Whether you’re up 400% or down 3000%, that’s not my business, nor my motivation. I provide the accurate and bias-free information, and you then do with it what makes you happy.

If Creative Edge gets to a place where they can fix all these paperwork issues, that's great. That's ideal. I would like nothing more than for, in six months, a slew of dudebro's to hit up my Twitter account with "haha, I told ya so, ya moran", because that would mean nobody got scammed. If you get rich on a pipe dream, that’s awesome, as long as the guy on the other end of your trades had clear and full information to base his or her trades on, not Seth Myers monologues.

If a mine operator started claiming that their silver mine was going to be the world’s largest without any actual data or funding to make that happen, investors would burn the core shack to the ground in rage and follow the coke trail back to the CEO’s home where they would curbstomp him for giggles. Investors in junior resources have seen those types come and go and there are regulatory mechanisms to prevent them from re-emerging. Not so much in the OTC, and (sadly) not so much in the weed sector.

A 60,000 sq. ft grow facility (with no value-adding) is a fine business in and of itself (as Anexco would happily point out), assuming it gets its MMPR approval. That’s the real Creative Edge story right now. Outside of that, they’re behind Tweed and Supreme Pharmaceuticals on the whole ‘world’s largest’ goal, and right now have a smaller customer base than the Pigeon Park Compassion Club.

And no manner of hate mail from bagholders is going to change the fact.

FITX down 6% today.

Before we wrap this one up - a quick note to those classless penny stock vultures who think the correct response to questions being asked about their company is to get personal and attack the messenger in the thinking he'll go away, or leave your stock alone, or find another line of work: You clearly don't know me very well.

I'm not some part time blogger hoping to make a few bucks shorting -this is what I do. I've worked alongside people who have bulletproof glass on their living room windows and get death threats every other day. I've worked with people who were held at gunpoint in Rwanda. I worked with legendary promoter-destroyer David Baines, who policed the Vancouver exchange for decades like a crusading hammer of justice. I've worked on award-winning journalism projects that took down gangs and changed the law.

So if I say your company management needs to pick its game up, your options are for management to pick their game up or

be beatendown to

putty. I work for my readers, not penny stock slingers.

Offense freely given to those who choose to accept it at

my Twitter feed. Exclesior, d-bags.

THE MOVERS: