It appears to be an accepted fact that the price of zinc will rally in the near future.

In recent months, a raft of mining analysts have said they expect to see zinc prices move materially higher over the next 12 to 24 months as visible inventories continue to be drawn down.

Zinc is one of the world’s most widely used base metals. Its primary role is to protect steel against corrosion and improve its durability. It can also be used as an essential nutrient that can be used in fertilizers to improve crop quality and improve human health.

In a report this week, Scotia Capital said it expects the zinc price to rise from 99 cents a pound this year to US$1.20 by 2020.

Scotia said its enthusiasm for zinc has been somewhat tempered with the strong U.S. dollar but added it would not be surprised to see zinc prices well above those forecasts.

However, Scotia's optimism comes with a warning.

“In our view, the relatively unknown ability of Chinese producers to ramp-up zinc production in response to a higher price environment remains the key wildcard in this market,’’ the investment firm said.

That’s because in addition to being the world’s largest consumer of zinc, China is also the world’s largest producer of the metal, accounting for 37% of global production.

Companies with significant zinc exposure include Teck Resources Ltd. (TSX: T.TCK.B, Stock Forum) which traded this week at $15.68, leaving a market cap of $8.9 billion, based on 566.8 million shares outstanding. The 52-week range is $26.98 and $12.46.

Vancouver-based Teck is Canada’s largest diversified mining company and the third largest mine producer of zinc in the world.

On April 21, 2015, the company said it was slashing its dividend by 67% in order to focus on cash preservation. The dividend cut is expected to save the company about $345 million a year, according to CIBC World Markets.

Lundin Mining Corp. (TSX: T.LUN, Stock Forum) trading this week at $4.98, leaving a market cap of $3.6 billion, based on 718.4 million shares outstanding. The 52-week range is $6.57 and $3.68.

Lundin is a diversified base metals mining company with operations and projects in Chile, Portugal, Sweden and Spain, producing copper, zinc, lead and nickel. The company also holds a 24% stake in the Tenke Fungurume copper/cobalt mine in the Democratic Republic of Congo.

Hudbay Minerals Inc. (TSX: T.HBM, Stock Forum) is trading this week at $10.15, leaving a market cap of $2.4 billion, based on 233.7 million shares outstanding.

Hudbay underlined its commitment to northern Manitoba on April 17, 2015, by agreeing to acquire the Snow Lake mine and processing plant from QMX Gold Corp. (TSX: V.QMX, Stock Forum). Hudbay now has four mines in the province.

Nevsun Resources Ltd. (TSX: T.NSU, Stock Forum) is trading at $4.48, leaving a market cap of $894.5 million, based on 199.7 million shares outstanding. The 52-week range is $5.30 and $3.58.

Trevali Mining Corp. (TSX: T.TV, Stock Forum) trades at $1.09, leaving a market cap of $311.7 million, based on 258.9 million shares outstanding. The 52-week range is $1.41 and 91 cents.

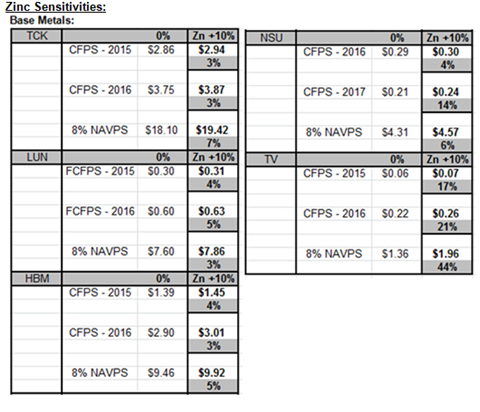

As a primary zinc producer, Trevali has the highest leverage with Scotia modelling a 44% increase in net asset value per share (8%) on a 10% increase in the zinc price.

Trevali recently announced drill results that could lead to a resource expansion at its Caribou zinc mine in New Brunswick. Trevali is an emerging zinc-focused metals producer with assets in New Brunswick’s Bathurst mining camp and a mine in Peru.

Nevsun released an update Wednesday on its Bisha zinc expansion project, which is located 150 kilometres west of Eritrea, East Africa. Bisha was constructed in 2010 and is currently designed to produce copper in concentrates. An US$92 million expansion project, scheduled for completion in mid-2016 will expand the flotation capacity to produce zinc concentrates, in addition to copper from primary ore.

In the update, Nevsun said the expansion is 60% complete. Its aim is to enable the mine to produce 225 million pounds of zinc and 55 million pounds of copper annually for 10 years after startup in 2016.

To date US$63 million has been committed with US$31 million remaining to be spent.

“We are confident that the robust flotation process plant will facilitate potential future throughput expansions and extended mine life,’’ said Nevsun CEO Cliff Davis.

“We have also been careful not to commit any of our zinc off-take so as to take advantage of the expected tightening of worldwide zinc supply.’’

FULL DISCLOSURE: Trevali Mining is a client of Stockhouse Publishing.