Throughout 2016, talk of “the gold rally” has been front-and-center in the precious metals sector. This begs the question, why? Why have so few media pundits and market analysts been talking about silver? It is a question for which there are few (if any) good answers.

- Year over year, the price of silver has risen more than the price of gold: 12% for silver versus 10% for gold, as of this writing.

- The gold/silver price ratio: for over 4,000 years, the gold/silver price ratio has gravitated around 15:1. It is only over the last century that this price ratio has been skewed to a ridiculous extreme. There is no (legitimate) reason for the perversion of this price-ratio.

- The silver market has been in a supply deficit for 30 years, if not longer.

Why would rational analysts and media pundits talk “gold, gold, gold” and completely ignore a parallel market which was performing equally well? Some will argue that the gold market has received 100% of media attention and the silver market 0% of media attention because the gold market is much larger. Markets (and market analysis) don’t work like that.

As individuals, investors can make just as much money investing in small markets as investing in large ones. Indeed, collectively, a mass-move by investors into (or out of) a smaller market must produce a much larger price differential than a similar move into a large market. There is no legitimate reason for the manner in which mainstream pundits and analysts have been completely ignoring silver.

What illegitimate reason is there for ignoring silver? Just ask the Bullion Banks. It is these convicted, criminal institutions which have been manipulating precious metals markets for decades. The difference between manipulating the gold market versus manipulating the silver market? Stockpiles.

As “precious” metals, humanity has accumulated tremendous stockpiles of gold and silver over a span of thousands of years. What has changed over roughly the last century is that our stockpiles of silver have been literally consumed.

Neophyte investors may scratch their heads over such a statement. How can a metal be “consumed”? The answer comes by looking at the supply/demand fundamentals for the silver market. As humanity’s most versatile metal, silver has been used in a plethora of industrial applications. Being particularly useful in hi-tech applications, silver’s industrial appeal is actually increasing as we move into the 21st century.

However, silver is also a very potent element, in both chemical and metallurgical terms. This means that in many of its most-popular applications silver is only required in tiny quantities. The problem is that with silver grossly under-priced, it is completely uneconomical to recycle any of this silver. Thus all the silver that is being used in these billions and billions of consumer items is cluttering landfills all over the world.

Unless-and-until the price of silver rises radically (i.e. by at least an order of magnitude), it will never be practical to recycle this silver. For all intents and purposes, this silver is gone forever – it has been consumed.

We are thus faced with an insane investment paradox. The supply ratio between gold and silver has been steadily shrinking. Noted silver market analyst and researcher Ted Butler has previously estimated that more than 90% of the world’s stockpiles of silver have been consumed. Estimates of the current supply ratio between gold and silver range from 6:1 on the high side to claims by some analysts that above-ground stockpiles for gold exceed the amount of silver available.

Meanwhile, the price ratio for the two metals has moved close to an all-time extreme in the opposite direction. Instead of the normal/natural ratio of 15:1, currently the price ratio exceeds 70:1. The mainstream media’s reporting on this subject has been less-than-useless. Clueless media pundits assert that the supply ratio between gold and silver should be expanding because silver’s increased industrial applications mean that it is now merely an “industrial metal.”

Such reporting defies rationality:

- Most of the world continues to regard silver as money, thus in no way has silver lost its status as a monetary and “precious” metal.

- The fact that silver also has numerous, important industrial applications cannot make silver less “precious” and thus less valuable. It can only make silver more valuable.

In proportionate terms, for thousands of years humanity has had an equal preference for gold and silver. This is demonstrated by the fact that the price ratio for these two metals has always closely paralleled the supply ratio – until the last century.

Over this last, one hundred years silver has become increasingly useful while at the same time its supply ratio versus gold has steadily shrank, as the world’s silver stockpiles have been consumed. This means that the price ratio versus gold should have been shrinking to below 15:1 – not expanding to absurd extremes.

There is no legitimate explanation for the movement in the price of silver over the past century. This leaves only an illegitimate explanation: manipulation. Silver historian Charles Savoie has documented the early decades of silver manipulation in his detailed chronology “The Silver Stealers”.

Knowledgeable readers will already be familiar with some forms of more recent silver manipulation. The Bullion Banks have already confessed to their conspiracy of serially manipulating the “silver fix”. During the Great Take-Down of precious metals in 2011; the CME Group used margin-hikes to manipulate the price of silver lower. It imposed six, rapid-fire margin hikes on the silver market, with the last five increases taking place after the price of silver had already begun plummeting lower.

Typically, margin increases are used to cool-down markets where prices are rising too rapidly. There is no previous history of margin-hikes being used to pound down a market where the price was already in free-fall. Naked shorting, algorithm manipulation, and bullion “leasing” are other, common (and illegal) methods of manipulating the price of silver.

The primary pretend-regulator of the silver market is the Commodity Futures Trading Commission. The CFTC has made a career of ignoring silver price manipulation. The price of silver was manipulated to a 600-year low during the 1980’s and 1990’s. The CFTC has claimed that it “probed” this market for a span of five years, but was unable to see any signs of market manipulation.

This would be akin to an insurance adjustor examining the City of New Orleans after Hurricane Katrina, but claiming he was unable to see any signs of wind or water damage. The silver market has been subjected to such extreme price manipulation, for so many decades, that most investors mistakenly assume that the current parameters in the market reflect normalcy – even equilibrium.

Nothing could be further from the truth. As noted previously, the silver market has been in a supply deficit for thirty years, if not longer. Such a phenomenon is not even supposed to be possible in any legitimate market. In legitimate markets, the economic mechanism known as “price discovery” acts to quickly eliminate any supply/demand imbalances.

The mechanics are elementary. When demand exceeds supply and there is a supply deficit, the price rises. This discourages consumption while encouraging increased supply. The price continues to rise until demand falls and supply rises enough for equilibrium to be restored. When supply exceeds demand, the mechanics operate in a precisely inverse manner.

Price discovery is an automatic mechanism which functions in all markets. The fact that we have had thirty years of supply deficits in silver necessarily implies that we have had no price discovery with silver for thirty years. This is absolutely impossible in any real market, ergo we do not have a market for silver. What we have, instead, is an institutionalized price-fixing operation, perpetrated by the Bullion Banks and ignored by all of the pseudo-regulators and pseudo-justice officials who supposedly police our markets.

What would a legitimate price for silver look like? Answering that question is like peeling an onion. Layers and layers of market manipulation and media mythology would first have to be stripped away. If the price of silver had not been driven down to a 600-year low during the 1980’s/90’s, but had remained at its previous price ratio versus gold (roughly 20:1), this alone would mean that the price of silver would be over $60/oz (USD) today.

If the price of silver had remained at its historic (15:1) price ratio, the price of silver would be over $80/oz today. If we adjusted the price to reflect the dwindling stockpiles of silver and dwindling supply ratio versus gold (6:1 at most), we would get a price for silver somewhere in excess of $200/oz.

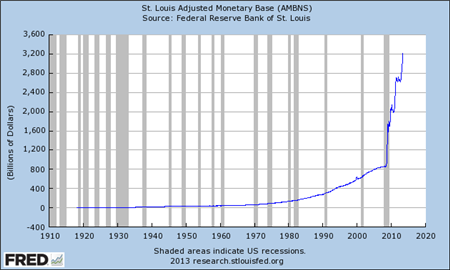

However, all those numbers assume that the current price of gold is, itself, a legitimate number. Knowledgeable readers know that this isn’t the case. Based on only its fundamentals as a monetary metal, the price of gold would have had to go to at least $4,000/oz (USD) by the end of 2014 – as a direct consequence of the Bernanke Helicopter Drop.

This is an automatic price correction which would have to take place with the price of gold between 2009 and 2014, assuming that there was a legitimate market for gold. The fact that the price of gold never approached this minimum number is absolute proof that we do have a legitimate market for gold either.

If the price of gold was at a fair/rational price level today (i.e. somewhere in excess of $4,000/oz USD), then this means that the price of silver could already be at or above four figures. Such a price level would be what was previously estimated by analyst Rob Kirby, using the historic wage as his metric.

Kirby noted that throughout history the typical wage for the Average Worker has been approximately one ounce of silver per week. With the average wage for today’s workers somewhere around $50,000/year (i.e. $1,000/week), this pegs a fair price for silver – today – at around $1,000/oz.

Investors should never forget that silver is a physical commodity. Those silver investors who are outraged by the serial manipulation which occurs (and is ignored) in this sector have an obvious recourse: buy more. When inventories/stockpiles are driven to zero via this under-pricing of silver, the Bullion Banks will lose their capacity to continue to rig the price. Then silver investors will have the last laugh, along with the companies mining this grossly undervalued metal.

The case for silver is a compelling one. The price of silver is currently below $18/oz (USD). That price is literally a crime, and one of the biggest stories in the entire commodities spectrum.