Despite uncertainty in commodity markets and the plunging price of oil, investors have not lost their appetite for small-cap resource stocks.

That much was clear from the robust attendance at the Cambridge House International investment conference in Vancouver Sunday.

“There are a lot of interesting opportunities out there if you have the money,’’ said Pablo Martin, Director of Business Development at 121 Group, a United Kingdom-based company which attempts to match mining companies with interested investors in Europe and Asia.

“In the past few months there has been a lot of interest in zinc, and there are a lot of gold bugs out there who believe in the metal no matter what price it has been trading at,’’ he said.

Attendees who showed up early Sunday were rewarded when five of the resource sector’s top newsletter writers revealed their stock picks.

Casey Research analyst Louis James kicked off the 2-day conference by naming a list of companies that he believes will benefit from any improvement in the price of gold.

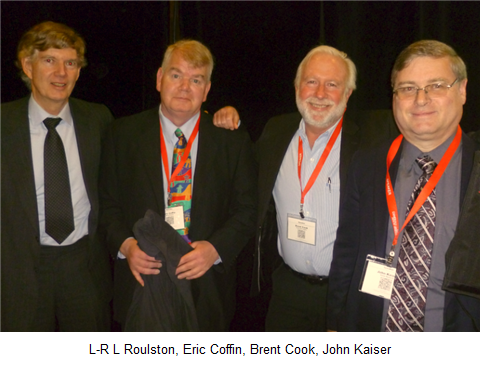

James was quickly followed by a 2015 exploration outlook panel comprised of Brent Cook, Eric Coffin, John Kaiser and Lawrence Roulston.

Martin said that in his view, the best opportunities currently lie in companies that are moving from exploration to the development stage and could be put into production quickly.

Companies that fit into that category include Integra Gold Corp. (TSX: V.ICG, Stock Forum), a Louis James pick, which recently completed a mineral resource estimate for its Lamaque gold project located in Val d’Or, Que.

James said he likes the fact that the company was recently able to acquire a bankrupt mill (2,200 tonne-per-day on an adjacent property for a cash outlay of only $1.8 million and 25 million common shares. This offers the potential for the integration of underground infrastructure on Integra’s Lamaque South claims and the newly acquired property.

After a recent jump, Integra Gold is trading at 26 cents, leaving a market cap of $54.8 million, based on 210.6 million shares outstanding.

James said he likes Dalradian Resources Inc. (TSX: T.DNA, Stock Forum), which is developing a high grade gold deposit in Northern Ireland. With a fully funded budget of $30 million, the company is working to complete a pre-feasibility study in support of a planned application for construction at the Curraghinalt Gold Project.

Dalradian was trading at 87 cents last week, leaving a market cap of $121.8 million, based on 140.1 million shares outstanding. The 52-week range is $1.08 and 46 cents.

Another name on James’s stock list is Rubicon Minerals Corp. (TSX: T.RMX, Stock Forum), which is developing an advanced stage gold project located in the northwestern Ontario mining camp, which also hosts Goldcorp’s Red Lake Mine.

“This thing has takeover written all over it,’’ said James. The Casey Research analyst said Goldcorp may wait to see if Rubicon’s Pheonix Gold project makes any money before considering a possible takeover bid. That may leave the door open for anyone who wants to grab a foothold in Goldcorp Inc. (TSX: T.G, Stock Forum) back yard.

Rubicon was trading last week at $1.38, leaving a market cap of 511.3 million, based on 370.5 million shares outstanding. The 52-week range is $1.95 and 90 cents.

Given recent investor interest in uranium, it was hardly surprising to find the name of Fission Uranium Corp.(TSX: V.FCU,Stock Forum), especially after last week’s favourable response to a new resource estimate for the company’s Patterson Lake South property in Northern Saskatchewan.

However, some members of the 2015 exploration outlook panel were cautious on the outlook for Fission going forward.

Kaiser Bottom Fishing Report publisher John Kaiser said the company still has a lot of work to do to “stitch together” the high grade pods at the Integra Gold. Brent Cook said the company will be challenge by the fact that the uranium is located under a frozen lake. “I see a long, long permitting time,’’ he said.

Eric Coffin also said that unless there is an unexpected spike in the price of uranium, potential acquirers such as Cameco Corp. (TSX: T.CCO, Stock Forum) will likely take their time and wait for Fission to do a lot more drilling. “I don’t think the big guys need to do anything right now,’’ he said.

Aside from permitting newsletter writers to showcase their stock picks, Cambridge House also offers some companies the opportunity to showcase new technology, especially techniques that aim to allow juniors to save time and money during the exploration process.

It is Michel Fontaine, vice-president, business development with DIAGNOS Inc. (TSX: V.ADK, Stock Forum) was prepared to make the trip to Vancouver from Brossard, Que., for this year’s Cambridge House conference.

DIAGNOS has developed a computer system that uses pattern recognition algorithms to analyze vast sets of data with the aim of predicting the location of minerals, including gold, copper, zinc and diamonds.

“We use that technology on publicly available data to find targets near the Detour Lake gold project in Ontario,’’ said Fontaine. The company’s roster of clients include financier Ned Goodman, who owns 19% of the company, Noront Resources Ltd. (TSX: V.NOT, Stock Forum) and Puma Exploration Inc. (TSX: V.PUM, Stock Forum).

FULL DISCLOSURE: Integra Gold is a client of Stockhouse Publishing.